Is Fuel Reimbursement Taxable Income It does NOT therefore in an wa modif or replace the General Legislation Income Tax Act Cap 470 and the Tax Procedures Act 2015 The Guide is available on the KRA website

While they re not required by the IRS accountable plans help you set criteria that comply with IRS regulations on what reimbursements are deductible and what reimbursements count as taxable income An accountable plan for employee expenses acts as a guardrail for employees to avoid being taxed on employer reimbursements OVERVIEW If you use your own car for work purposes and are reimbursed by your employer for the related expenses the mileage reimbursement generally isn t taxable income if it s paid under an accountable plan However if it s paid under a nonaccountable plan the reimbursement is generally taxed TABLE OF CONTENTS

Is Fuel Reimbursement Taxable Income

Is Fuel Reimbursement Taxable Income

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

4 Ways To Keep Track Of Fuel Use WikiHow

https://www.wikihow.com/images/f/f2/Calculate-Your-Income-Tax-in-India-Step-5.jpg

Fuel Management System Fuel Card Management IntelliShift

https://intellishift.com/wp-content/uploads/2022/03/[email protected]

Typically a mileage reimbursement stays non taxable as long as the cents per mile rate used does not exceed the IRS standard business rate 0 67 mile for 2024 But this assumes that other rules are being followed to make the reimbursement part of an accountable plan If your business uses an accountable plan reimbursements are not taxable You do not have to withhold or contribute income FICA or unemployment taxes To have an accountable plan your employees must meet all three of the following rules The employee must have incurred deductible expenses while performing services as your

The answer No it s not ok How to Tell If Your Car Allowance Is Taxable As an employer if you require your employees to use their personal vehicles for business purpose you have two options to address their driving expenses You can either 1 Compensate employees taxable allowance OR 2 Reimburse employees non taxable method What is a taxable benefit Automobile or motor vehicle benefits Allowances or reimbursements provided to an employee for the use of their own vehicle Other taxable benefits Determine the tax treatment of payments other than regular employment income How to calculate Make corrections before filing

Download Is Fuel Reimbursement Taxable Income

More picture related to Is Fuel Reimbursement Taxable Income

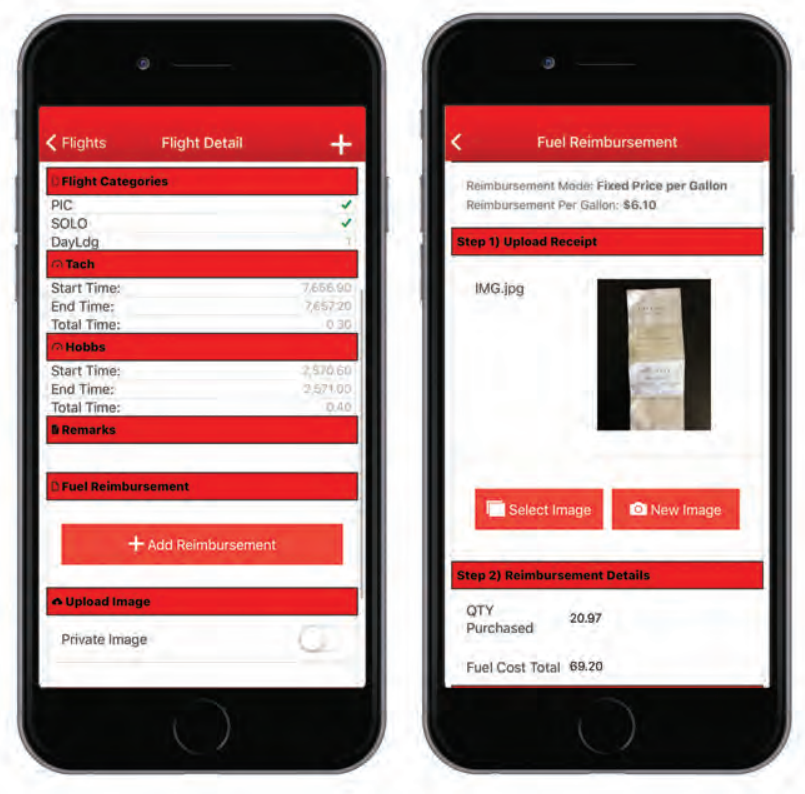

Gas Mileage Reimbursement Form Excel Templates

https://lh5.googleusercontent.com/proxy/j4mOQddD5-1FkIZi30o19VDVtHe4y6mELoZ0vyqyue5n7DWA4Mn1O_nkWkuM4K3Vrn59iIPd2SWrxRkfNaomxfjASorwF7clNsO67cCcr6H2lzJpzZQfjHgSIF2EteQ=s0-d

