Is Extended Health Insurance Tax Deductible In Canada Definition Health insurance benefits purchased and paid for by the employee This could be because their employer doesn t provide such benefits or that person has additional insurance on top of what is included in their workplace benefits part of compensation Tax deductible Yes

Private health services plan premiums If you make contributions to a private health services plan such as medical or dental plans for employees there is no taxable benefit for the employees LIFE OR HEALTH INSURANCE OWNED BY AN EMPLOYEE WITH PREMIUMS PAID BY EMPLOYER For individuals No Premiums paid by the employer are a taxable employee benefit For businesses Yes as long as the premium payments are a reasonable business expense

Is Extended Health Insurance Tax Deductible In Canada

Is Extended Health Insurance Tax Deductible In Canada

https://shorttermhealthinsurance.com/wp-content/uploads/2018/10/self_employed_health_insurance_tax_deduction-960x540.jpg

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/08/tax-calculator.jpeg.jpg

Is Health Insurance Tax Deductible For Self Employed International

https://www.internationaltrisomyalliance.com/wp-content/uploads/2023/01/is-health-insurance-tax-deductible-for-self-employed.png

A self insured plan meets the all or substantially all generally 90 or more requirement for a calendar year if all or substantially all of the benefits paid to all employees that year are for medical expenses that are eligible for the METC This guide explains your responsibilities and shows you how to calculate the value of taxable benefits or allowances For information on calculating payroll deductions go to How to calculate For information on filing an information return go to When to file information returns

The exception is Quebec where individual extended health care plan premium is a taxable benefit in the hands of the employee In the case of shareholders Revenue Canada may determine the premium is a taxable shareholder benefit rather than a non taxable employee benefit Many employees pay all or a portion of the premiums for their extended health benefits with the premiums being deducted from their pay When the employer pays the premiums for provincial health care plan this is considered a

Download Is Extended Health Insurance Tax Deductible In Canada

More picture related to Is Extended Health Insurance Tax Deductible In Canada

Health Insurance For International Students Taxation Without

https://policyoptions.irpp.org/wp-content/uploads/sites/2/2008/03/PO_HealthInsurance.jpg

Tax Benefits In Group Health Insurance

https://www.ethika.co.in/wp-content/uploads/2022/06/Untitled.png

Is Private Health Insurance Tax Deductible In The UK

https://www.heathcrawford.co.uk/wp-content/uploads/2020/05/Best-private-health-insurance.jpg

A business may deduct Private Health Services Plan PHSP or Health Spending Account HSA payments made on behalf of employees and their dependants These payments are not taxable to the employees and there are no The CRA considers private health services plan PHSP premiums payable to an insurance company to be deductible and that can include your premiums for your personal health insurance policy that covers you your spouse or common law partner or your eligible dependents

Premiums as well as any uncovered costs can be deducted from your tax return using 2 methods the Medical Expense Tax Credit or a Health Spending Account Read this article to find out which works best for you Are Health Insurance Premiums Tax Deductible in Canada Yes private insurance premium is tax deductible in Canada as long as it falls under the medical expenses category as defined by Canada Revenue Agency

What Is A Deductible Insurance Shark

https://myinsuranceshark.com/wp-content/uploads/2020/03/what-is-a-deductible.png

Are Disability Insurance Premiums Tax Deductible In Canada

https://briansoinsurance.com/wp-content/uploads/2021/11/Are-Disability-Insurance-Premiums-Tax-Deductible-In-Canada.jpg

https://www.canadalife.com/insurance/health-and...

Definition Health insurance benefits purchased and paid for by the employee This could be because their employer doesn t provide such benefits or that person has additional insurance on top of what is included in their workplace benefits part of compensation Tax deductible Yes

https://www.canada.ca/en/revenue-agency/services/...

Private health services plan premiums If you make contributions to a private health services plan such as medical or dental plans for employees there is no taxable benefit for the employees

