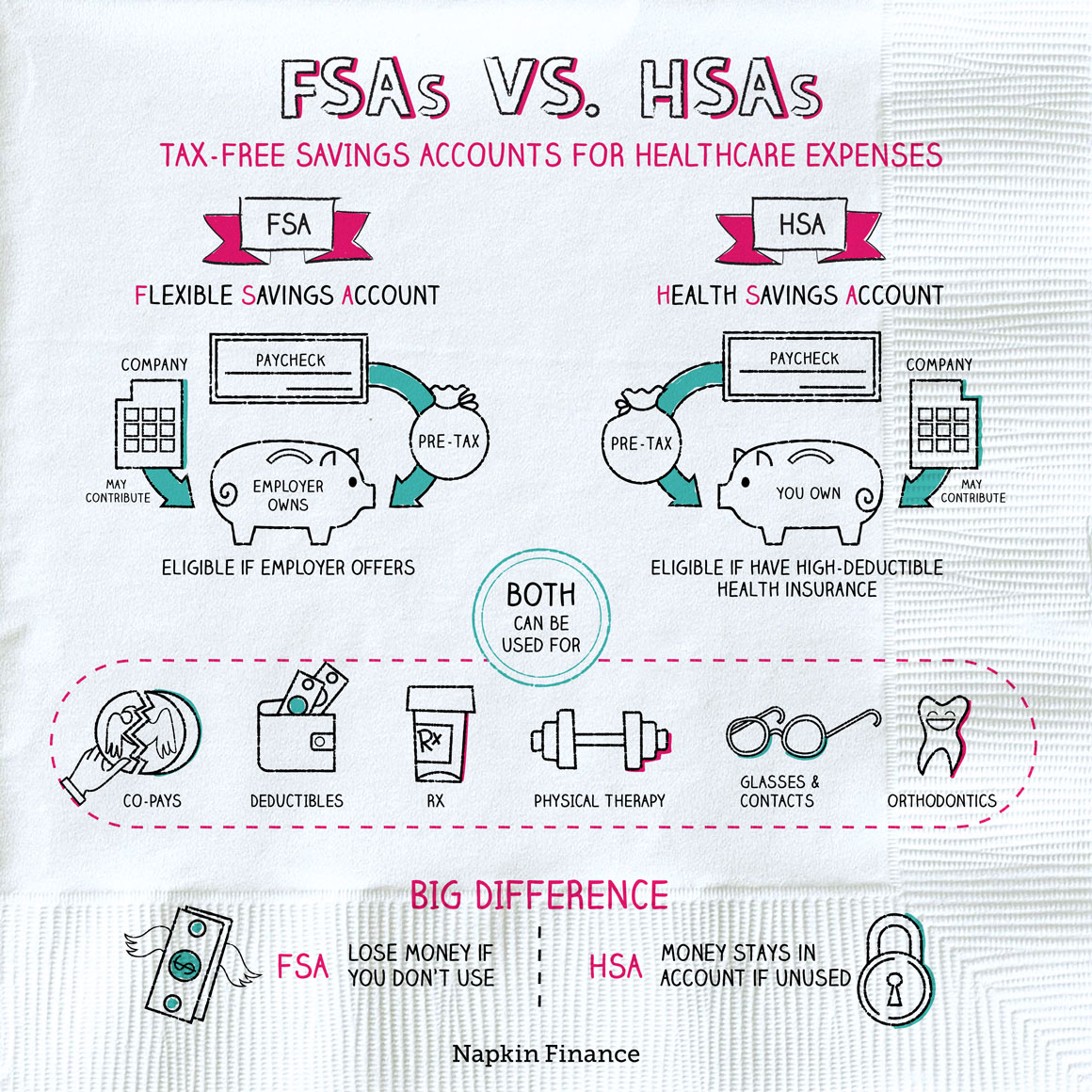

Is Hsa Pre Tax An HSA is a tax advantaged account that can be used to pay for qualified medical expenses including copays prescriptions dental care contacts and eyeglasses bandages X rays and a lot more

