Is Health Insurance Rebate Based On Taxable Income In 2023 the medical contribution is 0 60 of the employee s income taxable in municipal taxation The daily allowance contribution of health insurance is 1 36

Frequently asked questions on the federal tax consequences to an insurance company that pays a MLR rebate and an individual policyholder who receives a MLR rebate as well To be eligible for the private health insurance rebate your income for surcharge purposes must be less than the Tier 3 income threshold Tier 3 is the highest

Is Health Insurance Rebate Based On Taxable Income

Is Health Insurance Rebate Based On Taxable Income

https://images.theconversation.com/files/458508/original/file-20220419-24-8c9jju.png?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

Health Insurance

https://lifeadvice.ca/public/front/img/images/insurance-board.gif

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Expert Alumni You do not have to include it as income on your tax return as long as you did not take an itemized deduction for the premiums on last year s return You can use the private health insurance PHI rebate calculator to find out your private health rebate percentage updated annually on 1 April income for

To work out your income use the Australian Taxation Office ATO Private Health Insurance Rebate calculator Use this simple calculator to find out what your current The rebate can be used to reduce your premiums or claimed when you lodge your tax return with the Australian Taxation Office Please note that if you have a Lifetime Health

Download Is Health Insurance Rebate Based On Taxable Income

More picture related to Is Health Insurance Rebate Based On Taxable Income

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096872/

Services Of Insurance Company Character Set With Policy Negotiations

https://i.pinimg.com/originals/df/f4/49/dff449dff6f35e775985a196ebbbfbd2.jpg

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

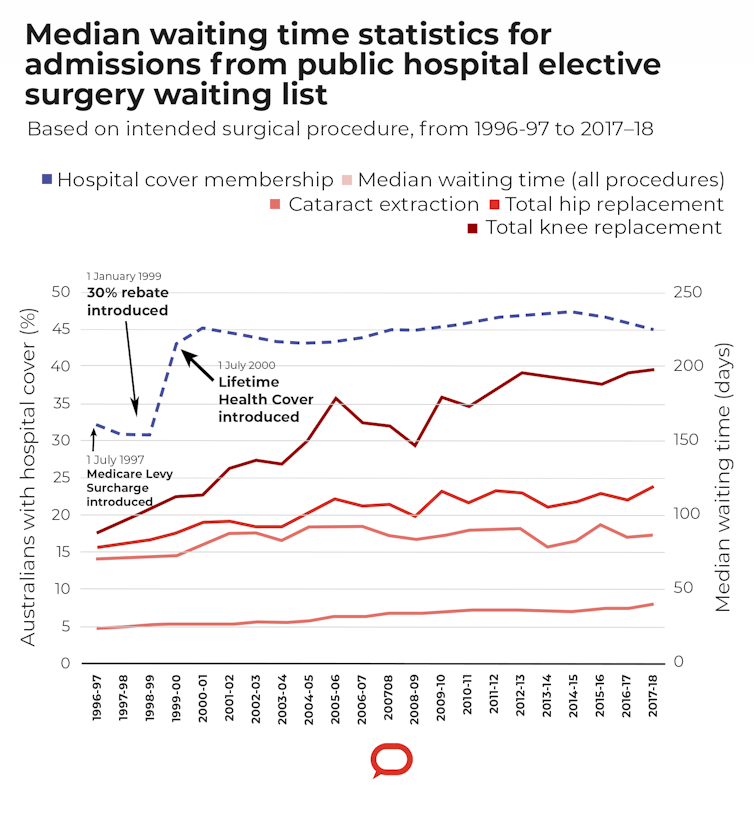

If you have a taxable income of 151 000 or less as a single or 302 000 or less as a couple or family you could be eligible to save on your health insurance The private health insurance rebate is income tested The table below details the different rebate amounts The rebate applies to hospital general treatment and

The private health insurance rebate is a contribution the Australian Government makes towards your private health insurance premium It is based on your income and age A higher income generally lowers the The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased

How To Choose The Right Health Insurance Plan Today s Top Flickr

https://live.staticflickr.com/65535/52233487909_369aed7dce_b.jpg

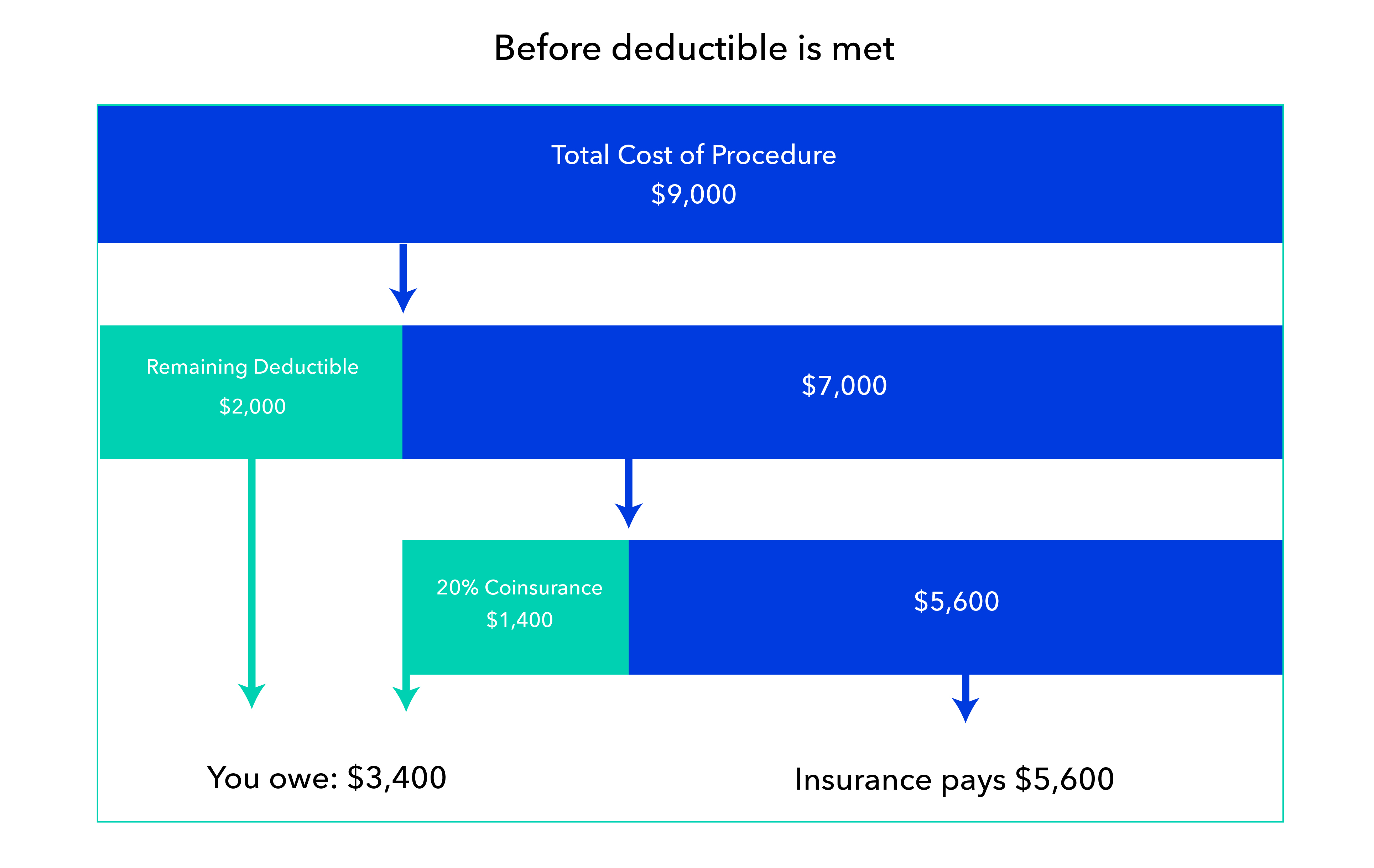

Is Health Insurance Just A Medical Discount Plan Until You Reach Your

https://www.pocketero.com/blog/content/images/size/w1000/2022/07/health-insurance-just-medical-discount-plan-until-deductible.jpg

https://www. vero.fi /en/individuals/tax-cards-and...

In 2023 the medical contribution is 0 60 of the employee s income taxable in municipal taxation The daily allowance contribution of health insurance is 1 36

https://www. irs.gov /newsroom/medical-loss-ratio-mlr-faqs

Frequently asked questions on the federal tax consequences to an insurance company that pays a MLR rebate and an individual policyholder who receives a MLR rebate as well

How Much Is Health Insurance Cost Sharing Explained

How To Choose The Right Health Insurance Plan Today s Top Flickr

What Is Health Insurance The Details You Probably Didn t Know

Should You Pay For Your Health Insurance Through Your Business The

Pin On Insurance Affordable Health Insurance Plans Non Obamacare

Calculate My Income Tax SuellenGiorgio

Calculate My Income Tax SuellenGiorgio

InsurSafe

Top 10 Health Insurance Update 2022 2022

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Is Health Insurance Rebate Based On Taxable Income - Expert Alumni You do not have to include it as income on your tax return as long as you did not take an itemized deduction for the premiums on last year s return