Is Disability Pension Taxable In India The pension amount consists of 2 components the service component and the disability component and is fully exempt from tax under Section 10 14 of the Income Tax Act 1961 The service component is equal to the retiring pension which is 50 of the last drawn emoluments

The matter has been examined in the The notification no 878 F dated 21 03 1922 provides income tax exemption to all members of Armed Forces who have been invalided for naval military or air force service on account of bodily disability attributable to or aggravated by such service Pension is taxable under the head salaries in your income tax return Pensions are paid out periodically generally every month However you may also choose to receive your pension as a lump sum also called commuted pension instead of a periodical payment

Is Disability Pension Taxable In India

Is Disability Pension Taxable In India

https://updatedyou.com/wp-content/uploads/2018/09/Webp.net-resizeimage-2.jpg

Do You Have To Report VA Disability As Income For 2023 Taxes Hill

https://www.hillandponton.com/wp-content/uploads/2021/03/DISABILITY20TAX20THUMBNAIL-1280x720.png

How Much Is The Disability Pension GeniusWriter

https://geniuswriter.net/wp-content/uploads/2021/11/disability-support-pension-life-insurance-disability-medical-insurance-policy-for-seniors-laptop-1536x1024.jpg

At the time of disbursing disability pension tax laws mandate that TDS is not required to be deducted If you receive retirement benefits in the form of a pension the amount received will be taxable and must be included in your income tax return ITR Just like other incomes accrued in

Section 80U of Income Tax Act provides tax benefits to those with disabilities in India A resident with at least 40 disability can claim Rs 75 000 deduction under 80U while severe disabilities yield Rs 1 25 000 Disability Pension Indian Army Section 10 14 Supports Armed Forces personnel disabled during service with the pension being fully exempt under Section 10 14 comprising service and disability components

Download Is Disability Pension Taxable In India

More picture related to Is Disability Pension Taxable In India

Disability Pension Taxable If Personnel Retired Under Normal

https://resize.indiatvnews.com/en/centered/newbucket/1200_675/2019/06/tax-934362444-6-1561519704.jpg

VA Disability Retirement Pay Calculator VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/va-disability-pension-pay-chart-fumut.jpg

Disability Pension For Army Veterans When Is It Taxable

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/06/26/841091-714636-disability-thinkstock.jpg

The matter has been re examined in the Board and it has been decided to reiterate that the entire disability pension i e disability element and service element of a disabled officer of the Indian Armed Forces continues to be exempt from income tax New Delhi The disability pension given to military personnel will be taxable unless they re forced out of service due to the disability sustained in service the finance ministry has ruled

Are these disability pensions tax free The entire pension and disability element of pension in all the categories is exempt from payment of income tax Uncommuted Pension Fully Taxable However disability pension payable to disabled armed forces personnel shall be exempt from tax Family Pension 33 33 of Family Pension subject to a maximum of Rs 15 000 shall be exempt from tax However the family pension received by the family members of the armed forces shall be fully

Is Disability Income Taxable In California Resources On Disability

https://www.disabilityhelp.org/wp-content/uploads/2023/04/is-disability-income-taxable-in-california.jpg

