Invite to Our blog, an area where curiosity meets info, and where day-to-day subjects come to be engaging discussions. Whether you're looking for understandings on lifestyle, modern technology, or a little whatever in between, you've landed in the appropriate area. Join us on this exploration as we dive into the worlds of the normal and amazing, understanding the world one article each time. Your trip right into the fascinating and varied landscape of our Is Family Tax Benefit And Income Support Payment begins right here. Discover the fascinating web content that awaits in our Is Family Tax Benefit And Income Support Payment, where we decipher the complexities of different topics.

Is Family Tax Benefit And Income Support Payment

Is Family Tax Benefit And Income Support Payment

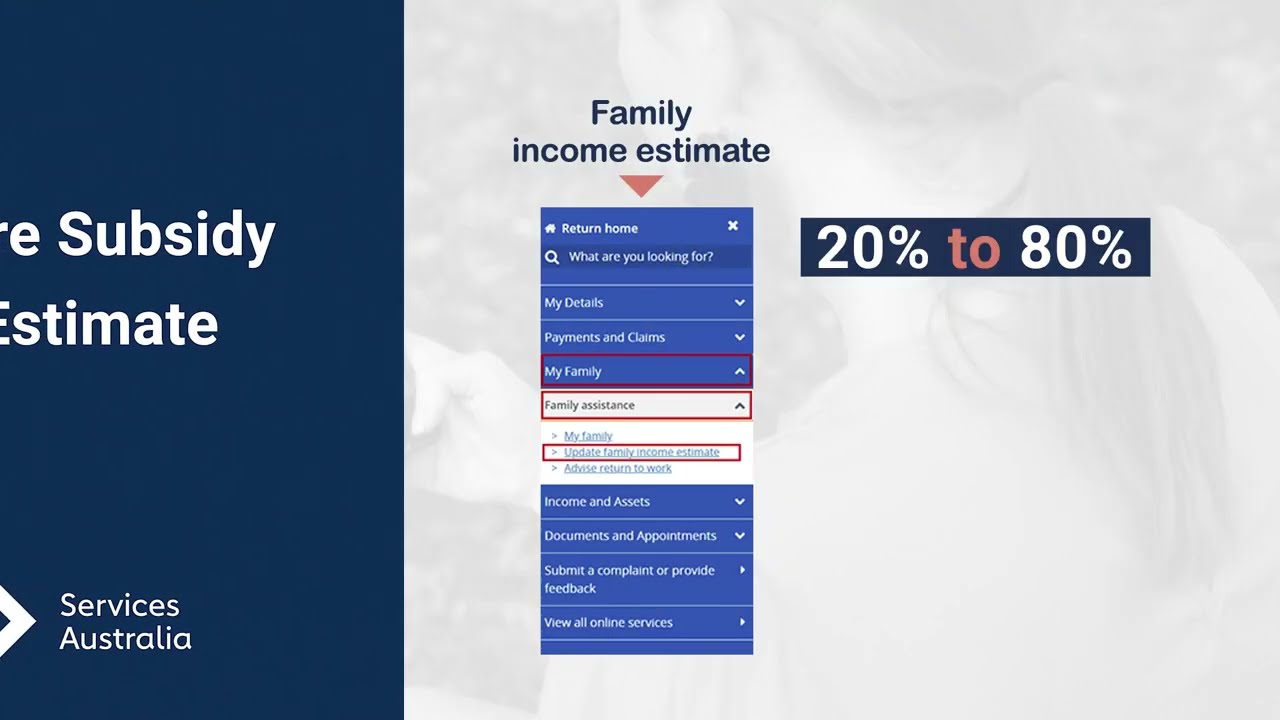

Child Care Subsidy Income Estimate YouTube

Child Care Subsidy Income Estimate YouTube

Shared Care And Family Tax Benefit

Shared Care And Family Tax Benefit

Gallery Image for Is Family Tax Benefit And Income Support Payment

The 10 Top Tax Benefits For Businesses

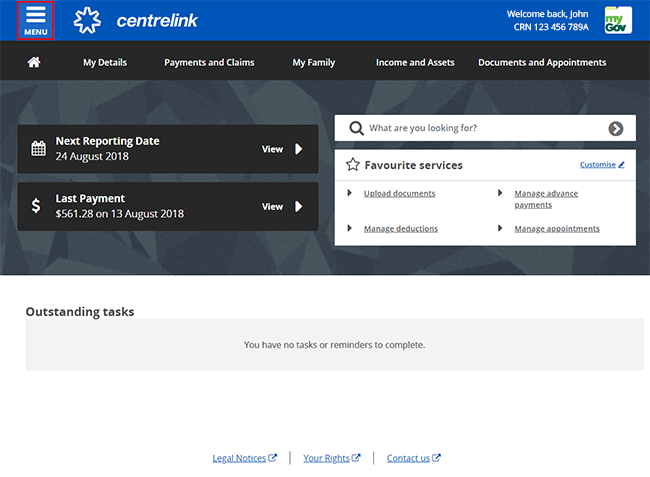

Centrelink Online Account Help Update Your Family Income Estimate And

Income Tax Benefits On Home Loan Loanfasttrack

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

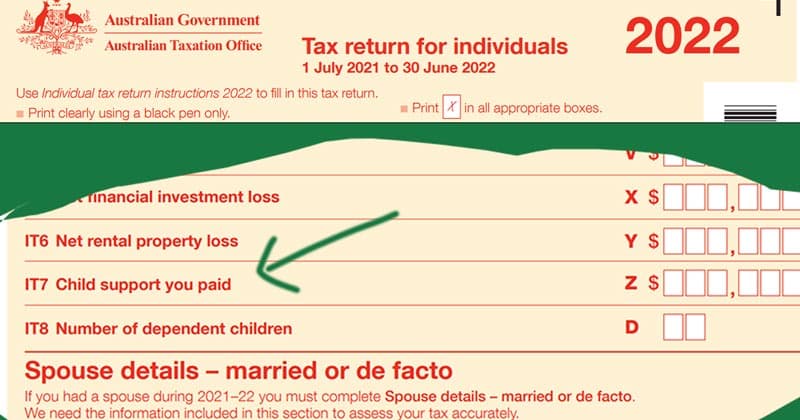

Is Child Support Taxable Income Child Support Australia

How To Claim The Family Tax Benefit One Accountancy

How To Claim The Family Tax Benefit One Accountancy

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

Thanks for picking to discover our web site. We sincerely wish your experience exceeds your assumptions, and that you find all the details and resources about Is Family Tax Benefit And Income Support Payment that you are seeking. Our dedication is to offer an user-friendly and helpful system, so do not hesitate to navigate via our pages with ease.