Is Hawaii Excise Tax Deductible Web 1 Dez 2023 nbsp 0183 32 Excel Workbook of the General Excise Tax Exemptions Deductions by Activity Code as of November 6 2023 XLSX Please also search our website for Tax Information Releases Attorney General Opinions Letter Rulings and other resources related to the General Excise Tax

Web REMINDER A county surcharge on the State s general excise and use taxes is imposed on Hawaii taxpayers Taxpayers MUST complete Part V of their periodic and annual general excise use tax returns to assign their taxes to each county or may be subject to a 10 penalty for noncompliance Web deductions for any taxable year shall be allowed to an individual only to the extent that the aggregate of those deductions exceeds two percent of adjusted gross income 2 IRC section 67 b provides that the term miscellaneous itemized deductions means all itemized deductions other than certain deductions enumerated within that statute

Is Hawaii Excise Tax Deductible

Is Hawaii Excise Tax Deductible

http://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/9c4ab4cb-56e2-11e9-a65a-d37e40182361.png

Hawaii Business Registration Including General Excise Or GE License

https://static.wixstatic.com/media/f6316a_60731ca093b64328b7e01d7285ce0334~mv2.jpeg/v1/fill/w_1000,h_495,al_c,q_85,usm_0.66_1.00_0.01/f6316a_60731ca093b64328b7e01d7285ce0334~mv2.jpeg

