Is Interest On Fd Taxable For Senior Citizens Assuming the senior citizen gets same interest rate of 7 on tax saving fixed deposits in next five years At 7 75 interest rate an FD of Rs 1 06 873 each year

The interest earned on these fixed deposits is usually taxable However there is a way to earn tax exempted returns from tax saving FD if you are a senior Section 80TTB is a provision under the Indian Income Tax Act that offers tax benefits to senior citizens on their interest income

Is Interest On Fd Taxable For Senior Citizens

Is Interest On Fd Taxable For Senior Citizens

https://hutslot382.weebly.com/uploads/1/3/5/9/135915457/530926544.aspx

TDS On FD Interest And Know How To Save It IDFC FIRST Bank

https://www.idfcfirstbank.com/content/dam/idfcfirstbank/images/blog/finance/is-interest-on-fd-taxable-717x404.jpg

Know More About Highest FD Interest Rates In India In 2020

https://softrop.com/wp-content/uploads/2020/08/FD-Interest-Rates.jpg

Fixed deposit for senior citizens Senior citizen FDs can be opened by people over the age of 60 These FDs offer relatively higher interest rates However the rest of the For senior citizens aged 60 years and above the limit is Rs 50 000 income from FD interest in a year and banks charge 10 percent TDS thereafter However from

Tax benefits While the interest earned on regular FDs is taxable the interest income on up to Rs 50 000 earned on Senior Citizen FDs is exempt from tax But with a 5 year Tax Saver Fixed Deposit premature withdrawal isn t allowed This investment for senior citizens is in the ETT category Up to Rs 50 000 of

