Is Home Loan Interest Part Of 80c Thus even if there is no payment made in the given financial year then also deduction can be claimed on the basis of interest payable Now a new Section has been inserted Section 80EEA that allows

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

Is Home Loan Interest Part Of 80c

Is Home Loan Interest Part Of 80c

https://img.etimg.com/thumb/msid-92431453,width-1070,height-580,imgsize-418743,overlay-etwealth/photo.jpg

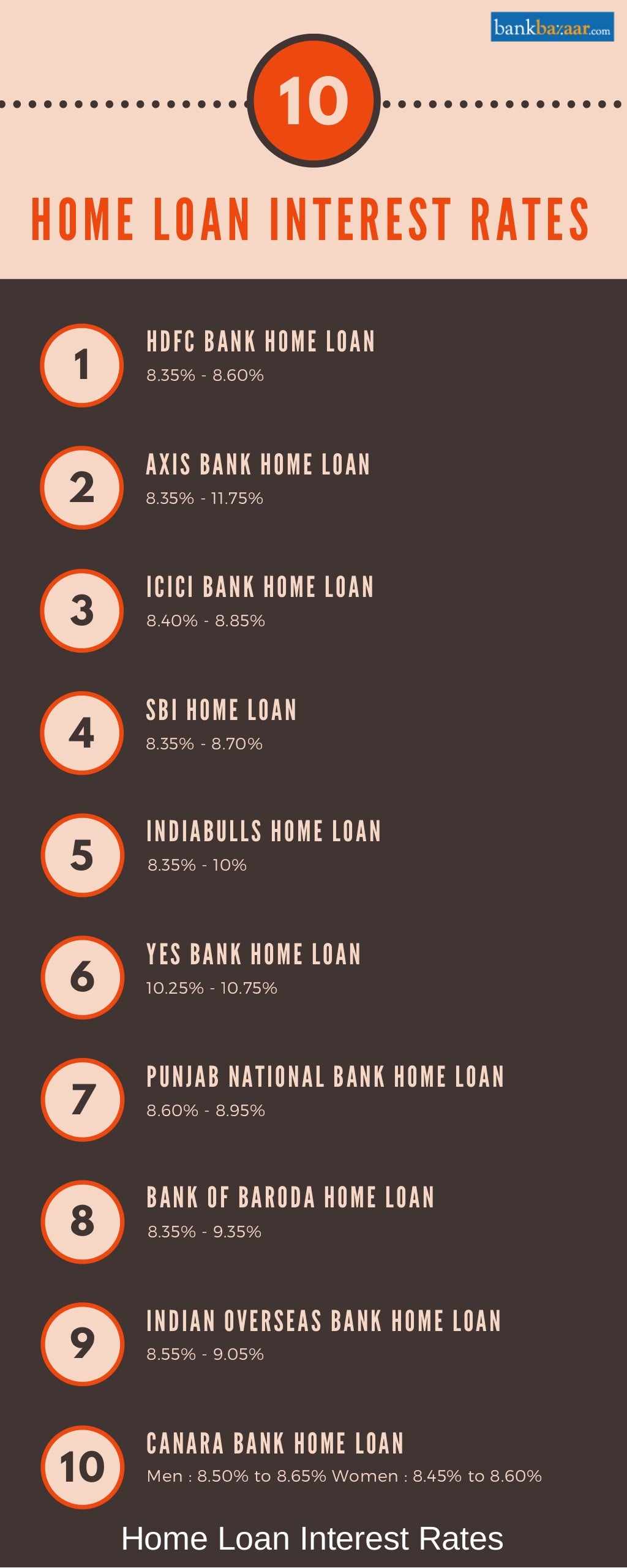

What Is Home Loan Interest Rate Documents Required

https://www.loomsolar.com/cdn/shop/articles/home_loan_d1490422-8834-4a6e-ad9b-c3eff815053a.jpg?v=1692945293

Home Loan Interest Rate Home Sweet Home

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/average_home_loan_rate

Yes home loan principal is part of Section 80C of the Income Tax Act Under this section an individual is entitled to tax deductions on the amount paid as repayment of the Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Discover the tax advantages of home loans under the Income Tax Act 1961 Explore Sections 24B 80C 80EE and 80EEA which offer deductions for interest on loan borrowed principal Is home loan interest part of section 80C of the Income tax Act No interest paid on home loan is not part of section 80C of the Income tax Act However principal amount repaid is part of section 80C

Download Is Home Loan Interest Part Of 80c

More picture related to Is Home Loan Interest Part Of 80c

Best Home Loan Rates

https://images.livemint.com/img/2021/12/26/original/loan_1640547127620.png

How To Get Home Loan Interest Back YouTube

https://i.ytimg.com/vi/CcZVodEGai4/maxresdefault.jpg

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C Is home loan interest part of section 80C of the Income tax Act No section 80C of the Income tax Act does not apply to interest paid on a mortgage Principal repayments however are covered by section

There is no threshold limit for claiming principal repayment of home loans hence any principal payment amount up to Rs 1 5 lakh irrespective of whether it is pre You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid

How To Make Home Loan Interest Free YouTube

https://i.ytimg.com/vi/DzRNY0kxBEs/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYZSBeKFkwDw==&rs=AOn4CLCqnQxs-plNLE5Ic154uwRNX24rtw

Home Loan Interest Rates 2021 Best Home Loan 6 85 In India EMI

https://i.ytimg.com/vi/QVVsvtSyi1o/maxresdefault.jpg

https://taxguru.in/income-tax/tax-benefit…

Thus even if there is no payment made in the given financial year then also deduction can be claimed on the basis of interest payable Now a new Section has been inserted Section 80EEA that allows

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Home Loan Interest

How To Make Home Loan Interest Free YouTube

Home Loan Interest Rates

These Banks Hike Home Loan Interest Rates Here s How Much Your EMI

Be Careful If You Want To Take A Home Loan Interest Rate Can

How Is Interest Calculated On A Home Loan Homestar Finance

How Is Interest Calculated On A Home Loan Homestar Finance

Pin On Home Loan

Home Loan Interest Rates How To Reduce Home Loan Interest Burden

ICICI Bank Home Loan Home Loans Loan Icici Bank

Is Home Loan Interest Part Of 80c - Repayments towards the principal component of home loan EMIs are eligible for deduction under Section 80C This benefit is available If the property s