Is Incentive Pay Taxed Similarly to how a business deducts tax from a regular salary a deduction is made from incentive pay too Known as tax withholding this is sent to the IRS by the company

The bonus tax rate is 22 for bonuses under 1 million If your total bonuses are higher than 1 million the first 1 million gets taxed at 22 and every Generally speaking employees should plan to pay taxes on any incentives or rewards they receive from their employer This includes cash bonuses gift cards

Is Incentive Pay Taxed

Is Incentive Pay Taxed

https://blog.ethereum.org/_next/image?url=%2Fimages%2Fposts%2Fupload_85feb744f451f63fe2ce9b39a012fbdd.jpg&w=3840&q=75

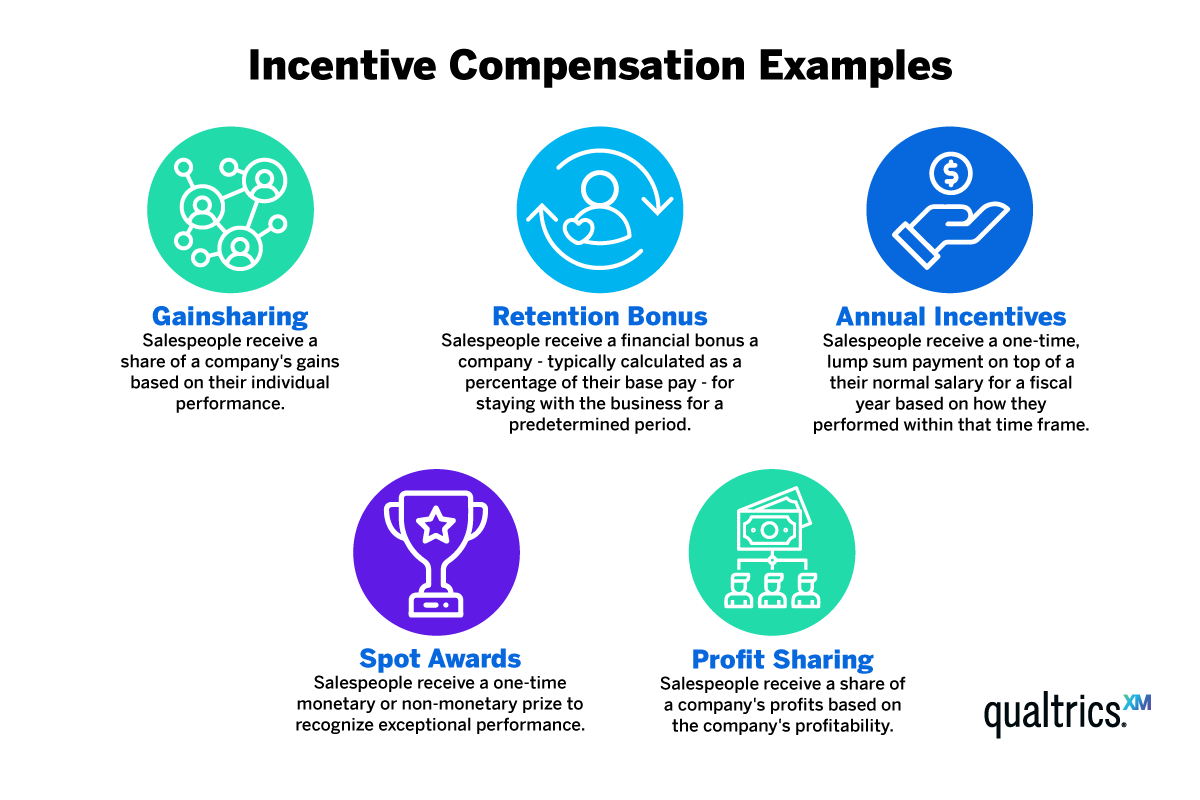

What Is Incentive Pay Incentive Programs Reward And Recognition

https://i.pinimg.com/736x/d4/bf/cc/d4bfcc427ef277dc48cc3e85ffad2f64.jpg

What Are The Disadvantages Of Rewards Leia Aqui What Are The

https://www.decusoft.com/wp-content/uploads/2021/06/Individual-incentives-vs-Team-Incentives-updated-410x1024.png

Bonuses paid to you are taxable because they are income under Section 61 and no IRC section excludes them from taxation However if you receive fringe benefits How is incentive pay taxed Incentive pay is generally taxed as regular income subject to applicable income tax rates and withholding However specific tax treatment may vary

The IRS legally holds the employee responsible for paying taxes on monetary bonuses paid incentives and commissions or tips Do you get taxed on incentive pay Yes according to the IRS incentive bonuses count as supplemental income and are subject to federal and state taxes How

Download Is Incentive Pay Taxed

More picture related to Is Incentive Pay Taxed

What Is Incentive Pay

https://www.betterteam.com/images/what-is-incentive-pay-2400x240-20201117.jpg?crop=21:16,smart&width=420&dpr=2

Incentive Pay Terminology YouTube

https://i.ytimg.com/vi/hToaZXXb8I8/maxresdefault.jpg

Incentive Pay Definition Structures Examples More

https://www.patriotsoftware.com/wp-content/uploads/2012/06/incentive-pay-1.jpg

Income tax isn t withheld from incentive payments although they ll be included with your taxable income when you prepare your tax return You don t have to What you may not know is that the IRS considers bonus pay a form of earnings known as supplemental wages which is subject to a separate tax withholding

As such bonuses like other supplemental wages are treated differently than ordinary wage or salary income when it comes to taxes withheld at payout There are Good examples would be a signing bonus or a bonus from a set incentive pay plan How bonuses are taxed There are a few options to treat income tax

When Do You Have To Pay Taxes On ISOs How Incentive Stock Options Are

https://i.ytimg.com/vi/fK55SHdTre4/maxresdefault.jpg

Why Are Incentives So Important For Your Staff IRIS FMP

https://fmpglobal.com/wp-content/uploads/2019/05/AdobeStock_85406876.jpeg

https://perkupapp.com/post/how-is-incentive-pay...

Similarly to how a business deducts tax from a regular salary a deduction is made from incentive pay too Known as tax withholding this is sent to the IRS by the company

https://www.nerdwallet.com/article/taxes/bonus-tax...

The bonus tax rate is 22 for bonuses under 1 million If your total bonuses are higher than 1 million the first 1 million gets taxed at 22 and every

Incentive Compensation In Financial Services Projected To Drop In 2022

When Do You Have To Pay Taxes On ISOs How Incentive Stock Options Are

Where Is Our Incentive Pay Incentive Paying Pay Rise

The Pros And Cons Of Incentive Pay Capital Services

Employee Incentive Programs Examples Best Practices

Tax Free On Sign Meaning Not Taxed Stock Photo Alamy

Tax Free On Sign Meaning Not Taxed Stock Photo Alamy

Incentive Compensation Plan Template New How To Develop A Sales

Is Incentive Pay Right For Your Business Hourly Inc

Welcome To The Cosgrave Law Blog Legal Ez Tax Alert Partnership

Is Incentive Pay Taxed - How is incentive pay taxed Incentive pay is generally taxed as regular income subject to applicable income tax rates and withholding However specific tax treatment may vary