Is Child Care Tax Deductible In California The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities There are two major benefits of the credit This is a tax credit rather than a tax deduction December 1 2023 Tax Deductions For parents who are responsible for childcare handling the cost of bringing up children can be challenging That s why the IRS allows you to deduct certain child or dependent care expenses on your tax return

Is Child Care Tax Deductible In California

Is Child Care Tax Deductible In California

https://www.choklits.com.au/wp-content/uploads/2023/02/Is-child-care-taxt-deductible.jpg

Brand New Child Care Tax Credit YouTube

https://i.ytimg.com/vi/i1vloumpjd4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AGMAoAC4AOKAgwIABABGGUgWihHMA8=&rs=AOn4CLArl3ifqGw4lwT6w8iyX3x6cVDb-A

Is Memory Care Tax Deductible What You Can Claim 2019

https://well-more.com/wm/wp-content/uploads/2020/02/mc-thumb.jpg

Yes Nursery school preschool and similar pre kindergarten programs are considered child care by the IRS Summer day camps also count as child care Expenses for overnight summer camps kindergarten and first grade or higher don t qualify for the Child and Dependent Care credit Dependent care services provided by one of your kids who is under the age of 19 at the end of the plan year are not eligible for reimbursement For example if you pay your 18 year old to take care of your 9 year old or a parent the expense is not reimbursable Food and clothing costs are not reimbursable

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons

Download Is Child Care Tax Deductible In California

More picture related to Is Child Care Tax Deductible In California

DAYCARE TAX STATEMENT Childcare Center Printable End Of The Etsy In

https://i.pinimg.com/originals/32/9e/c2/329ec24df04c77c70081e4a28267c980.jpg

Is Memory Care Tax Deductible What You Can Claim 2019

https://well-more.com/wm/images/blog/banners/mc-questions-banner.jpg

How Much Childcare Is Tax Deductible 2018 Tax Walls

https://img.jakpost.net/c/2018/01/05/2018_01_05_38433_1515117518._large.jpg

The person providing the care can t be Your spouse Parent of your qualifying child under age 13 Person you can claim as a dependent If your child provides the care they Must be age 19 or older Can t be your dependent If you re married but not filing jointly with your spouse you can claim the credit if People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For taxes filed in 2024 1 600 of the credit is potentially refundable

After applying the California percentage allowable the estimated California Child and Dependent Care Expenses Credit is 100 million Under current law the amount of credit each taxpayer can use is limited by their tax liability These taxpayers currently claim an estimated 33 million in Child and Dependent Care Expenses Credit per year For your 2021 tax return the cap on the expenses eligible for the credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or more Additionally you may be able to

Tax Deductible Child Care Gathers Steam

https://static.ffx.io/images/$width_620%2C$height_349/t_crop_fill%2Cq_88%2Cf_auto/3d6d91e1d3a2d334a1acec714111cc878021b0c6

Is Lawn Care Tax Deductible Maybe GreenPal

https://greenpal-production.s3.amazonaws.com/9cLt1YVsjs3XYRNWdUBPc3PJ

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

https://turbotax.intuit.com/tax-tips/family/the...

Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities There are two major benefits of the credit This is a tax credit rather than a tax deduction

School Supplies Are Tax Deductible Wfmynews2

Tax Deductible Child Care Gathers Steam

Is Nursing Home Care For Dementia Tax Deductible Dementia Talk Club

Is Dementia Care Tax Deductible Credits Deductions For Caregivers

Medicare Part B Premium 2024 Chart

Parenting Less Taxing With Child Care Credit H R Block Newsroom

Parenting Less Taxing With Child Care Credit H R Block Newsroom

Health Care Decoded The Daily Dose CDPHP Blog

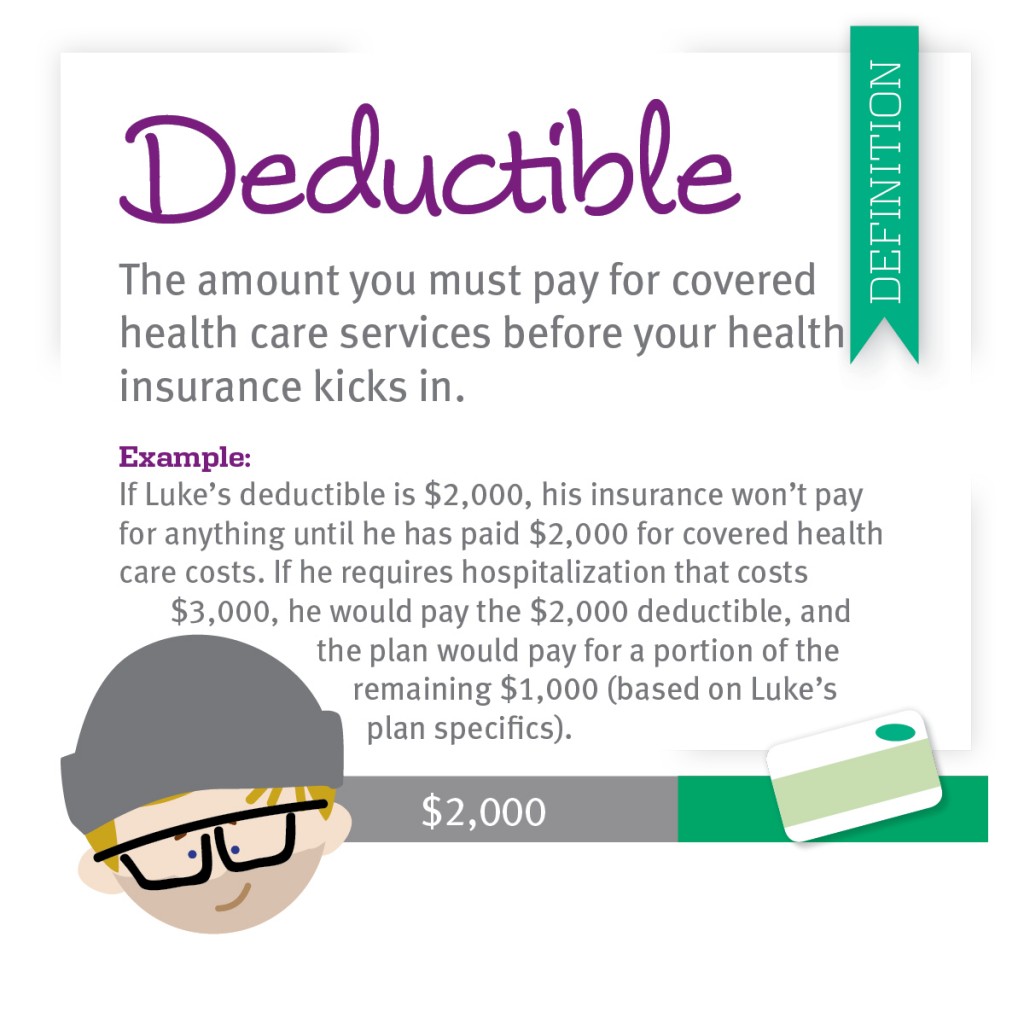

Benefits A Z What Is A Deductible

Is Your Auto Insurance Tax Deductible Answer At Good To Go Insurance

Is Child Care Tax Deductible In California - The Child and Dependent Care Tax Credit The child care credit is a tax credit based on your childcare expenses Under the regular rules the maximum credit is 35 of childcare expenses up to 3 000 for one child or 6 000 for two or more However for 2021 only the maximum credit is 50 of childcare expenses up to 8 000 for one child and