Is Employer Reimbursement For Cell Phone Use Taxable Income Under the guidance issued today where employers provide cell phones to their employees or where employers reimburse employees for business use of their personal cell

An employer provided cell phone is not provided primarily for noncompensatory business purposes and results in taxable Personal use of an employer provided cell phone provided primarily for noncompensatory business reasons is excludable from an employee s income as a de minimis fringe

Is Employer Reimbursement For Cell Phone Use Taxable Income

Is Employer Reimbursement For Cell Phone Use Taxable Income

https://www.zento.in/wp-content/uploads/2021/04/zento_blog_image_14-4-2021.jpg

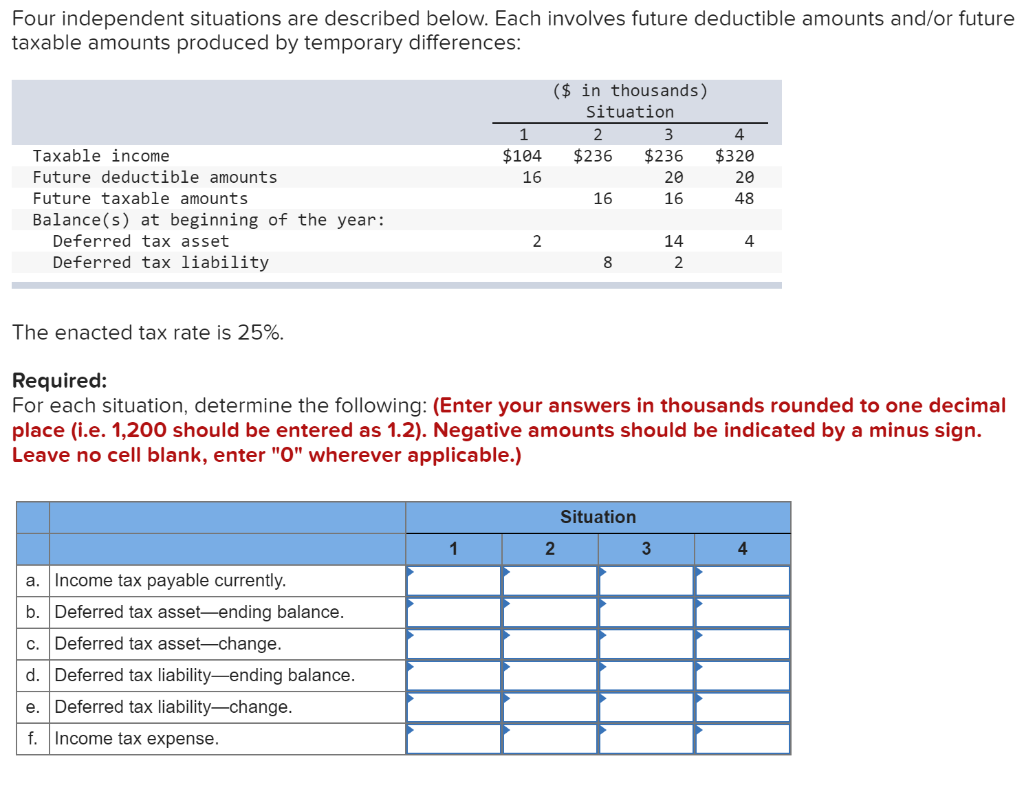

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

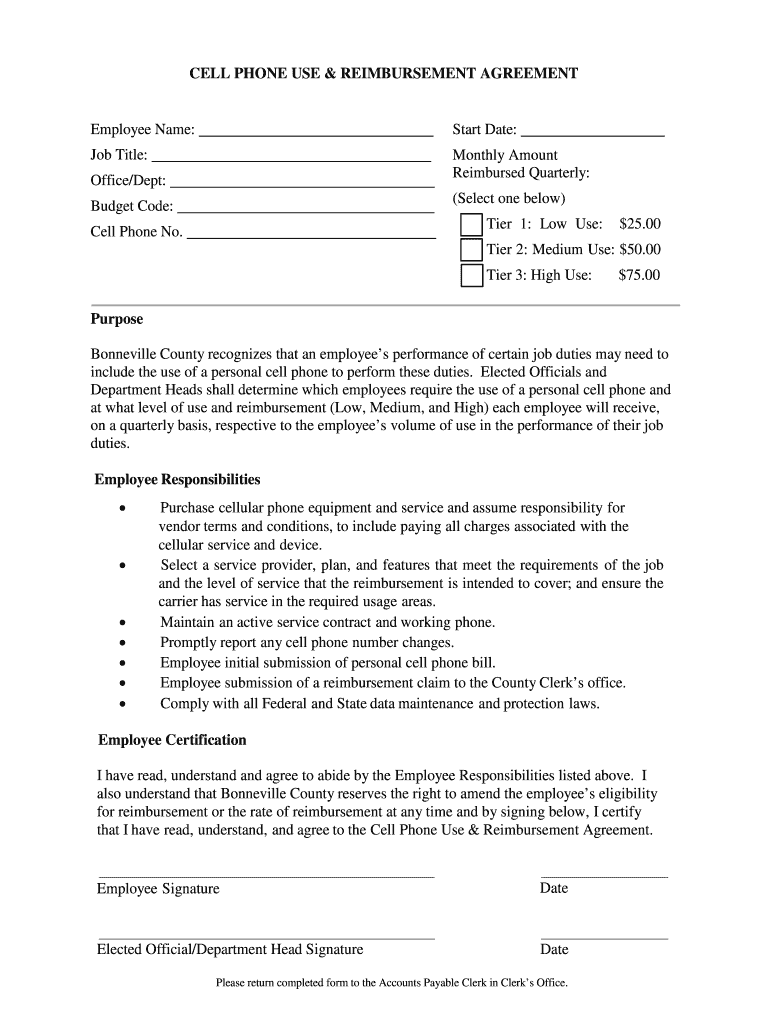

Cell Phone Agreement Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/404/237/404237649/large.png

If you require your employees to use their personal cell phones for business purposes reimbursements of the employees expenses for reasonable cell phone When an employer provides a cell phone or reimburses cell phone expenses the primary concern for employees is whether these benefits will be considered taxable

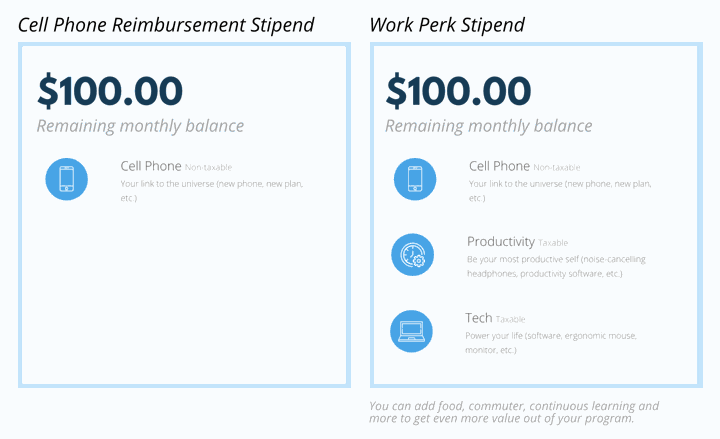

And while it could be seen as additional employee compensation if you re wondering are cell phone allowances taxable the answer is no Cell phone stipends are a non Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on

Download Is Employer Reimbursement For Cell Phone Use Taxable Income

More picture related to Is Employer Reimbursement For Cell Phone Use Taxable Income

