Is Family Tax Benefit Classed As Income All Family Tax Benefit payments are not included in Taxable income However It is important you do not underestimate your gross family income when applying for Family Tax benefit

This document outlines the components of adjusted taxable income ATI used for Family Tax Benefit FTB Child Care Subsidy CCS Stillborn Baby Payment SBP and Parental Leave Even if income is below the tax free threshold it is classed as taxable income and assessed for FTB and CCS purposes as well as for SBP income test purposes A loss is treated as zero

Is Family Tax Benefit Classed As Income

Is Family Tax Benefit Classed As Income

https://media.apnarm.net.au/media/images/2015/09/28/IQT_29-09-2015_OPINION_02_ThinkstockPhotos-200405397-001.1_fct1024x768_ct1880x930.jpg

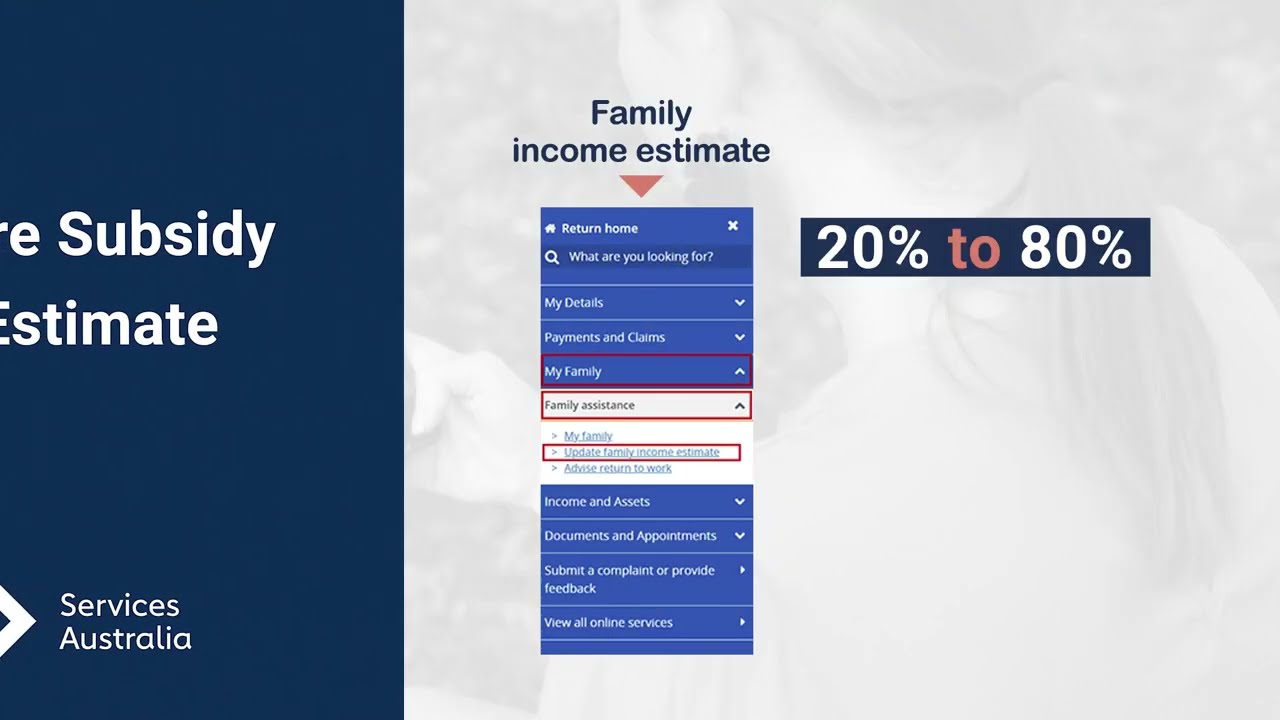

Child Care Subsidy Income Estimate YouTube

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

Shared Care And Family Tax Benefit

https://flast.com.au/s/bx_posts_photos_resized/qzcn8hzfsz5nrttexf4rngmdepayyzfb.png

