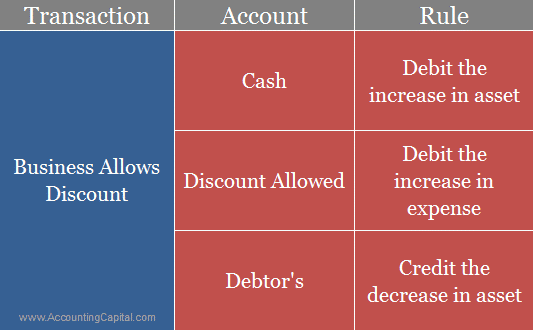

Is Discount Allowed An Expense Discount allowed is a reduction in the price of goods or services allowed by a seller to a buyer and is an expense for the seller However the discount received is the concession in the price received by the buyer of the goods and services from the seller and is

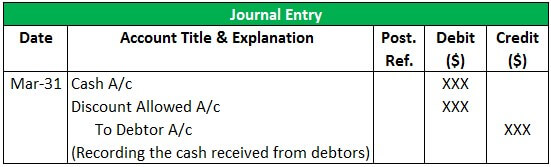

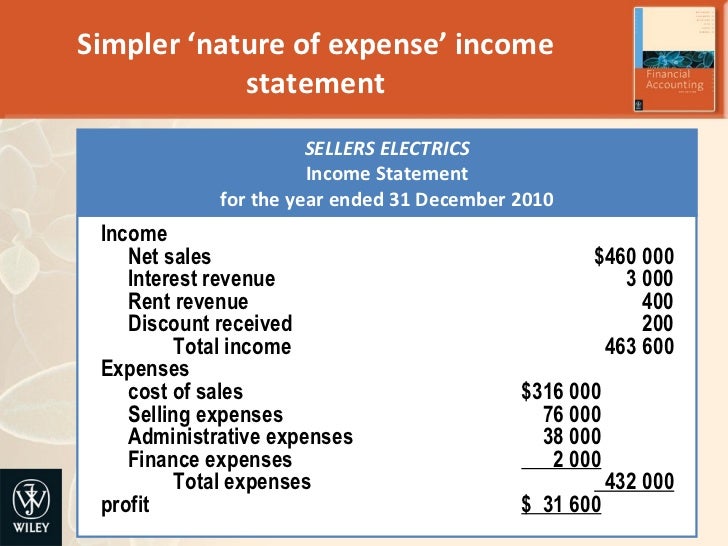

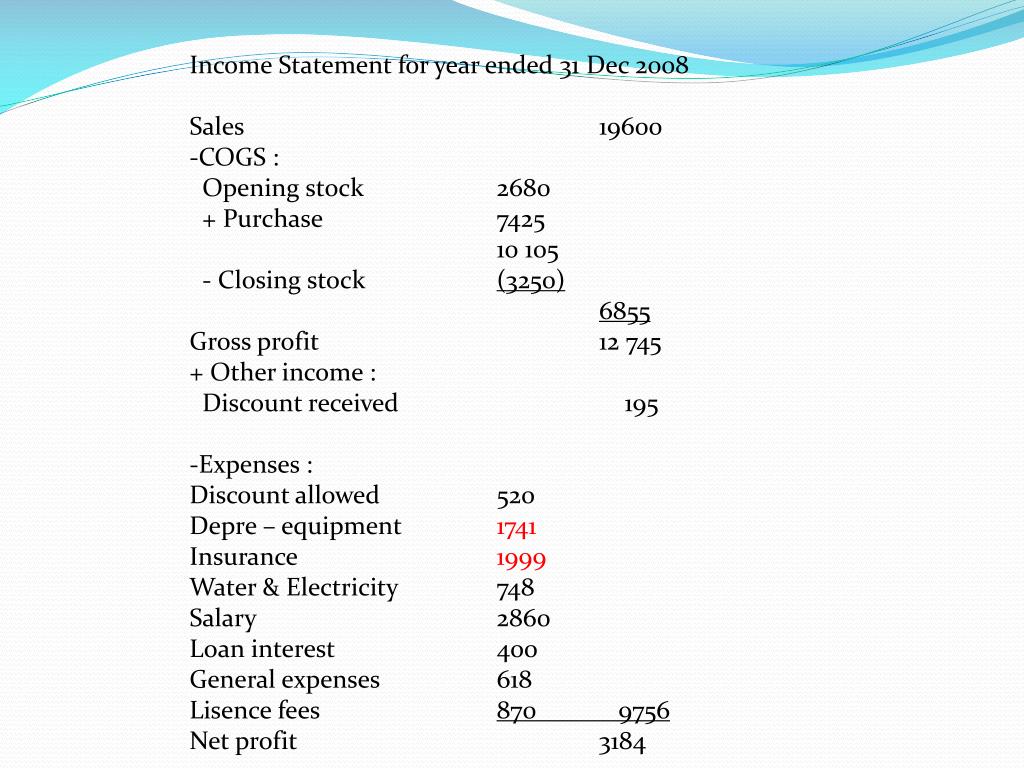

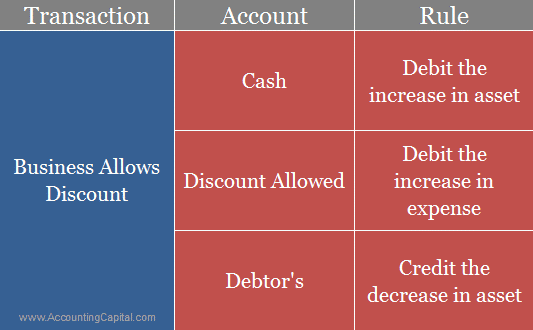