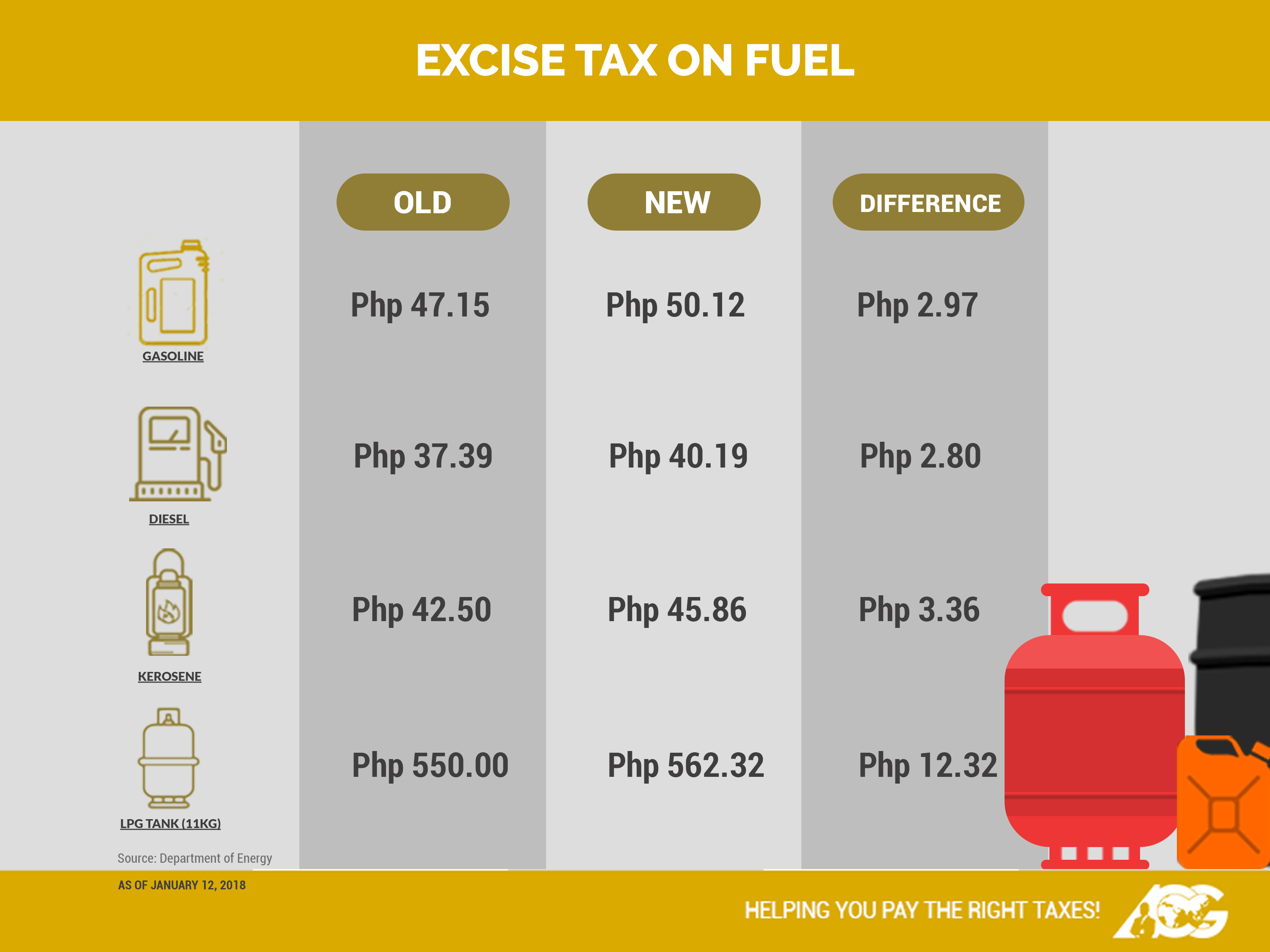

AskTheTaxWhiz Top 10 Questions About The Tax Reform Law

https://assets.rappler.com/236649B6231D4201B05E94B2E2A71319/img/2B538918FE284ADE88461405900A8AC8/Excise_Tax_on_Fuels.jpg

Web Hawaii s General Excise Tax GET is imposed on a taxpayer s gross income or gross receipts for the privilege of conducting business in the State of Hawaii Gross income is the total business income before any deduction of business expenses and it includes any cost passed on to customers such as the GET as well Web No The GET is a part of the price the customer is charged whether it is visibly passed on or not The tax law prohibits the business from claiming there is no tax charged if the business is subject to GET on the sale Businesses who violate this provision may be fined up to 50 section 237 49 HRS Can businesses charge customers GET 6 Yes

Web Excise and Use Tax Laws and the rules issued thereunder IN THE CASE OF A CORPORATION OR PARTNERSHIP THIS RETURN MUST BE SIGNED BY AN OFFICER PARTNER OR MEMBER OR DULY AUTHORIZED AGENT Form G 45 REV 2023 10 FORM G45 DO NOT WRITE IN THIS AREA 10 REV 2023 Column a Column b Web Vor 5 Tagen nbsp 0183 32 Want to look up a form by its number Please see our Hawaii Tax Forms Alphabetical Listing The Department of Taxation s forms and instructions as well as many brochures newsletters and reports are provided as pdf files Viewing and printing forms and instructions requires Adobe Reader

Download Is Hawaii Excise Tax Deductible

More picture related to Is Hawaii Excise Tax Deductible

Your Separation Agreement Impacts Whether Spousal Support Payments Are

https://sharifflaw.com/wp-content/uploads/2023/11/post-1.jpeg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

