Is Graduate School Tax Deductible Just like an undergraduate student a graduate student is usually eligible for grad student tax deductions including Tuition and fees deduction Lifetime Learning Credit

Tax filers can deduct up to 4 000 of tuition and fees paid for higher education in the tax year It is an above the line deduction meaning filers can claim it Updated for Tax Year 2020 December 1 2022 9 14 AM OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to

Is Graduate School Tax Deductible

Is Graduate School Tax Deductible

https://www.ak-up.com/wp-content/uploads/2021/04/5DFEEED3-CA69-4C75-A8BD-8E71FA7F8CC7_1_105_c.jpeg

11 Things That Change In Grad School Grad School School Grad

https://i.pinimg.com/originals/7f/00/38/7f0038f7ad3eb558e4c81431b51ae211.jpg

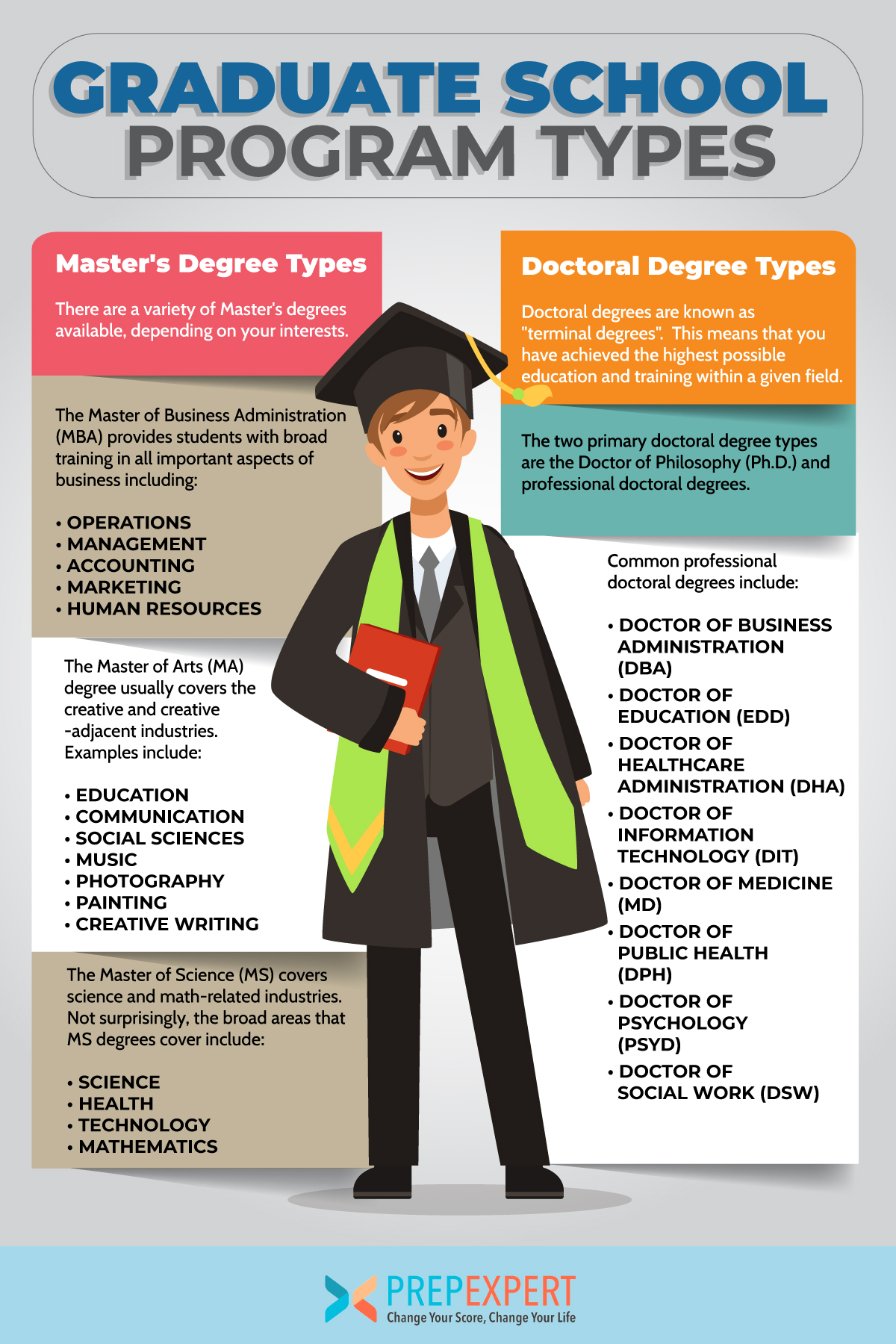

What Type Of Degree Is Accounting

https://prepexpert.com/wp-content/uploads/2019/08/505981_GraduateSchool_081319.jpg

Learn how to save money on your taxes through various programs for educational expenses such as the American Opportunity Graduate school tuition can be a deductible education expense under the tuition and fees deduction if you meet the criteria To qualify you must pay the tuition for

The ability to deduct otherwise qualifying EBE has been suspended for tax years beginning January 1 2018 through tax years ending December 31 2025 So for How to Deduct MBA Tuition on Your Taxes There are several ways MBA students can deduct tuition on their taxes experts say Under the IRA s tuition and fee deduction an MBA student can adjust up

Download Is Graduate School Tax Deductible

More picture related to Is Graduate School Tax Deductible

Tax Deductible Donations Bold

https://bold-org.ghost.io/content/images/2023/04/tax-deductible-donations-1.jpg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

Is Private School Tuition Tax Deductible EdChoice

https://www.edchoice.org/wp-content/uploads/2016/04/Private-School-Tuition-Tax-Deductible-Main-1.jpg

