Is Hra Tax Deductible On June 20 2019 the Internal Revenue Service the Department of the Treasury the Department of Labor and the Department of Health and Human Services issued final rules regarding health reimbursement arrangements

The amount your employer is willing to reimburse you for medical expenses through an HRA is not considered taxable income nor are the actual amounts reimbursed as long as you put the The only stipulation is you must have a High Deductible Health Plan HDHP to have an HSA An HRA is set up owned and funded by your employer only A Health FSA is much like an HRA

Is Hra Tax Deductible

Is Hra Tax Deductible

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 2 850 Your employee is given tax free money to use for qualified medical expenses and contributions are 100 tax deductible for the business An HRA is an excellent benefit and when paired with a flexible spending account it can go a long way toward alleviating your workers financial burdens

Tax savings Employee reimbursements are tax deductible for your business Plan design flexibility Standard HRAs may be configured to fit your organization s needs Customize your contribution schedule extension options plan duration and more HRA funds are contributed to employees on a pre tax basis therefore the funds are not taxable to the employee As such employees need not claim an income tax deduction for an expense that has been reimbursed under the HRA

Download Is Hra Tax Deductible

More picture related to Is Hra Tax Deductible

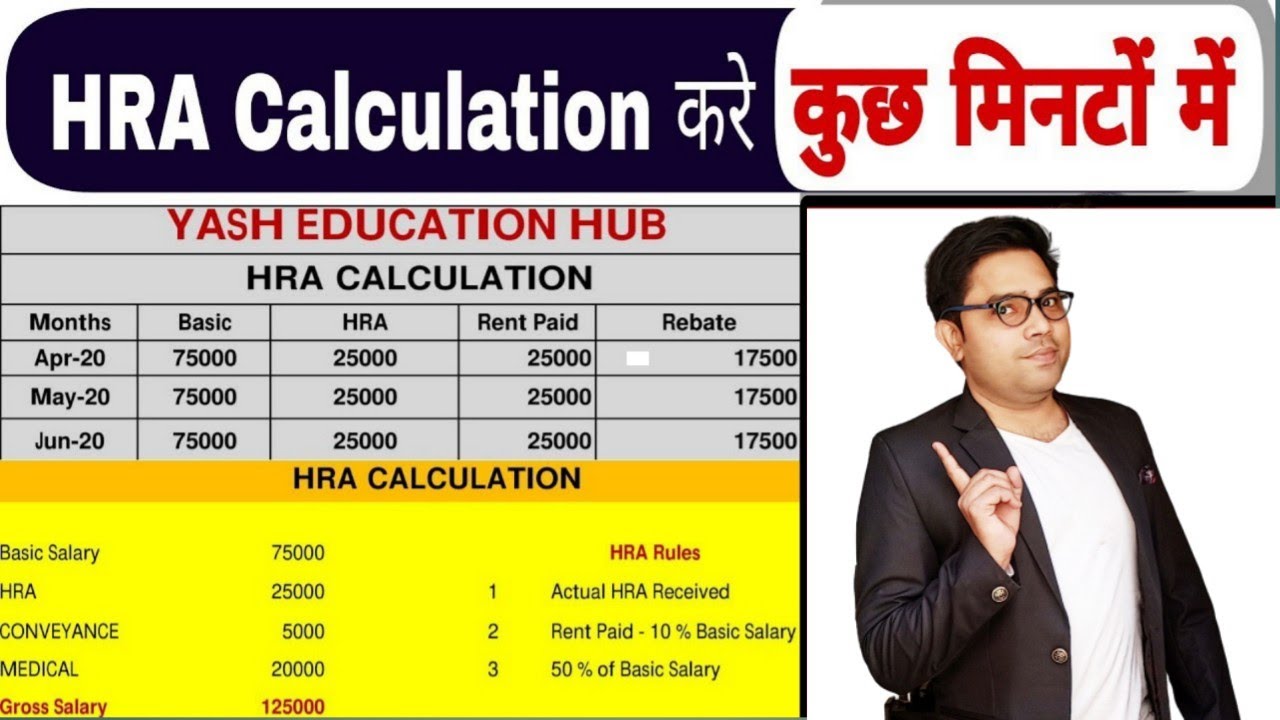

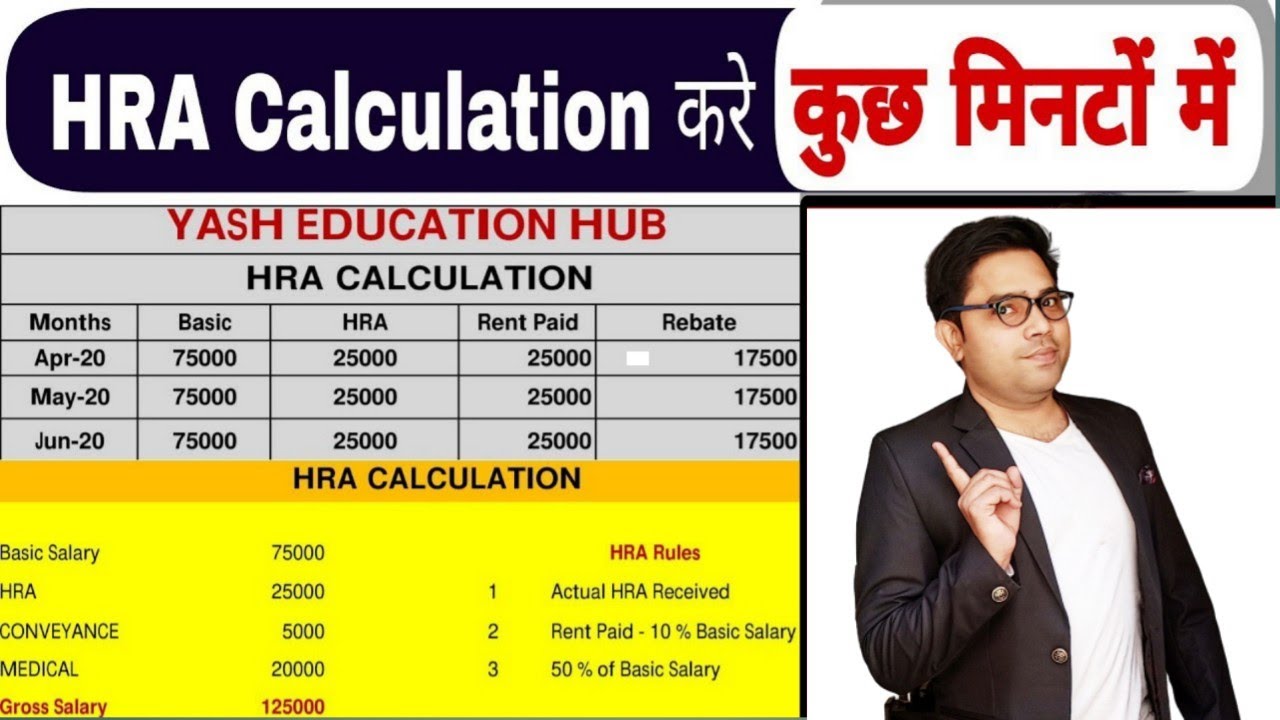

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

https://i.ytimg.com/vi/J04no0lpYJA/maxresdefault.jpg

What s The Difference Between An HSA FSA And HRA Medical Health

https://i.pinimg.com/originals/aa/77/4b/aa774bbfaa51f1cf3e4e1c3926cd8443.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Starting back in June of 2002 the IRS defined what an HRA is and how it could be used An HRA is a type of employer funded plan that reimburses employees for eligible medical expenses Contributions to HRAs are not considered taxable income and unused funds may roll over to the next year Health reimbursement arrangements HRAs can come in handy if you need to pay for medical expenses not covered by your health insurance plan Similar to a flexible spending account FSA or health savings account HSA your reimbursements won t count toward your taxable income