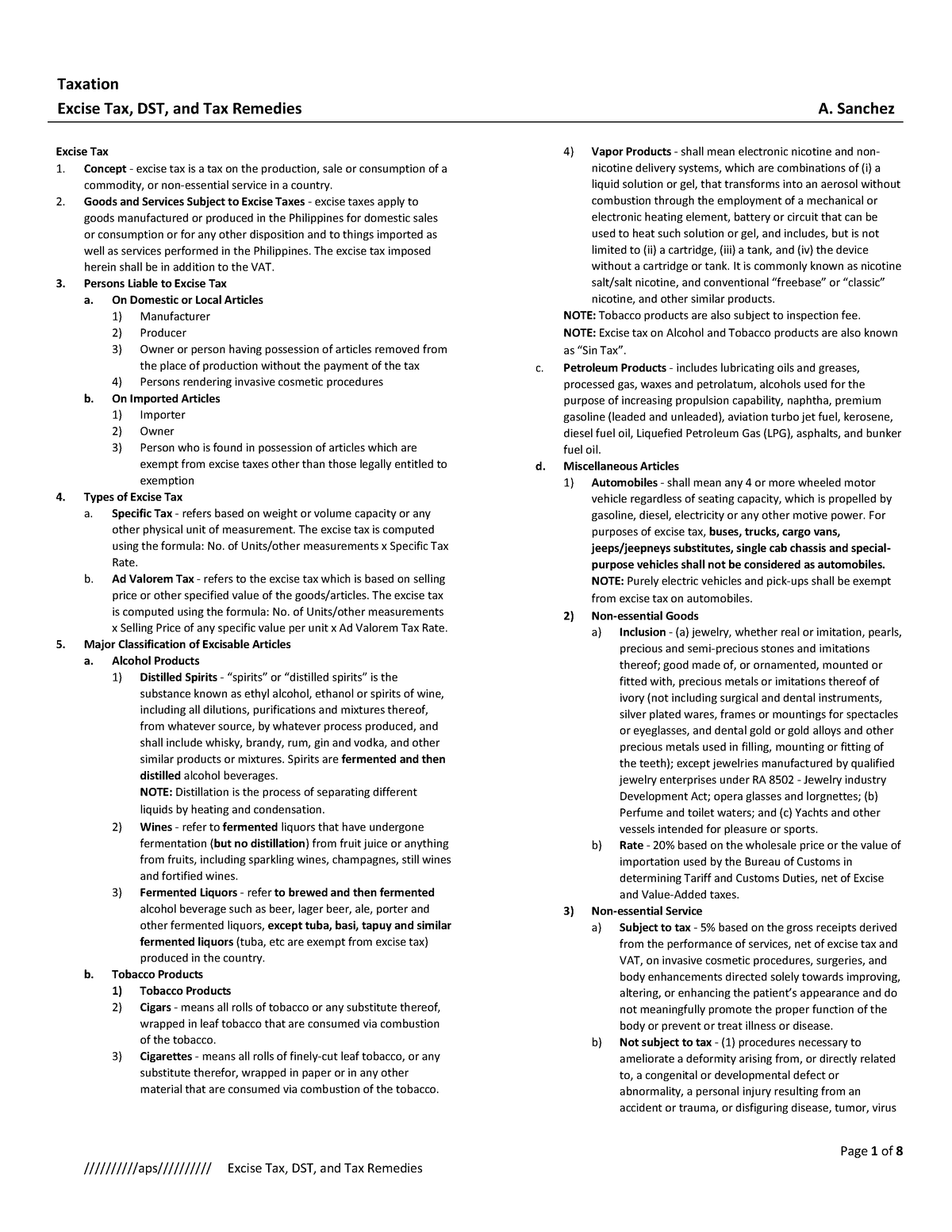

Excise Tax DST And Tax Remedies Page 1 Of 8 Taxation Excise Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/00541d448947df24948c7124ad3a49c3/thumb_1200_1553.png

Web 3 Enter the Tax District in which the exemption deduction is claimed Oahu enter 1 Maui enter 2 Hawaii enter 3 Kauai enter 4 4 Enter your total amount of the exemption deduction claimed for that Activity ED Code and District Example Taxpayer A has made a 2 000 sale of tangible personal property to the Federal Web Excise and Use Tax GET filers claimed 29 772 GET exemptions Taxpayers claimed 33 3 billion in exemptions from their gross receipts and hence 26 1 of the gross receipts were exempted from the GET in 2020

Web Hawaii General Excise Taxes can often be deducted on federal schedules E for rental income and C for sole proprietorship income If you have a multi member partnership or corporation GE Tax can often be written off on the appropriate income tax forms Web Introduction to the General Excise Tax brochure Please refer to this brochure for more information on the general excise tax GET If you have any questions please call or email us Our contact information is provided at the back of this brochure Note This brochure provides general information and is not a substitute for legal or other