If it is to be included in the customer s Australian Income Tax Return ITR it is not classed as Foreign Income for family assistance Instead the customer must include this income within Complete the following steps to claim Family Tax Benefit Before you start check if you can get it Your options and obligations for Family Tax Benefit We compare your income estimate with

Is the FTB taxable income Taxable income is your gross income minus allowable deductions It is the income for which you must pay tax It includes income from wages and salaries a When it comes to paying or receiving child support receiving family tax benefits or other income support payments there s lots of confusion and misinformation floating around as to what counts as income when Child

Download Is Family Tax Benefit Classed As Income

More picture related to Is Family Tax Benefit Classed As Income

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

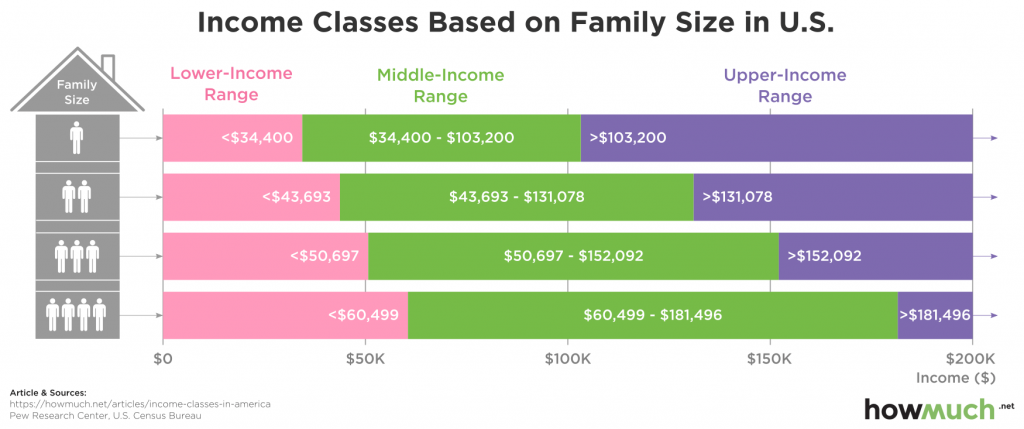

Think You re Middle Class Find Out The Sounding Line

https://thesoundingline.com/wp-content/uploads/2018/12/income_classes2-2517-1024x429.png

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

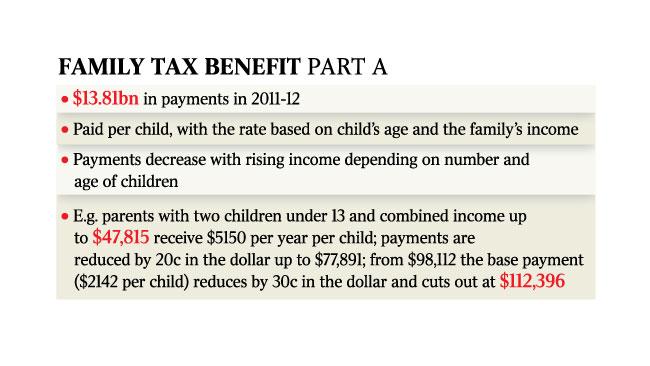

80 rowsFamily Tax Benefits are assessable if they are paid on a fortnightly or recurrent basis Family Tax Benefits are assessable when back paid to a parent following the birth of a child A parent may receive Family Tax Benefits for FTB Part A is designed to help families with the cost of raising children Payment of FTB Part A is based on the combined income of a family and is paid in respect of each

This document outlines how to determine if a payment or benefit received by a person is child support maintenance income for Family Tax Benefit FTB purposes Maintenance income can Family Tax Benefit FTB is a payment from Services Australia Who can get it To get this you must have a dependent child or full time secondary student aged 16 to 19 who