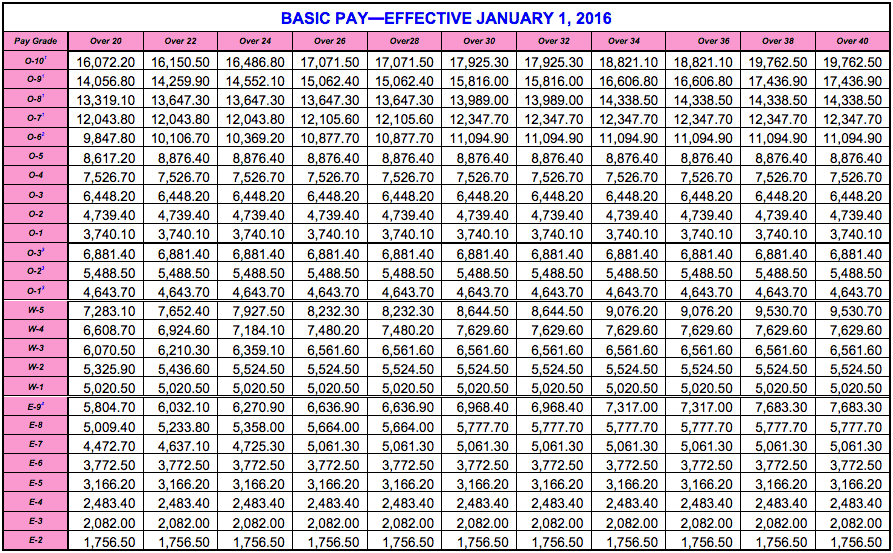

2024 Military Disability Pay Chart

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

https://www.caclubindia.com/articles/itr-for-army-personnel-52016.asp

The pension amount consists of 2 components the service component and the disability component and is fully exempt from tax under Section 10 14 of the Income Tax Act 1961 The service component is equal to the retiring pension which is 50 of the last drawn emoluments

https://taxguru.in/income-tax/disability-pension...

The matter has been examined in the The notification no 878 F dated 21 03 1922 provides income tax exemption to all members of Armed Forces who have been invalided for naval military or air force service on account of bodily disability attributable to or aggravated by such service