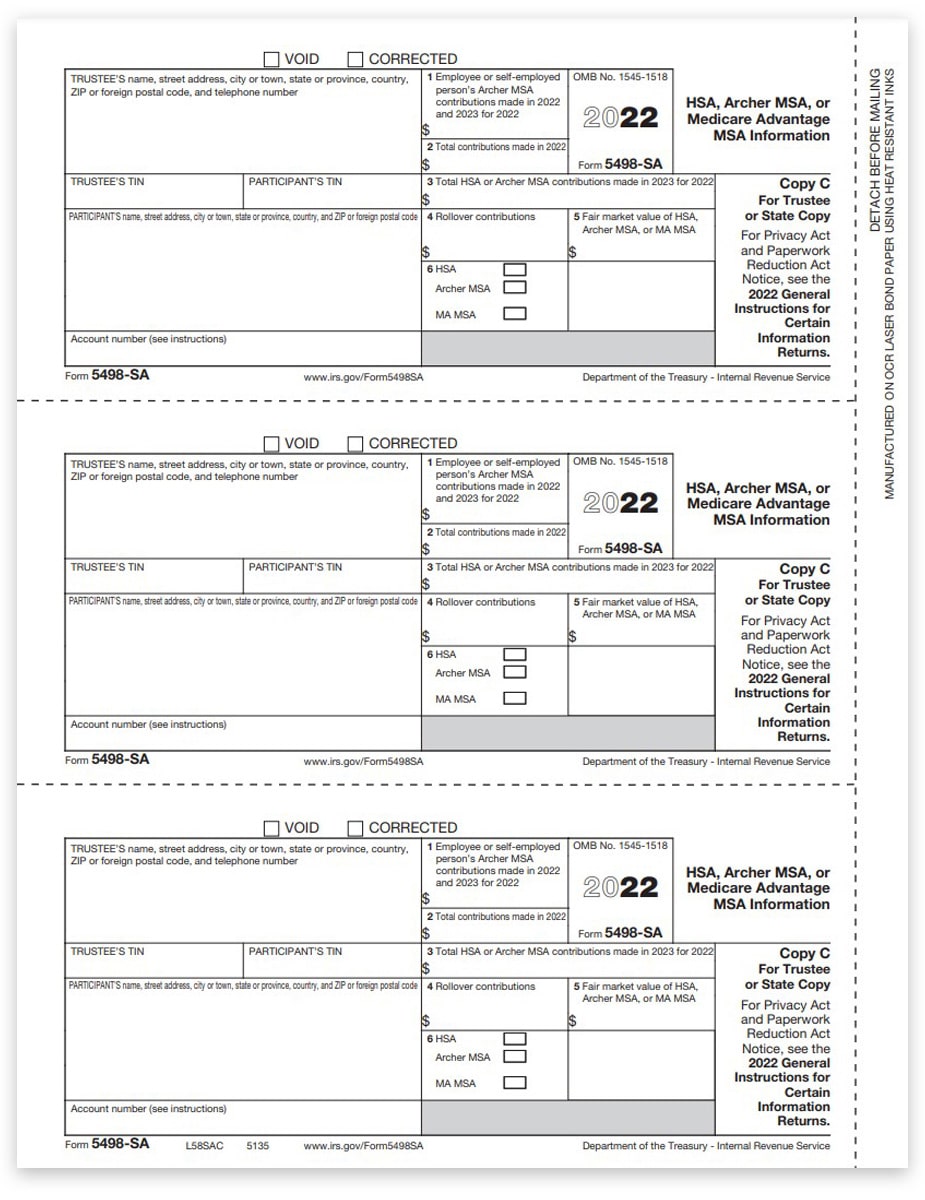

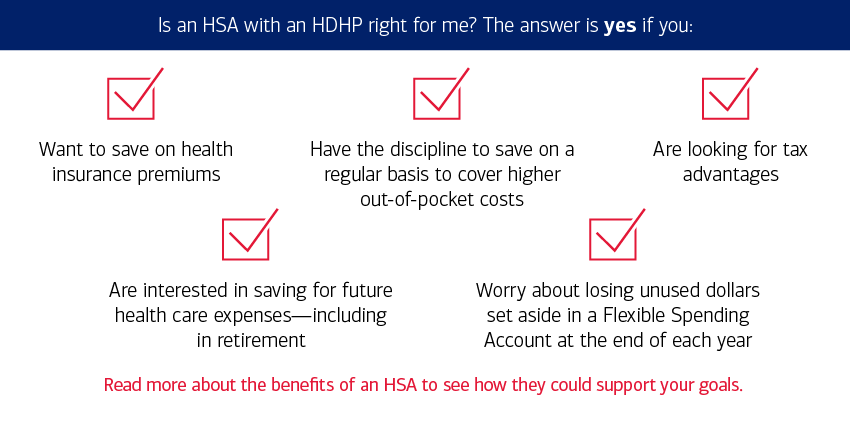

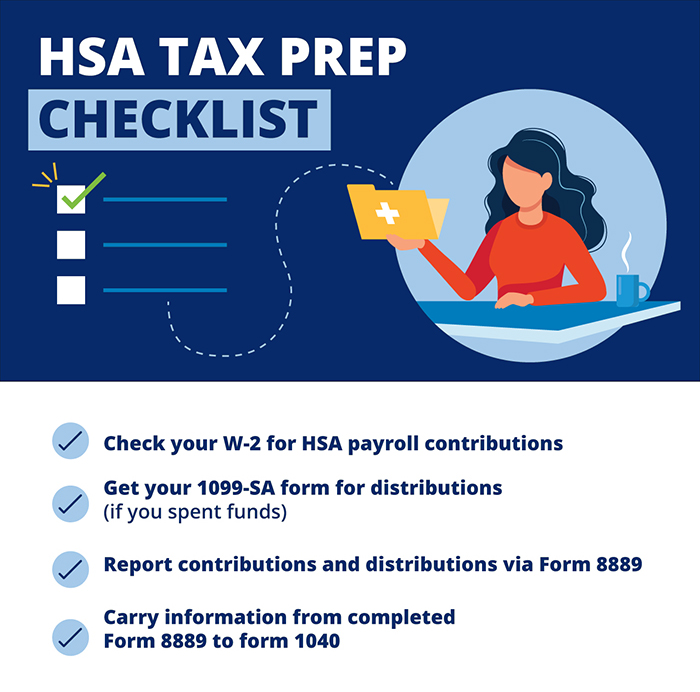

An HSA lets you set aside pre tax income to cover healthcare costs that your insurance doesn t pay You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year In order to enjoy the full tax benefits of an HSA and stay compliant with IRS rules you need to complete and file Form 8889 each year you contribute to or distribute money from your HSA

Is Hsa Pre Tax

Is Hsa Pre Tax

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/2147486381/images/B45llY3CT0uY8f3C1vrC_HSA.jpeg

Employees Should Max Out Their HSA Contributions Wellable

