Is Interest On Fd Tax Free Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving

The interest earned on an FD is taxable It is added to your total income and taxed at the slab rates that apply to your entire income Investors should declare it on their tax return When it comes to taxation of FDs many investors are in a quandary as to whether the tax on interest earned is to be paid on maturity or every year Both ways

Is Interest On Fd Tax Free

Is Interest On Fd Tax Free

http://softrop.com/wp-content/uploads/2020/08/FD-Interest-Rates.jpg

Bank Of Baroda Fixed Deposit Interest Rate

https://hutslot382.weebly.com/uploads/1/3/5/9/135915457/530926544.aspx

Income Tax On Interest On Savings Bank FD Account In India Fintrakk

https://i.pinimg.com/originals/c7/f8/4d/c7f84d4efa6c6046d255be17cd85dabd.jpg

The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any If you invest in a tax saving FD scheme you can claim tax benefits up to Rs 1 5 lakh per annum under Section 80C Know about TDS on FD interest Find the

Is a fixed deposit tax free No an income from a fixed deposit is not tax free The interest on FD is chargeable to income tax at the slab rates Moreover an Different banks offer different interest rates on tax saving FDs so it is best to compare rates before you make an investment Are tax saving FDs risky Tax saving

Download Is Interest On Fd Tax Free

More picture related to Is Interest On Fd Tax Free

Tax On FD Interest Everything You Need To Know

https://www.wintwealth.com/blog/wp-content/uploads/2022/10/Tax-on-FD-Interest.jpg

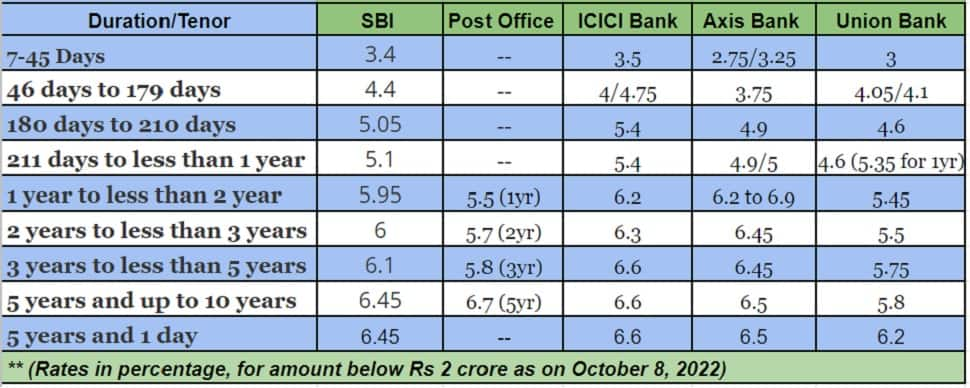

Comparing Fixed Deposit Rates Post Office Vs SBI And Other Banks

https://www.india.com/wp-content/uploads/2021/03/Bank-Fixed-Deposits.jpg

You Must Know These Few Rules Before You Invested In FD

http://fixed-deposits.weebly.com/uploads/1/0/4/9/104915161/tds-rates_orig.jpg

The interest from fixed deposits under Income Tax Act is fully taxable It comes under Income from Other Sources while filing an income tax return FD Interest Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can

How large amount FD is tax free The amount of Fixed Deposit FD that is tax free depends on the type of FD and the investor s tax slab For individuals and Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms conditions charges other requirements