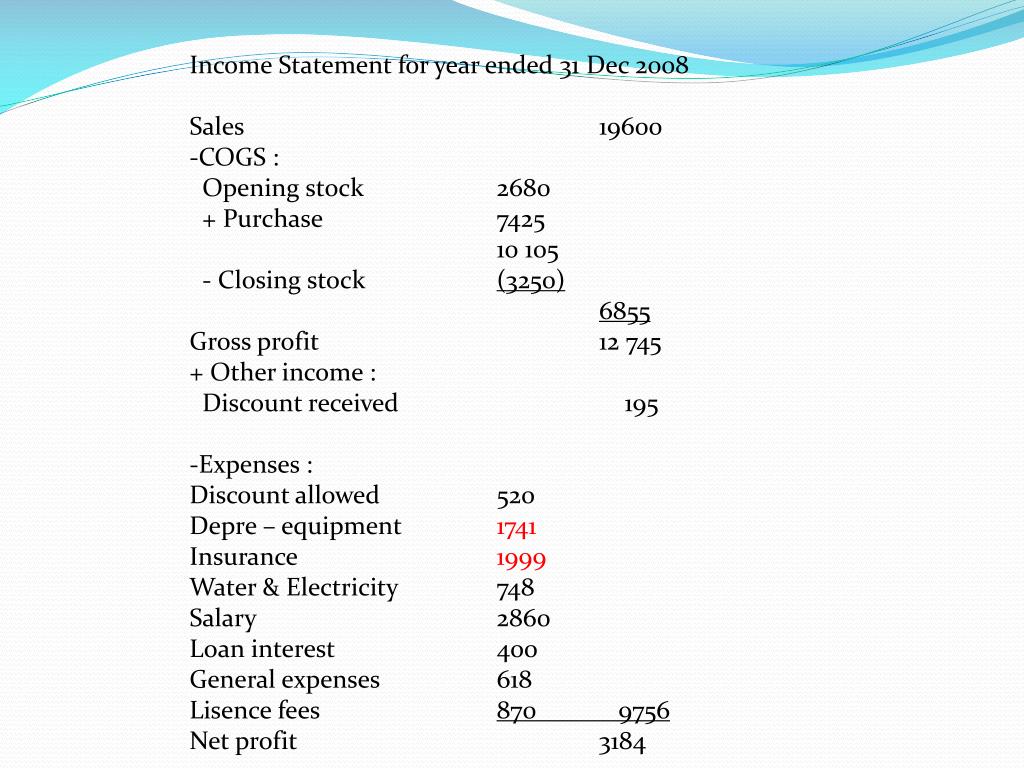

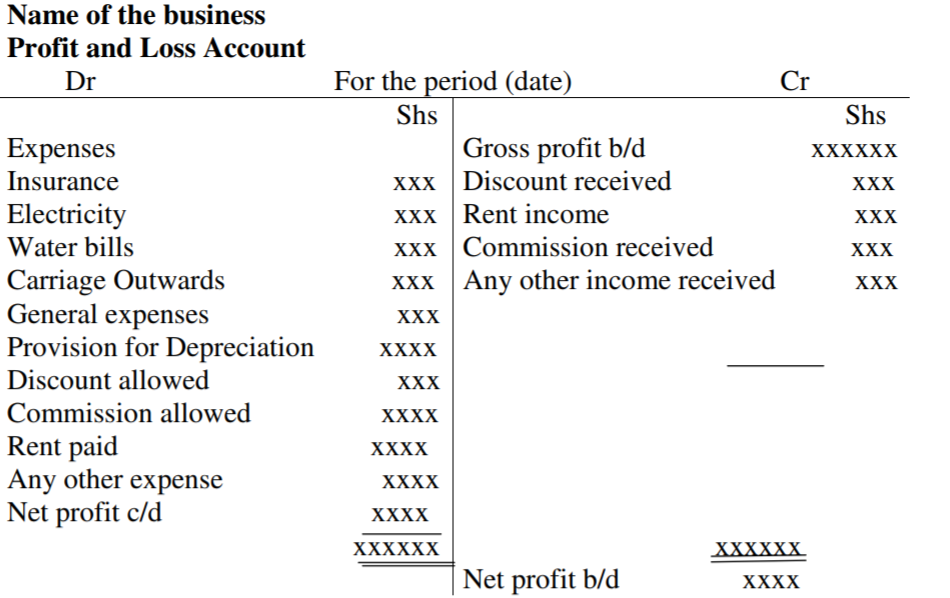

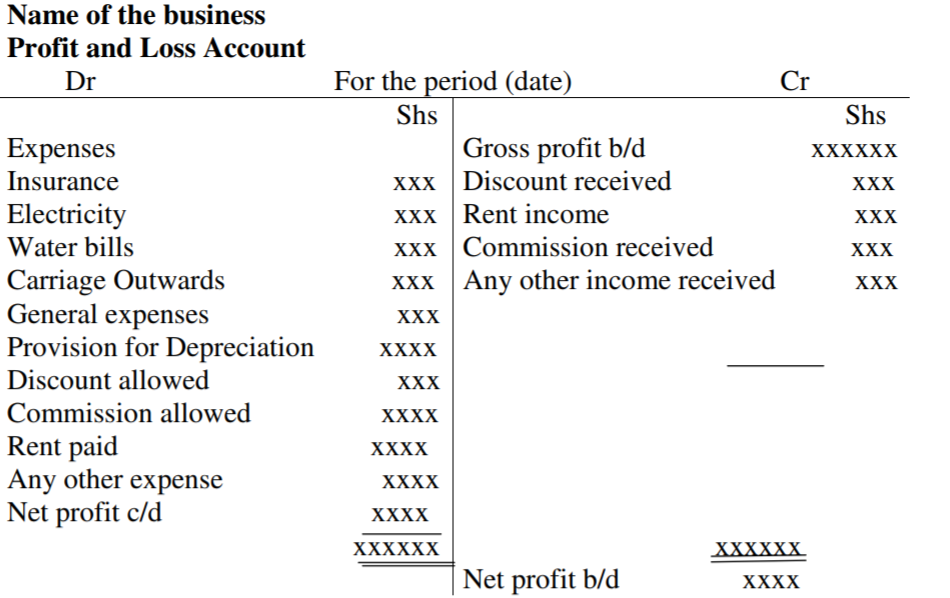

Discount allowed acts as an additional expense for the business and it is shown on the debit side of a profit and loss account Trade discount is not shown in the main financial statements however cash discount and other types of discounts are supposed to By definition a discount allowed is the reduction in the sale price of a good or service sold allowed to the buyer by the seller It is an income to the buyer but an expense for the seller Usually sellers allow discounts on credit sales when payments are made early

Is Discount Allowed An Expense

Is Discount Allowed An Expense

https://www.accountingcapital.com/wp-content/uploads/2018/08/Explanation-and-rules-for-journal-entry-for-discount-allowed.png

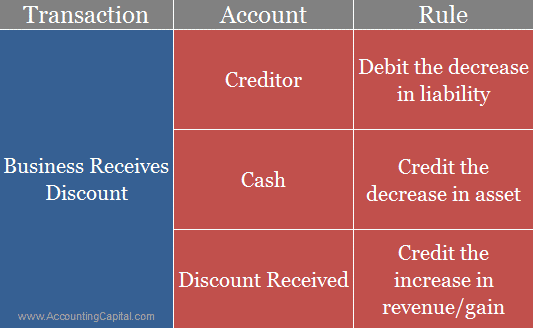

Discount Received Journal Entry Cash Purchase Of Goods Double Entry

http://image.slidesharecdn.com/accweek4-101212004354-phpapp01/95/acc-week-4-31-728.jpg?cb=1292114699

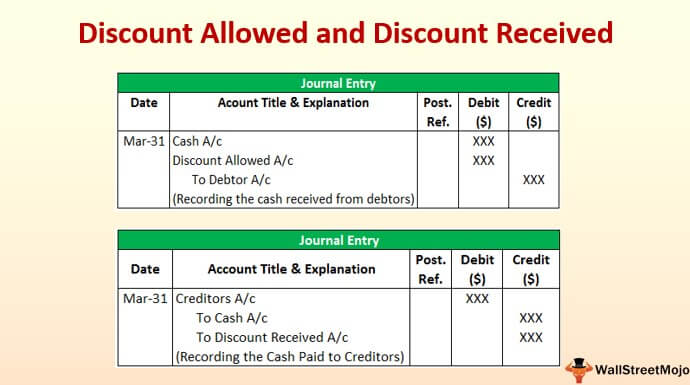

Discount Allowed And Discount Received Journal Entries With Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received-Journal-Entry-1.4.jpg

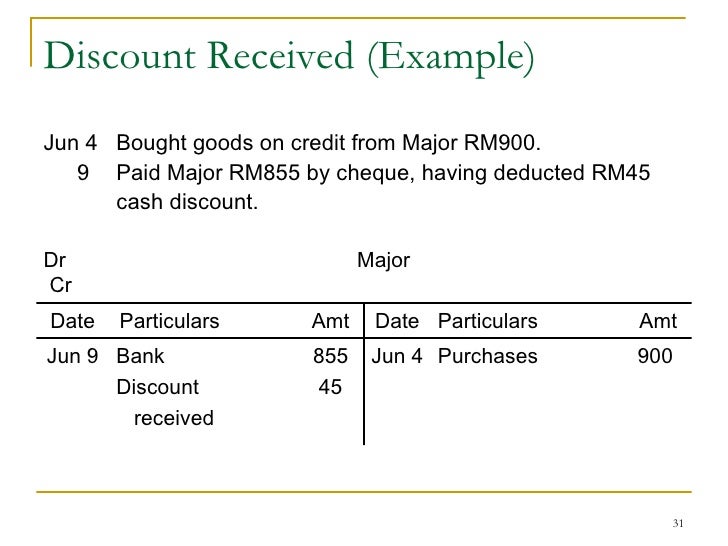

Discount allowed is the expense of the seller while the other is an income of the buyer Discount allowed is recorded on the debit side in the books of the seller while the other is recorded in the credit side in the buyer s books Discounts may be classified into two types Trade Discounts offered at the time of purchase for example when goods are purchased in bulk or to retain loyal customers Cash Discount offered to customers as an incentive for timely payment of their liabilities in respect of credit purchases

Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account How to Account for Sales Discounts An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice date rather than the normal 30 days also noted on an invoice as 1 10 Net 30 terms

Download Is Discount Allowed An Expense

More picture related to Is Discount Allowed An Expense

Retailing

https://image.slidesharecdn.com/retailing-120113225132-phpapp01/95/retailing-33-728.jpg?cb=1326496404

Solved Statement Of Cash Flows In The Pro Forma Provided Below With

https://www.coursehero.com/qa/attachment/7051045/

Solved Statement Of Cash Flows In The Pro Forma Provided Below With

https://www.coursehero.com/qa/attachment/7051039/

Sales discounts along with sales returns and allowances are deducted from gross sales to arrive at the company s net sales Hence the general ledger account Sales Discounts is a contra revenue account Sales discounts are not reported as an expense From the seller s perspective discounts allowed are considered an expense and are usually recorded in the company s financial statements under operating expenses For example if a business sells a product for 500 but allows a 10 discount for early payment the discount allowed would be 50 The seller records this 50 as an expense

[desc-10] [desc-11]

PPT INCOMPLETE RECORD PowerPoint Presentation Free Download ID 5566939

https://image3.slideserve.com/5566939/slide38-l.jpg

What Is The Journal Entry For Discount Received Accounting Capital

https://www.accountingcapital.com/wp-content/uploads/2018/08/Explanation-and-rules-for-journal-entry-for-discount-received.png

https://www.wallstreetmojo.com/discount-allowed-and-discount-received

Discount allowed is a reduction in the price of goods or services allowed by a seller to a buyer and is an expense for the seller However the discount received is the concession in the price received by the buyer of the goods and services from the seller and is

https://www.accountingcapital.com/journal-entries/...

