Is Child Tax Benefit Taxable Income Canada child benefit The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB may include an additional amount for the child disability benefit

July 2022 to June 2023 based on your adjusted family net income from 2021 In other words a change in your income in 2022 will only be reflected in your payments starting in July 2023 If your payment changed or stopped in another month go to If your payment stopped or changed Related provincial and territorial benefits The Child Disability Benefit CDB begins to be scaled back at the 68 708 family net income point for 2020 For new parents who haven t yet received any child benefits the application process for the CCB is described here Benefit payments will continue to be paid on the 20 th of each month If you share custody of your children

Is Child Tax Benefit Taxable Income

Is Child Tax Benefit Taxable Income

https://www.formsbirds.com/formimg/child-tax-benefit-application-form/3297/canada-child-tax-benefit-statement-of-income-d1.png

Child Tax Benefit Increase 2021 Everything You Need To Know

https://www.moneyreverie.com/wp-content/uploads/2021/07/Child-Tax-Benefit-Increase-2021.jpg

Fillable Social Security Benefits Worksheet 2022 Fillable Form 2023

http://fillableforms.net/wp-content/uploads/2022/07/fillable-social-security-benefits-worksheet-2022.png

Opt to have some of your salary paid in the form of childcare vouchers if your employer offers such a scheme The tax is 1 of the amount of child benefit for each 100 of income on a sliding The Child Tax Credit is a tax benefit granted to American taxpayers with children under the age of 17 as of the end of the year For the 2023 tax year the tax return filed in 2024

As the income of the parent in this scenario is 9 000 over the threshold they face a tax charge of 90 of 1 828 which is 1 645 That means the overall value of the family s child benefit Canada Revenue Agency Tax credits and benefits for individuals Canada child benefit Starting November 20 2023 all individuals will be required to provide proof of birth when applying for the Canada child benefit CCB The Canada child benefit CCB is administered by the Canada Revenue Agency CRA

Download Is Child Tax Benefit Taxable Income

More picture related to Is Child Tax Benefit Taxable Income

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

https://blog.navitmoney.com/wp-content/uploads/2020/07/what-is-taxable-income-1400x1125.png

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Helpful Resources For Calculating Canadian Employee Taxable Benefits

https://www.artofaccounting.ca/wp-content/uploads/2020/01/TaxBenefits-1024x640.jpg

Child tax credit is a means tested benefit that can top up your income if you are responsible for at least one child or young person You don t have to be working to claim You can only claim child tax credit if you already receive working tax credit have claimed child tax credit in the past year Otherwise you ll need to claim Universal Credit If you live in Canada and have a child below the age of 18 you may be eligible for the Canada Child Benefit a monthly tax exempt payment administered by the Canada Revenue Agency Here s what you need to know

Child Benefit income based use the Child Benefit tax calculator to see if you ll have to pay tax Child Tax Credit Disability Living Allowance DLA free TV licence for The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

https://www.canada.ca/.../canada-child-benefit.html

Canada child benefit The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB may include an additional amount for the child disability benefit

https://www.canada.ca/en/revenue-agency/services/...

July 2022 to June 2023 based on your adjusted family net income from 2021 In other words a change in your income in 2022 will only be reflected in your payments starting in July 2023 If your payment changed or stopped in another month go to If your payment stopped or changed Related provincial and territorial benefits

