Is Family Tax Benefit Calculated On Taxable Income Family Tax Benefit is not a taxable payment and so is not pre filled in your tax return

There are 2 methods used to calculate the rate of Family Tax Benefit FTB Part A depending on whether the family s adjusted taxable income ATI is above or below the Part A higher income We ll deduct any child support you pay from your adjusted taxable income for family assistance We ll use your adjusted taxable income to work out your child support payments The types of

Is Family Tax Benefit Calculated On Taxable Income

Is Family Tax Benefit Calculated On Taxable Income

https://geniuswriter.net/wp-content/uploads/2021/11/top-view-of-tax-form-laptop-and-blue-card-with-tax-word-at-workplace-1024x684.jpg

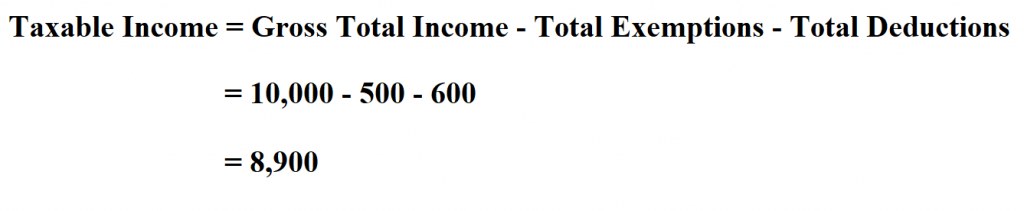

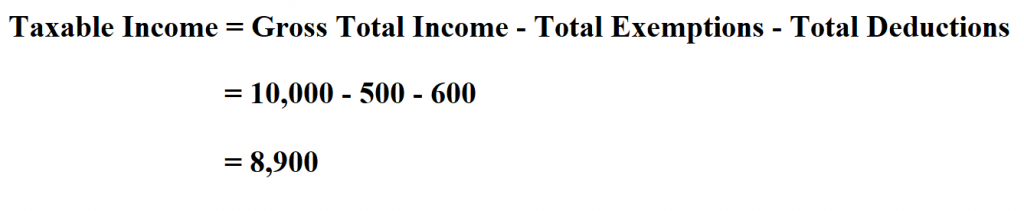

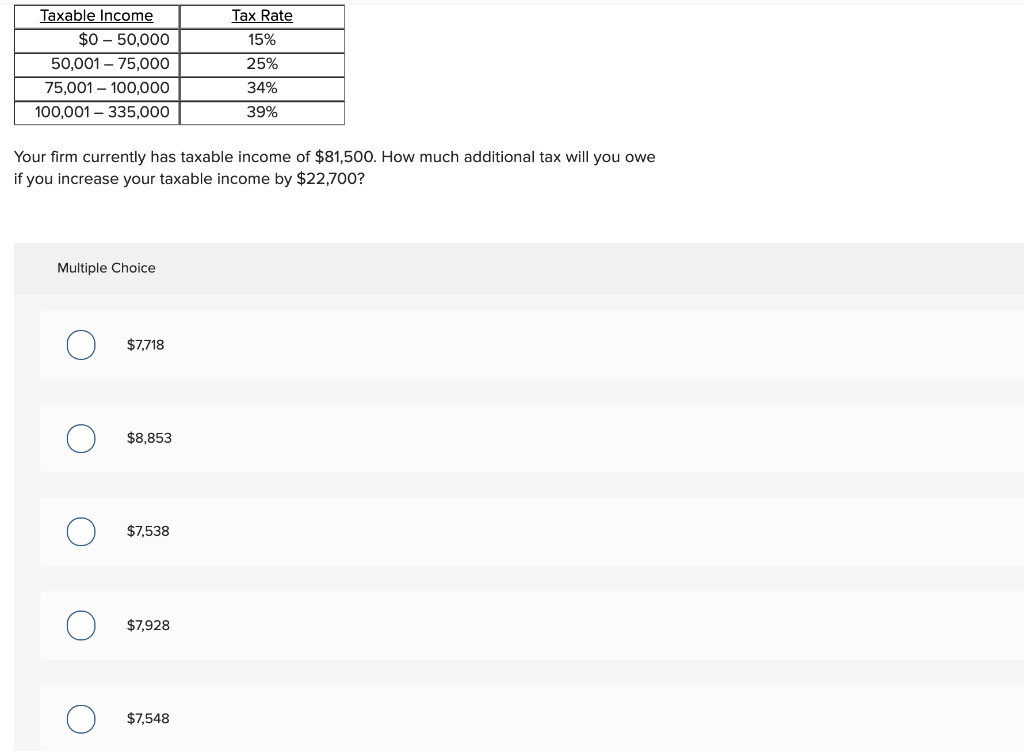

How To Calculate Taxable Income

https://www.learntocalculate.com/wp-content/uploads/2020/06/taxable-income-2-1024x211.png

