Is Indiana 529 Tax Credit Refundable Web 29 Aug 2022 nbsp 0183 32 A tax credit like Indiana provides reduces the tax that you owe A tax deduction reduces the taxable income on which the tax is calculated For example assume an Indiana resident

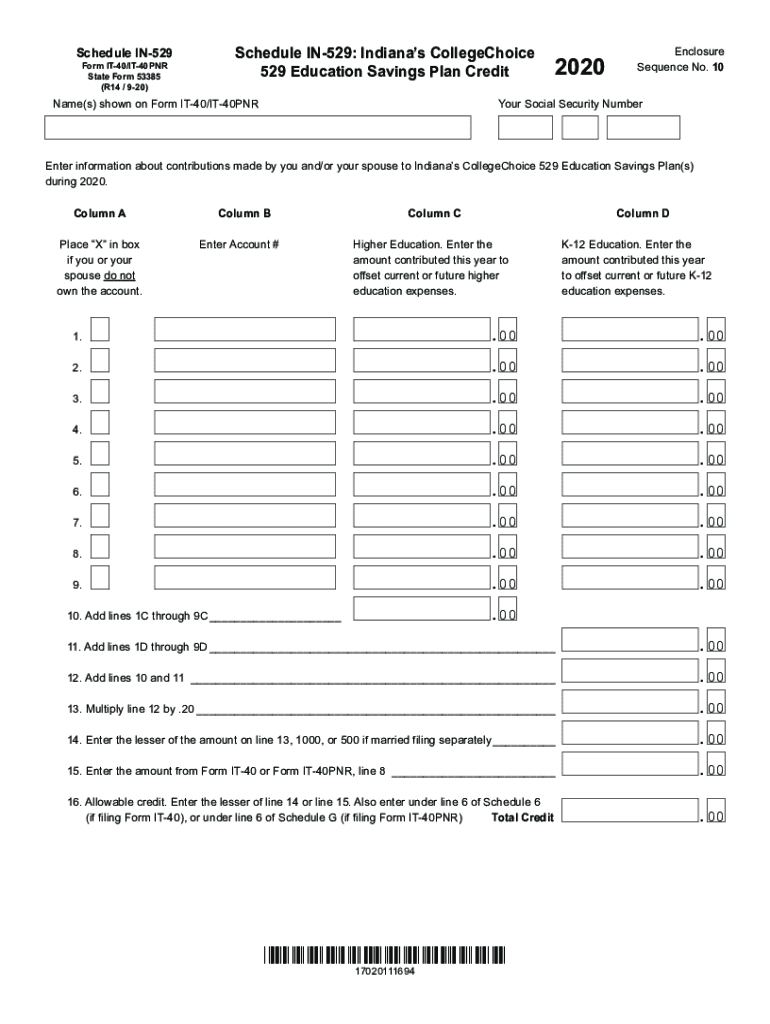

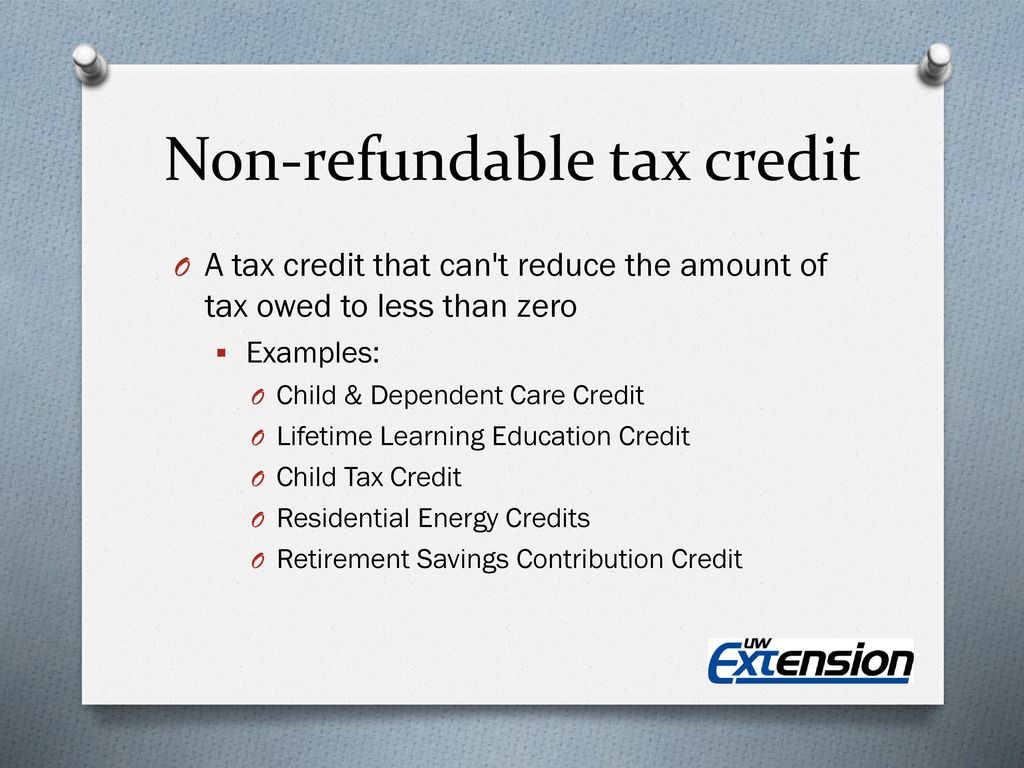

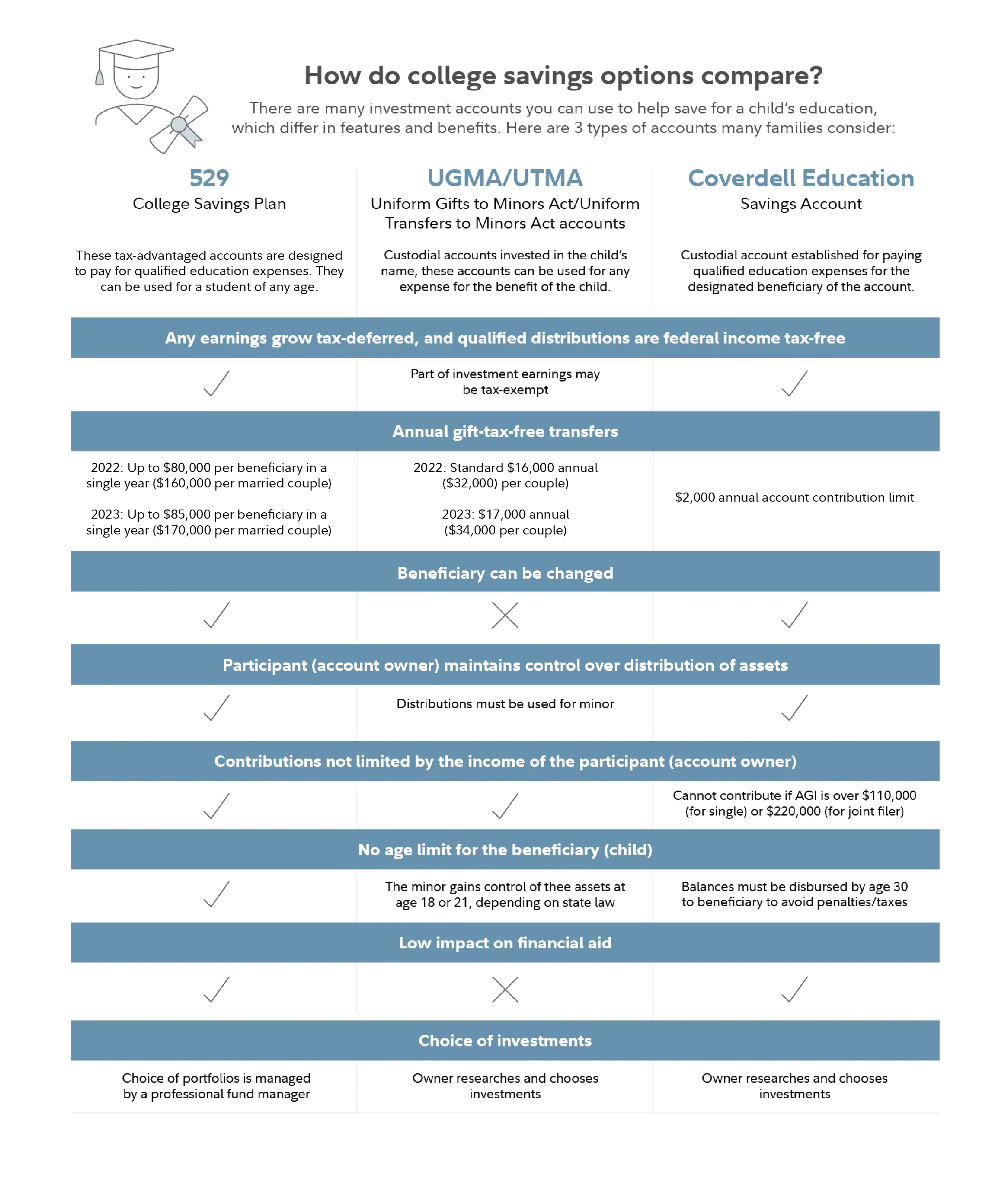

Web 21 Okt 2021 nbsp 0183 32 Taxpayers in Indiana who contribute to the state s CollegeChoice 529 Savings Plan can get the lesser of a tax credit on 20 back on their contribution or a 1 000 tax credit Starting in January Web Additionally Indiana taxpayers who contribute to a CollegeChoice 529 account may be eligible for a 20 state income tax credit of up to 1 500 each year 750 for married

Is Indiana 529 Tax Credit Refundable

Is Indiana 529 Tax Credit Refundable

https://www.carasshulman.com/wp-content/uploads/2023/03/iStock-1410271656-scaled.jpg

3 Limitations Of The Indiana 529 Tax Credit YouTube

https://i.ytimg.com/vi/ytofGTtjmT4/maxresdefault.jpg

Indiana 529 Tax Credit Increase 50 In 2023 YouTube

https://i.ytimg.com/vi/l3aat-dafCM/maxresdefault.jpg

Web Introduction The purpose of this bulletin is to provide guidance concerning the Indiana income tax credit for contributions to the Indiana CollegeChoice 529 Education Savings Web All Indiana taxpayers contributing to an INvestABLE Indiana Account are eligible for the credit INDIANAPOLIS Ind The Indiana State Treasurer s office announced a new tax