Section 213 of the Code generally allows a deduction for expenses paid during the taxable year for medical care if certain requirements are met Expenses for medical care under section 213 of the Code also are eligible to be paid or reimbursed under an HSA FSA Archer MSA or HRA You can only deduct your total medical expenses that exceed 7 5 of your adjusted gross income AGI For example if your AGI is 100 000 and you have 10 000 in

Tax Deductible Bricks R Us

https://www.bricksrus.com/wp-content/uploads/2018/03/35808436_l-1.jpg

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp

https://www.irs.gov/newsroom/health-reimbursement-arrangements-hras

On June 20 2019 the Internal Revenue Service the Department of the Treasury the Department of Labor and the Department of Health and Human Services issued final rules regarding health reimbursement arrangements

https://www.investopedia.com/.../how-hras-work.asp

The amount your employer is willing to reimburse you for medical expenses through an HRA is not considered taxable income nor are the actual amounts reimbursed as long as you put the

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

Tax Deductible Bricks R Us

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Rent Above Rs 1 Lakh Submitting Proof Obligatory For HRA Tax Deduction

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

HRA Calculation In Salary HRA Calculation In Excel HRA Calculation

HRA Calculation In Salary HRA Calculation In Excel HRA Calculation

HRA HRA CALCULATION HRA EXEMPTION SECTION 10 13A INCOME TAX HRA

What Is A Health Reimbursement Account HRA

HRA Tax Exemption Documents To Submit Who Can Claim And When

Is Hra Tax Deductible - Your employee is given tax free money to use for qualified medical expenses and contributions are 100 tax deductible for the business An HRA is an excellent benefit and when paired with a flexible spending account it can go a long way toward alleviating your workers financial burdens