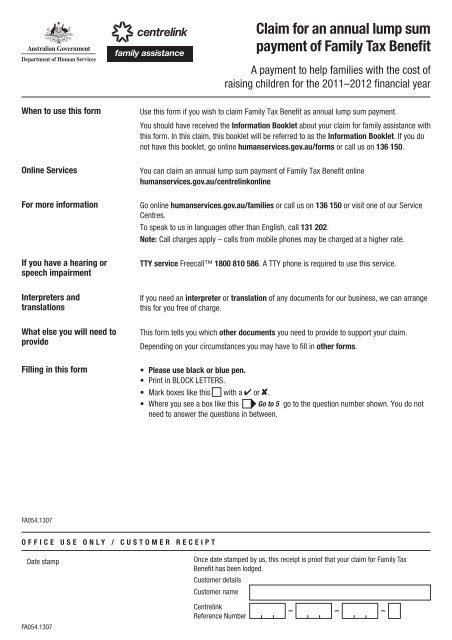

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

There are two methods used to work out the rate of Family Tax Benefit FTB Part A depending on whether the family s adjusted taxable income ATI is above or below the Part A higher Is the FTB taxable income Taxable income is your gross income minus allowable deductions It is the income for which you must pay tax It includes income from wages and salaries a

All Family Tax Benefit payments are not included in Taxable income However It is important you do not underestimate your gross family income when applying for Family Tax benefit Is the Family Tax Benefit considered taxable income Family Tax Benefit payments are not counted as taxable income However it s important you do not miscalculate your gross family income when applying for and while