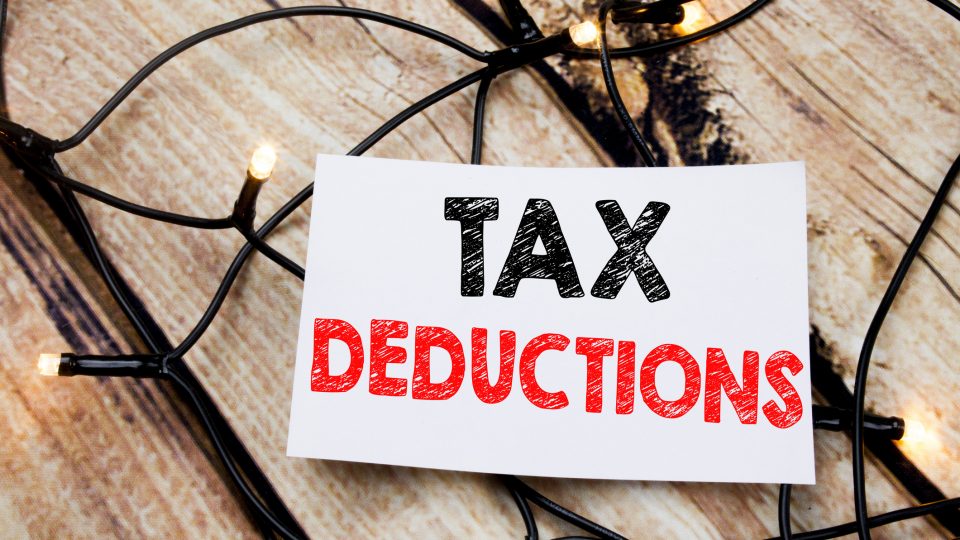

School Supplies Are Tax Deductible Wfmynews2

What Is A Deductible Insurance Shark

Are Life Insurance Premiums Tax Deductible In Canada DBA

Is Health Insurance Tax Deductible Get The Answers Here

Premiums Deductibles Copay s How It All Works

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions You Can Deduct What Napkin Finance

Is Homeowners Insurance Tax Deductible For Rental Property ALLCHOICE

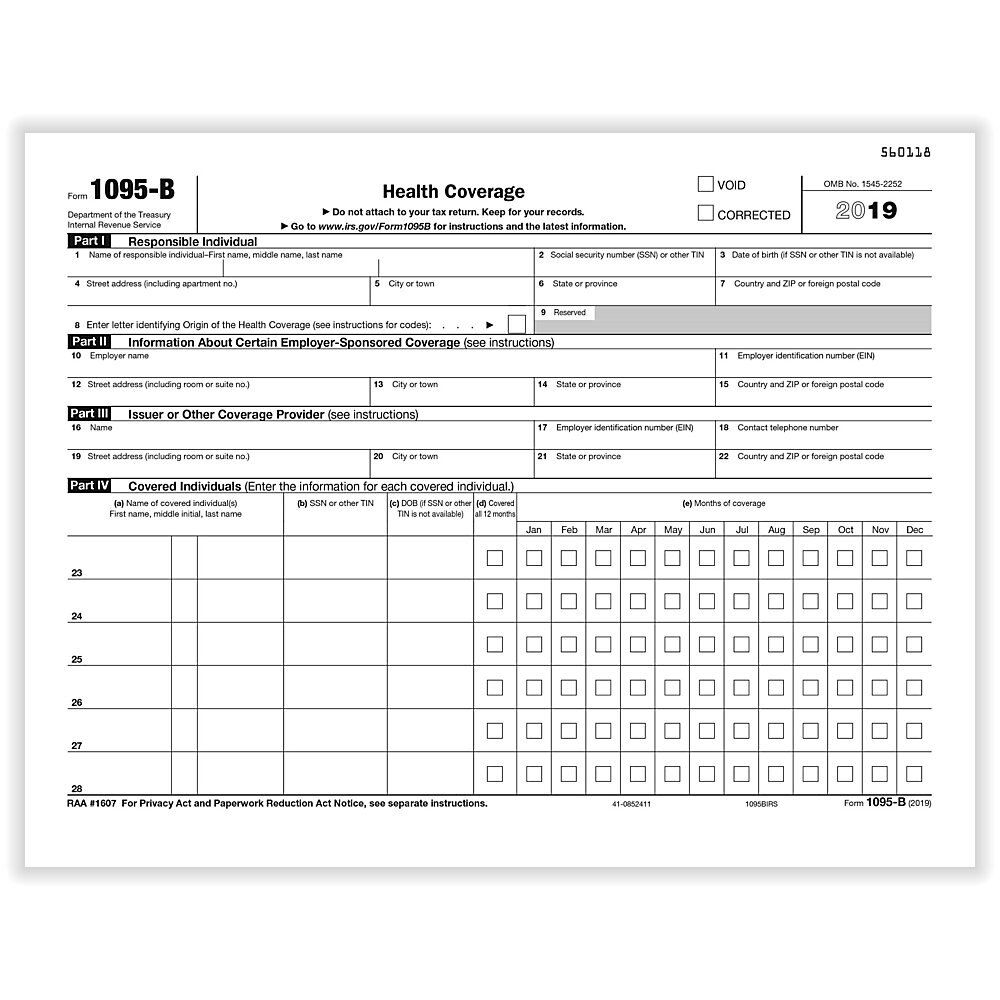

What Tax Forms Do I Need For Employee Health Insurance 2023

Are Health Premiums Tax Deductible Health Insurance FAQs

Is Extended Health Insurance Tax Deductible In Canada - Many employees pay all or a portion of the premiums for their extended health benefits with the premiums being deducted from their pay When the employer pays the premiums for provincial health care plan this is considered a