Is Home Office Tax Deductible You may be eligible for the home office deduction if you had any income from self employment in 2023 but the rules are strict Key Takeaways

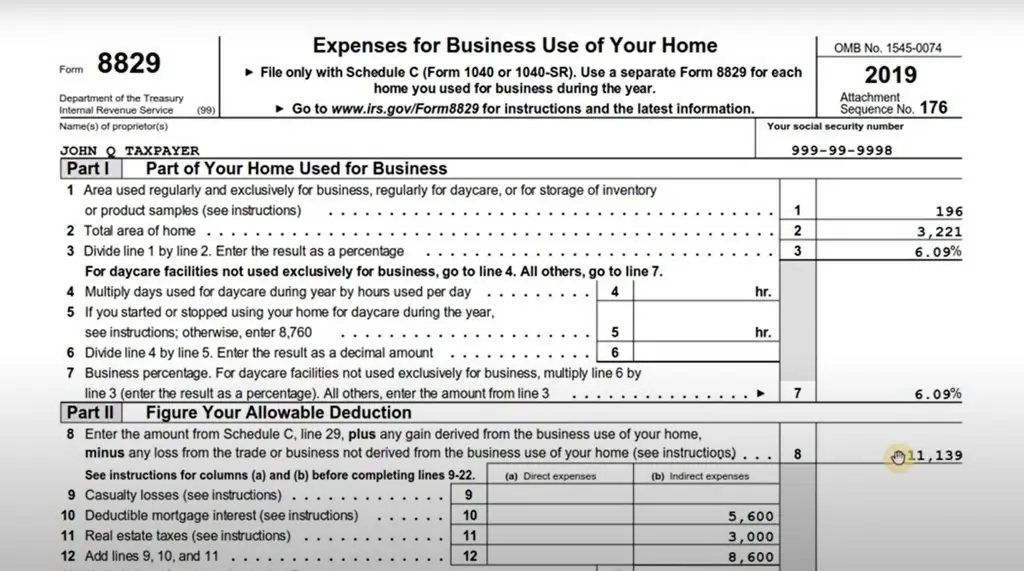

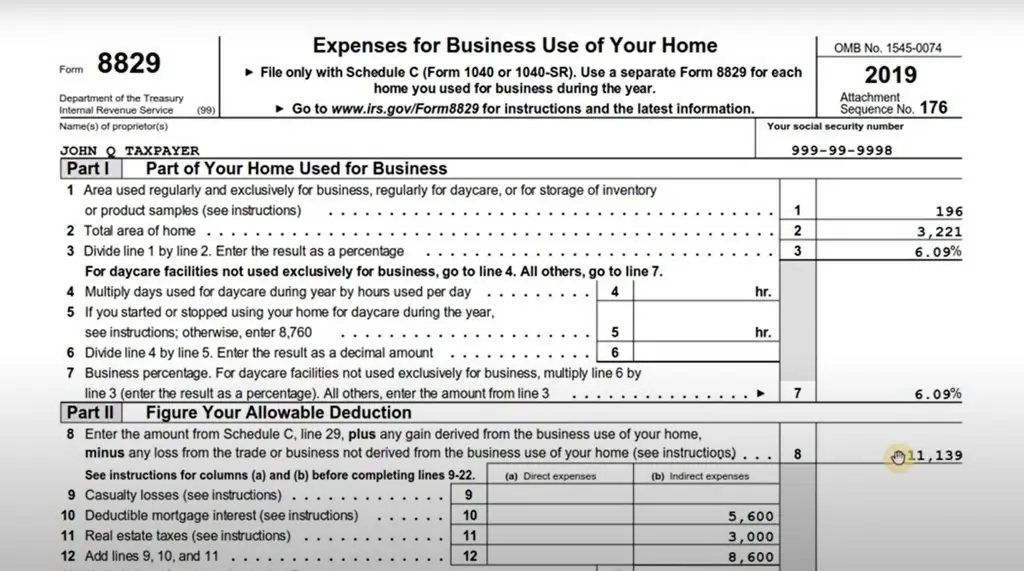

Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage Home office expenses are direct or indirect for tax purposes Direct expenses are 100 deductible but most expenses are indirect and only a portion is deductible

