Is Ertc Tax Credit Legitimate The findings of the IRS review confirmed concerns raised by tax professionals and others that there was an extremely high rate of improper ERC claims The claims followed a flurry of aggressive marketing and promotions last year that led to people being misled into filing for the ERC

The Employee Retention Credit ERC also sometimes called the Employee Retention Tax Credit or ERTC is a legitimate tax credit Many businesses legitimately apply for the pandemic era credit The IRS has added staff to handle ERC claims which are time consuming to process because they involve amended tax returns The Internal Revenue Service warns about scams revolving around the Employee Retention Credit a tax credit for businesses that continued paying employees during the COVID 19 shutdowns or had a

Is Ertc Tax Credit Legitimate

Is Ertc Tax Credit Legitimate

https://i.ytimg.com/vi/MTexk06nrJQ/maxresdefault.jpg

Fast Free ERTC Eligibility Assessment Get Tax Credit Help In

https://www.dailymoss.com/wp-content/uploads/2022/06/fast-free-ertc-eligibility-assessment-get-tax-credit-help-in-providence-ri-629f7af47e164.png

What Is ERTC Tax Credit ScottHall co

https://scotthall.co/wp-content/uploads/2022/04/covid-safe-greeting.jpg

First most people just call it the ERC but it s a refundable tax credit for businesses and tax exempt organizations that had employees and were affected during the COVID 19 The employment retention credit is a tax break designed to help employers who were harmed by the Covid 19 pandemic Lately it has become a hotbed of fraud

The IRS has issued a new warning urging people to carefully review the Employee Retention Credit ERC guidelines before claiming the credit In IR 2022 183 the IRS is warning employers to watch out for third parties advising them to claim the Employee Retention Credit ERC when they may not actually qualify for the credit by disregarding the taxpayer s eligibility

Download Is Ertc Tax Credit Legitimate

More picture related to Is Ertc Tax Credit Legitimate

ERTC Eligibility Who Qualifies For The Employee Retention Tax Credit

https://i.ytimg.com/vi/Pt_NVlVFAos/maxresdefault.jpg

How To Receive The Employee Retention Tax Credit ERTC For Law Firm

https://smbteam.com/wp-content/uploads/2022/10/Artboard1_4-1.png

ERTC

https://www.cpabr.com/assets/htmlimages/ertc 500px wide.jpg

The CARES Act created a tax credit to keep employees on payroll during the pandemic The Internal Revenue Service IRS recently warned employers to look out for scammers using the credit to promise tax savings that are too good to be true In addition to recapturing funds the IRS is pursuing criminal charges against promoters and preparers engaging in fraudulent ERC practices Kiplinger highlighted a case where the U S