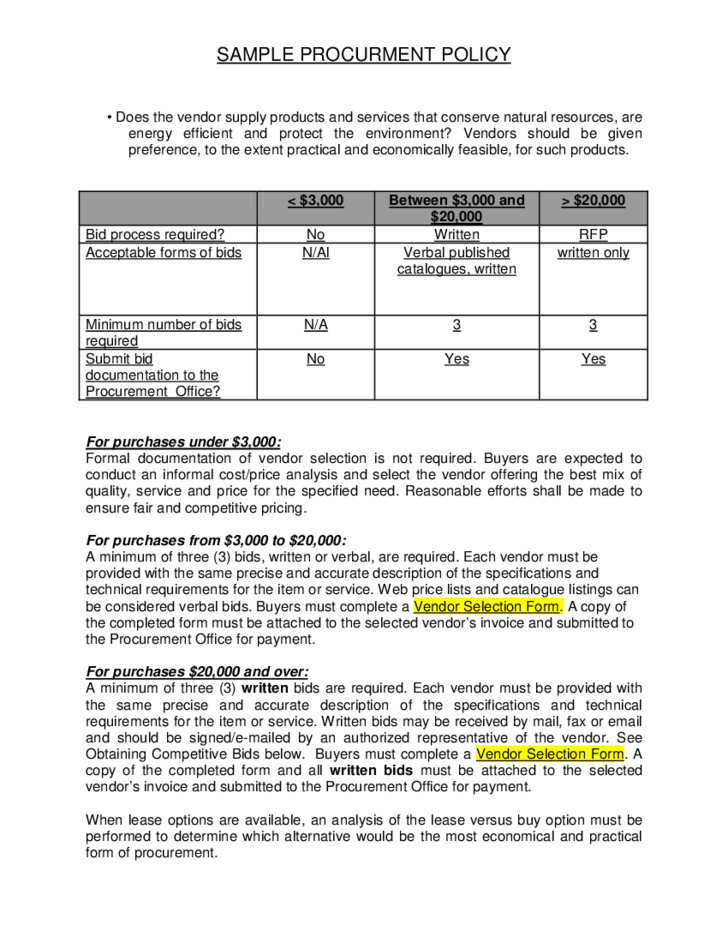

Fresh Cell Phone Reimbursement Policy Template Sparklingstemware

http://sparklingstemware.com/wp-content/uploads/2021/08/awesome-cell-phone-reimbursement-policy-template.png

How To Set Up A Cell Phone Reimbursement Policy

https://www.peoplekeep.com/hubfs/How-to-set-up-a-cell-phone-reimbursement-policy_fb.jpg