https://www.wellable.co/blog/wp-content/uploads/2022/08/Diagram-PiggyBank.jpg

What You Need To Know About Health Savings Accounts HSAs

https://irp-cdn.multiscreensite.com/207226d8/dms3rep/multi/Depositphotos_317550154_l-2015.jpg

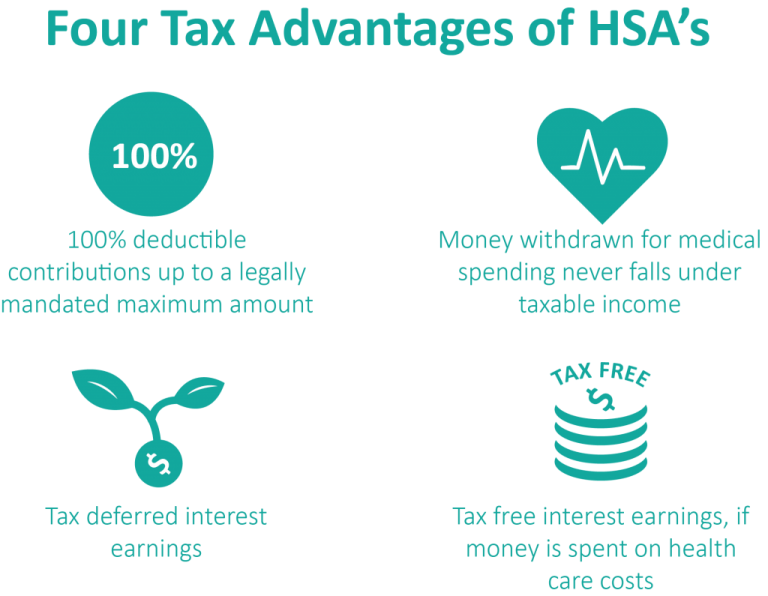

Key Takeaways A Health Savings Account HSA is a tax advantaged account to help you save for medical expenses that are not reimbursed by high deductible health plans HDHPs No tax is A health savings account is a tax advantaged savings account combined with a high deductible health insurance policy to provide an investment and health coverage Deposits to the HSA are tax deductible and grow tax free

