Is Dental Work Tax Deductible In Ontario Web On line 33099 of your tax return Step 5 Federal Tax enter the total amount that you or your spouse or common law partner paid in 2022 for eligible medical expenses Step 2

Web For the 2023 tax year you can claim your total amount of eligible medical expenses the lesser of 2 635 3 of your net income These expenses mustn t have been reimbursed Web General information How to claim medical expenses Credits or deductions related to medical expenses Certain medical expenses require a certification Common medical

Is Dental Work Tax Deductible In Ontario

Is Dental Work Tax Deductible In Ontario

https://www.kkcpa.ca/wp/wp-content/uploads/Webp.net-resizeimage.jpg

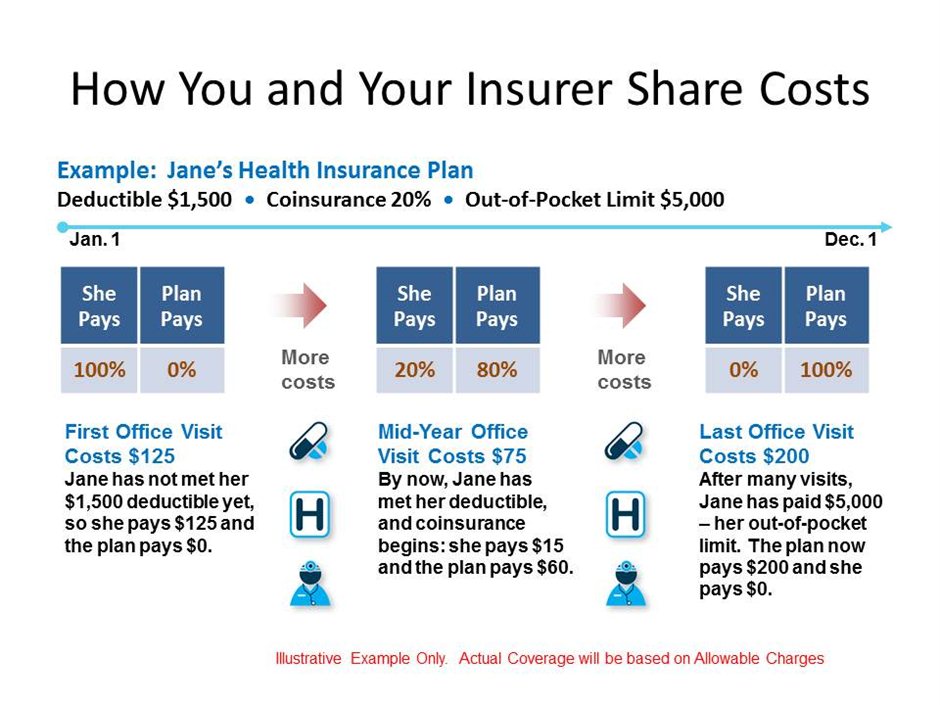

What Is A Car Insurance Deductible In Ontario KBD Insurance

https://kbdinsurance.com/wp-content/uploads/2022/07/what-is-a-deductible-in-car-insurance-1.jpg

Is Volunteer Work Tax Deductible Agingnext

https://agingnext.org/wp-content/uploads/2022/03/Volunteer-Tax-Deductions.jpg

Web 22 Juli 2023 nbsp 0183 32 The cost of dental devices and appliances such as dentures braces retainers and mouthguards may be eligible for tax deductions Dental Cleanings and Web 1 Okt 2020 nbsp 0183 32 Identify which medical expenses you can claim when filing taxes Plus learn about common medical expenses if family members can claim and the 12 month rule

Web If you make contributions to a private health services plan such as medical or dental plans for employees there is no taxable benefit for the employees Note Employee paid Web This guide gives you general financial tax and legal information to help you succeed in all phases of your practice

Download Is Dental Work Tax Deductible In Ontario

More picture related to Is Dental Work Tax Deductible In Ontario

Are Dental Expenses Tax Deductible Maybe

https://www.deltadentalia.com/webres/image/blog/Taxes-iStock.jpg

What Is A Dental Insurance Deductible Delta Dental Of Washington

https://www.deltadentalwa.com/-/media/DDWA/page-images/dental-insurance-101/deductible/DDWA_A-Dental-Deductible-Is_Site_540x395.ashx

How To Maximize Your Tax Deductible Donations Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2021/12/tax-deductible-donations-before-Dec-31.jpeg

Web Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including Dental services Fillings Other dental work not Web 28 Feb 2022 nbsp 0183 32 The lowest federal tax rate is 15 And if they lived in Ontario where the lowest rate is 5 05 their total credit would be 601 50 20 05 of 3 000 Getting 600 back after out of pocket expenses of

Web 22 Juni 2023 nbsp 0183 32 Yes dental expenses can be tax deductible in certain situations In Canada you can claim eligible dental expenses as medical expenses on your tax Web CRA permits dental instruments below 500 to be written off as expenses There are many grey area decisions as to whether an expense is really a business expense at all For

2022 Tax Changes Are Meals And Entertainment Deductible

https://ryanreiffert.com/wp-content/uploads/2022/06/2022-Business-Owner-Update-The-Meals-and-Entertainment-Tax-Deductions.png

Do Dental Work And Implants Is Tax Deduction Dental News Network

https://sandiegoinvisaligndentist.org/wp-content/uploads/2022/08/What-dental-expenses-are-tax-deductible.jpeg

https://www.canada.ca/en/revenue-agency/services/tax/individuals/...

Web On line 33099 of your tax return Step 5 Federal Tax enter the total amount that you or your spouse or common law partner paid in 2022 for eligible medical expenses Step 2

https://turbotax.community.intuit.ca/turbotax-support/en-ca/help...

Web For the 2023 tax year you can claim your total amount of eligible medical expenses the lesser of 2 635 3 of your net income These expenses mustn t have been reimbursed

School Supplies Are Tax Deductible Wfmynews2

2022 Tax Changes Are Meals And Entertainment Deductible

Understanding Deductibles For Renters Insurance Goodcover Fair

Deductible Business Expenses For Independent Contractors Financial

Are Work Clothes Tax Deductible For Self Employed

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

Insurance And Benefits In Buffalo Grove Arlington Heights IL ARC

Are Dental Implants Tax Deductible Dental News Network

Tax Deductible Donations Through The Episcopal Church St Andrew s

Is Dental Work Tax Deductible In Ontario - Web This guide gives you general financial tax and legal information to help you succeed in all phases of your practice