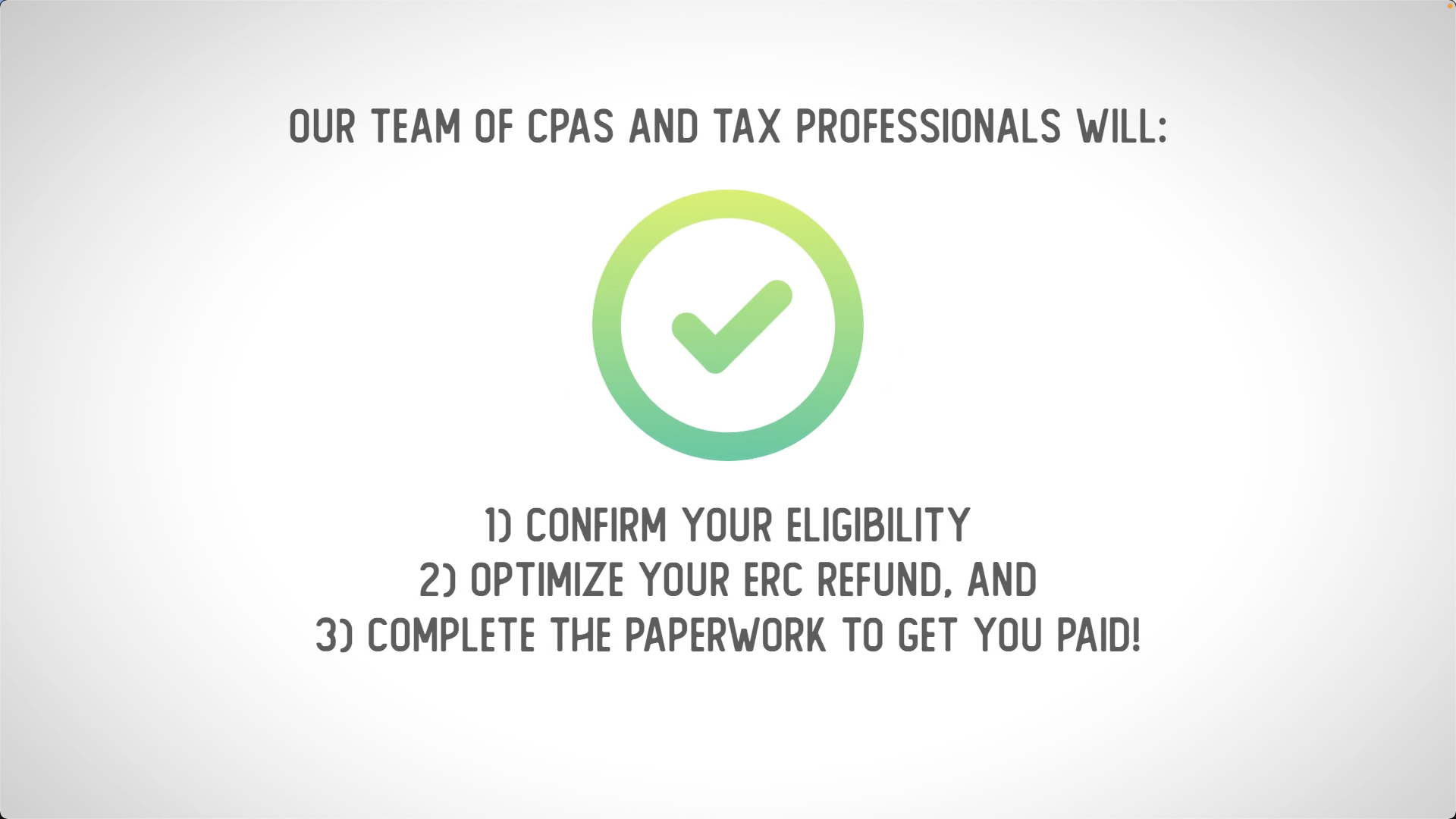

ERTC Express which has offices in Atlanta and Tampa Fla has a team of in house accountants and a rigorous monthlong process to determine if a client is eligible for tax credits Credit The IRS is now conducting ERC audits to crack down on third party tax credit providers that may be practicing Employee Retention Credit fraud Read on to learn how to determine if your tax credit specialist is trustworthy

Get Money Now ERTC Tax Credit ERTC Qualifications ERC Tax Credit

https://i.ytimg.com/vi/8RrHsNqq7Wc/maxresdefault.jpg

The Employee Retention Tax Credit Or ERTC Everything You Need To Know

https://claimertc247.com/wp-content/uploads/2022/06/ertc-claims.jpg

https://www.irs.gov/newsroom/irs-enters-next-stage...

The findings of the IRS review confirmed concerns raised by tax professionals and others that there was an extremely high rate of improper ERC claims The claims followed a flurry of aggressive marketing and promotions last year that led to people being misled into filing for the ERC

https://www.irs.gov/newsroom/irs-alerts-businesses...

