Is Cash Back Taxable Income Uk Verkko 19 marrask 2013 nbsp 0183 32 My understanding is a cashback or reward in a current account is classed as savings income and would already have 20 basic rate income tax

Verkko 2 huhtik 2021 nbsp 0183 32 Commissioner TC Memo 2021 23 the Court held that while generally cash back rewards are not includible in an individual taxpayer s gross income they Verkko 27 elok 2022 nbsp 0183 32 As for the Santander 123 account the cashback it offers on certain bills capped at 163 5 a month for each of its bill categories is treated as a reduction in your

Is Cash Back Taxable Income Uk

Is Cash Back Taxable Income Uk

https://support.planwithvoyant.com/hc/article_attachments/360080423812/mceclip3.png

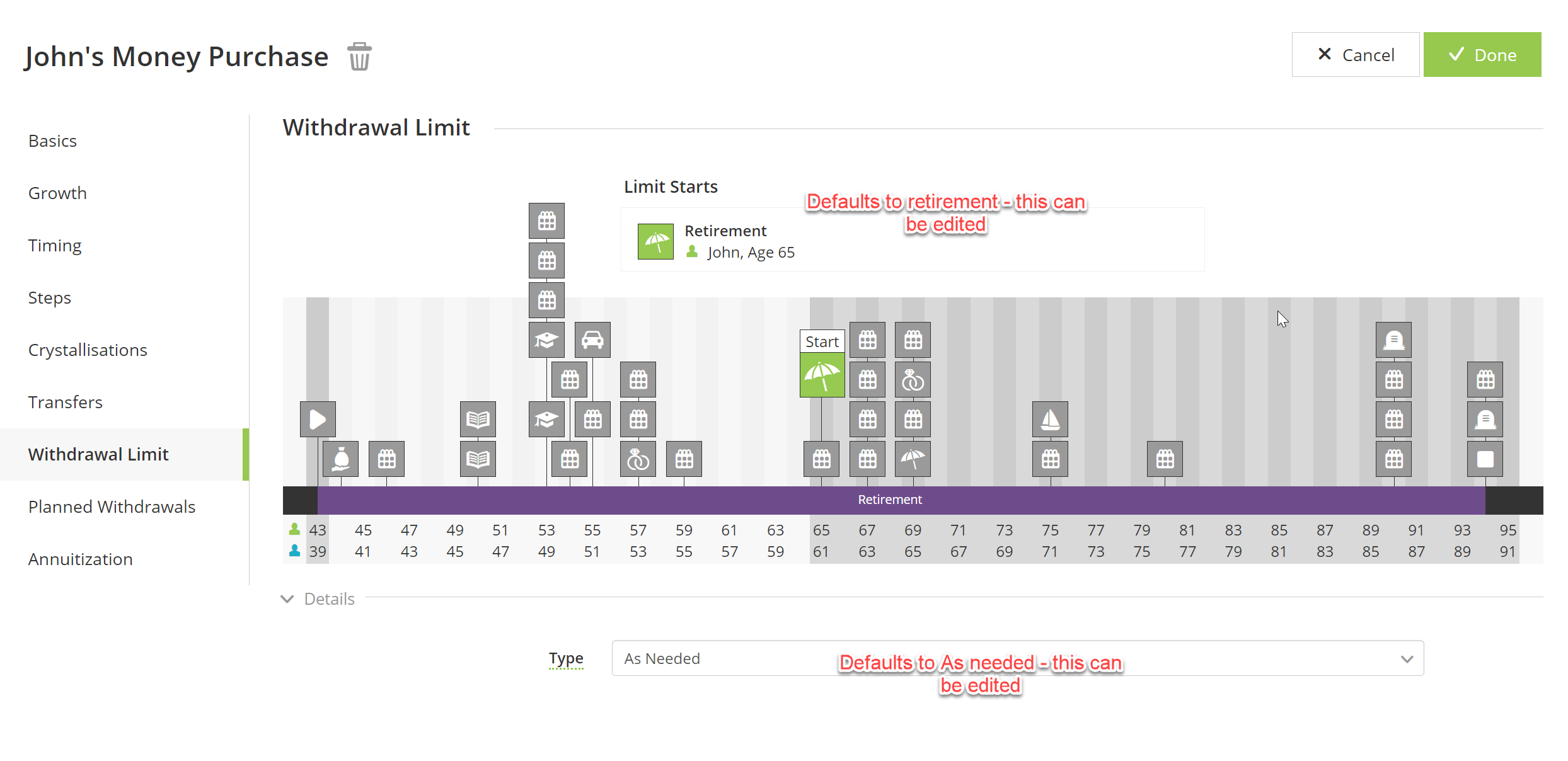

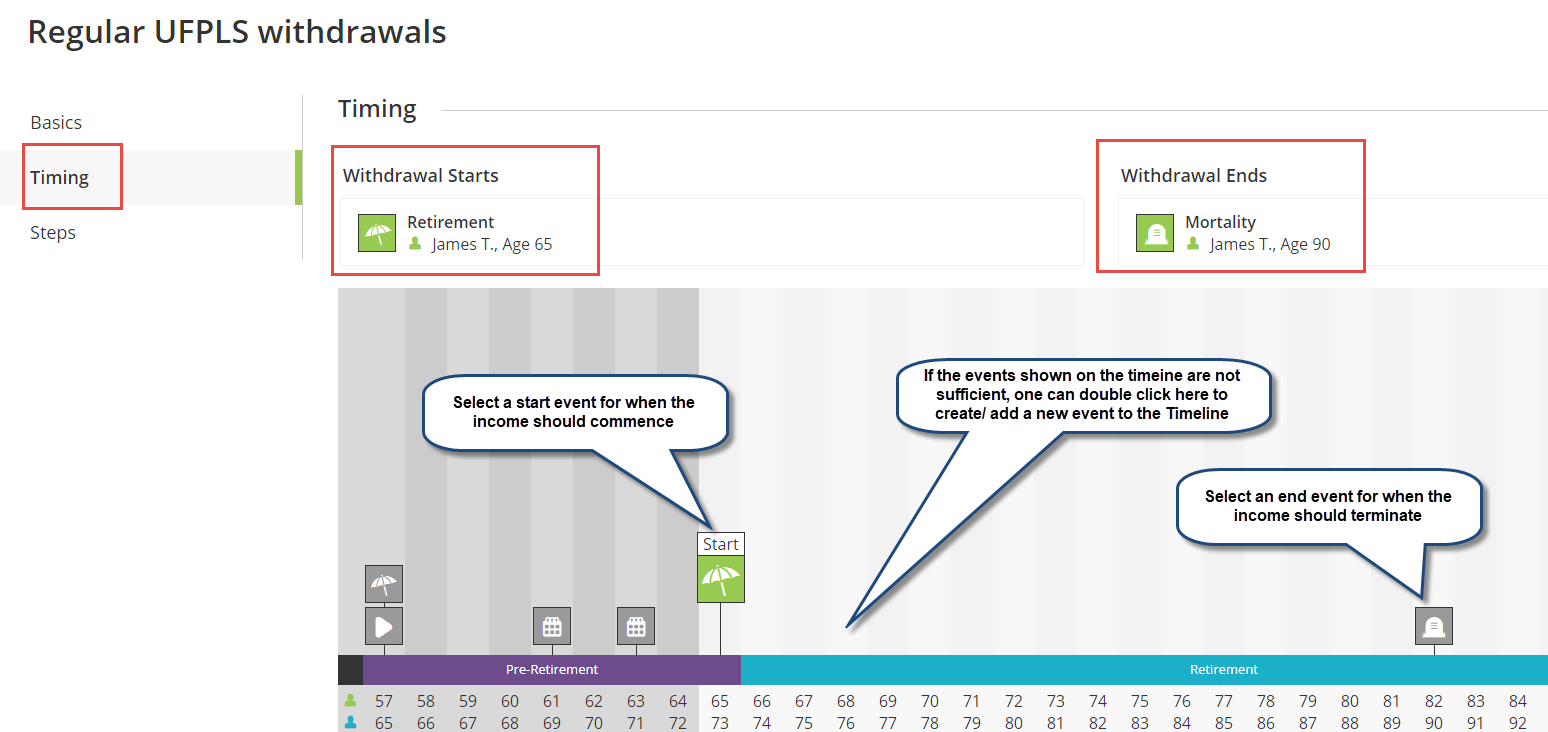

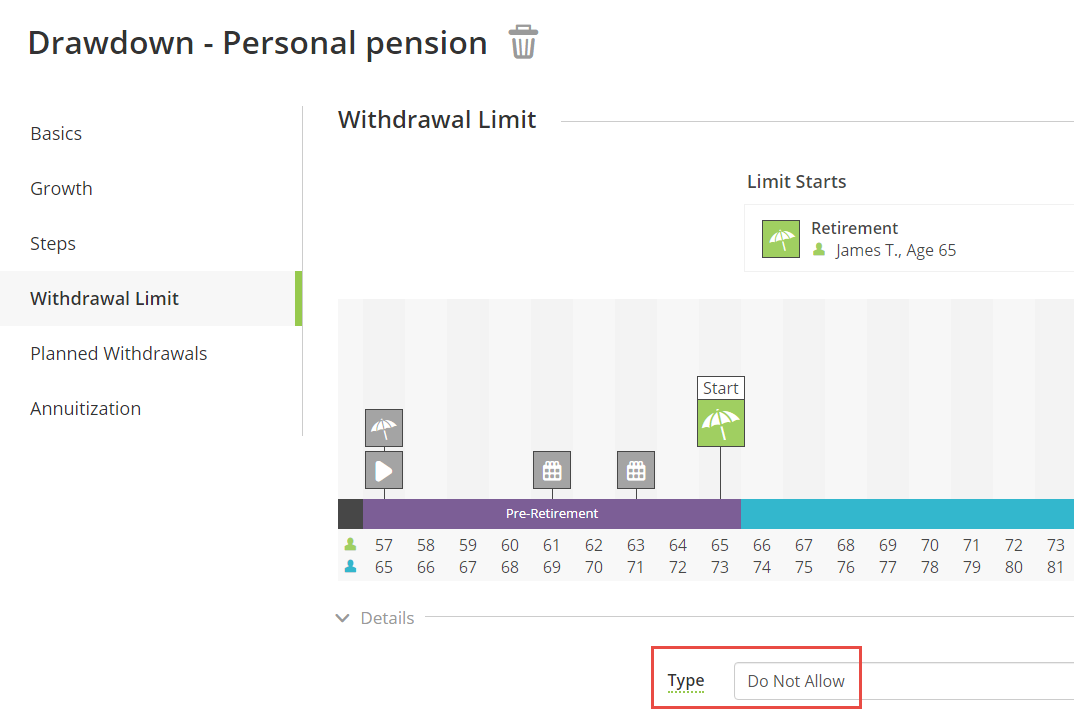

Retirement Planning Withdraw Full Tax free Cash With Or Without

https://support.planwithvoyant.com/hc/article_attachments/360080422792/mceclip3.png