Tax Deductible Bricks R Us

https://www.bricksrus.com/wp-content/uploads/2018/03/35808436_l-1.jpg

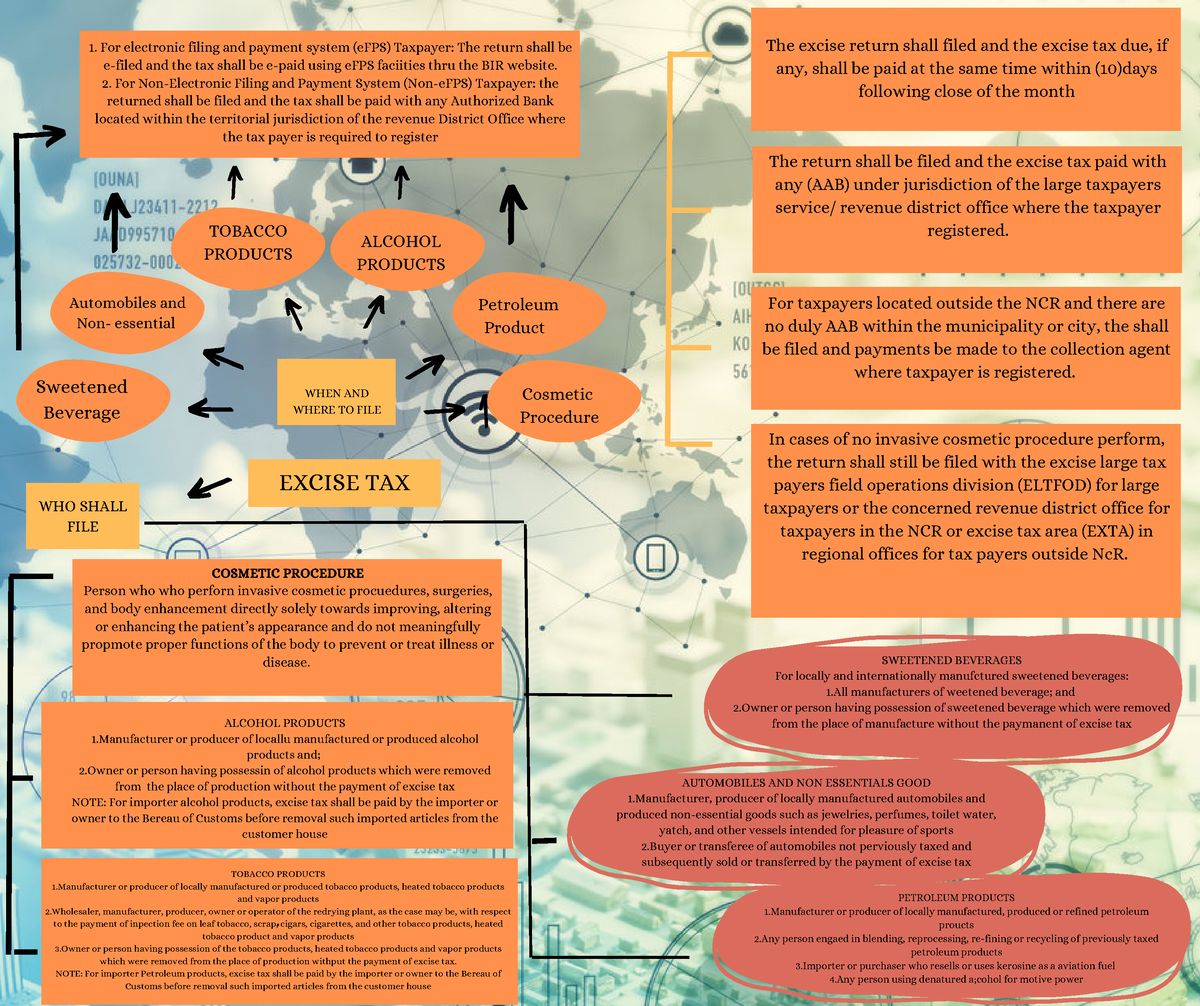

Excise TAX Good EXCISE TAX WHEN AND WHERE TO FILE For Electronic

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a591dba265ad026706c581f576e4e847/thumb_1200_1006.png

https://tax.hawaii.gov/geninfo/get

Web 1 Dez 2023 nbsp 0183 32 Excel Workbook of the General Excise Tax Exemptions Deductions by Activity Code as of November 6 2023 XLSX Please also search our website for Tax Information Releases Attorney General Opinions Letter Rulings and other resources related to the General Excise Tax

https://files.hawaii.gov/tax/forms/2022/g45ins.pdf

Web REMINDER A county surcharge on the State s general excise and use taxes is imposed on Hawaii taxpayers Taxpayers MUST complete Part V of their periodic and annual general excise use tax returns to assign their taxes to each county or may be subject to a 10 penalty for noncompliance

How Much Per Person Does Your State Collect In Excise Taxes

Tax Deductible Bricks R Us

Ultimate Excise Tax Guide Definition Examples State Vs Federal

General Excise And Use Tax In Hawaii Lorman Education Services

Calculate Excise Tax Deductions In The UAE

Say Hello To Tax Deductible Gifts Bundled

Say Hello To Tax Deductible Gifts Bundled

OC The Difference An Excise Tax Makes Australia Dataisbeautiful

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Hawaii General Excise Tax Id Number Roselee Seeley

Is Hawaii Excise Tax Deductible - Web 1 Sept 2023 nbsp 0183 32 Does Hawaii accept the Federal Form 4868 Application for Automatic Extension of time to File U S Individual Income Tax Return in lieu of the Hawaii extension form What is Hawaii s personal exemption amount What is the standard deduction amount for Hawaii What is the formula for calculating penalty