Is Insulation Tax Deductible The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements Is there an insulation tax credit for 2022 Yes If you installed insulation in 2022 you may be able to write off some of the cost up to 10 on your taxes Is there an insulation tax credit for 2023 Definitely The tax

Is Insulation Tax Deductible

Is Insulation Tax Deductible

https://kiwitax.co.nz/wp-content/uploads/2021/10/Insulation.jpg

Image Result For Reflective Vapor Barrier Radiant Barrier Foil

https://i.pinimg.com/originals/24/cd/04/24cd04d4735f39def86477b12a33f7b9.jpg

Is Medical Marijuana Deductible On Your Taxes Leafy DOC

https://leafydoc.com/wp-content/uploads/is-medical-marijuana-tax-deductible.jpg

For 2023 and 2024 the insulation tax credit is 30 of material costs The tax credit has an annual upper limit of 1 200 but can be reapplied for each year there is no lifetime limit Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer for certain qualified expenditures including 1 qualified energy

Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation windows and doors solar Key Takeaways Insulation upgrades can qualify for the Energy Tax Credit offering homeowners a chance to save money while reducing energy waste and

Download Is Insulation Tax Deductible

More picture related to Is Insulation Tax Deductible

Insulation Tax Credits Insulation Depot

https://insulationdepot.com/wp-content/uploads/2020/05/41611855_472915256538826_8157084038402670592_o.jpg

FEDERAL TAX CREDITS FOR SPRAY FOAM INSULATION

https://accufoam.com/wp-content/uploads/2022/09/IMG_9060-scaled.jpg

What Medical Expenses Are Tax Deductible

https://optimataxrelief.com/wp-content/uploads/2023/05/23-optima-medical-tax-deductible.png

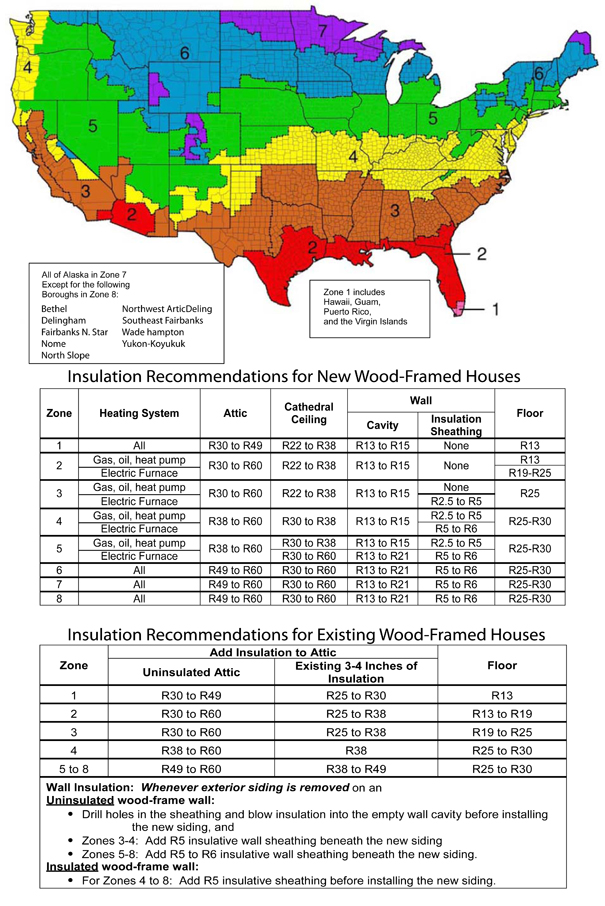

Insulation Typical bulk insulation products such as batts rolls blow in fibers rigid boards expanding spray and pour in place can qualify for 10 percent of the cost up to The insulation tax credit is a federal tax credit available to homeowners who upgrade their home insulation The credit is worth up to 600 and it can be

Get a credit for adding insulation Adding insulation to improve heating and cooling efficiency qualifies for the 30 energy efficient home improvement tax credit Beginning in 2023 the Inflation Reduction Act increased the tax credit to 30 of the cost of insulation and air sealing up to 1 200 annually Visit Energy Star for additional

2023 Insulation Tax Credit What You Need To Know Yellowblue

https://yellowbluetech.com/wp-content/uploads/2023-insulation-tax-credit.jpg

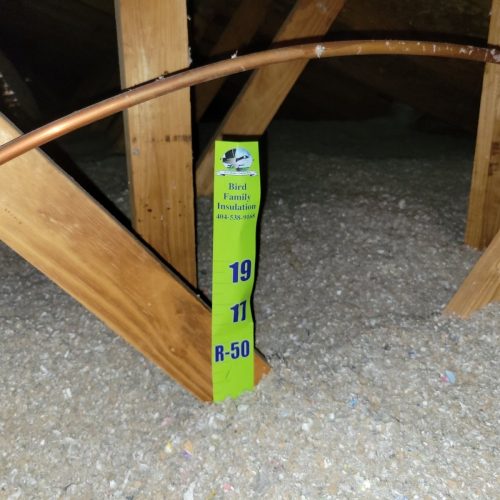

Federal Tax Credit For Attic Insulation Bird Family Insulation

https://birdinsulation.com/wp-content/uploads/elementor/thumbs/IMG_3358-pze8n0tf8snl7o1gxaaq5ak87jitysx13y600w87m0.jpg

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs

https://www.energystar.gov/about/federal-tax-credits/insulation

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements

SPRAY FOAM INSULATION TAX CREDITS FOR YOU AND YOUR CUSTOMERS Accufoam

2023 Insulation Tax Credit What You Need To Know Yellowblue

Rocky Mountain Power Attic Insulation Rebate PowerRebate

Small Business Tax Deductions Deductible Expenses

Tax Deductible Bricks R Us

Home Insulation Are There Energy Efficient Tax Credits Attainable Home

Home Insulation Are There Energy Efficient Tax Credits Attainable Home

Federal Tax Credit Info Shore Insulation

Insulating Old House Exterior Walls Insulation Specialists

Insulation Meaning

Is Insulation Tax Deductible - For 2023 and 2024 the insulation tax credit is 30 of material costs The tax credit has an annual upper limit of 1 200 but can be reapplied for each year there is no lifetime limit