Is Giving To Charity Tax Deductible Uk The tax relief you get depends on the rate of tax you pay To donate 1 you pay 80p if you re a basic rate taxpayer 60p if you re a higher rate taxpayer 55p if you re an additional rate

How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings If you were on a higher tax rate of 40 a 20 monthly donation would only cost you 12 and 11 at 45 tax There s no minimum or maximum to what you can give And this is a better system for charities as they can t

Is Giving To Charity Tax Deductible Uk

Is Giving To Charity Tax Deductible Uk

https://zonaltrabajoandahuaylas.com/wp-content/uploads/2020/02/Charity-donations-scaled.jpg

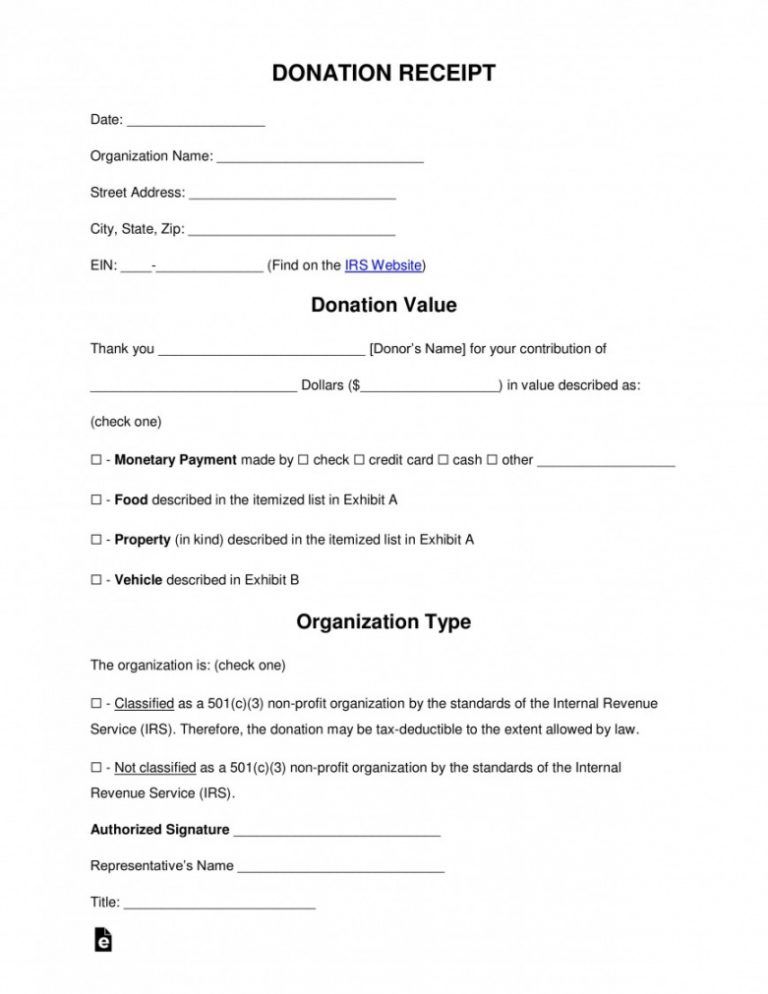

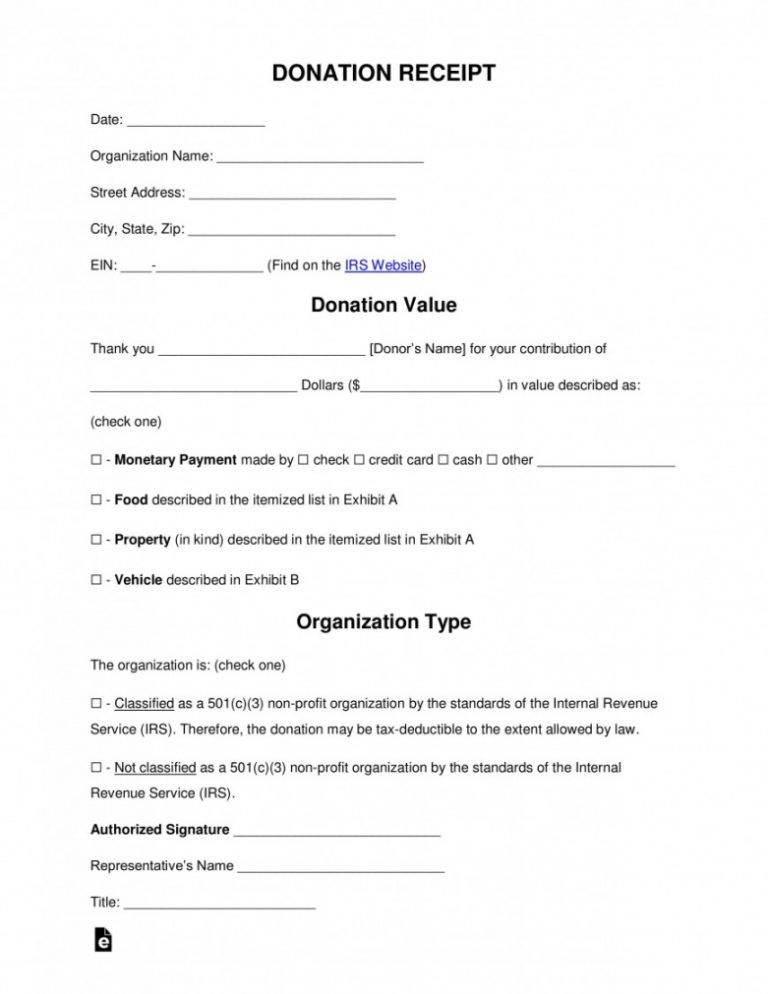

Free Tax Donation Form Template Addictionary Tax Deductible Donation

http://www.emetonlineblog.com/wp-content/uploads/2020/06/free-tax-donation-form-template-addictionary-tax-deductible-donation-receipt-template-sample-768x994.jpg