Download Is Interest On Fd Taxable For Senior Citizens

More picture related to Is Interest On Fd Taxable For Senior Citizens

SBI FD Interest Rate April 2023 Latest SBI Fixed Deposit Rates

https://navi.com/blog/wp-content/uploads/2023/04/SBI-FD-Interest-Rate.jpg

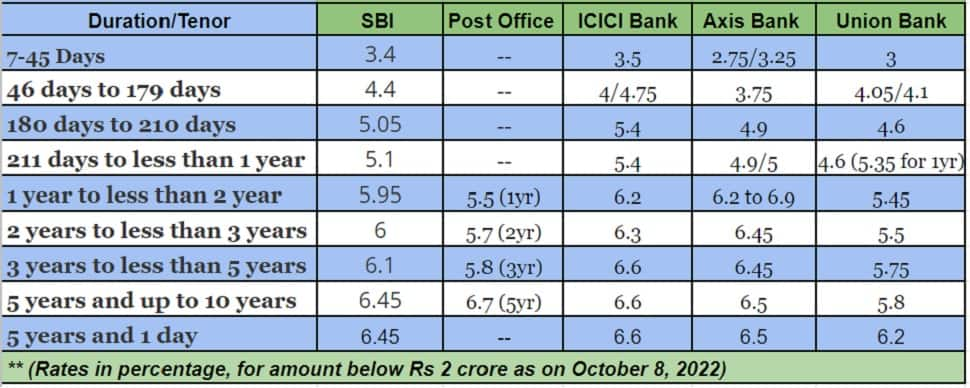

Senior Citizen FD Rates 2022 SBI Vs Post Office Vs ICICI Vs Axis Vs

https://english.cdn.zeenews.com/sites/default/files/FD-rates2022.jpg

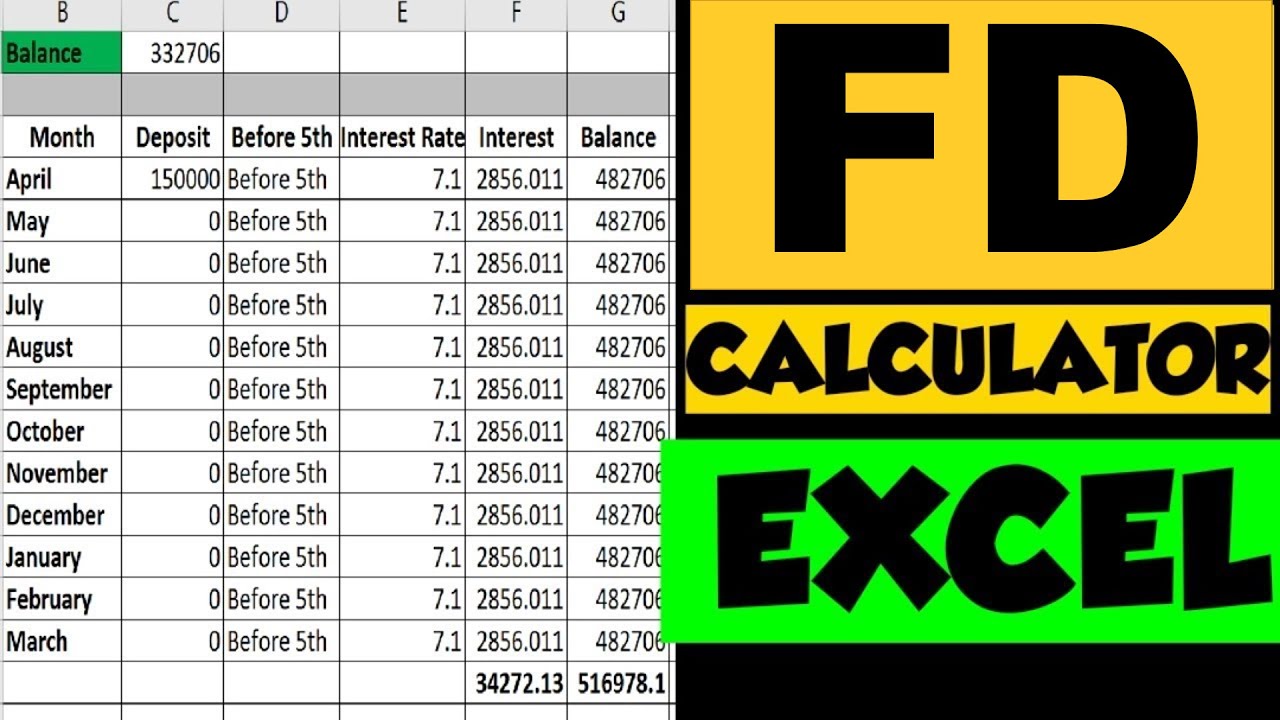

FD Calculator Fixed Deposit Interest Calculator FinCalC Blog

https://i.ytimg.com/vi/fZ0XcrgOmOk/maxresdefault.jpg

However senior citizens can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB applicable to the interest earned on tax saving Is interest on FD taxable for senior citizens Interest on FD earned from bank or post office deposit schemes is not taxable for senior citizens under Section 80 TTB of the Income Tax Act 1961 up

Post Office FD Interest Rates 2024 Benefits For Senior Citizens Updated on Jan 3rd 2024 9 min read CONTENTS Show The Post Office Fixed Deposit POFD also April 4 2023 By Harshini Income Tax Exemption for Senior Citizens on FD Interest The elderly receive tax breaks from the government Senior citizens are exempt from

How Interest Rates Affect Businesses ILG

https://initiallendinggroup.com/wp-content/uploads/2019/03/How-Interest-Rates-Affect-Businesses-1024x683.jpeg

Union Bank FD Interest Rates January 2024

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/01/union-bank-fd-rates.jpg

https://economictimes.indiatimes.com/wealth/invest/...

Assuming the senior citizen gets same interest rate of 7 on tax saving fixed deposits in next five years At 7 75 interest rate an FD of Rs 1 06 873 each year

https://m.economictimes.com/wealth/tax/fixed...

The interest earned on these fixed deposits is usually taxable However there is a way to earn tax exempted returns from tax saving FD if you are a senior

