Is Ccb Taxable The new CCB is completely tax free meaning the payments are not reported on your tax return or factored into your tax payable calculation You are required to file an annual

The Canada child benefit CCB is administered by the Canada Revenue Agency CRA It is a tax free monthly payment made to eligible families to help with the cost of raising children Your CCB payment is not taxable This means that you will not receive a slip and you don t have to report it on your tax return Find out if you can get your taxes done for free

Is Ccb Taxable

Is Ccb Taxable

https://www.planeasy.ca/wp-content/uploads/2020/06/Canada-Child-Benefit-Increase-2020-1200x630-w-Words.jpg

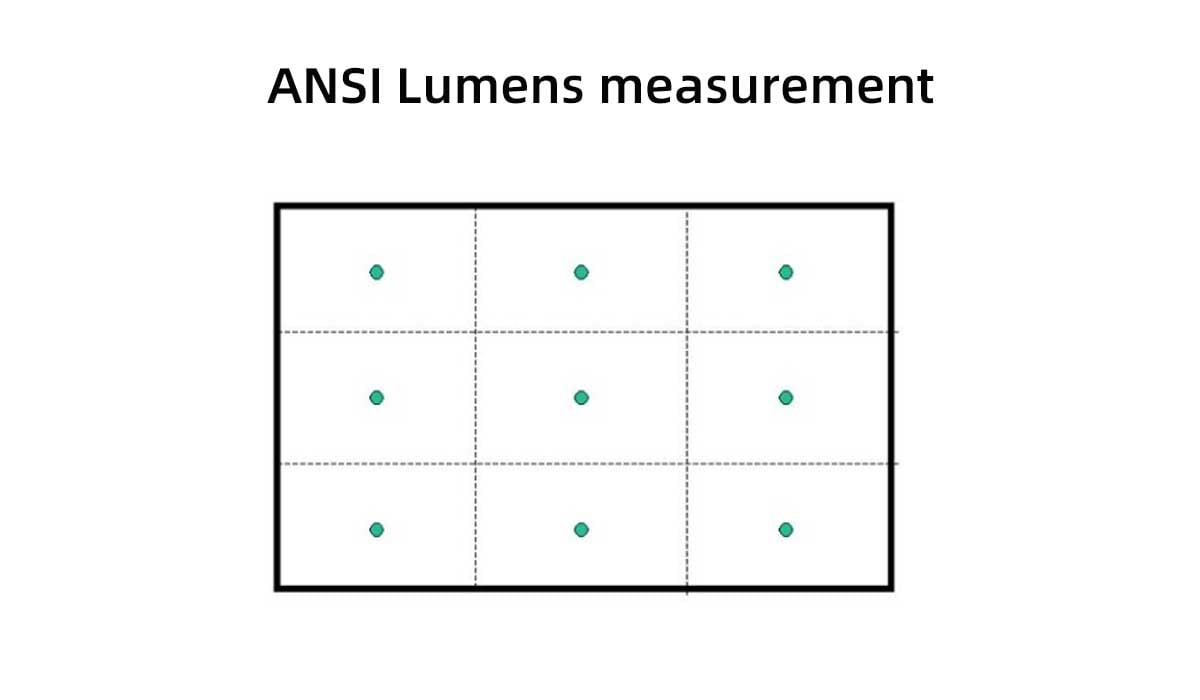

What Is CCB Lumens CCB Lumens Vs ANSI Lumens TVsBook

https://www.tvsbook.com/cdn-cgi/image/quality=85,format=auto/attachments/ansi-lumens-measurement-jpg.17580/

An Overview

https://samalcity.gov.ph/images/ccb_2.jpg

What is the CCB The Canada Child Benefit CCB is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The The Canada child benefit CCB provides a tax free monthly payment to families to help them with the cost of raising children under the age of 18 You must meet specific criteria to qualify for

Q4 Does the CCB affect my taxes No the Canada Child Benefit is tax free and does not count as taxable income However failing to file your taxes on time may affect your Note that CCB and CDB are not included in taxable income so don t have to be deducted to get to AFNI Entitlement to the CCB for the July 2025 to June 2026 benefit year is based on AFNI

Download Is Ccb Taxable

More picture related to Is Ccb Taxable

What Is CCB Notice Instaccountant

https://instaccountant.com/wp-content/uploads/2022/03/family.jpg

CCB Website Upgrading Yuchima Experience Prototyper

https://payload.cargocollective.com/1/21/682551/11348647/homebanner2_1920.jpg

How Is Ccb Lob I Am Joining Ccb Lob On 8th Aug An Fishbowl

https://files.getfishbowl.com/content_preview_images/how-is-ccb-lob-i-am-joining-ccb-lob-on-8th-aug-and-will-i-be-eligible-for-a-hike-and-a-bonus-in-the-month-of-jan-also-i-heard-about.png

The Universal Child Care Benefit UCCB was a taxable payment that the Canada Revenue Agency ended in 2016 and replaced with the tax free CCB If your child has a Income earned on any of the above amounts is taxable For example any interest that you earn when you invest lottery winnings must be reported on your return Complete Form T90

The amount you receive from the Canada Child Benefit CCB depends on a few factors one is the taxable net income for the family line 23600 on your tax return another is the number of If you live in Canada and have a child below the age of 18 you may be eligible for the Canada Child Benefit CCB a monthly tax exempt payment administered by the Canada

Are My Social Security Benefits Taxable Calculator

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

CCB Community Centered Board In Government Military By

http://acronymsandslang.com/acronym_image/130/5ba76f75cec9a4dd4170aa780fcf0fdd.jpg

https://turbotax.intuit.ca › tips

The new CCB is completely tax free meaning the payments are not reported on your tax return or factored into your tax payable calculation You are required to file an annual

https://www.canada.ca › en › revenue-agency › services...

The Canada child benefit CCB is administered by the Canada Revenue Agency CRA It is a tax free monthly payment made to eligible families to help with the cost of raising children

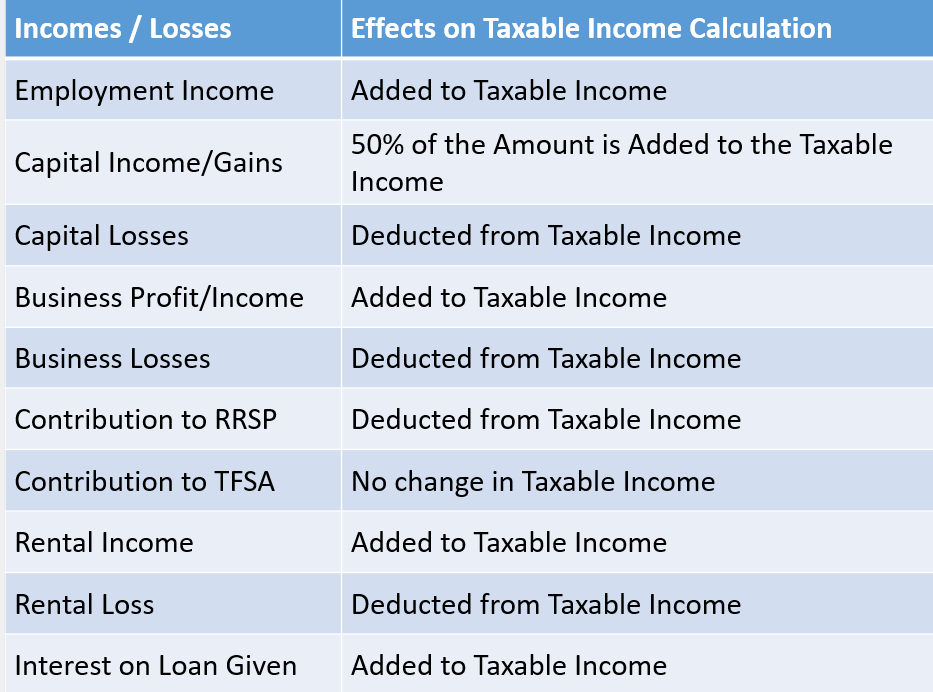

Solved Sample Process Method Calculate Taxable Income And Chegg

Are My Social Security Benefits Taxable Calculator

How Is CCB Line Of Business In Terms Of Job Securi Fishbowl

ProjectManagement The Role Of The CCB

What Is CCB Lumen Projector1

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

A Sufficient Condition For C CAB CCa Is CCB Chegg

CCB Skopje

Oregon Contractor License Course CCB Exam Prep OnlineEd

Is Ccb Taxable - The Canada child benefit CCB provides a tax free monthly payment to families to help them with the cost of raising children under the age of 18 You must meet specific criteria to qualify for