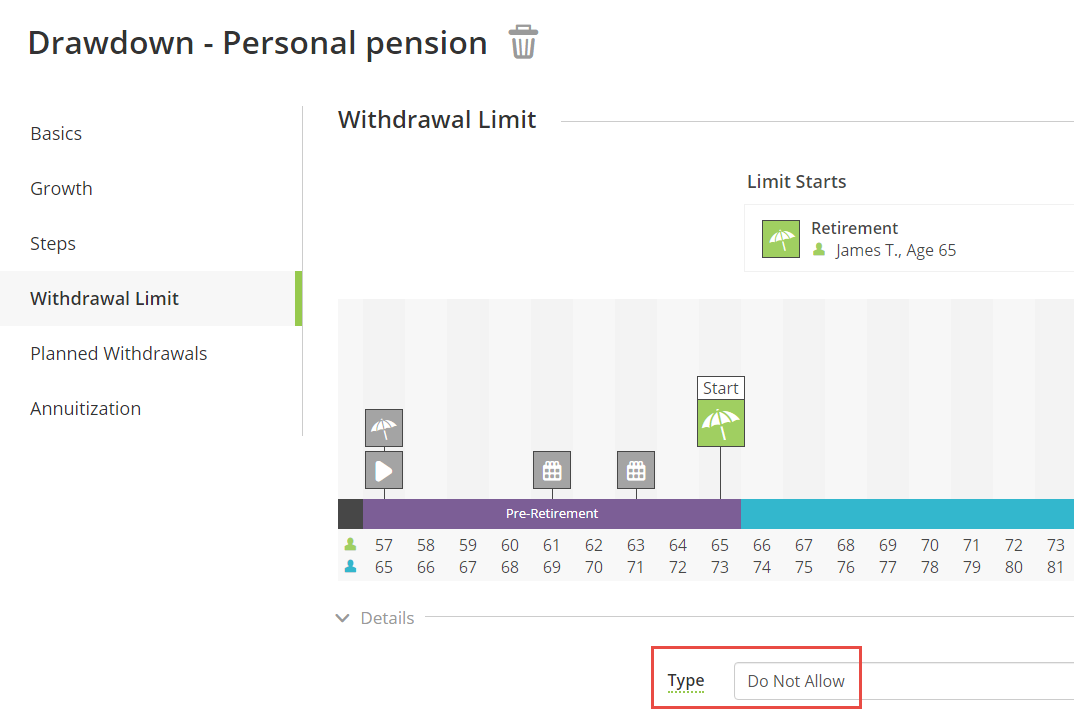

Retirement Planning Withdraw Full Tax free Cash With Or Without

https://support.planwithvoyant.com/hc/article_attachments/4408202262939/mceclip0.png

Verkko Other taxable Income 2022 HS325 Updated 6 April 2023 This helpsheet gives you information to help you work out the figures to include in boxes 17 and 18 of the Verkko Capital Gains Tax CGT the cash back is not chargeable to CGT where it is paid by the lender in return for the customer taking out the mortgage or other loan with them

Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 However not all money made through a side hustle is considered taxable income That s because you have a trading allowance of 163 1 000 a year in Verkko 3 tammik 2024 nbsp 0183 32 Firms will now report your earnings to HMRC so check if you need to pay tax If you sell goods online on sites such as eBay Etsy or Vinted rent out your