The Word Tax Spelled With Wooden Letters On Top Of An Open Book

https://i.pinimg.com/originals/78/44/5d/78445dd455fc4c827885f2d1d8d79b78.jpg

What Is Classed As Low Income For Council Tax Reduction The Money Edit

https://cdn.mos.cms.futurecdn.net/eJwNQZWaKBtnmoj4DQ43fn-1920-80.jpg

https://www.bishopcollins.com.au › what-is …

All Family Tax Benefit payments are not included in Taxable income However It is important you do not underestimate your gross family income when applying for Family Tax benefit

http://operational.servicesaustralia.gov.au › public › Pages › families

This document outlines the components of adjusted taxable income ATI used for Family Tax Benefit FTB Child Care Subsidy CCS Stillborn Baby Payment SBP and Parental Leave

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

The Word Tax Spelled With Wooden Letters On Top Of An Open Book

What Is Classed As A Low income Household Who Is Eligible To Get The

What Is Classed As Low Income For Council Tax Reduction Huuti

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

Family Tax Benefit PART A PART B Care For Kids

Family Tax Benefit PART A PART B Care For Kids

What Is Classed As A Low income Household Who Will Benefit From Rishi

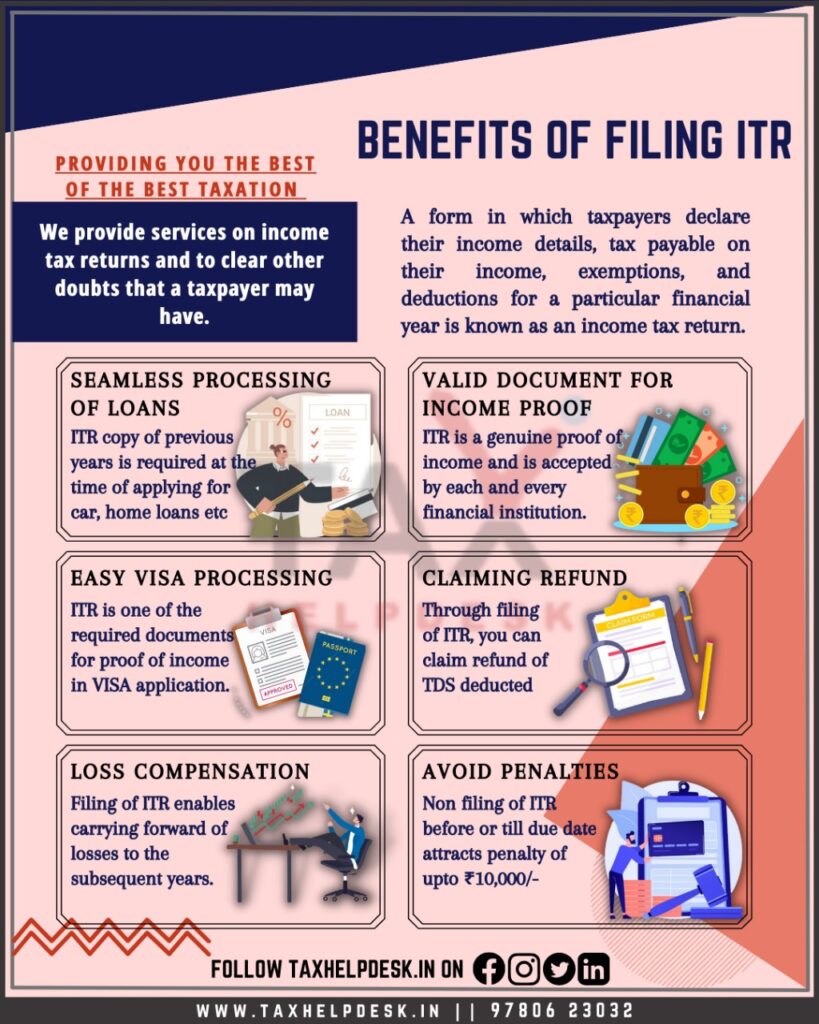

7 Reasons Why You File Your Income Tax Return In India TaxHelpdesk

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

Is Family Tax Benefit Classed As Income - When it comes to paying or receiving child support receiving family tax benefits or other income support payments there s lots of confusion and misinformation floating around as to what counts as income when Child