Is Home Office Tax Deductible

Is Home Office Tax Deductible

https://www.xtraspace.co.za/sites/default/files/home-office-tax-deductions.jpg

What Home Office Expenses Are Tax Deductible

https://www.we-heart.com/upload-images/homeofficetaxdeductions1.jpg

Is My Home Office Tax Deductible YouTube

https://i.ytimg.com/vi/atwCjxmTbWc/maxresdefault.jpg

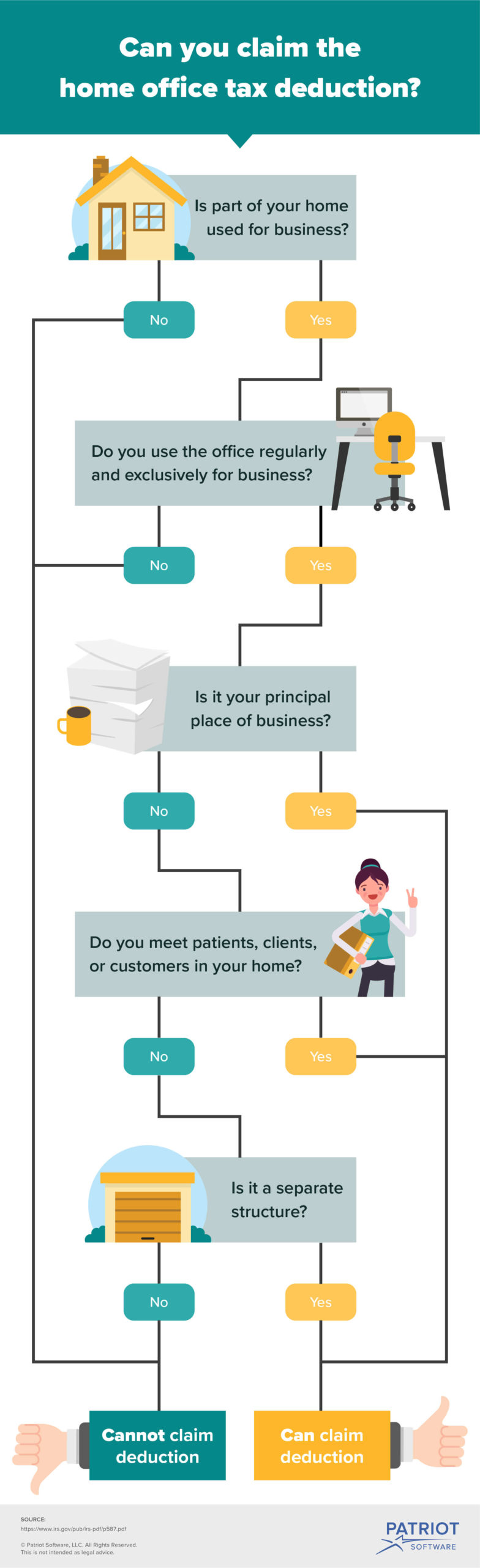

The self employed are eligible for the home office tax deduction if they meet certain criteria The workspace for a home office must be used exclusively and regularly for business Total What is the Home Office Deduction and Who Qualifies The home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business

Learn how to deduct certain home expenses when you use part of your home or a separate structure as your primary place of business Find out the requirements But the reality is not every taxpayer can claim the home office deduction Here s what you should know about the home office tax deduction before you file your 2023 tax return

Download Is Home Office Tax Deductible

More picture related to Is Home Office Tax Deductible

Is My Home Office Tax Deductible Biggest Tax Questions Part 2 YouTube

https://i.ytimg.com/vi/xW9FH5Lzsz8/maxresdefault.jpg

Is Office Furniture Tax Deductible Small Business Tax Deductions

https://i.pinimg.com/originals/af/4c/43/af4c438edd6de952d097aade0b191b1d.png

Home Office Expense Tax Deductions Platinum Accounting

https://uploads-ssl.webflow.com/63cf642db9b930dbbc59f679/6423a0f1a39de2271b0a67a6_49 - Home Office Expense Tax Deductions.jpg

The home office deduction is one of the most popular work from home tax deductions Once you understand how to calculate record and report home office expenses you The home office deduction is a way for self employed business owners including sole proprietors limited liability company LLC owners or partners in partnerships to deduct

A home office deduction allows you to deduct expenses related to your home office if it is your primary place of business Your employment status can impact whether or not you qualify for this deduction This deduction First it needs to be the primary space where you work if you rent office space somewhere else your home office isn t tax deductible Second the space needs to be dedicated to

Is A Home Office Tax Deductible File Smarter In The US UK Or Canada

https://backyardworkspace.com/wp-content/uploads/2022/06/tax-form-8829-1024x571.jpg

I Your Home Office Tax Deductible Woodland Hills SFV Real Estate

https://i.pinimg.com/736x/9e/e0/26/9ee02666d018777118567108d153abf3--accounting-home-offices.jpg

https://money.usnews.com/money/pers…

You may be eligible for the home office deduction if you had any income from self employment in 2023 but the rules are strict Key Takeaways

https://www.irs.gov/credits-deductions/individuals/...

Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage

Home Office Tax Deduction What Is It And How Can It Help You

Is A Home Office Tax Deductible File Smarter In The US UK Or Canada

Tax Deductible Bricks R Us

Home Office Tax Strategies Write Off Home Office BIG Home Office Tax

Deductible Business Expenses For Independent Contractors Financial

Tax Return 2023 Surprise Home Office Tax Write offs You Can Claim

Tax Return 2023 Surprise Home Office Tax Write offs You Can Claim

Expired Tax Breaks Deductible Unreimbursed Employee Expenses

The HMRC Home Office Tax Deduction Rules

Is Office Furniture Tax Deductible Mazuma

Is Home Office Tax Deductible - The self employed are eligible for the home office tax deduction if they meet certain criteria The workspace for a home office must be used exclusively and regularly for business Total