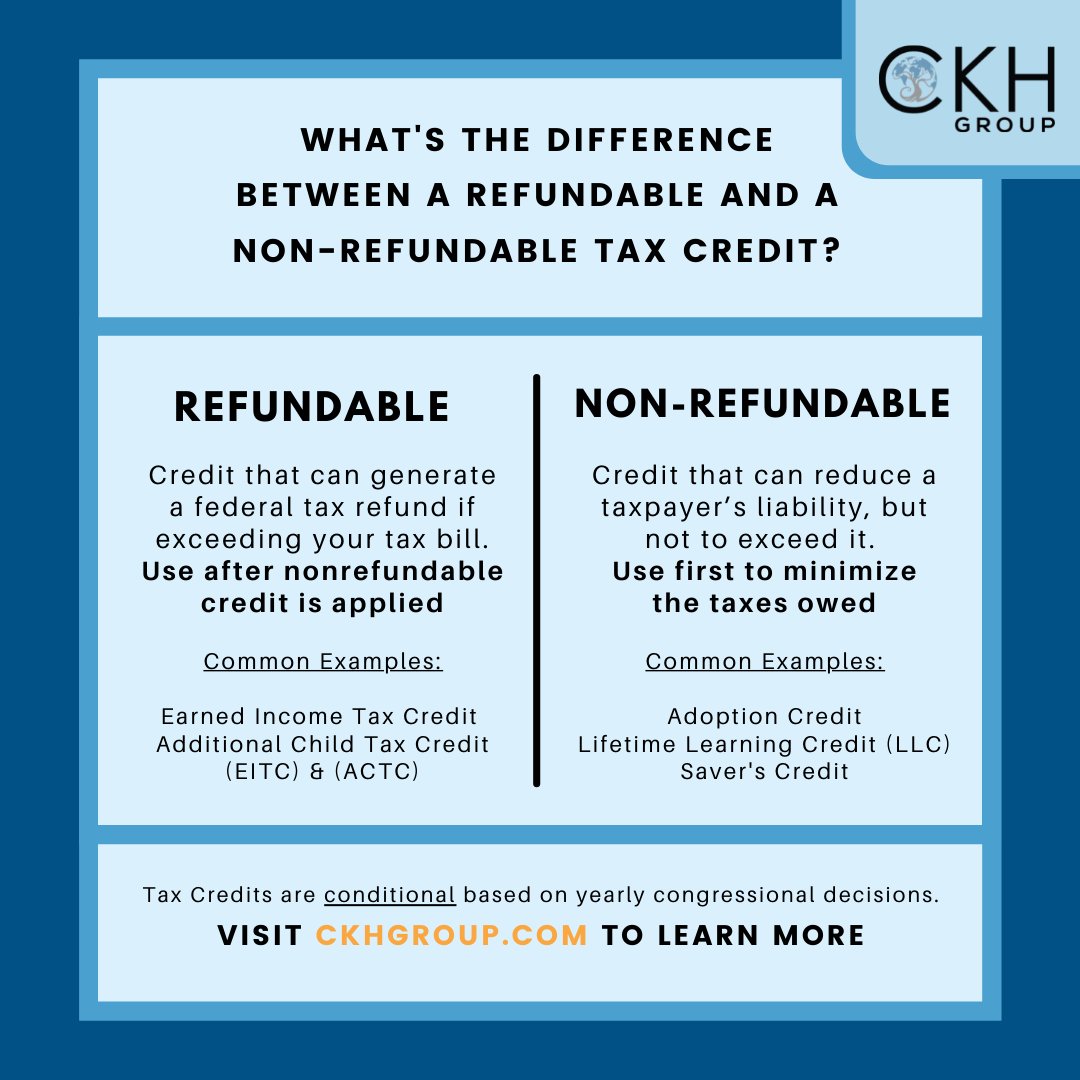

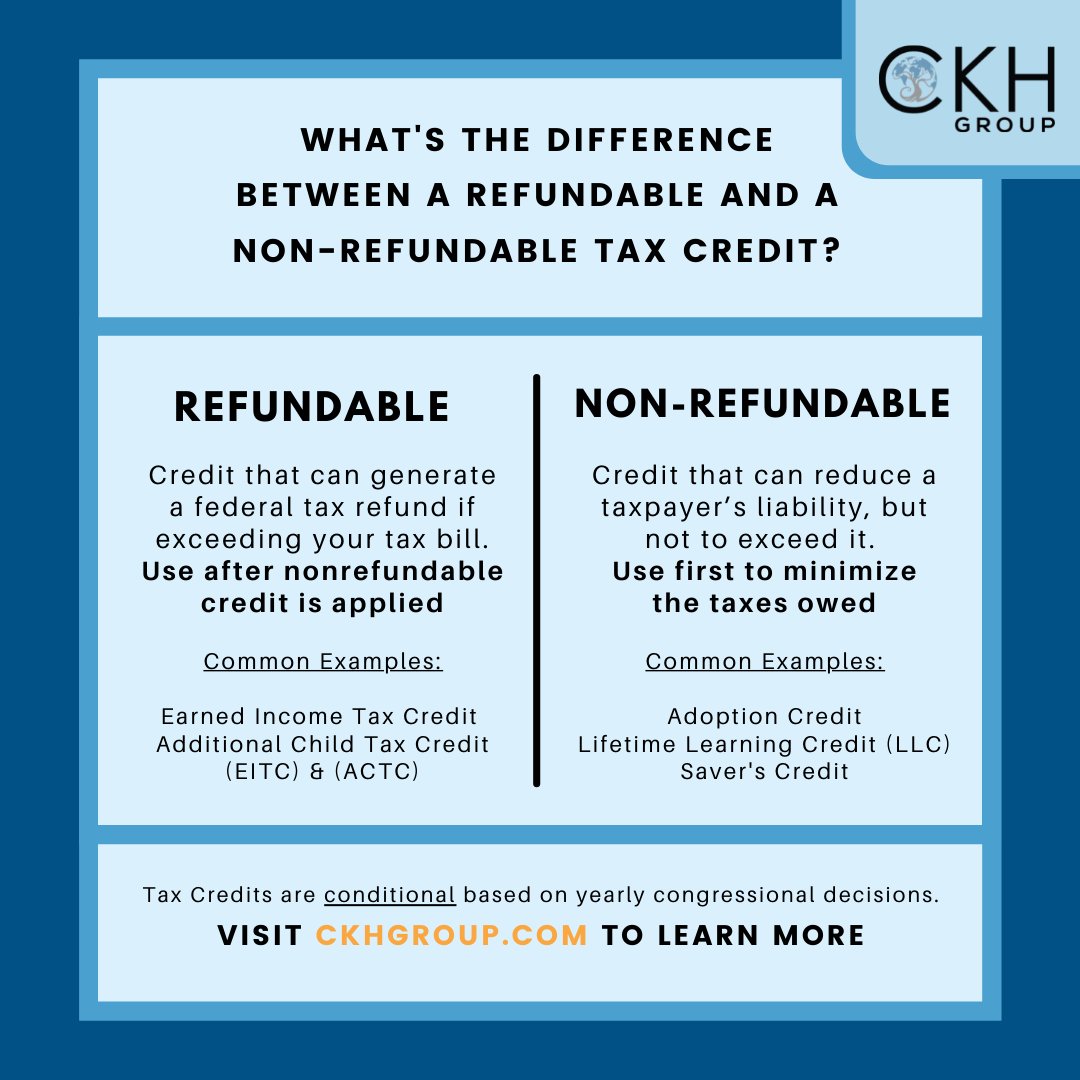

Web DOR Individual Income Taxes Filing My Taxes Tax Credits Learn what tax credits you can claim on your Indiana individual income tax return You can find all available credits Web 3 M 228 rz 2012 nbsp 0183 32 Indiana taxpayers may receive a state income tax credit equal to 20 of their contributions to a CollegeChoice 529 account up to 1 000 per year 500 for

Download Is Indiana 529 Tax Credit Refundable

More picture related to Is Indiana 529 Tax Credit Refundable

Indiana 529 Login 2020 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/563/641/563641079/large.png

Tax Credit Refundable Vs Non refundable YouTube

https://i.ytimg.com/vi/6yRrW0RII6s/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYESBsKHIwDw==&rs=AOn4CLC7MrqaSk4YHwv08XqUWcDLuNSwMA

Benefits Of A 529 Plan District Capital 48 OFF

https://napkinfinance.com/wp-content/uploads/2018/07/NapkinFinance-529Plan-Napkin-02-26-19-v05-1.jpg

Web An eligible Indiana resident can claim the 2022 Additional Automatic Taxpayer Refund 200 ATR as a refundable tax credit when filling out their 2022 Indiana Individual Web December 19 2022 Indiana taxpayers who contribute to a CollegeChoice 529 may receive a state income tax credit equal to 20 of their contributions For contributions occurring through December 31 2022