Download Is Cash Back Taxable Income Uk

More picture related to Is Cash Back Taxable Income Uk

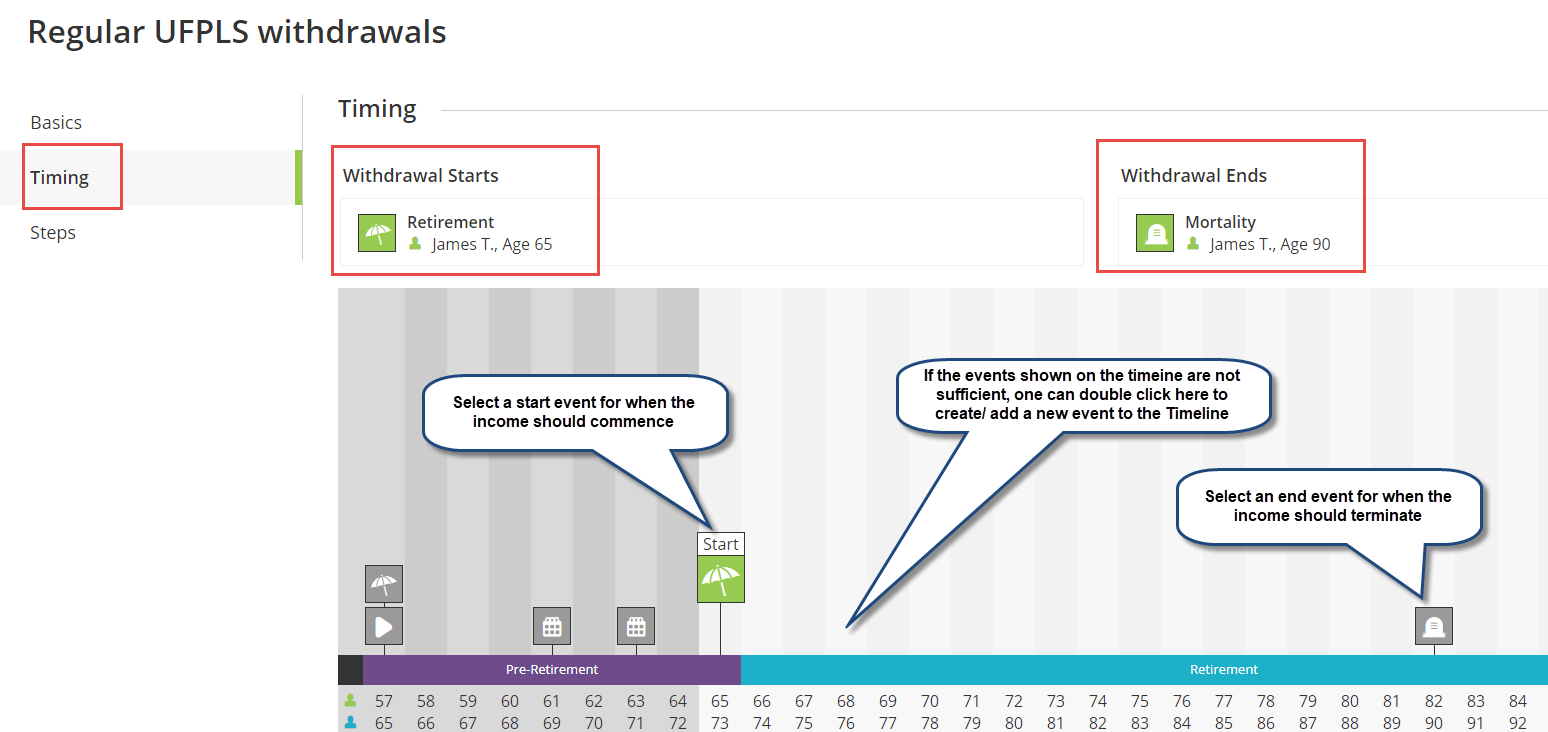

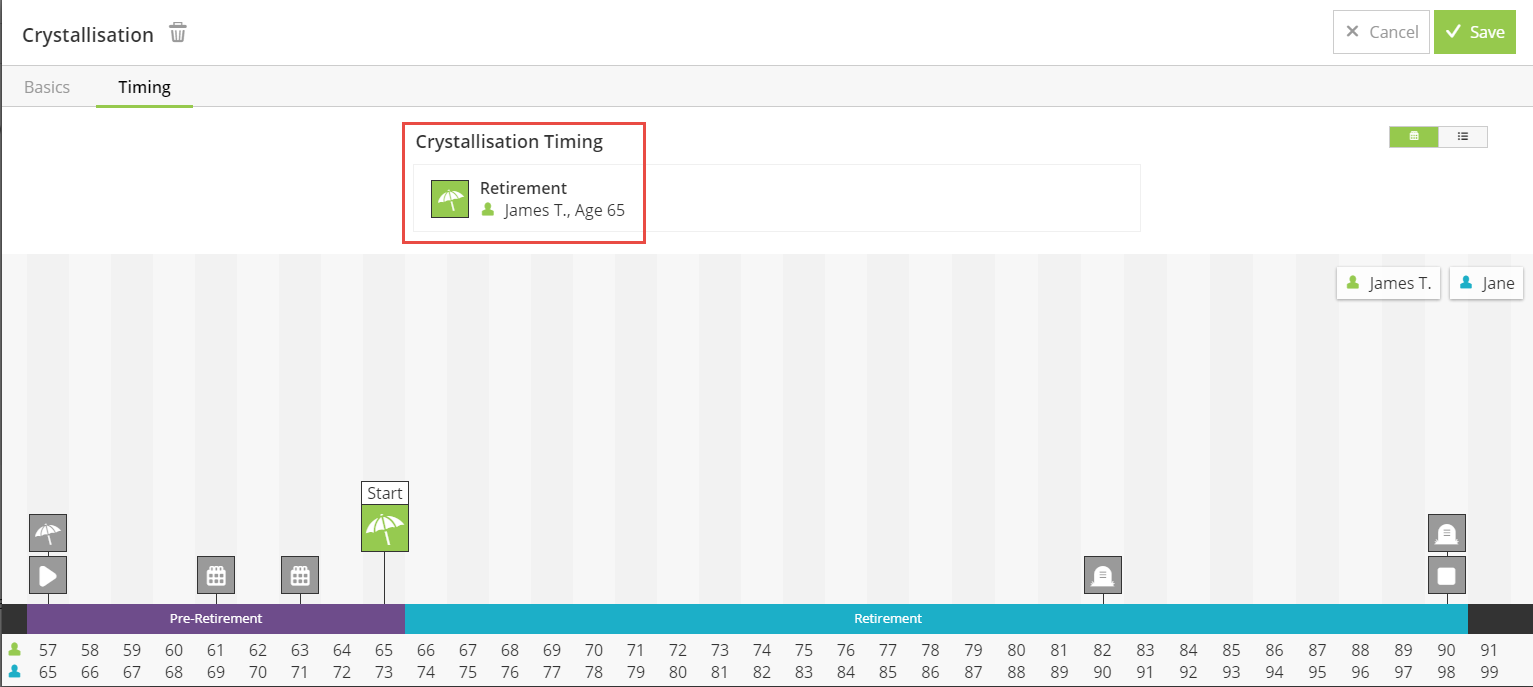

Retirement Planning Withdraw Full Tax free Cash With Or Without

https://support.planwithvoyant.com/hc/article_attachments/360080541371/mceclip2.png

What Counts As Taxable Income In The UK Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2020/06/taxable-income-uk.jpg

Income Tax What s It All About

https://images.prismic.io/payfit/4a90d271-43c6-4dcf-834a-53fa79bb3a33_UK+tax+rates.png?auto=compress,format&rect=0,0,642,406&w=2429&h=1536

Verkko Taxable income Tax rate Personal Allowance Up to 163 12 570 0 Basic rate 163 12 571 to 163 50 270 20 Higher rate 163 50 271 to 163 125 140 40 Additional rate Verkko If the taxpayer is a financial trader in cryptoassets or the cashback is received in the course of another trade these cashback rewards will be treated as taxable trading

Verkko 29 huhtik 2013 nbsp 0183 32 A spokesman said quot There is no question of tax becoming payable on cashbacks received from credit debit and loyalty cards or any other kind of cashback Verkko Basis of taxation in the UK An individual s basis of taxation in the UK depends on both their residence and domicile position Both concepts are discussed further below If an