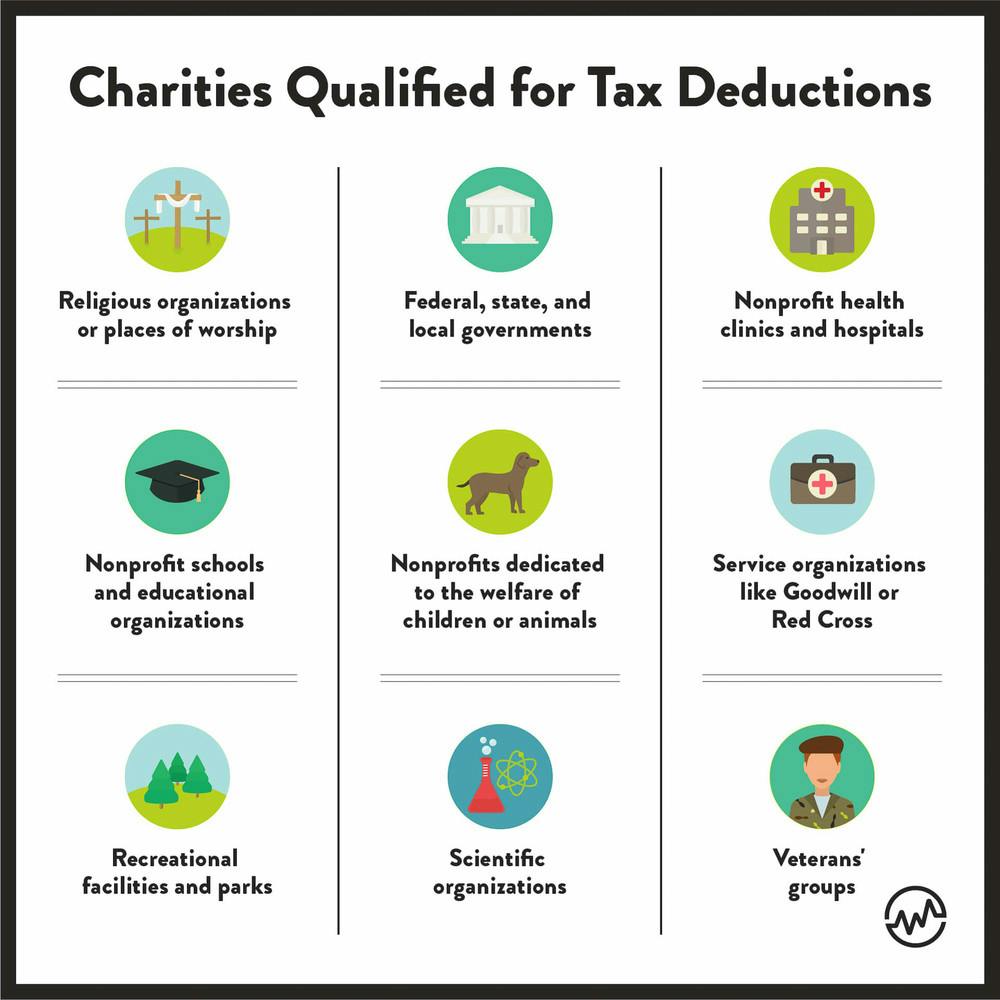

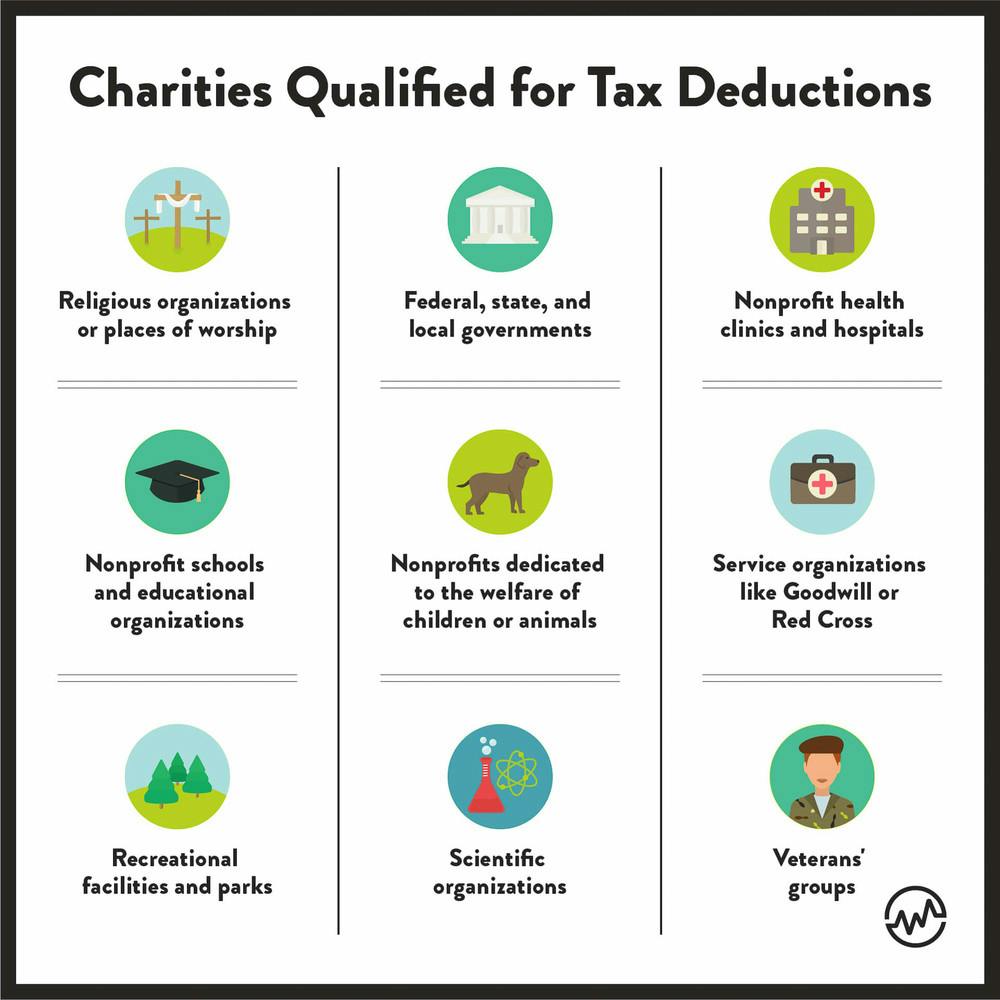

Donation Tax Deductions The Benefits Of Giving Zoe Financial

https://zoefin.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-30-at-12.18.51-AM.png

As an individual you may qualify for tax relief when you donate to a charity in the United Kingdom Tax relief on charity donations can occur through schemes like Gift Aid Payroll If you ve donated to a charity as a sole trader or business partnership and you re eligible to receive tax relief you can include this when you fill out your Self Assessment tax return

Limited companies can make donations and receive immediate reduction to their corporation tax liability This is because charitable donations are an allowable business expense The charity will have to be an officially Gift Aid transforms charitable donations by allowing charities and CASCs to claim 25p extra for every 1 given at no additional cost to you Higher and additional rate taxpayers can

Download Is Giving To Charity Tax Deductible Uk

More picture related to Is Giving To Charity Tax Deductible Uk

AccountingAnswers Is Donating To Charity Tax Deductible

https://blog.inspire.business/hubfs/FullSizeRender-15-1.jpg#keepProtocol

Tax On Donations Are Homes Donated To Charity Tax Deductible

https://lirp.cdn-website.com/3f82f4e9/dms3rep/multi/opt/91273105_presentation-wide-1920w.jpg

Is Donating To Charity Tax Deductible ACRF

https://www.acrf.com.au/wp-content/uploads/2021/05/AreCharityDonationsTaxDeductible.jpg

Yes charitable donations can be tax deductible However these options will depend on whether the donor is an individual taxpayer i e a single person or a company To qualify for tax relief your donations must be made to UK charities registered with the Charity Commission or to Community Amateur Sports Clubs CASCs Some overseas