Discount allowed acts as an additional expense for the business and it is shown on the debit side of a profit and loss account Trade discount is not shown in the main financial statements however cash discount and other types of discounts are supposed to

How To Treat Discount Allowed In Income Statement Aljazeera Medical

PPT INCOMPLETE RECORD PowerPoint Presentation Free Download ID 5566939

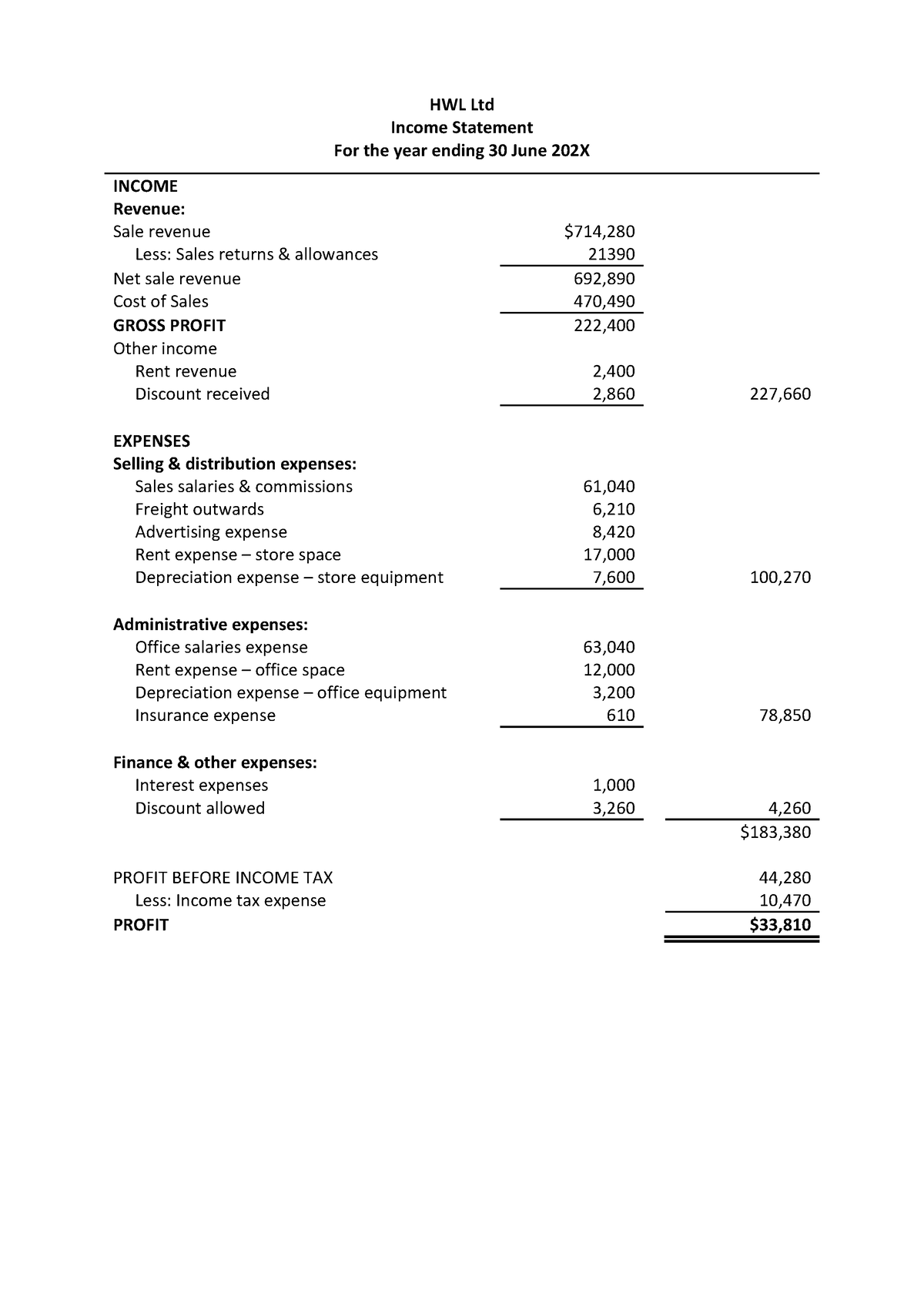

Handout 2 2 2 Practice Applying Standards To The Internal Income

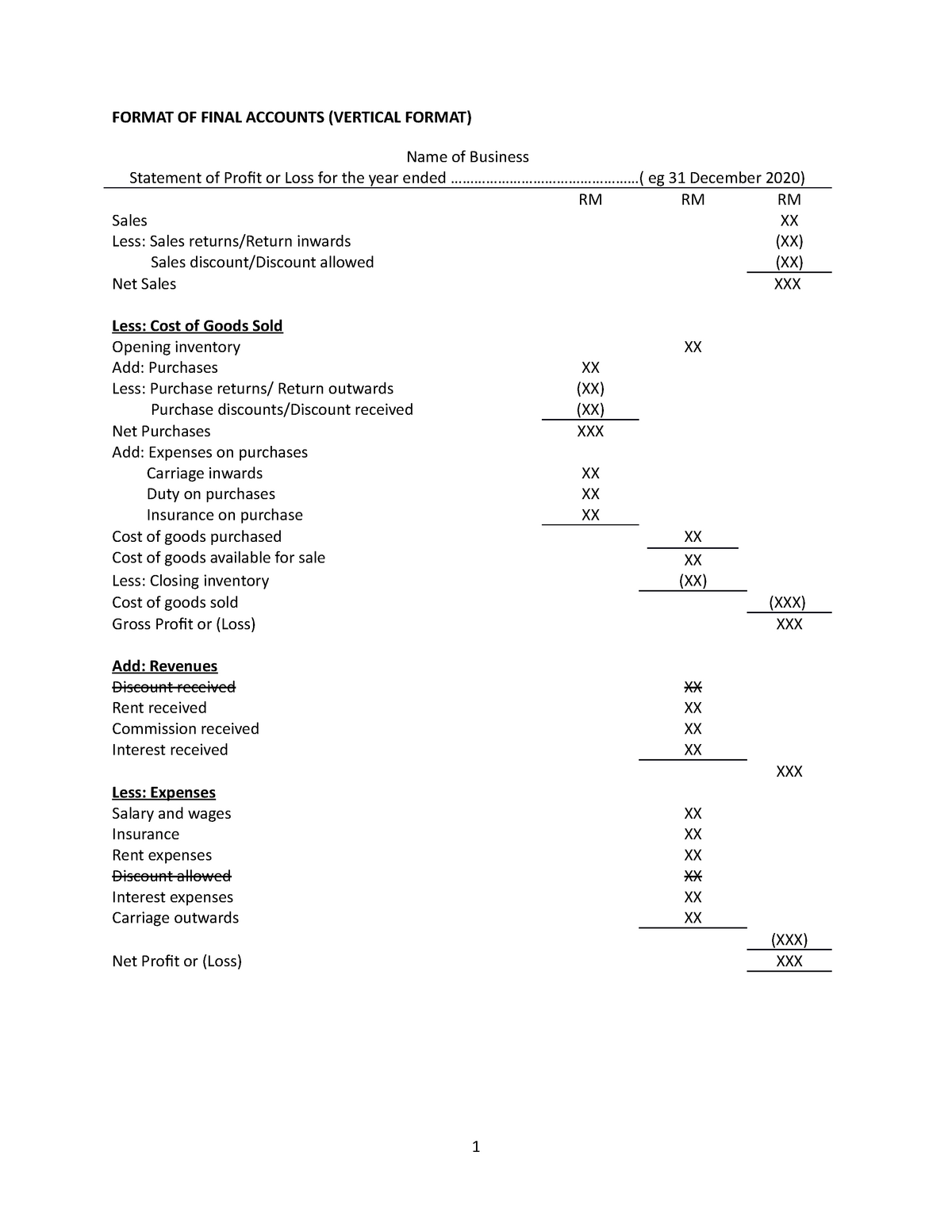

Fomat Statement Of Profit Loss Details FORMAT OF FINAL ACCOUNTS

Journal Entry For Discount Allowed And Received GeeksforGeeks

Financial Statements 2

Financial Statements 2

Discount Allowed And Discount Received Journal Entries With Examples

How To Use Pricing Strategies To Boost Sales Nihaojewelry Blog

Discount Allowed And Discount Received Journal Entries With Examples

Is Discount Allowed An Expense - How to Account for Sales Discounts An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice date rather than the normal 30 days also noted on an invoice as 1 10 Net 30 terms