Tuition and Fees Deduction for Graduate Students The Tuition and Fees Deduction allows you to claim up to 4 000 per tax year for graduate students with a Educational Tax Credits and Deductions You Can Claim for Tax Year 2022 Several tax breaks can help you cover the cost of education and new laws expand some benefits By Kimberly Lankford

IRS Tax Tip 2021 106 July 22 2021 As a new school year approaches students are considering what classes they need to take and how much the classes will The deduction for tuition and fees expired on December 31 2020 However taxpayers who paid qualified tuition and fees in 2018 2019 and 2020 could claim a

Federal Tax Breaks For Graduate School Other Tax Benefits Graduate

https://www.graduateprogram.org/wp-content/uploads/2020/04/Apr.-6-Federal-Tax-Breaks-for-Graduate-School-Other-Tax-Benefits-web.jpg

Why Go To Graduate School Graduate Studies

https://blogs.tntech.edu/graduate/wp-content/uploads/sites/6/2018/03/7.jpg

https://www.hrblock.com/tax-center/filing/...

Just like an undergraduate student a graduate student is usually eligible for grad student tax deductions including Tuition and fees deduction Lifetime Learning Credit

https://www.brookings.edu/articles/yes-there...

Tax filers can deduct up to 4 000 of tuition and fees paid for higher education in the tax year It is an above the line deduction meaning filers can claim it

MythBusters Graduate School Edition UF

Federal Tax Breaks For Graduate School Other Tax Benefits Graduate

School Supplies Are Tax Deductible Wfmynews2

Sars 2022 Weekly Tax Tables Brokeasshome

Approved 3 2 Partnership Programs Graduate School Virginia Tech

Are Roth IRA Contributions Tax Deductible Roth Ira Contributions

Are Roth IRA Contributions Tax Deductible Roth Ira Contributions

Is Graduate School The Right Choice For You University Affairs

Is Office Furniture Tax Deductible Small Business Tax Deductions

Is Trucking School Tax Deductible Big Rig Pros

Is Graduate School Tax Deductible - Medical expenses or student fees Transportation or mileage Fees for maintaining or acquiring a license broker CPA etc Tutoring expenses Private high