Is Health Insurance Tax Deductible Health insurance premiums can count as a tax deductible medical expense along with other out of pocket medical expenses if you itemize your deductions You can only deduct medical

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain criteria Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the money you paid toward your monthly premiums can be taken as a tax deduction

Is Health Insurance Tax Deductible

Is Health Insurance Tax Deductible

https://www.heathcrawford.co.uk/wp-content/uploads/2020/05/Best-private-health-insurance.jpg

Is Health Insurance Tax Deductible For Self Employed International

https://www.internationaltrisomyalliance.com/wp-content/uploads/2023/01/is-health-insurance-tax-deductible-for-self-employed.png

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/08/tax-calculator.jpeg.jpg

Your health insurance deductible is the amount you pay for covered services before your insurer pays their share A lower deductible usually results in higher monthly premiums and vice versa Your deductible directly impacts your out of pocket health care costs Knowing the ins and outs of your health insurance plan is important Is health insurance tax deductible Health insurance premiums are deductible on federal taxes in some cases as these monthly payments are classified as medical expenses Generally if you pay for medical insurance on your own you can deduct the

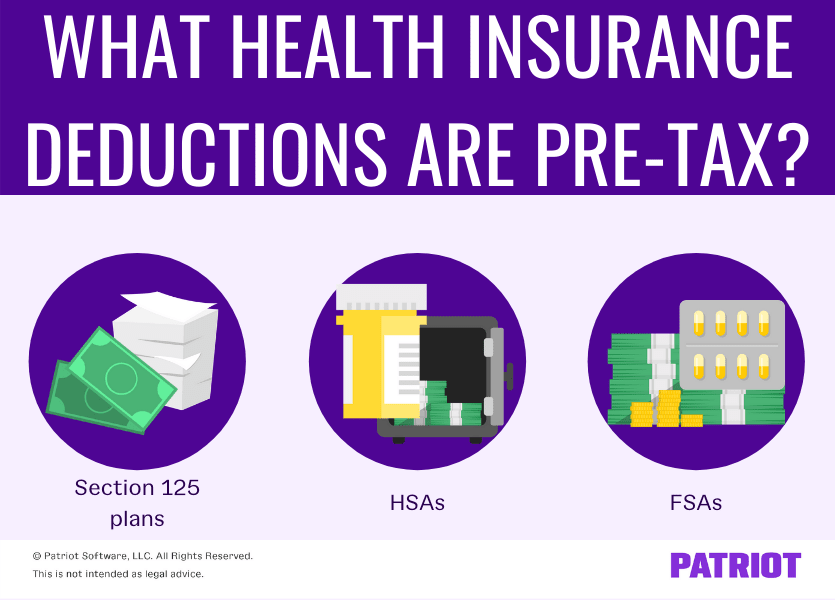

The contribution you make to your HSA is 100 tax deductible up to a limit in 2024 of 4 150 if your HDHP covers just yourself and 8 300 if it also covers at least one additional family member For 2025 these limits increase to 4 300 and 8 550 respectively You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

Download Is Health Insurance Tax Deductible

More picture related to Is Health Insurance Tax Deductible

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

Is Health Insurance Tax Deductible SmartFinancial

https://s3.amazonaws.com/assets.smartfinancial/uploads/1604434340435_1597071455056_tax.jpg

Is Health Insurance Tax Deductible

https://s3.ap-south-1.amazonaws.com/healthinsurances3.com/prod/imagegallery/Is-Health-Insurance-Tax-Deductible.jpg

Generally health insurance premiums may be tax deductible if you re not receiving a reimbursement anywhere else But if you are not self employed you can only deduct those premiums that exceed 7 5 of your AGI Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction

[desc-10] [desc-11]

Can I Deduct Short Term Health Insurance From My Taxes If I m Self

https://shorttermhealthinsurance.com/wp-content/uploads/2018/10/self_employed_health_insurance_tax_deduction-960x540.jpg

Pre tax Vs After tax Medical Premiums

https://www.peoplekeep.com/hubfs/All Images/Featured Images/pre-tax vs after-tax medical premiums_fb.jpg#keepProtocol

https://money.usnews.com/money/personal-finance/...

Health insurance premiums can count as a tax deductible medical expense along with other out of pocket medical expenses if you itemize your deductions You can only deduct medical

https://www.investopedia.com/are-health-insurance...

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain criteria

Are Health Insurance Costs Tax deductible

Can I Deduct Short Term Health Insurance From My Taxes If I m Self

Is Health Insurance Tax Deductible Get The Answers Here

Is Your Private Health Insurance Tax Deductible Checkout Best

Is Health Insurance Tax Deductible 2024

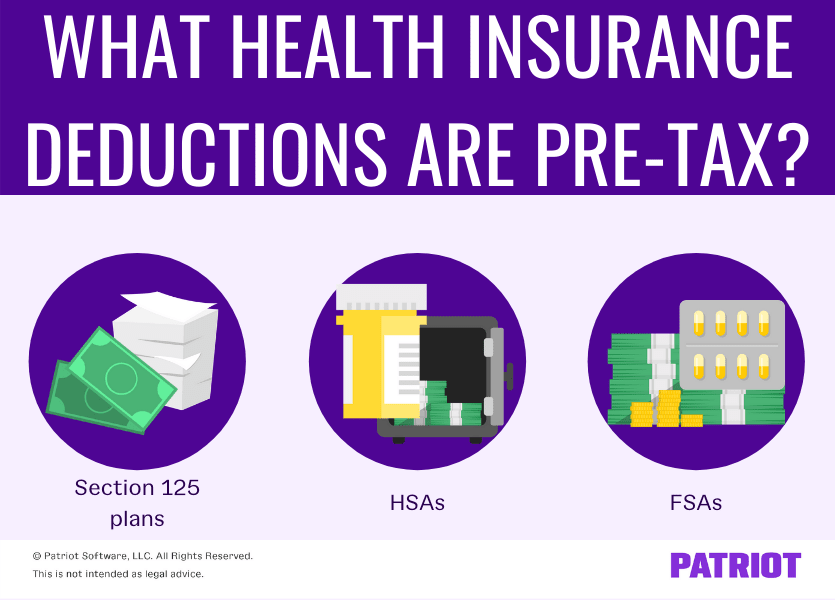

Are Payroll Deductions For Health Insurance Pre Tax Details More

Are Payroll Deductions For Health Insurance Pre Tax Details More

Is Car Insurance Tax Deductible Explore All Insights

/close-up-of-woman-planning-home-budget-and-using-calculator--869247602-5bf9abc846e0fb0051ddd36e-585e7c2336c44accbba2bb63a9b82c5c.jpg)

Can You Deduct Life Insurance Premiums On Your Taxes 7 Insurance

Is Health Insurance Tax Deductible For S Corp Insurance Reference

Is Health Insurance Tax Deductible - [desc-12]