Disability Discrimination In The Workplace Mayo Wynne Baxter

Is Disability Income Taxable In California Resources On Disability

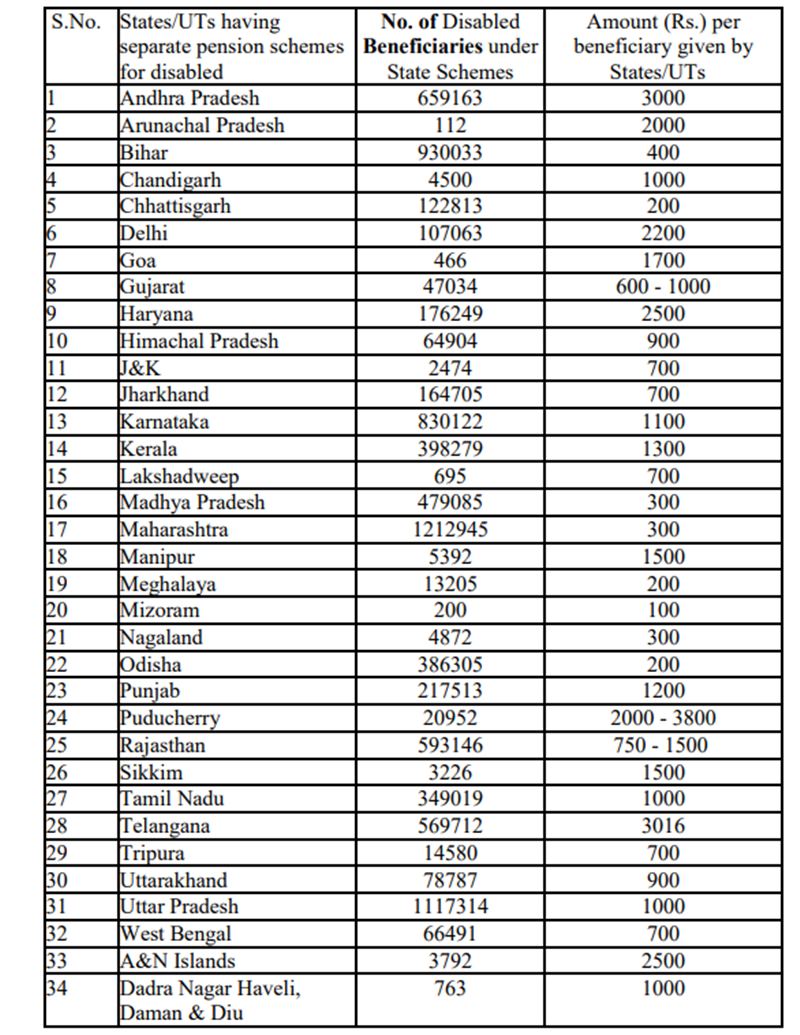

Disability Pension Less Than Rs 500 A Month In Eight States Govt

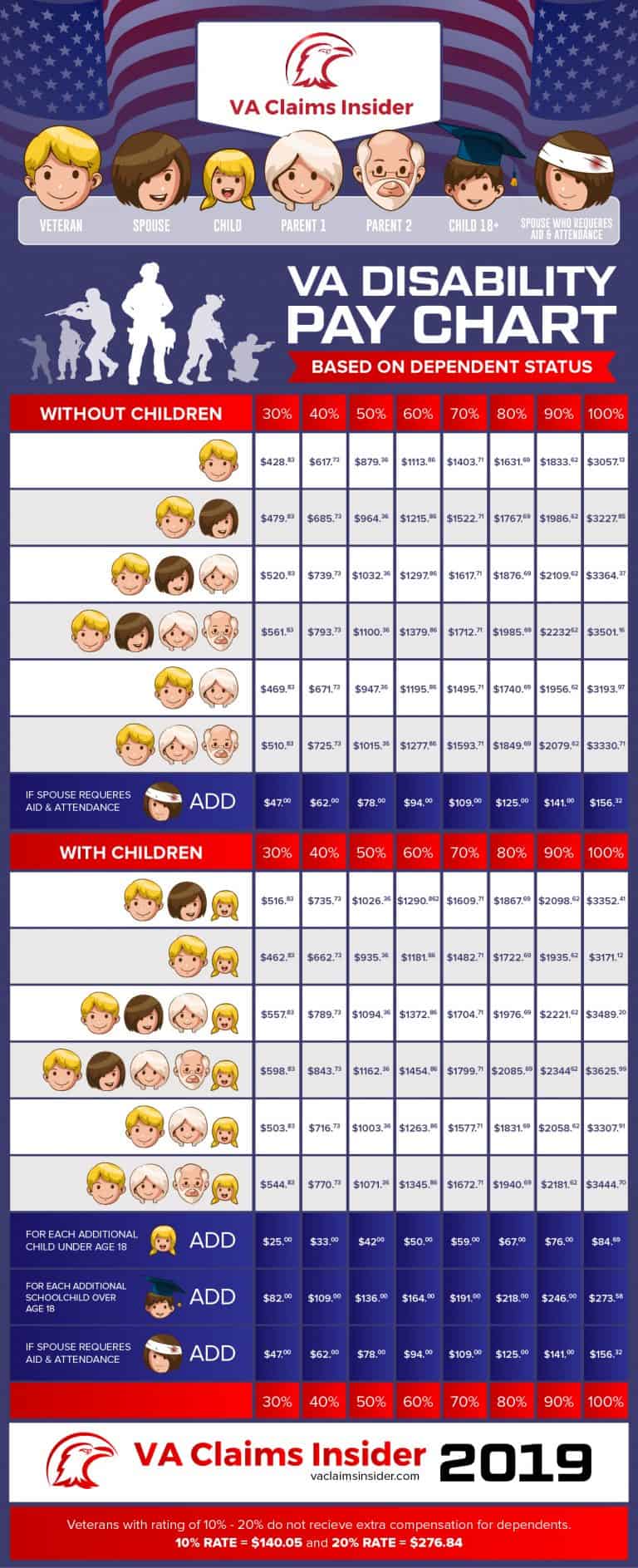

2019 VA Disability Pay Chart Based On Dependent Status VA Claims Insider

Are Disability Insurance Benefits Taxable In Canada

What Is The Treatment Of Disability Pension Income Retire Gen Z

What Is The Treatment Of Disability Pension Income Retire Gen Z

How Supplemental Disability Insurance Works For Doctors

7th Pay Disability Pension Latest News For Armed Forces Pensioners PCDA

Disability Pension Extraordinary Family Pension As Per 7th Pay

Is Disability Pension Taxable In India - The matter has been re examined in the Board and it has been decided to reiterate that the entire disability pension i e disability element and service element of a disabled officer of the Indian Armed Forces continues to be exempt from income tax