Is A Mileage Reimbursement Taxable

https://www.mburse.com/hubfs/2020-chevy-malibu copy.jpg

Employee Gifts Are They Taxable Income Tax Deductible For The Company

https://www.gannett-cdn.com/-mm-/53ed1c02a484aa0c0dd5755eb74649939ad78bce/c=0-296-1077-905/local/-/media/2017/11/30/TennGroup/Nashville/636476613769144276-1212-LBMC.jpg?width=3200&height=1680&fit=crop

An employer is not allowed an income tax deduction for any expense incurred or any payment or reimbursement for providing transportation to an employee in connection with travel between the employee s residence and principal place of employment except as necessary for ensuring the safety of the employee when unsafe If the reimbursement amount is at the standard IRS there won t be any tax implications However if your employer reimburses you at a higher rate the excess will be considered taxable income for you In other words your company is paying you more than what the IRS determines is the cost per mile It is therefore considered compensation

[desc-10] [desc-11]

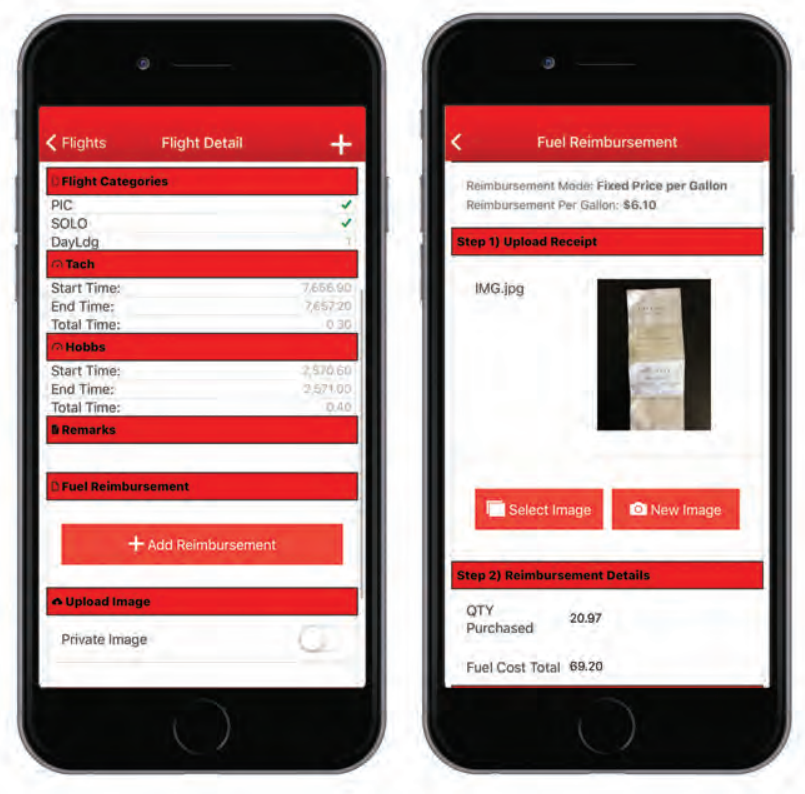

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

http://www.pilotpartner.net/wp-content/uploads/2021/04/FuelReimbursement.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

https://www. kra.go.ke /images/publications/PAYE...

It does NOT therefore in an wa modif or replace the General Legislation Income Tax Act Cap 470 and the Tax Procedures Act 2015 The Guide is available on the KRA website

https://www. justworks.com /blog/expenses-101...

While they re not required by the IRS accountable plans help you set criteria that comply with IRS regulations on what reimbursements are deductible and what reimbursements count as taxable income An accountable plan for employee expenses acts as a guardrail for employees to avoid being taxed on employer reimbursements