The Employee Retention Credit ERC also sometimes called the Employee Retention Tax Credit or ERTC is a legitimate tax credit Many businesses legitimately apply for the pandemic era credit The IRS has added staff to handle ERC claims which are time consuming to process because they involve amended tax returns

ERTC Credit Recovery Consultant Employee Retention Tax Credit

Get Money Now ERTC Tax Credit ERTC Qualifications ERC Tax Credit

How To Find The Right ERTC Service For Your Business

ERTC Qualifications Requirements For 2020 Live Rank Sniper

ERTC Credit Recovery Consultant Employee Retention Tax Credit

How To Calculate ERTC Correctly ScottHall co

How To Calculate ERTC Correctly ScottHall co

Employee Retention Credit Scams 10 Tips To Avoid ERC Fraud

Fast ERTC Eligibility Check For SMB Non Profit IRS Payroll Tax Rebates

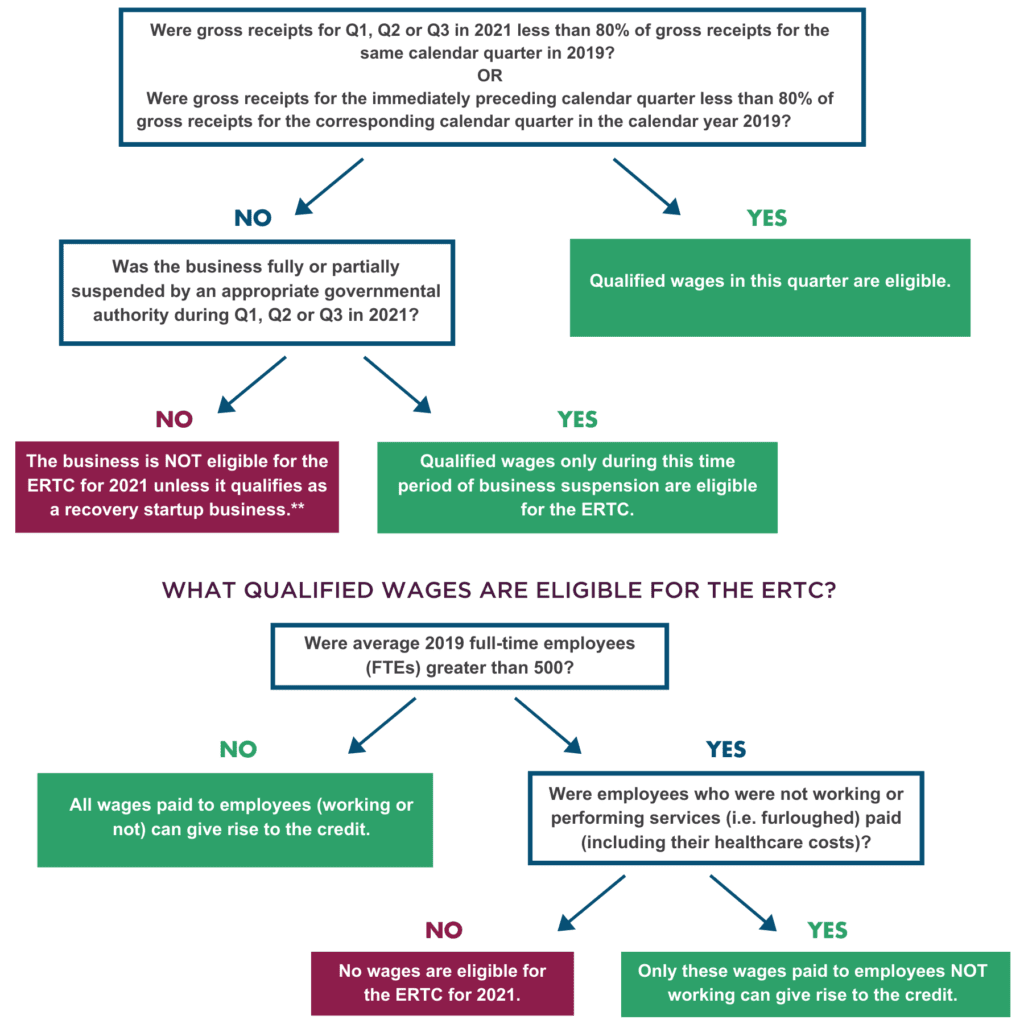

Is Your Business Eligible For The ERTC Anders CPA

Is Ertc Tax Credit Legitimate - In IR 2022 183 the IRS is warning employers to watch out for third parties advising them to claim the Employee Retention Credit ERC when they may not actually qualify for the credit by disregarding the taxpayer s eligibility