Is Excess Social Security Refundable Yes you can get excess Social Security tax refunded The procedure depends on whether the excess withholdings were caused by multiple employers

Switching employers mid year often results in a overpaying withheld social security taxes For tax year 2021 once an employee earns 142 800 from an employer If only one employer is reported on the tax return the employer must refund any excess social security taxes withheld directly to the taxpayer and it is not reported on your tax

Is Excess Social Security Refundable

Is Excess Social Security Refundable

https://i.ytimg.com/vi/Hjh2wQ4Tp8E/maxresdefault.jpg

Aug 04 Friday What Is Excess Social Security And RRTA Tax Withheld

https://i.ytimg.com/vi/_ezs_koa5Ac/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBQgZSg5MA8=&rs=AOn4CLBm6xNR2VQYjCVbrqS8tZBYGP69VQ

Contact Security People

https://securityandpeople.com/wp-content/uploads/2017/07/cropped-cover-photo-1.jpg

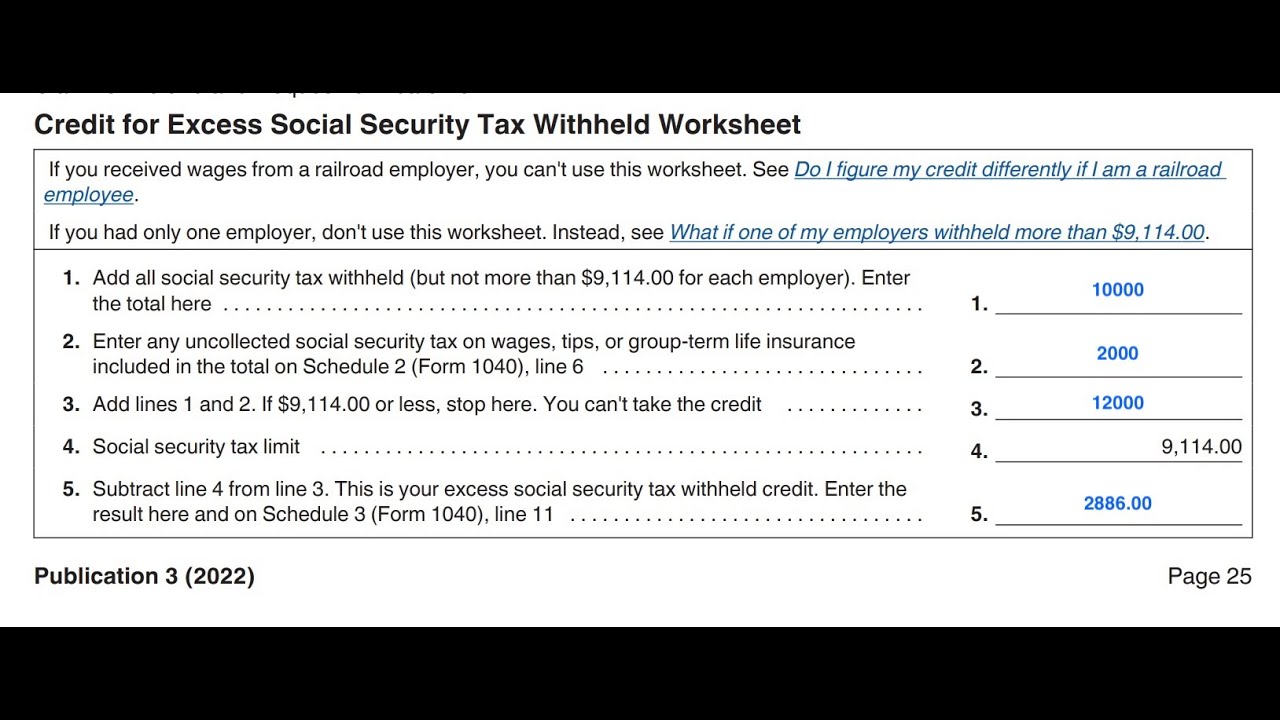

A refund to an employee of excess social security Medicare or RRTA tax withheld by any one employer but only if your employer will not adjust the overcollection If you have excess Social Security tax withheld because your earnings exceed the annual limit you re entitled to a refund But how you claim that refund

For the year Social Security withholds 2 590 from your payments half of the 5 180 that exceeded the earnings limit That works out to about 2 months of Overwithholding of Social Security benefits is returned to the taxpayer in the form of a refundable tax credit If the tax credit puts the taxpayer s liability below zero

Download Is Excess Social Security Refundable

More picture related to Is Excess Social Security Refundable

Social Security Offices Planning To Reopen In Spring Of 2022 Vets

https://www.vetsdisabilityguide.com/wp-content/uploads/2022/01/Social-Security-Offices-Planning-to-Reopen-in-Spring-of-2022-blog-header-image-scaled.jpg

A Good Time To Take Social Security Before Railroad Retirement

https://static.twentyoverten.com/5b74784bd10c860c99acdebb/c1t8o1DR-Bm/Tim-to-take-SS-befor-RRR.png

Coalition To Save Our Social Security Delivers Petition To Flickr

https://live.staticflickr.com/3927/15236306437_08a083ef6f_b.jpg

If you would have owed tax then you ll owe 223 20 less than your bill would have been If you re due a refund then it ll be 223 20 larger thanks to the excess tax How to Get a FICA Refund of Social Security and Medicare Taxes Are you entitled to a Social Security tax refund Some taxpayers are exempt from or overpay

If any one employer withheld too much social security or Tier 1 RRTA tax the taxpayer cannot take the excess as a credit against income tax If the employer refuses to refund If your employer withheld too much Social Security tax in Box 4 or Medicare tax in Box 6 you will need to contact your employer for a refund of the excess FICA taxes withheld

Social Security Office Added A New

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1272138196198335

Talkdesk Security Policies Ebooks Talkdesk

https://infra-cloudfront-talkdeskcom.svc.talkdeskapp.com/talkdesk_com/talkdesk-security-policies-overview.png

https://ttlc.intuit.com/turbotax-support/en-us/...

Yes you can get excess Social Security tax refunded The procedure depends on whether the excess withholdings were caused by multiple employers

https://schwartzaccountants.com/2021/12/working...

Switching employers mid year often results in a overpaying withheld social security taxes For tax year 2021 once an employee earns 142 800 from an employer

Securevents Security Safety Hennef

Social Security Office Added A New

50 Credit For Excess Social Security And RRTA Tax Withheld Mediafeed

The Social Security Increase 2023 COLA

Sending Excess Social Security Contributions How Do I Request A Refund

URGENT Save Social Security Before It s Too Late Senior Security

URGENT Save Social Security Before It s Too Late Senior Security

Excess Baggage 1928

Biden Budget Calls For protecting And Strengthening Social Security

Excess Baggage 1997

Is Excess Social Security Refundable - If the same employer deducted too much Social Security tax contact them and ask them to fix the issue They should refund you the overpayment and adjust your