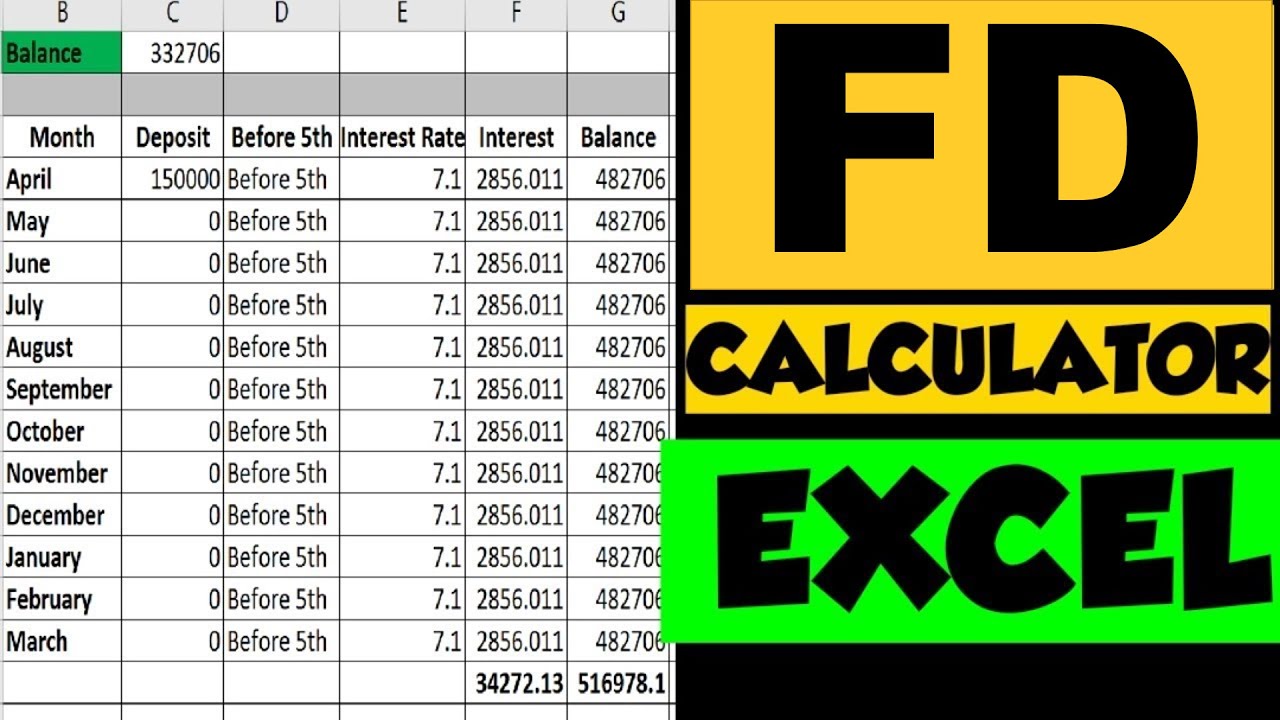

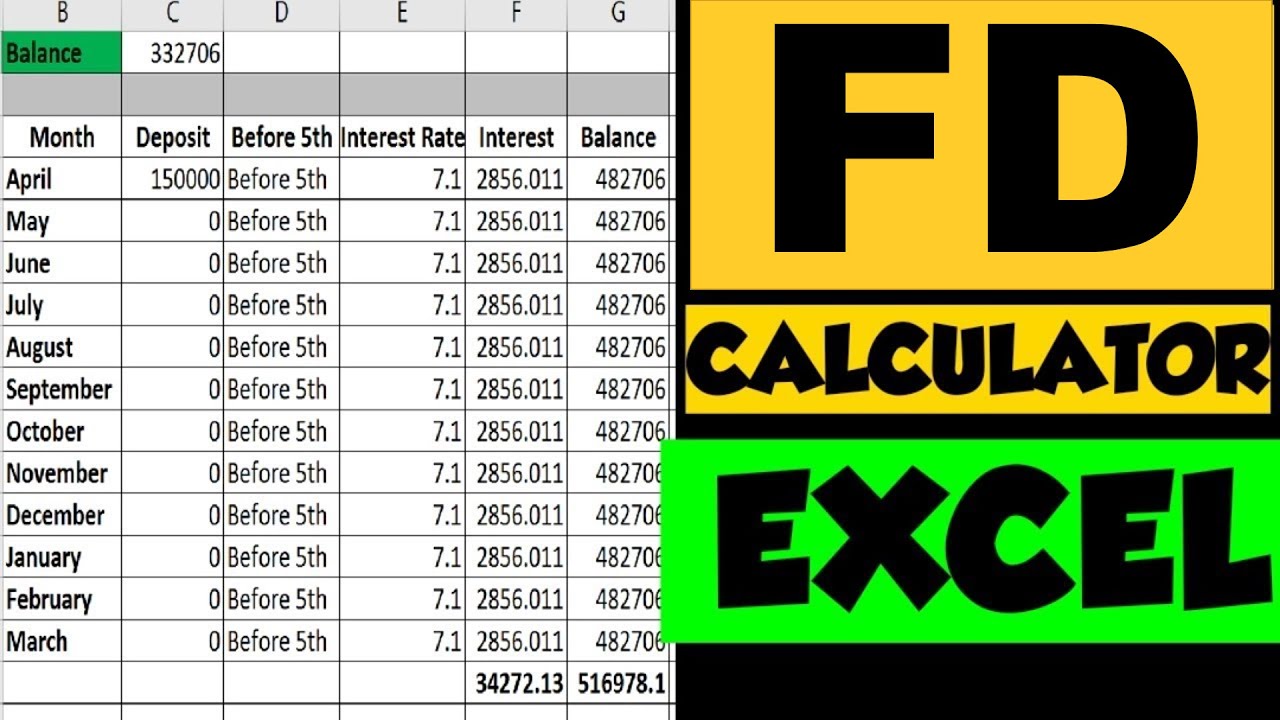

FD Calculator Fixed Deposit Interest Calculator FinCalC Blog

https://i.ytimg.com/vi/fZ0XcrgOmOk/maxresdefault.jpg

Union Bank FD Interest Rates March 2024

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/01/union-bank-fd-rates.jpg

https://www.paisabazaar.com/fixed-deposit/tax...

Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving

https://www.idfcfirstbank.com/finfirst-blogs/fixed...

The interest earned on an FD is taxable It is added to your total income and taxed at the slab rates that apply to your entire income Investors should declare it on their tax return

Senior Citizen FD Rates 2022 SBI Vs Post Office Vs ICICI Vs Axis Vs

FD Calculator Fixed Deposit Interest Calculator FinCalC Blog

Tax On FD TDS On Fixed Deposit Interest 2024

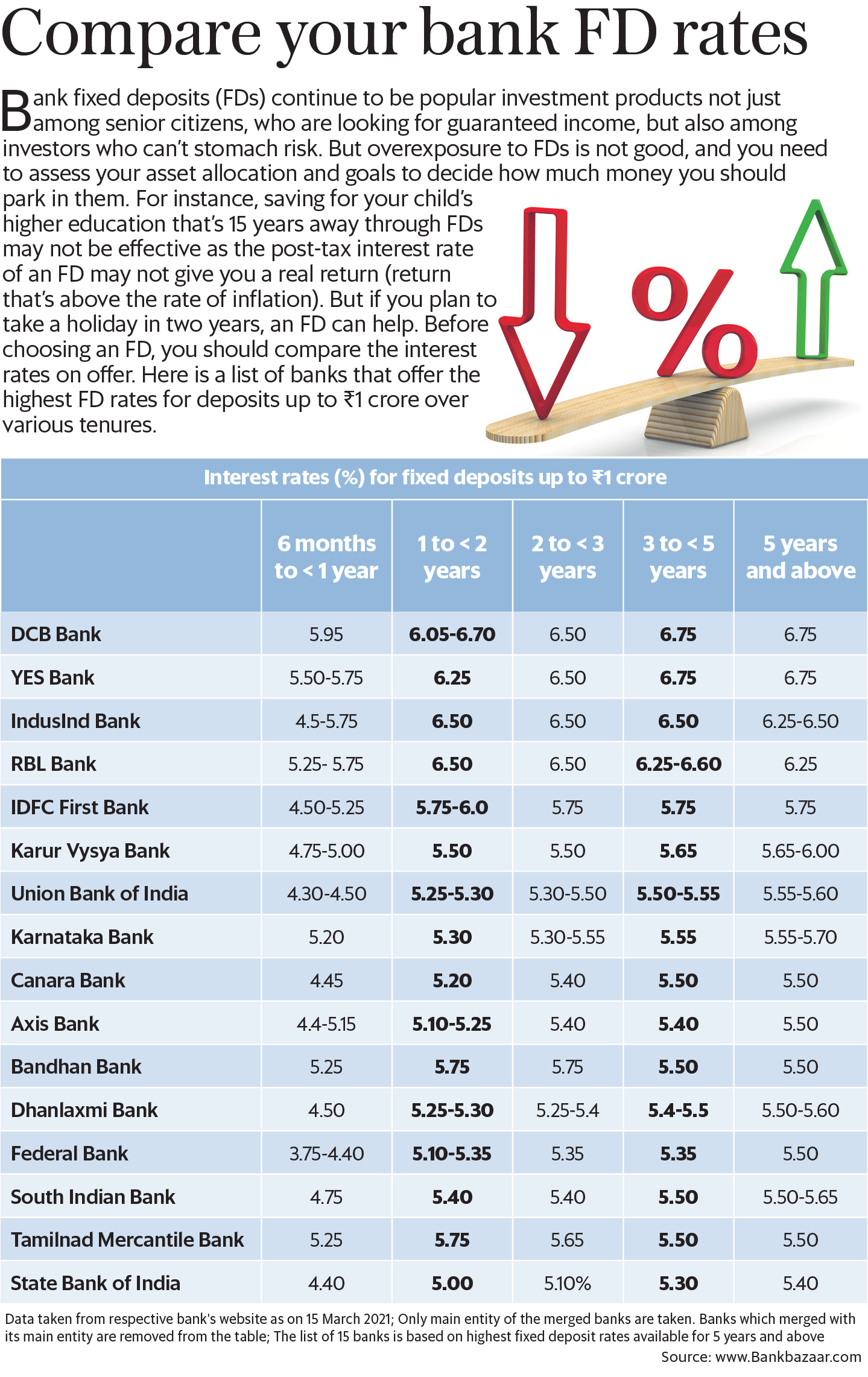

Compare Your Bank FD Rates Mint

PNB Vs SBI Vs ICICI Bank Vs BoB Check Senior Citizens Fixed Deposit

What Is Accrued Interest Formula Loan Calculator

What Is Accrued Interest Formula Loan Calculator

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

Safe Mode Of Investment

How To Download ICICI Bank FD Advice Receipt FD Certificate From

Is Interest On Fd Tax Free - Yes Interest on FD is subject to taxation under Income Tax Interest amount up to INR 40 000 per annum is tax free However this slab raises to INR 50 000