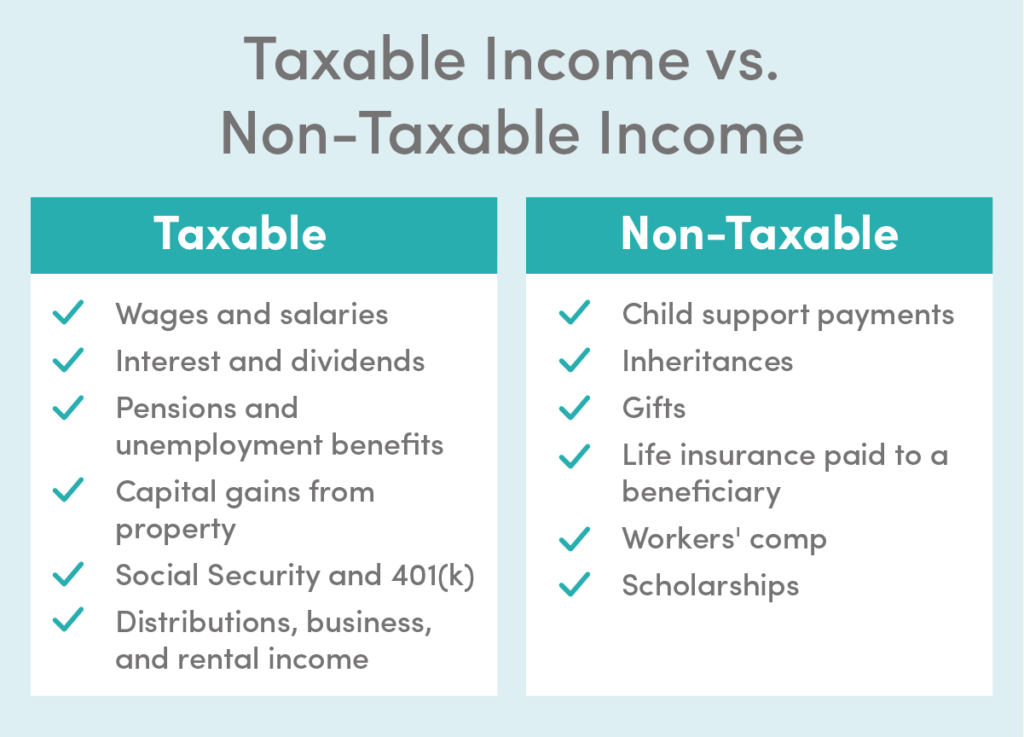

Taxable Non Taxable Income What s The Difference Borshoff Consulting

https://borshoffconsulting.com/wp-content/uploads/2020/03/Taxable-Non-Taxable-Income-Header-1200x400-1.jpg

Taxable Income Vs Nontaxable Income What You Should Know

https://www.aotax.com/wp-content/uploads/2017/10/Taxable-Income-vs.-Nontaxable-Income-What-You-Should-Know.jpg

https://forums.moneysavingexpert.com/discussion/4824597

Verkko 19 marrask 2013 nbsp 0183 32 My understanding is a cashback or reward in a current account is classed as savings income and would already have 20 basic rate income tax

https://blogs.law.ox.ac.uk/business-law-blog/blog/2021/04/cash-back...

Verkko 2 huhtik 2021 nbsp 0183 32 Commissioner TC Memo 2021 23 the Court held that while generally cash back rewards are not includible in an individual taxpayer s gross income they

Taxable Income What Is Taxable Income Tax Foundation

Taxable Non Taxable Income What s The Difference Borshoff Consulting

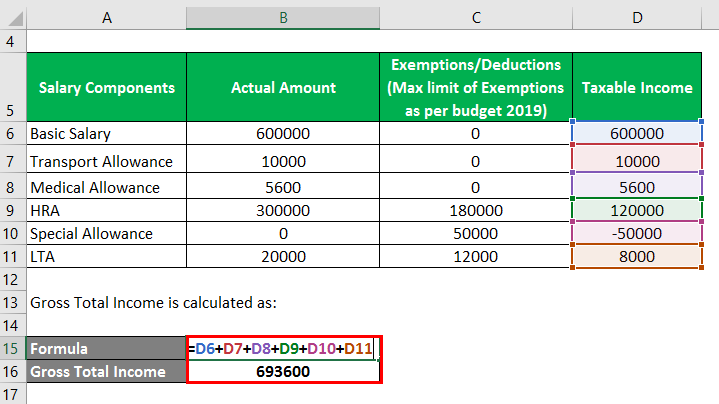

Taxable Income Formula Calculator Examples With Excel Template

Is Real Estate Agent Cash Back Taxable In US 1099 MISC USA

Taxable Income Formula Financepal

The Tax Implications Of Cash Back Credit Cards SpentApp

The Tax Implications Of Cash Back Credit Cards SpentApp

Here s How To Make The Most Out Of Cash back Credit Cards

Calculate UK Income Tax Using VLOOKUP In Excel Progressive Tax Rate

What Income Is Taxable Blog hubcfo

Is Cash Back Taxable Income Uk - Verkko 4 lokak 2022 nbsp 0183 32 These banking awards are taxable income taxed as other income They are not classed as bank interest and do not count towards the personal savings