Download Is Family Tax Benefit Calculated On Taxable Income

More picture related to Is Family Tax Benefit Calculated On Taxable Income

Understanding The Family Tax Benefit TaxLeopard

https://taxleopard.com.au/wp-content/uploads/family-tax-benefit.jpeg

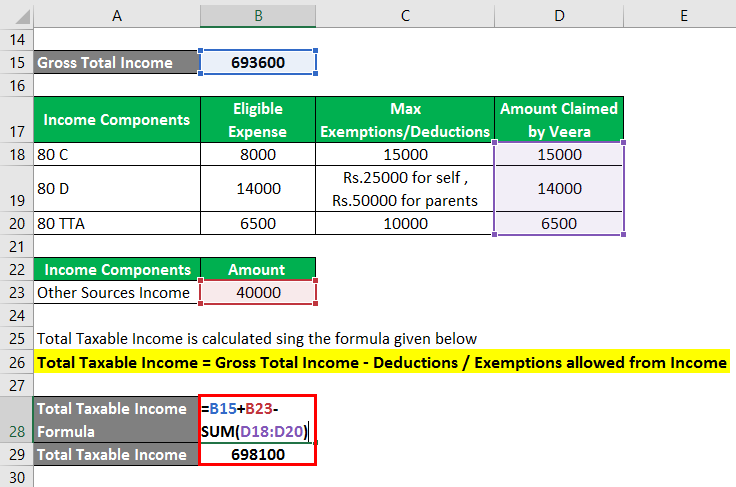

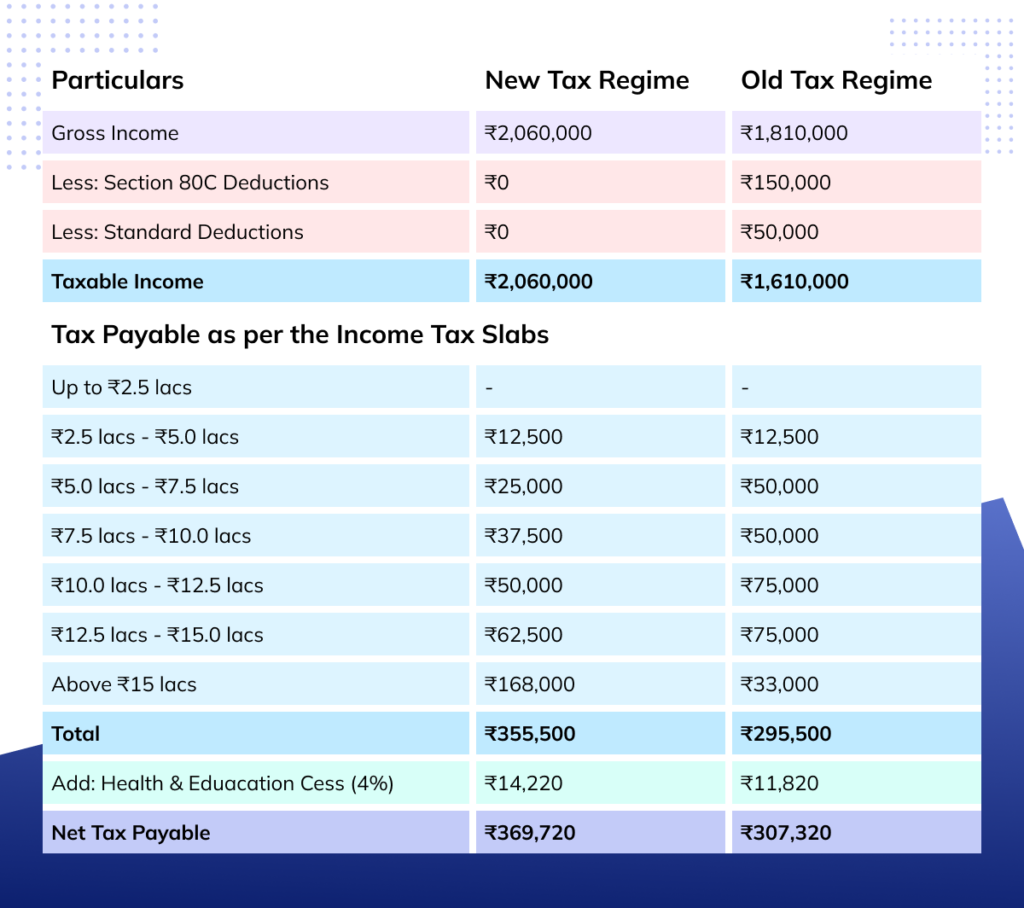

How To Calculate Gross Income Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-2.7.png

Income Crossword WordMint

https://images.wordmint.com/p/Income_2280966.png

Generally all taxable income is taken into account when the rate of FTB for individual families is calculated Taxable income is generally earned from employment type activities We use your family income estimate to work out how much family assistance to pay you This includes Family Tax Benefit FTB and Child Care Subsidy CCS

There are two methods used to work out the rate of Family Tax Benefit FTB Part A depending on whether the family s adjusted taxable income ATI is above or below the Part A higher How much Family Tax Benefit Part A can I receive Your FTB A payment rate is calculated by Using your adjusted taxable income and an income test and Looking at the

Foreign Social Security Taxable In Us TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

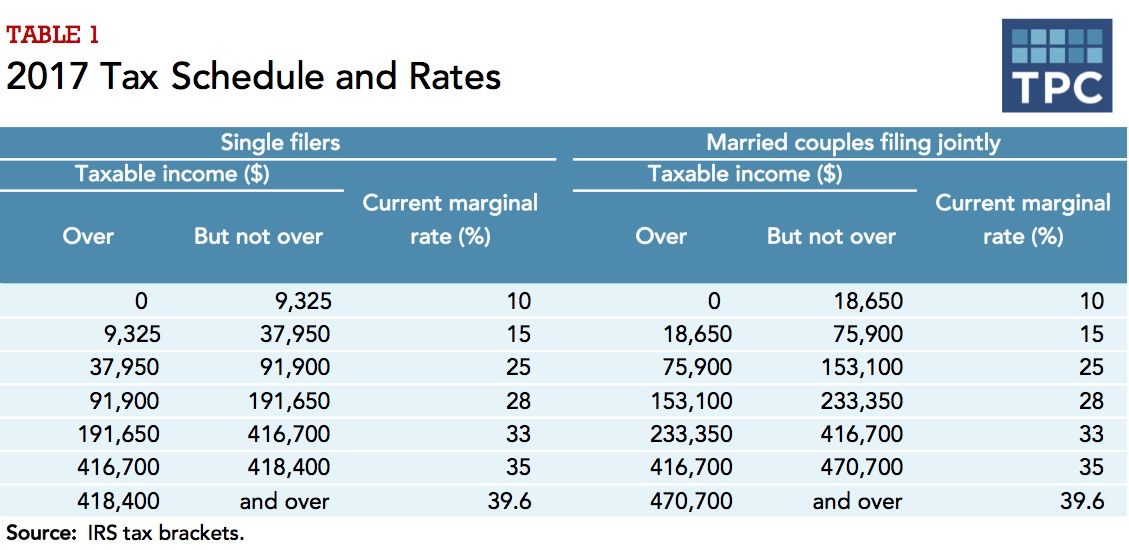

Solved 5 Understanding Taxes Using The Following Tax Schedule

https://www.coursehero.com/qa/attachment/21945180/

https://community.ato.gov.au › question

Family Tax Benefit is not a taxable payment and so is not pre filled in your tax return

https://operational.servicesaustralia.gov.au › public › Pages › families

There are 2 methods used to calculate the rate of Family Tax Benefit FTB Part A depending on whether the family s adjusted taxable income ATI is above or below the Part A higher income

Calculate My Income Tax SuellenGiorgio

Foreign Social Security Taxable In Us TaxableSocialSecurity

T ml Rejtett tutal s Tax Payable Calculator Megfejt Tengerpart Kinyit

How Federal Income Tax Rates Work Full Report Tax Policy Center

What Is Family Tax Benefit And Is It Taxable Income

What Is Family Tax Benefit And Is It Taxable Income

What Is Family Tax Benefit And Is It Taxable Income

Solved Taxable Income 0 50 000 50 001 75 000 75 001 Chegg

Solved Please Note That This Is Based On Philippine Tax System Please

What is taxable income Financial Wellness Starts Here

Is Family Tax Benefit Calculated On Taxable Income - Is the FTB taxable income Taxable income is your gross income minus allowable deductions It is the income for which you must pay tax It includes income from wages and salaries a