Is Fuel Tax Credit Taxable Income When using a fuel for a different purpose a taxpayer is likely to be exempt from the fuel excise tax As discussed below while a taxpayer may use fuel for a nontaxable use for excise tax purposes the same fuel may qualify for federal

Use Form 4136 to claim a credit for certain nontaxable uses of fuel the alternative fuel credit and a credit for blending a diesel water fuel emulsion A 2013 IRS Chief Counsel Advice memorandum CCA 2013 42 010 held that when a taxpayer has no fuel tax liability a refundable credit does not need to be included in

Is Fuel Tax Credit Taxable Income

Is Fuel Tax Credit Taxable Income

https://www.banlaw.com/wp-content/uploads/2021/12/who-can-claim-fuel-tax-credits-1024x763.jpg

What Income Is Taxable Blog hubcfo

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable-1038x576.png

Fuel Tax Credit Calculation Worksheet

https://i2.wp.com/data.formsbank.com/pdf_docs_html/128/1280/128053/page_1_thumb_big.png

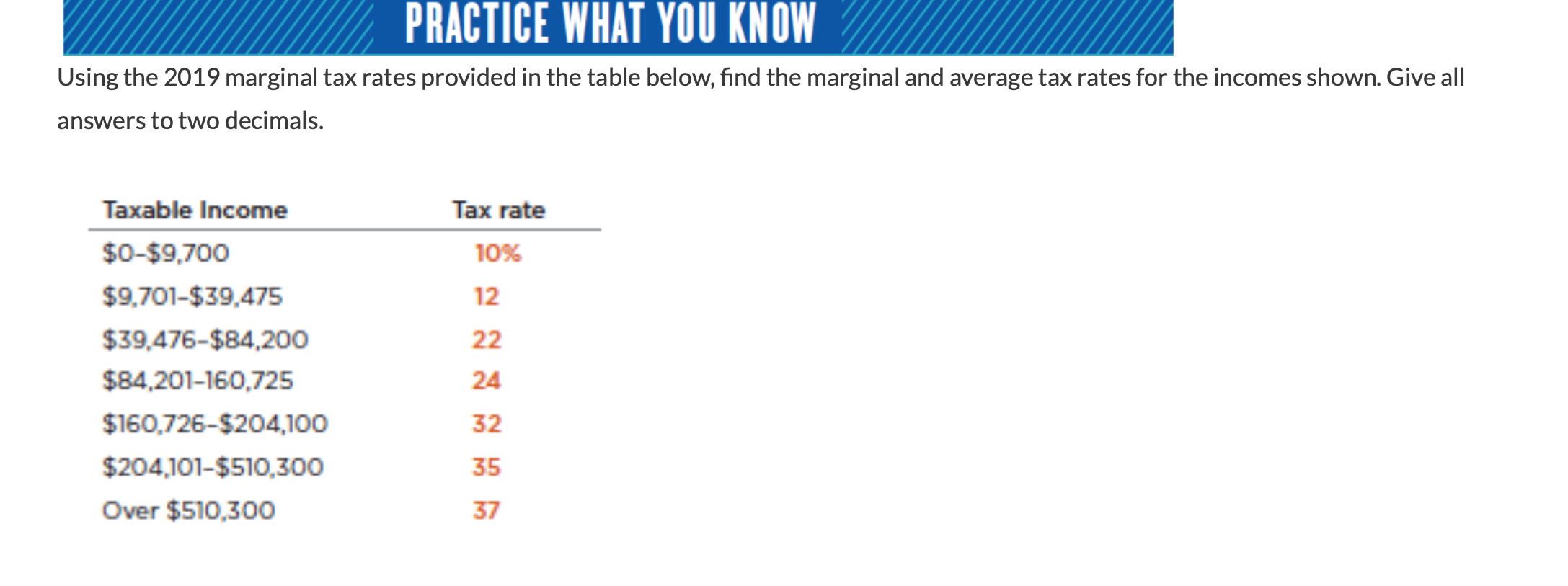

Use Form 4136 to claim the following The biodiesel or renewable diesel mixture credit The alternative fuel credit A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel Is federal fuel tax credit taxable income The federal fuel tax credit provided through Form 4136 is not considered taxable income This means that businesses can claim the credit to reduce their federal excise tax liability

Not all fuels are taxed by the federal government and there are certain circumstances where the government may not tax or implement reduced taxes The ultimate user of a fuel is typically eligible for a credit for untaxed Fuel tax credits are assessable income and should be disclosed in the tax return as assessable government industry payments They are also treated as installment income for the purpose

Download Is Fuel Tax Credit Taxable Income

More picture related to Is Fuel Tax Credit Taxable Income

4 Ways To Keep Track Of Fuel Use WikiHow

https://www.wikihow.com/images/f/f2/Calculate-Your-Income-Tax-in-India-Step-5.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Is federal fuel tax credit taxable income The fuel tax credit provided by Form 4136 can reduce your income tax liability but you may still need to include the amount of the credit as taxable income on your return You can claim a fuel tax credit on your income tax return for the year you used the fuel or sold the fuel in the case of a registered ultimate vendor claims Tip You may be able

Using Form 4136 businesses can claim a tax credit for federal excise taxes paid on fuel effectively reducing their overall tax liability This can be a substantial saving The fuel tax credit enables businesses to reduce taxable income based on specific fuel costs Individual taxpayers are generally ineligible with the credit limited to off highway

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

For Tax Purposes gross Income Is All The Money A Person Receives In

https://img.homeworklib.com/images/1e2b89e4-55e2-4a4f-b14c-62a8e8749f84.png?x-oss-process=image/resize,w_560

https://www.thetaxadviser.com/issues/2014…

When using a fuel for a different purpose a taxpayer is likely to be exempt from the fuel excise tax As discussed below while a taxpayer may use fuel for a nontaxable use for excise tax purposes the same fuel may qualify for federal

https://www.irs.gov/forms-pubs/about-form-4136

Use Form 4136 to claim a credit for certain nontaxable uses of fuel the alternative fuel credit and a credit for blending a diesel water fuel emulsion

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Solved Please Note That This Is Based On Philippine Tax System Please

Fuel Tax Credits Fleet Management Solutions Connect Fleet

Is The Employee Retention Credit Taxable Income ERC Bottom Line Savings

T ml Rejtett tutal s Tax Payable Calculator Megfejt Tengerpart Kinyit

Fuel Tax Credit Rates Have Increased Business Wise

Fuel Tax Credit Rates Have Increased Business Wise

Why Do Canadians Pay So Much IFTA Fuel Tax When They Buy Fuel In The

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

Oklahoma Taxable Fuel Bond Surety Bond Authority

Is Fuel Tax Credit Taxable Income - Use Form 4136 to claim the following The biodiesel or renewable diesel mixture credit The alternative fuel credit A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel