Is Home Mortgage Interest Deductible On Schedule A You claim the mortgage interest deduction on Schedule A of Form 1040 which means you ll need to itemize instead of take the standard deduction when you do your taxes

Home mortgage interest is reported on Schedule A of the 1040 tax form The mortgage interest paid on rental properties is also deductible but this is reported on For any home loan taken out on or before October 13 1987 all mortgage interest is fully deductible For home loan taken out after October 13 1987 and before

Is Home Mortgage Interest Deductible On Schedule A

Is Home Mortgage Interest Deductible On Schedule A

https://d3uhnnsvth2wmm.cloudfront.net/eyJidWNrZXQiOiJrbHItYXNzZXRzIiwia2V5IjoiaW5zaWdodHMvSG91c2Vfb3B0aW1pemVkLmpwZyIsImVkaXRzIjp7ImpwZWciOnsicXVhbGl0eSI6ODIsInByb2dyZXNzaXZlIjpmYWxzZSwidHJlbGxpc1F1YW50aXNhdGlvbiI6dHJ1ZSwib3ZlcnNob290RGVyaW5naW5nIjp0cnVlLCJvcHRpbWl6ZVNjYW5zIjp0cnVlfSwicmVzaXplIjp7IndpZHRoIjoxMjAwLCJoZWlnaHQiOjYzMCwiZml0IjoiY292ZXIifSwic2hhcnBlbiI6dHJ1ZX19?mtime=1673458374

HELOC Is The Interest Tax Deductible YouTube

https://i.ytimg.com/vi/SKMnUEmDjlU/maxresdefault.jpg

Contrary To Popular Belief Mortgage Interest Is Not Always Tax

https://i.pinimg.com/originals/24/29/ca/2429caff8b3b262ebba96743865cfe98.jpg

You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest That means forgoing the standard deduction for your filing status You Schedule A Form 1040 Home Mortgage Interest You can only deduct interest on the first 375 000 of your mortgage if you bought your home after December 15 2017 Per IRS

Since mortgage interest is an itemized deduction you ll use Schedule A Form 1040 which is an itemized tax form in addition to the standard 1040 form This form also lists other deductions including Advertiser disclosure What Is Schedule A of IRS Form 1040 Itemized Deductions in 2023 2024 You may need to file a Schedule A if you want to deduct mortgage interest charitable donations or

Download Is Home Mortgage Interest Deductible On Schedule A

More picture related to Is Home Mortgage Interest Deductible On Schedule A

What Is A Deductible Insurance Shark

https://myinsuranceshark.com/wp-content/uploads/2020/03/what-is-a-deductible.png

An infographic Of The Impact Of Interest Rate Increases Mortgage

https://i.pinimg.com/originals/fe/ca/85/feca8578870667d92e8413074d133608.jpg

Is HELOC Interest Tax Deductible Can You Write Off The Interest You

https://i.ytimg.com/vi/a-cJeW685G4/maxresdefault.jpg

Loans with deductible interest typically include A mortgage to buy or build your home A second mortgage A line of credit A home equity loan If the loan is not a If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying residence including your Main home or Second home You must be

For qualifying home loans taken after December 15th 2017 you can deduct the interest on up to 750 000 of home mortgage debt For loans taken after December Head of household filers have a standard deduction of 20 800 for the 2023 tax year If you are married and filing jointly or file as a qualifying widow er your 2023

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

https://www.thepeak.com/wp-content/uploads/2021/02/20210219-MEM.png

51 Is Mortgage Interest Deductible On Rental Property LorrettaArtem

https://image.isu.pub/220422204019-3968b688c1bf3b062cae91385e375bf3/jpg/page_1.jpg

https://www.nerdwallet.com/article/taxes/mo…

You claim the mortgage interest deduction on Schedule A of Form 1040 which means you ll need to itemize instead of take the standard deduction when you do your taxes

https://www.investopedia.com/terms/home-mortgage-interest.asp

Home mortgage interest is reported on Schedule A of the 1040 tax form The mortgage interest paid on rental properties is also deductible but this is reported on

Tax Deductions You Can Deduct What Napkin Finance

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

Is IRS Late Payment Interest Deductible On A Partn Fishbowl

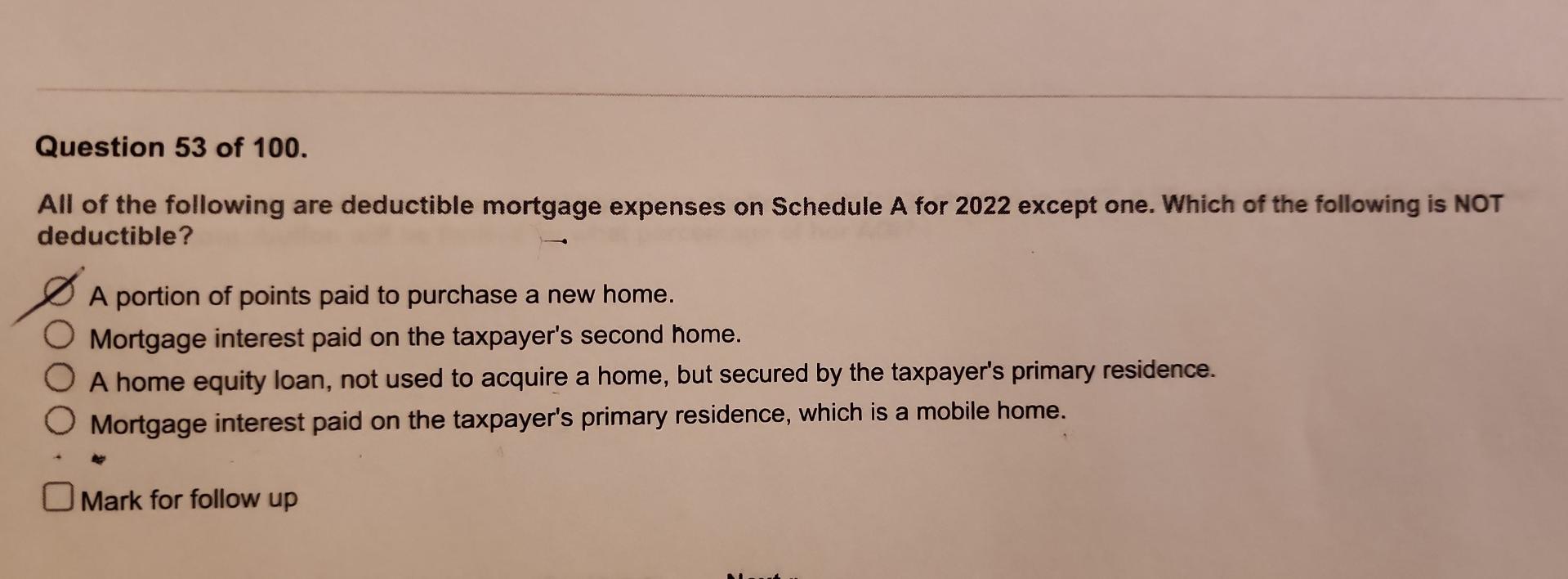

Solved All Of The Following Are Deductible Mortgage Expenses Chegg

Where Are Mortgage Rates Headed Mortgage Rates Mortgage Protection

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Mortgage Rates A History Over The Years INFOGRAPHICS

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

Is Mortgage Interest Deductible On Your Income Tax Return For 2017

Is Home Mortgage Interest Deductible On Schedule A - Schedule A Form 1040 Home Mortgage Interest You can only deduct interest on the first 375 000 of your mortgage if you bought your home after December 15 2017 Per IRS