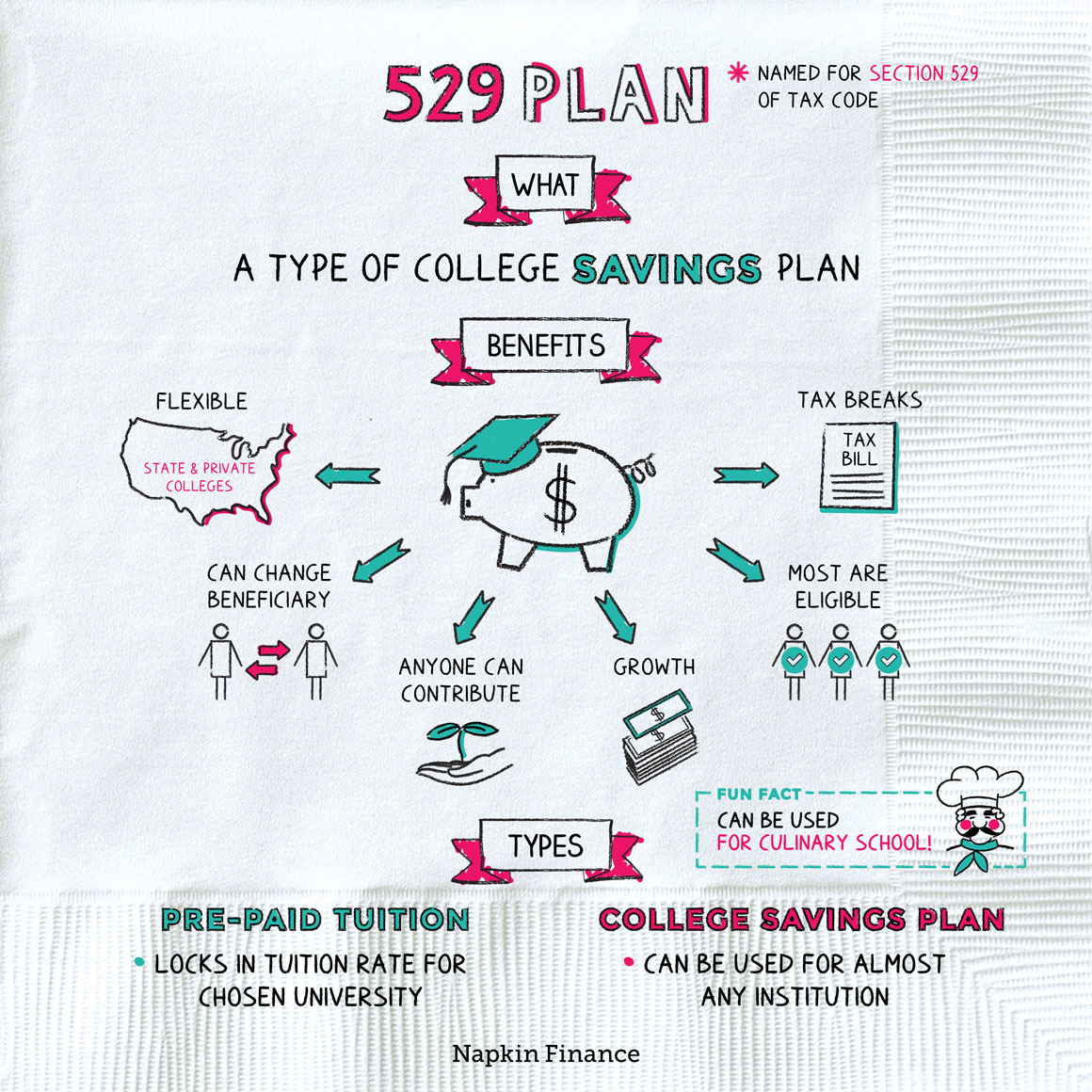

Web 26 Nov 2023 nbsp 0183 32 But Indiana Oregon Utah and Vermont offer a state income tax credit for 529 plan contributions Depending on their adjusted gross income Minnesota taxpayers are eligible for a state income tax Web Indiana does not have a 529 ABLE plan If you live in Indiana these might be good options for you to save for college These programs are designed to help make college more affordable so that you can get the education

Everything You Need To Know About 529 College Savings Plans In 2023

https://529-planning.com/wp-content/uploads/2020/12/GettyImages-182175346-5c4e721dc9e77c0001d7bb0f.jpg

529 Plan

https://res.cloudinary.com/americancentury/image/upload/t_desktop/education-custodial-accounts-529s-tax-savings-map.png

https://www.insideindianabusiness.com/…

Web 29 Aug 2022 nbsp 0183 32 A tax credit like Indiana provides reduces the tax that you owe A tax deduction reduces the taxable income on which the tax is calculated For example assume an Indiana resident

https://www.thebalancemoney.com/wha…

Web 21 Okt 2021 nbsp 0183 32 Taxpayers in Indiana who contribute to the state s CollegeChoice 529 Savings Plan can get the lesser of a tax credit on 20 back on their contribution or a 1 000 tax credit Starting in January

What Is Refundable Vs Nonrefundable Child Tax Credit Leia Aqui What

Everything You Need To Know About 529 College Savings Plans In 2023

How To Get Education Tax Credits With A 529 Plan Bankrate

Is The Elderly Tax Credit Refundable Progressive Care

The Unique Benefits Of 529 College Savings Plans

What Is The Difference Between A Tax Credit And A Tax Refund Leia Aqui

What Is The Difference Between A Tax Credit And A Tax Refund Leia Aqui

The Benefits Of A 529 Plan

Benefits Of A 529 Plan District Capital 48 OFF

Everything You Need To Know About 529 Tax Deductions

Is Indiana 529 Tax Credit Refundable - Web 21 M 228 rz 2022 nbsp 0183 32 Brandon Smith Starting when you pay your taxes in 2024 the tax credit available for CollegeChoice 529 plans will increase from 1 000 to 1 500 Brandon