Donations made to churches that are registered charities in the UK are eligible for tax relief under Gift Aid rules Gift Aid allows the charity to claim an additional 25 of the donation value and higher rate taxpayers can claim further tax Donations to charity from individuals are usually tax free Who receives the tax depends on the nature of the donation and how it is made The Gift Aid scheme simply means

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://images.prismic.io/wealthfit-staging/6c4dff5e8f000e8b664bb80e4577267e647b8ba9_01-maximize-charitable-deductions.jpg?auto=compress

Charitable Deductions For 2020

https://hbkcpa.com/wp-content/uploads/2020/10/GivingtoChairty.jpg

https://www.gov.uk › donating-to-charity › donating...

The tax relief you get depends on the rate of tax you pay To donate 1 you pay 80p if you re a basic rate taxpayer 60p if you re a higher rate taxpayer 55p if you re an additional rate

https://www.gov.uk › government › publications

How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings

Tips For Donating To Charities Non Profits Why Many Are NOT Tax

How To Maximize Your Charity Tax Deductible Donation WealthFit

How Much Do You Need To Donate For Tax Deduction

Is Housing Donated To Charity Tax Deductible Finance Zacks

How To Legally Claim A Tax Deduction For Charitable Giving From Your

Charity Tax Breaks Extended Through 2014 Only

Charity Tax Breaks Extended Through 2014 Only

Sars 2022 Weekly Tax Tables Brokeasshome

Pin On Ways To Save Money

How To Maximize Your Charity Tax Deductible Donation WealthFit

Is Giving To Charity Tax Deductible Uk - In some cases charitable donations might even be tax deductible That s why we ve compiled this comprehensive guide to walk you through what qualifies as a charitable