Fuel EPayCard

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

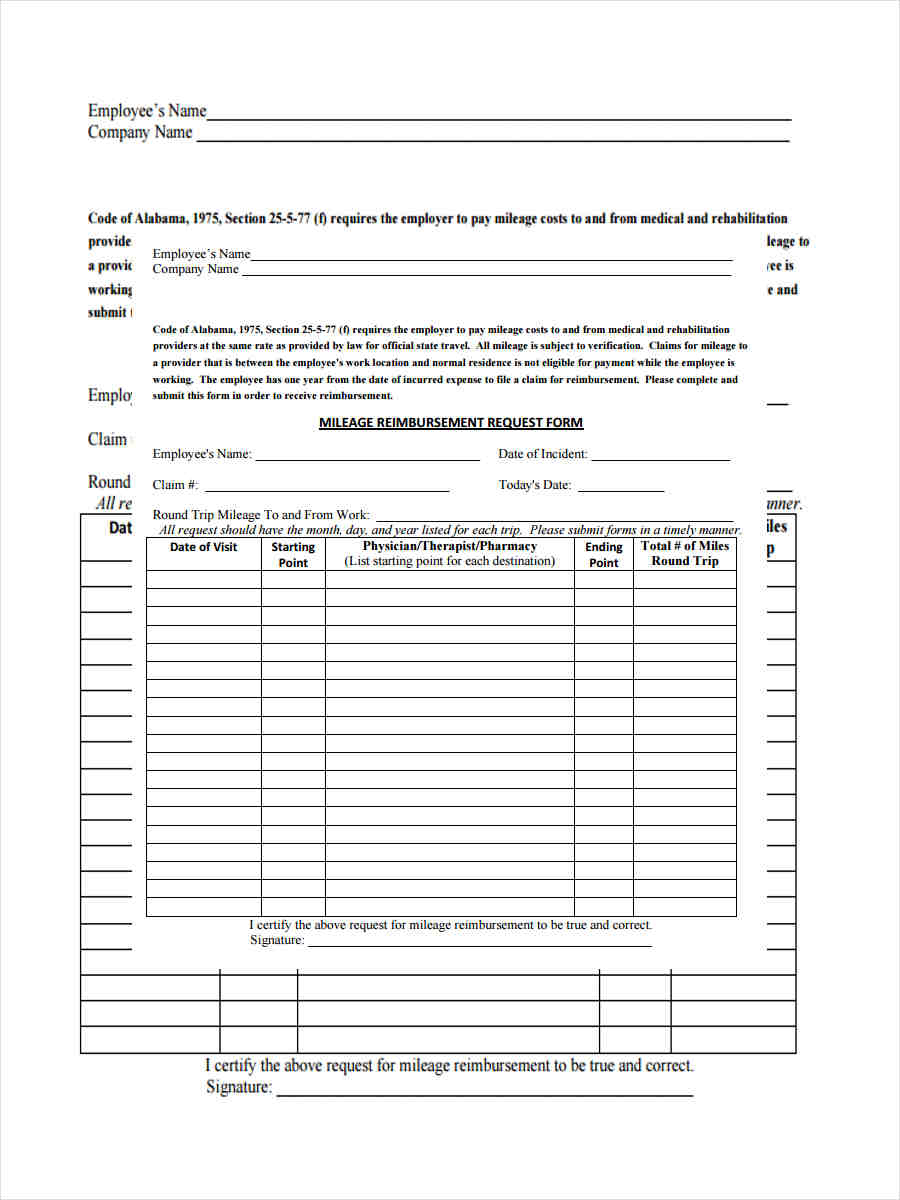

Work from home Reimbursement Definition Taxes Policy

USDA Announces SY2023 24 Reimbursement Rates School Nutrition Association

Lowering Personal Income Tax PIT Government PH

Lowering Personal Income Tax PIT Government PH

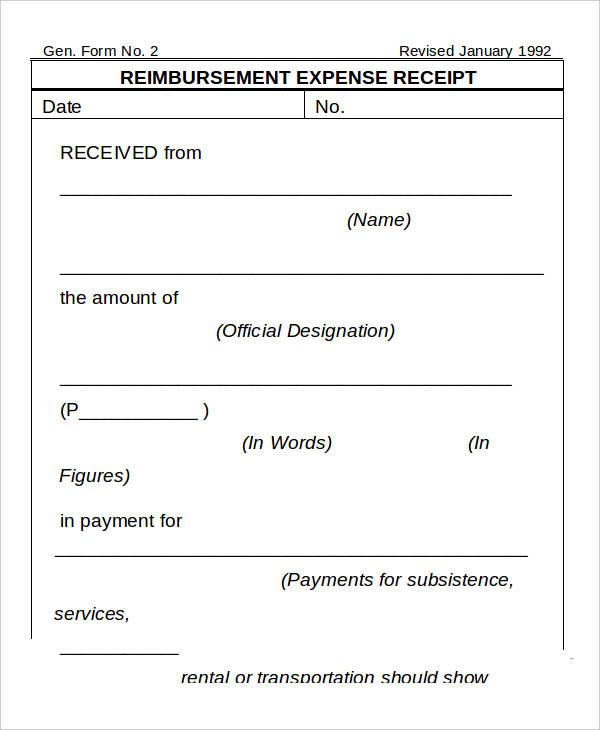

Original Reimbursement Expense Receipt Template Simple Receipt

What Is Pre Tax Commuter Benefit

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is Fuel Reimbursement Taxable Income - What is a taxable benefit Automobile or motor vehicle benefits Allowances or reimbursements provided to an employee for the use of their own vehicle Other taxable benefits Determine the tax treatment of payments other than regular employment income How to calculate Make corrections before filing