Is Contribution To Vpf Taxable This has made some people wonder if they should continue contributing towards a voluntary provident fund VPF which earns the

VPF contributions made towards the EPF accounts are eligible for tax deductions under the provisions of Section 80C of the Income Tax Act 1951 Hence you The entire maturity amount becomes taxable if the direct tax code comes into effect You can contribute 100 of basic plus dearness allowance DA as an investment in VPF If

Is Contribution To Vpf Taxable

Is Contribution To Vpf Taxable

http://web.mit.edu/vpf/tech/resources/calendar/directory.png

EPF Historical Interest Rates Since Year 1952 Succinct FP

https://www.succinctfp.com/wp-content/uploads/2013/02/EPF-VPF-Historical-Interest-Rates_FY2021-22.png

VPF Declaration Form PDF

https://imgv2-2-f.scribdassets.com/img/document/236111503/original/e08f7986b2/1673415047?v=1

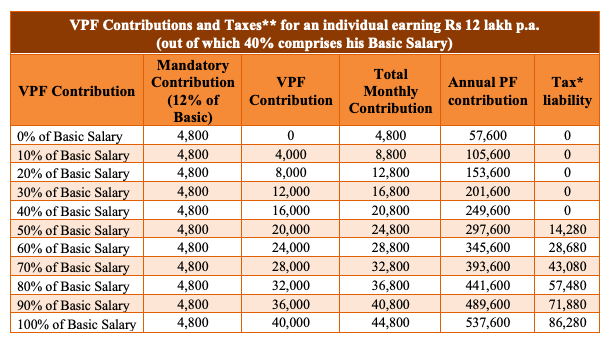

Finance Minister Nirmala Sitharaman has announced in the Union Budget 2021 22 to levy income tax on interest earned on employee s contribution towards the Employee Provident Fund or EPF if the sum VPF PPF EPF Eligibility Criteria Employed Indian Any Indian citizen Employed Indian Contribution Up to 100 Minimum contribution INR 500 and the

13 min read 14 May 2023 03 20 PM IST Vipul Das The three major government backed retirement plans Employee Provident Fund EPF Voluntary Provident Fund VPF and To make an additional contribution to the EPF account one can do so via Voluntary Provident Fund VPF However do note that if the contributions via EPF and

Download Is Contribution To Vpf Taxable

More picture related to Is Contribution To Vpf Taxable

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

https://certicom.in/wp-content/uploads/2020/09/Employee-Provident-Fund.png

EPF VPF PPF

https://www.jagranimages.com/images/newimg/15052020/15_05_2020-rupee_in_hand_20273880.jpg

How To Calculate Vpf Interest CETDGO

https://shubhwealth.com/wp-content/uploads/2020/01/VPF.png

The contribution towards PF is eligible for tax deduction under Section 80C of the Income Tax Act while VPF offers the same tax benefits as the PF Same as EPF Effective 1 April if you are contributing more than Rs2 5 lakh in your Employee s Provident Fund EPF the interest earned on the same will be taxable under

The contributions made towards VPF are eligible for tax deductions under Section 80C of the Income Tax Act 1961 Is VPF more beneficial than other tax saving investments Voluntary Provident Funds VPF fall under the EEE category that is exempt on contribution exempt from principal and exempt on interest This means you enjoy

Will The Tax On Increased EPF Contribution Impact You And How Does VPF

https://www.thebuyt.com/wp-content/uploads/2021/03/epf-vs-vpf.jpg

GlobalProtect VPN Welcome To VPF Tech

http://web.mit.edu/vpf/tech/resources/vpnbeta/gp-settings.png

https://www.timesnownews.com/business-eco…

This has made some people wonder if they should continue contributing towards a voluntary provident fund VPF which earns the

https://cleartax.in/s/pf-vs-vpf

VPF contributions made towards the EPF accounts are eligible for tax deductions under the provisions of Section 80C of the Income Tax Act 1951 Hence you

Income Tax News EPFO

Will The Tax On Increased EPF Contribution Impact You And How Does VPF

Have Voluntary Provident Funds Lost Their Sheen After Budget Scripbox

Vpf Interest Rate Voluntary Provident Fund Investing Contribution

EPF Contribution How Much Can You Invest Via VPF To Ensure Interest

VPF Interest Rate Voluntary Provident Fund Calculation

VPF Interest Rate Voluntary Provident Fund Calculation

Listed PSU Bonds Taxable Values Taken For SBI Bond N5 Eight Fixed

Use VPF And PPF To Balance The Reduction In EPF Contribution Mint

How To Earn 1 Crore With VPF Retirement Plan With PF YouTube

Is Contribution To Vpf Taxable - VPF PPF EPF Eligibility Criteria Employed Indian Any Indian citizen Employed Indian Contribution Up to 100 Minimum contribution INR 500 and the