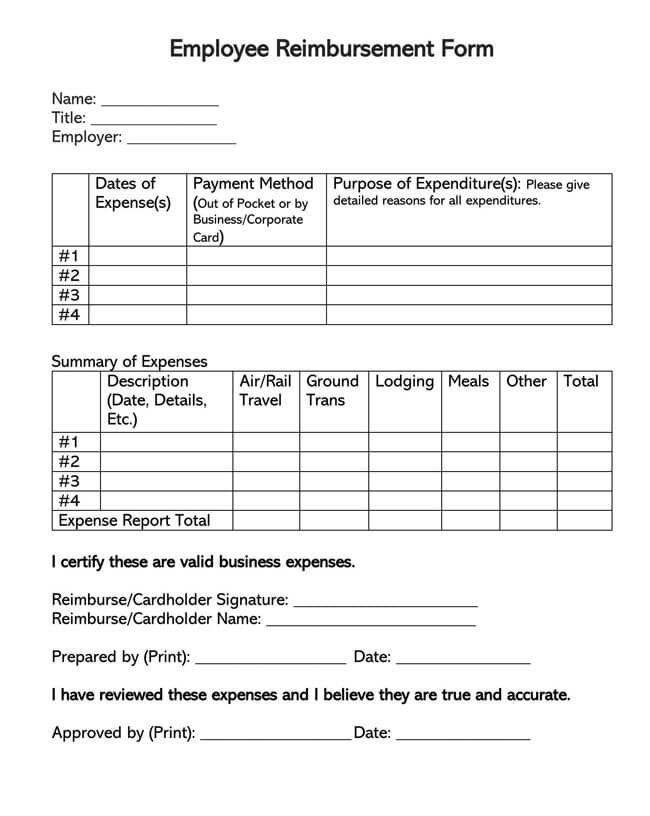

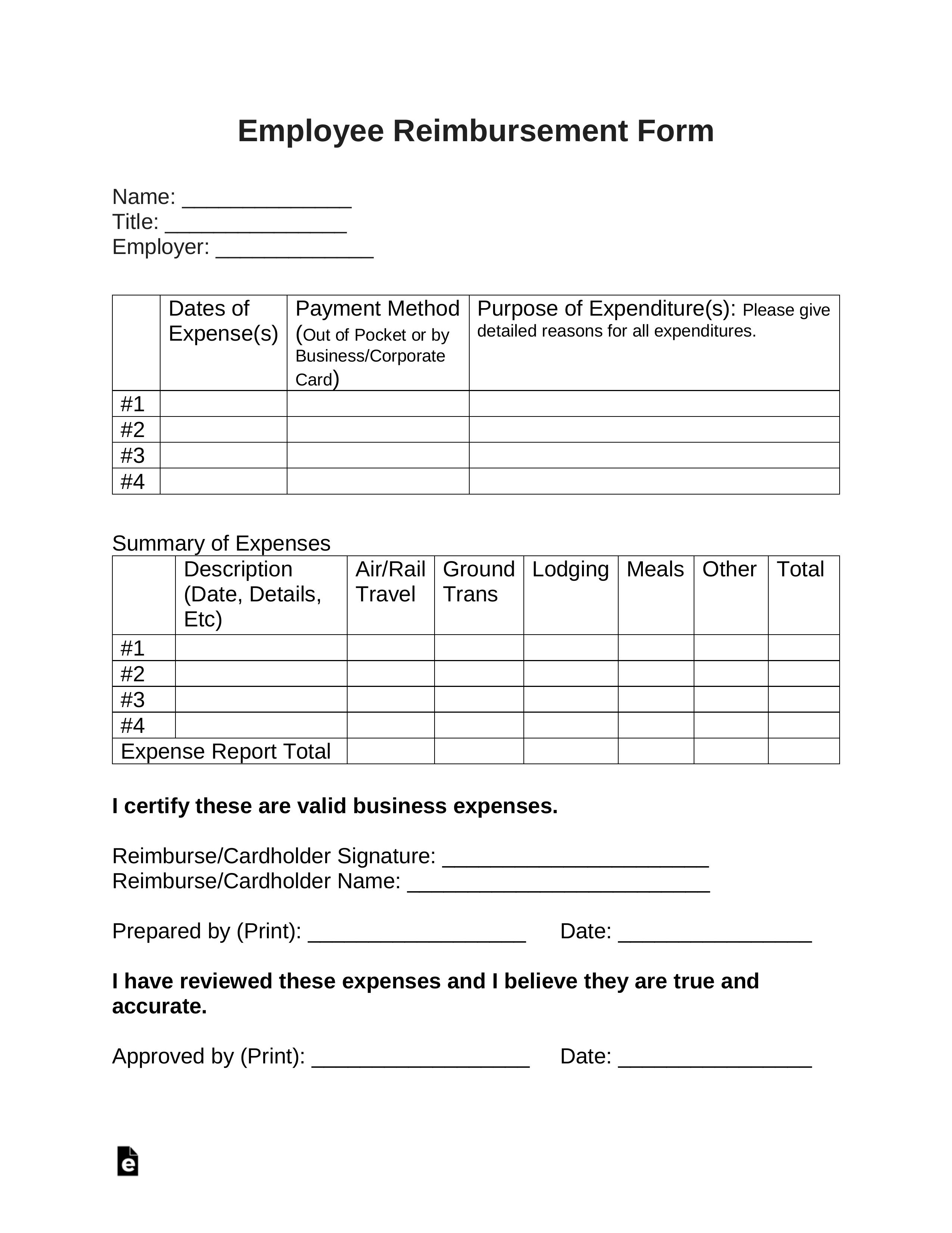

Employee Reimbursement Forms Free Printable

https://www.wordtemplatesonline.net/wp-content/uploads/2021/03/Employee-Reimbursement-Form-Template-01.jpg

Under the guidance where employers provide cell phones to their employees or where employers reimburse employees for business use of their personal Business use of an employer provided cell phone may be treated as a nontaxable working condition fringe benefit so long as the phone is provided

Cell phones provided for personal reasons or that are primarily used for personal reasons are not exempt from the normal recordkeeping requirements The IRS released guidance in 2011 Notice 2011 72 indicating that The value of the business use of an employer provided cell phone is excludable from an

Can My Work related Phone Bills And WiFi Bills Help Me Reduce Taxes

https://life.futuregenerali.in/media/qptadiyc/reduce-taxes-with-phone-and-wifi-bills.jpg

Image Result For Cell Phone Policy At Work Cell Phone Template Make

https://i.pinimg.com/originals/54/6f/f9/546ff9cbf340fd9c31c340174a1c9ded.jpg

https://www.irs.gov/pub/irs-news/ir-11-093.pdf

Under the guidance issued today where employers provide cell phones to their employees or where employers reimburse employees for business use of their personal cell

https://tax.thomsonreuters.com/blog/whe…

An employer provided cell phone is not provided primarily for noncompensatory business purposes and results in taxable

Buy Power Bank 10000mAh Ultra Slim Portable Charger With Built in

Can My Work related Phone Bills And WiFi Bills Help Me Reduce Taxes

The Ultimate Guide To Cell Phone Reimbursement Stipends Compt

Is A Cell Phone Stipend A Taxable Benefit What You Need To Know To

Reimbursement Sheet Template TUTORE ORG Master Of Documents

Free Mobile Phone Policy Template Australia Printable Templates

Free Mobile Phone Policy Template Australia Printable Templates

Does The Bank Use Taxable Income Or Gross Income To Determine If You

Taxable Benefits Cell Phone And Internet Service

Mobile Phone Reimbursement Is It Taxable Caramagno Associates

Is Employer Reimbursement For Cell Phone Use Taxable Income - If you require your employees to use their personal cell phones for business purposes reimbursements of the employees expenses for reasonable cell phone