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income

Download Is Hsa Pre Tax

More picture related to Is Hsa Pre Tax

Health Savings Accounts How HSAs Work And The Tax Advantages

http://www.ilhealthagents.com/wp-content/uploads/2018/04/Tax-Advantages-of-an-HSA-1024x795-1024x795-768x596.png

2023 Hsa Form Printable Forms Free Online

https://www.discounttaxforms.com/wp-content/uploads/2022/08/5498SA-Form-Copy-C-Trustee-State-L58SAC-FINAL-min.jpg

IRS Announces 2023 HSA Limits Blog Medcom Benefits

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

Any contributions you or your employer may make to your HSA are federal tax free and could help you pay for the HSA eligible health plan s deductible or other qualified medical expenses on a tax free basis in the current year or be saved for future qualified expenses HSAs offer the potential for a triple tax advantage account contributions are pre tax earnings are tax free and withdrawals for qualified medical expenses are tax free

[desc-10] [desc-11]

New Expenses Now Eligible For Your HSA FSA Funds Flyte HCM

https://flytehcm.com/wp-content/uploads/2020/04/Pharmacy-Over-the-Counter-scaled.jpeg

Is An HSA Right For Me

https://healthaccounts.bankofamerica.com/images/isanHSArightforyou_illus_HDHP-HSA_850x421.png

https://www.fidelity.com/learning-center/smart-money/what-is-an-hsa

An HSA is a tax advantaged account that can be used to pay for qualified medical expenses including copays prescriptions dental care contacts and eyeglasses bandages X rays and a lot more

https://www.investopedia.com/articles/personal...

An HSA lets you set aside pre tax income to cover healthcare costs that your insurance doesn t pay You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year

FSA Vs HSA Use It Or Lose It Napkin Finance

New Expenses Now Eligible For Your HSA FSA Funds Flyte HCM

HSAs And Pre tax Benefits What Is HSA compatible Part One BRI

What Is A Health Savings Account HSA Jefferson Bank

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

What Is A Health Savings Account HSA Jefferson Bank

What Is A Health Savings Account HSA Jefferson Bank

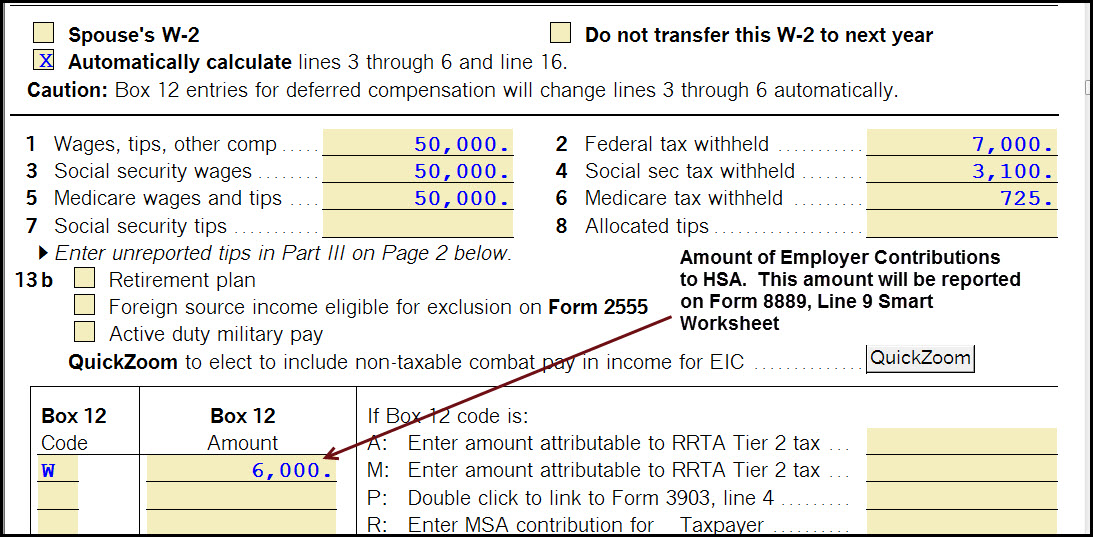

Entering HSA Health Savings Account Information Accountants Community

5 Things To Know About Health Savings Accounts ThinkHealth

Your HSA And Your Tax Return 4 Tips For Filing First American Bank

Is Hsa Pre Tax - Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income