Is Family Tax Benefit Taxable Income Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality religious affiliation

This applies to family assistance payments Carer Allowance and the Commonwealth Seniors Health Card Taxable income is your gross income minus allowable deductions It s the Juston he Family Tax Benefit FTB is a two part payment to assist with the cost of raising children To qualify for the FTB a person must have a dependent child or full time second

Is Family Tax Benefit Taxable Income

Is Family Tax Benefit Taxable Income

https://geniuswriter.net/wp-content/uploads/2021/11/top-view-of-tax-form-laptop-and-blue-card-with-tax-word-at-workplace-1024x684.jpg

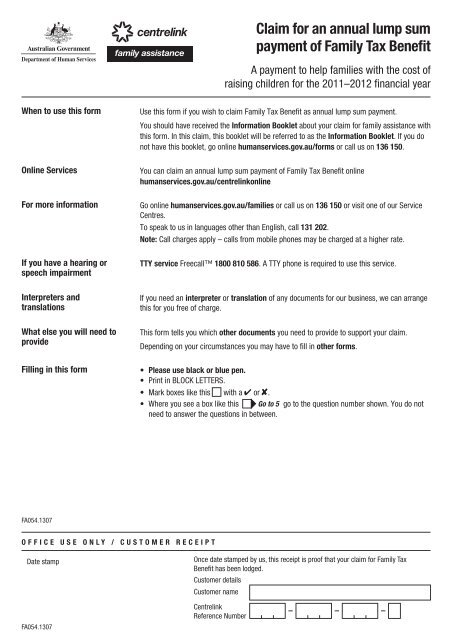

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

The most common state benefits you do not have to pay Income Tax on are Attendance Allowance Bereavement support payment Child Benefit income based use the Child Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid

We use your family income estimate to work out how much family assistance to pay you This includes Family Tax Benefit FTB and Child Care Subsidy CCS FTB Part A helps with the cost of raising children It is paid to a parent guardian carer including foster carer eligible grandparent or approved care organisation To be

Download Is Family Tax Benefit Taxable Income

More picture related to Is Family Tax Benefit Taxable Income

What Is Family Tax Recovery Canadian Tax Refunds

https://canadiantaxrefunds.ca/wp-content/uploads/2022/08/family-tax-recovery.jpg

Foreign Social Security Taxable In Us TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

https://blog.navitmoney.com/wp-content/uploads/2020/07/what-is-taxable-income-1400x1125.png

It could help you calculate the total income income tax tax rate of your contract or permanent salaries in Australia Family Tax Benefit FTB is a payment from Services Australia Who can get it To get this you must have a dependent child or full time secondary student aged 16 to 19 who

Senior Tax Manager at Etax Liz Russell explains The Family Tax Benefit FTB is a two part government payment designed to help eligible Australians with the cost of raising their You might receive some payments from us that are not taxable This means they are not included as taxable income Some examples are Family Tax Benefit Family Tax

Helpful Resources For Calculating Canadian Employee Taxable Benefits

https://www.artofaccounting.ca/wp-content/uploads/2020/01/TaxBenefits-1024x640.jpg

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

https://www.vero.fi/en/individuals/tax-cards-and...

Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality religious affiliation

https://www.servicesaustralia.gov.au/what-adjusted...

This applies to family assistance payments Carer Allowance and the Commonwealth Seniors Health Card Taxable income is your gross income minus allowable deductions It s the

How Does Family Tax Benefit Really Work Grandma s Jars

Helpful Resources For Calculating Canadian Employee Taxable Benefits

What Is Taxable Income Explanation Importance Calculation Bizness

Family Tax Benefit Everything You Need To Know About It From An Expert

Are My Social Security Benefits Taxable Calculator

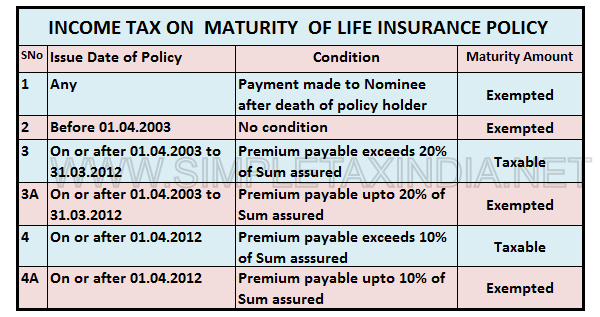

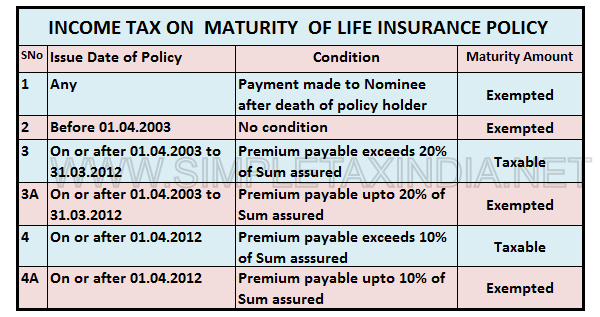

INCOME TAX BENEFIT ON LIFE INSURANCE SIMPLE TAX INDIA

INCOME TAX BENEFIT ON LIFE INSURANCE SIMPLE TAX INDIA

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

How Does Family Tax Benefit Really Work Grandma s Jars

Stamp Duty Tax Deductible

Is Family Tax Benefit Taxable Income - The Family Tax Benefit Part B is intended to provide additional assistance to single parents non parent carers grandparent carers and families with one main income You