Is Group Health Insurance Premium Tax Deductible Most group health insurance premiums are subsidized by your employer and the business pays a large portion of the cost The

Whether you recently started a new job and want to learn more about how your new group coverage works you already have group coverage and want to know more about it or you just lost or quit Some types of health insurance premiums are tax deductible a line item added to the budget but rarely considered for its possible financial benefits It s important to know that not all premiums are in fact created

Is Group Health Insurance Premium Tax Deductible

Is Group Health Insurance Premium Tax Deductible

https://cdn-myfed.pressidium.com/wp-content/uploads/2021/11/2023-medicare-premiums.jpg

Are Health Insurance Premiums Tax Deductible Investing BB

https://www.investingbb.com/wp-content/uploads/2020/09/Untitled1.png

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/08/tax-calculator.jpeg.jpg

The IRS clarifies in Publication 535 that even if you buy your own health insurance and are self employed you can t deduct the premiums if you re eligible to have coverage that s subsidized by an Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several For the 2022 tax year small businesses can contribute up to 5 450 for self only employee coverage 454 16 per month or 11 050 for family coverage 920 83 per month

Download Is Group Health Insurance Premium Tax Deductible

More picture related to Is Group Health Insurance Premium Tax Deductible

Insurance Premium Tax Increase Connect Insurance

https://www.connect-insurance.uk/wp-content/uploads/2018/10/insurance_premium_tax_2015.png

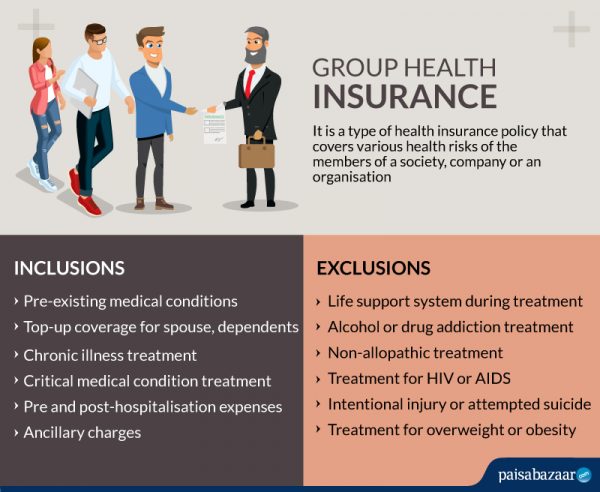

Group Health Insurance Coverage Claim

https://www.paisabazaar.com/wp-content/uploads/2018/12/Group-Health-Insurance-600x492.jpg

Are Payroll Deductions For Health Insurance Pre Tax Details More

https://www.patriotsoftware.com/wp-content/uploads/2021/06/health-insurance-pre-tax-1.png

In 2021 the average cost for health insurance premiums ranged from 2 664 to 7 152 per person You may be eligible to claim your health insurance premiums on your tax forms depending on your Premiums for company health insurance are not tax deductible Employers deduct premium payments from your paycheck on a pretax basis Since your employee

There are three common scenarios under which you may be able to claim your health insurance premium as a tax deduction We ll take a high level glance at This article helps small business owners understand which insurance premiums may be considered tax deductible Insurance Premium Tax Deductions for

Are Medicare Premiums Tax Deductible Medigap

https://www.medigap.com/wp-content/uploads/2022/03/Medicare-premiums-tax-deductible.jpg

Best Health Insurance Companies In India converted Bharti

https://online.pubhtml5.com/kfyn/louj/files/large/1.jpg

https://www.forbes.com/advisor/health-insur…

Most group health insurance premiums are subsidized by your employer and the business pays a large portion of the cost The

https://www.forbes.com/.../group-health-ins…

Whether you recently started a new job and want to learn more about how your new group coverage works you already have group coverage and want to know more about it or you just lost or quit

Solo Business Owners How To Qualify For Health Insurance Tax Credits

Are Medicare Premiums Tax Deductible Medigap

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

IRDAI Allows Payment Of Health Insurance Premium In Monthly Installments

Group Health Insurance Vs Individual Health Insurance

Is Health Insurance Tax Deductible Get The Answers Here

Is Health Insurance Tax Deductible Get The Answers Here

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

A Guide To Tax Benefits Of Health Insurance AKSSAI ProjExel Blog

Update Minnesota OKs Health Insurance Premium Relief And Here s What

Is Group Health Insurance Premium Tax Deductible - Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few