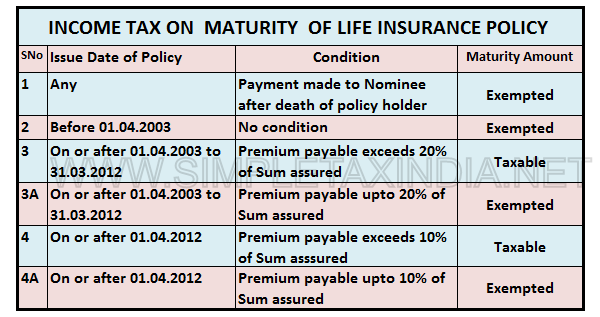

INCOME TAX ON MATURITY RECEIPT OF LIFE INSURANCE POLICY S K And

What Is Taxable Income Explanation Importance Calculation Bizness

Child Tax Benefit Stock Image Image Of Concept Children 96941031

Child Tax Credit 2022 Income Limit Phase Out TAX

Child Tax Benefit Payment Dates For 2021

Maximize Your Paycheck Understanding FICA Tax In 2023

Maximize Your Paycheck Understanding FICA Tax In 2023

How To Find Average Income Tax Rate Parks Anderem66

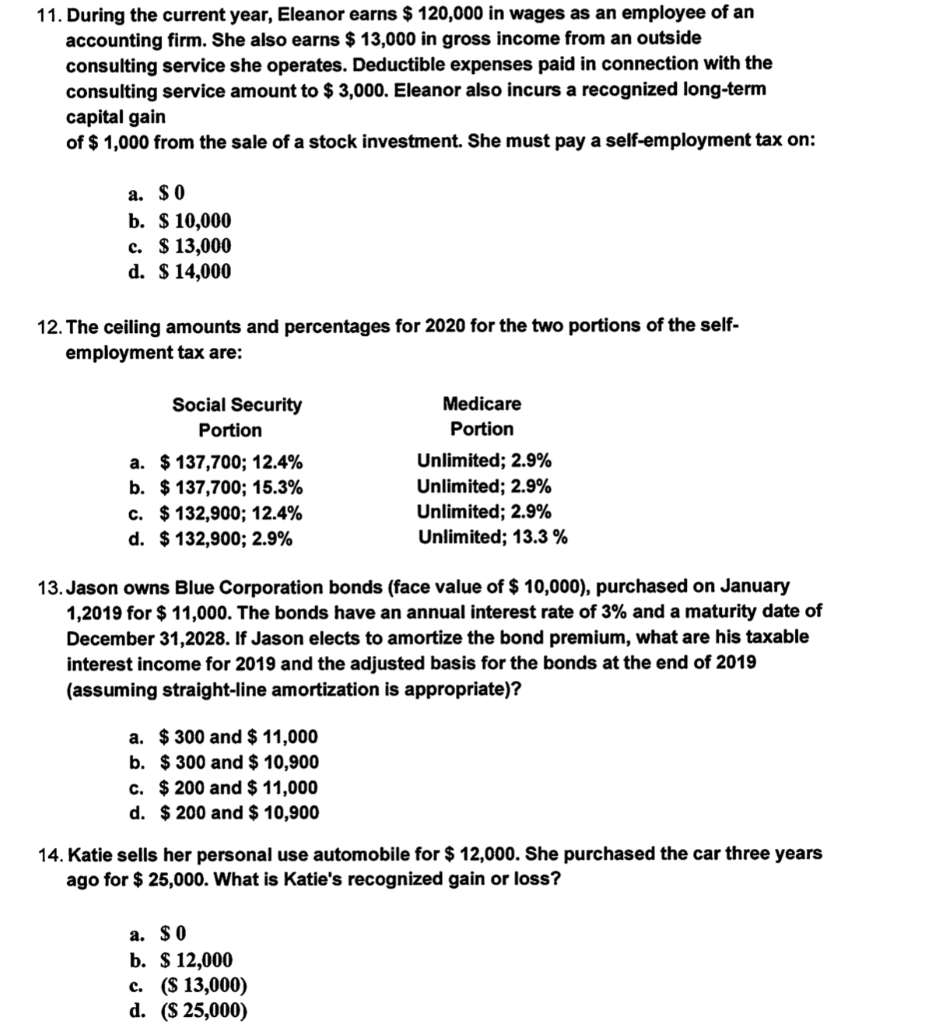

Solved 8 In 2020 George And Martha Are Married And File A Chegg

8 2023 Social Security Tax Limit Ideas 2023 GDS

Is Child Tax Benefit Taxable Income - As the income of the parent in this scenario is 9 000 over the threshold they face a tax charge of 90 of 1 828 which is 1 645 That means the overall value of the family s child benefit