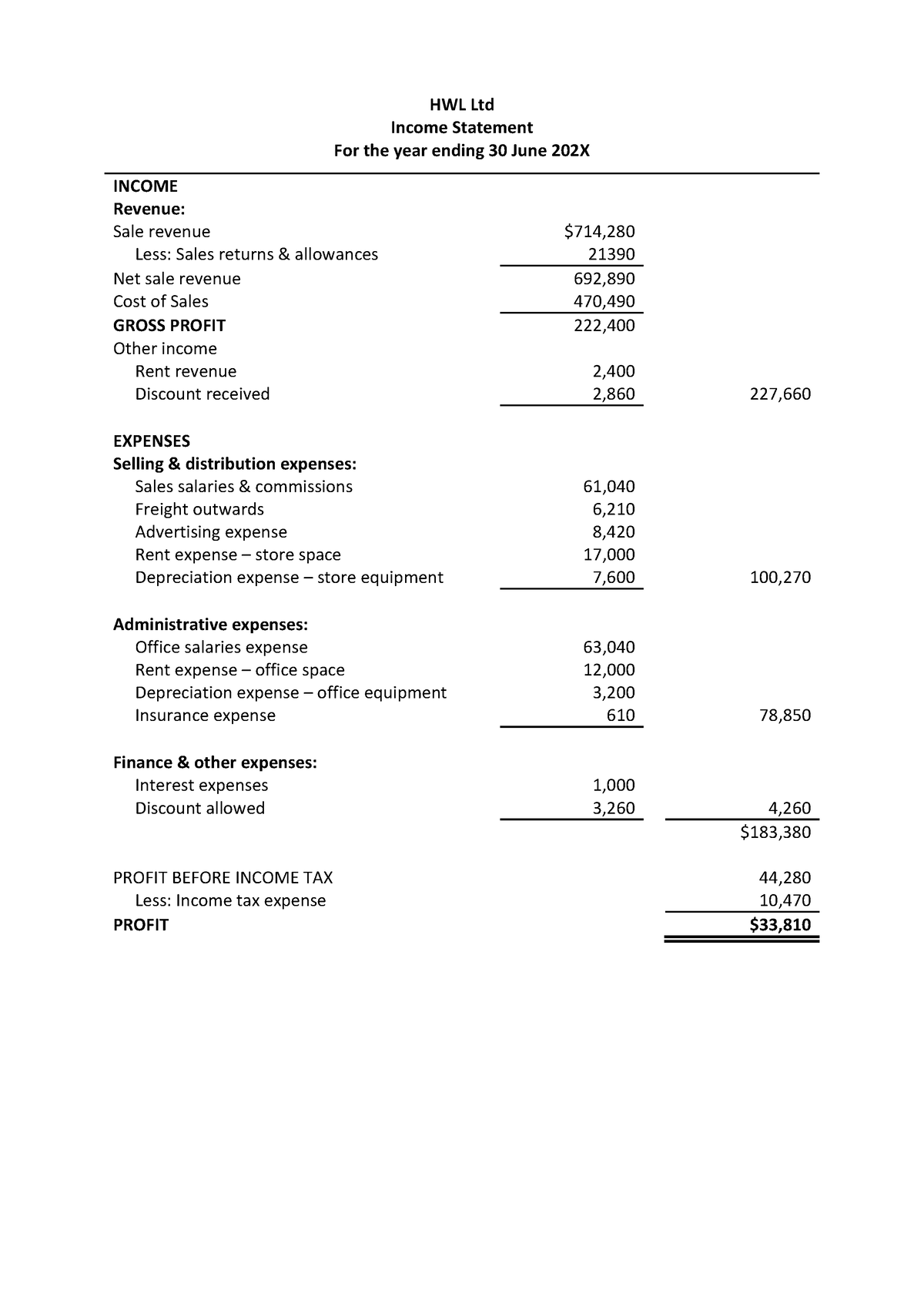

Is Discount Allowed Tax Deductible When a discount is allowed suppliers and retailers often disagree on whether the supplier has to issue a credit note for a price reduction or whether the retailer must issue a tax invoice for a separate taxable supply

There is no standard deduction There are no personal allowances However as set out in the rate table the first ZMW 61 200 of taxable income excluding taxable lump sum payments from approved pension funds gratuities and compensation for loss of office is subject to income tax at 0 Capital expenditure and expenditure incurred in producing exempt income are not tax deductible Expenses constitute the third element of cost after materials and labour Expenses can be classified as direct or indirect expenses

Is Discount Allowed Tax Deductible

Is Discount Allowed Tax Deductible

https://www.signnow.com/preview/497/329/497329174/large.png

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

If you accept returns or otherwise discount your products as part of a promotion or concession to a dissatisfied customer these amounts could be deductible on your Schedule C assuming your gross sales do not already exclude these amounts While discounts directly affect the purchase price and are visible to the customer at the point of sale deductions affect financial outcomes indirectly by reducing taxable income and their benefit is realized when assessing tax liabilities

A discount allowed is when the seller grants a payment discount to a buyer A discount received is when the buyer is granted a discount by the seller No free services are not deductible When filing as Self Employed you pay taxes based on your sales minus your expenses Think of it this way if you were paid for the service you would pay tax on that income Since you received no income for that service you don t have to pay taxes on it

Download Is Discount Allowed Tax Deductible

More picture related to Is Discount Allowed Tax Deductible

Handout 2 2 2 Practice Applying Standards To The Internal Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/31db1c6c7298ab6d5178467ef36f77a7/thumb_1200_1697.png

Company Tax Deductible Or Not Santos Business Services

https://www.santosbiz.co.za/wpn/wp-content/uploads/2022/12/Companie-tax-deductions.png

Tax Deductible Bricks R Us

https://www.bricksrus.com/wp-content/uploads/2018/03/35808436_l-1.jpg

Discount allowed is a reduction in the price of goods or services allowed by a seller to a buyer and is an expense for the seller However the discount received is the concession in the price received by the buyer of the goods and services from the seller and is When coupons or certificates are accepted by retailers as a part of the selling price of any taxable item the value of the coupon or certificate is excludable from the tax as a cash discount regardless of whether the retailer is reimbursed for the amount represented by the coupon or certificate

[desc-10] [desc-11]

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

https://www.investopedia.com/thmb/u2wJjKORNGwYIkLIUBgzZkTPInY=/1500x1000/filters:fill(auto,1)/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg

https://www.thesait.org.za › news › Allowances...

When a discount is allowed suppliers and retailers often disagree on whether the supplier has to issue a credit note for a price reduction or whether the retailer must issue a tax invoice for a separate taxable supply

https://taxsummaries.pwc.com › zambia › individual › deductions

There is no standard deduction There are no personal allowances However as set out in the rate table the first ZMW 61 200 of taxable income excluding taxable lump sum payments from approved pension funds gratuities and compensation for loss of office is subject to income tax at 0

Tax Deductions You Can Deduct What Napkin Finance

Prepare And File Form 2290 E File Tax 2290

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

7 Easy Ways To Save On Your Taxes This Year Ways To Save Money

Tax Reduction Company Inc

Difference Between Discount Allowed And Discount Received Discount

Difference Between Discount Allowed And Discount Received Discount

NFocus Tax Service LLC Clearwater FL

With A Tax deductible Donation You Can Help Us Show An Amazing Picture

Tax Return Legal Image

Is Discount Allowed Tax Deductible - [desc-13]