PNB Vs SBI Vs ICICI Bank Vs BoB Check Senior Citizens Fixed Deposit

How Interest Rates Affect Businesses ILG

FD RD PPF Tax Hello Maharashtra

The Impact Your Interest Rate Has On Your Buying Power INFOGRAPHIC

Fed Raising Interest Rates Duncan Oil Company

Fha Interest Rates Cheap Selling Save 41 Jlcatj gob mx

Fha Interest Rates Cheap Selling Save 41 Jlcatj gob mx

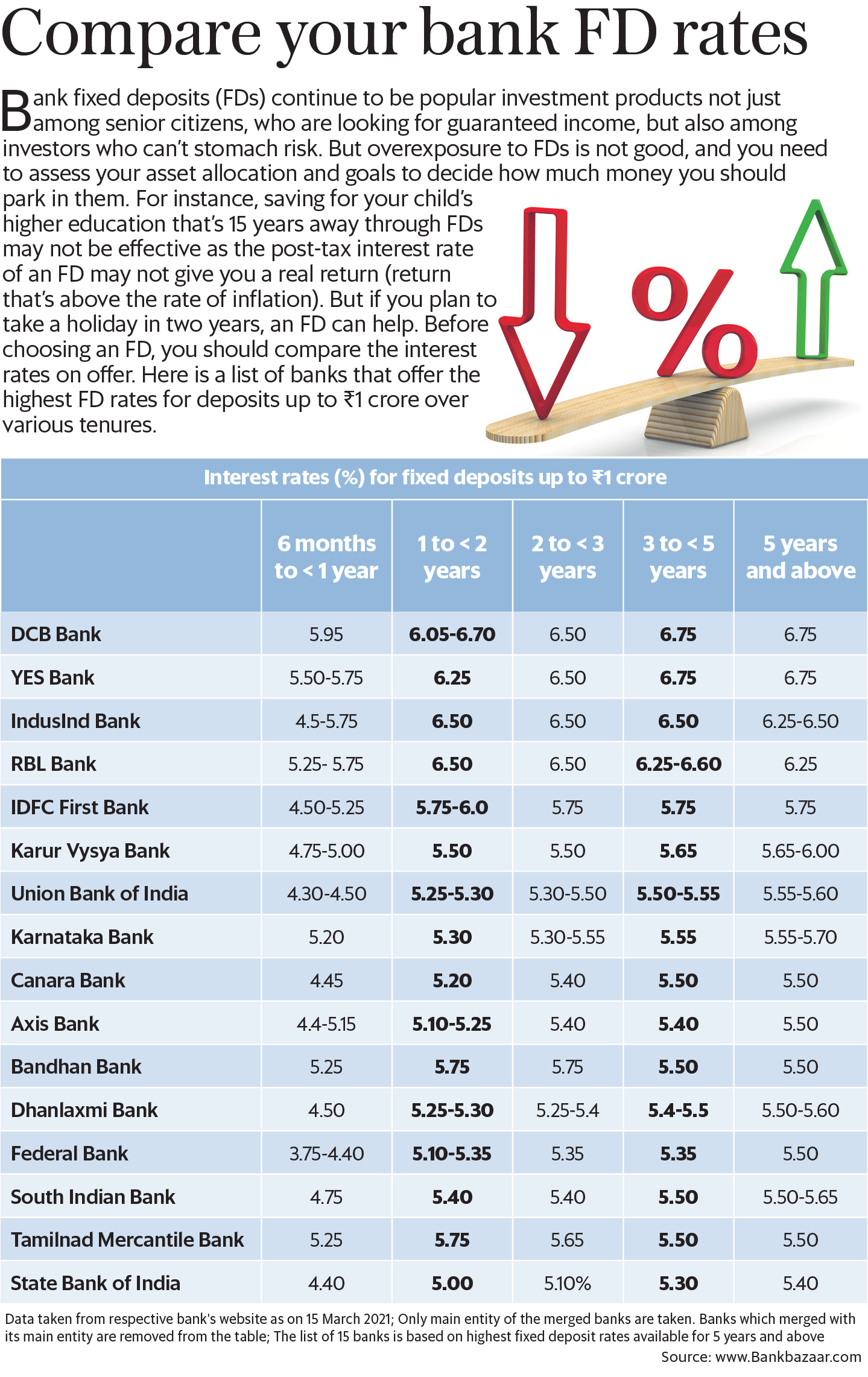

Compare Your Bank FD Rates Mint

FD Interest Rates High Fixed Deposit Interest Rates Jan 2024

Everything You Need To Know About TDS On FD Interest In India

Is Interest On Fd Taxable For Senior Citizens - But with a 5 year Tax Saver Fixed Deposit premature withdrawal isn t allowed This investment for senior citizens is in the ETT category Up to Rs 50 000 of