Is Interest On Nre Fixed Deposit Taxable In Us AFAIU you don t need pay any taxes for you amount in NRE account since this amount is already taxed I also think you do not need to pay taxes on the interest

Any interest that you earn from your NRE or NRO account or even Fixed Deposits for that matter is taxable And you must not Calculate Income Income generated from any of the following means would qualify to be taxed in the United States of

Is Interest On Nre Fixed Deposit Taxable In Us

Is Interest On Nre Fixed Deposit Taxable In Us

https://sfinopedia.com/wp-content/uploads/best-nre-fixed-deposits-768x512.jpg

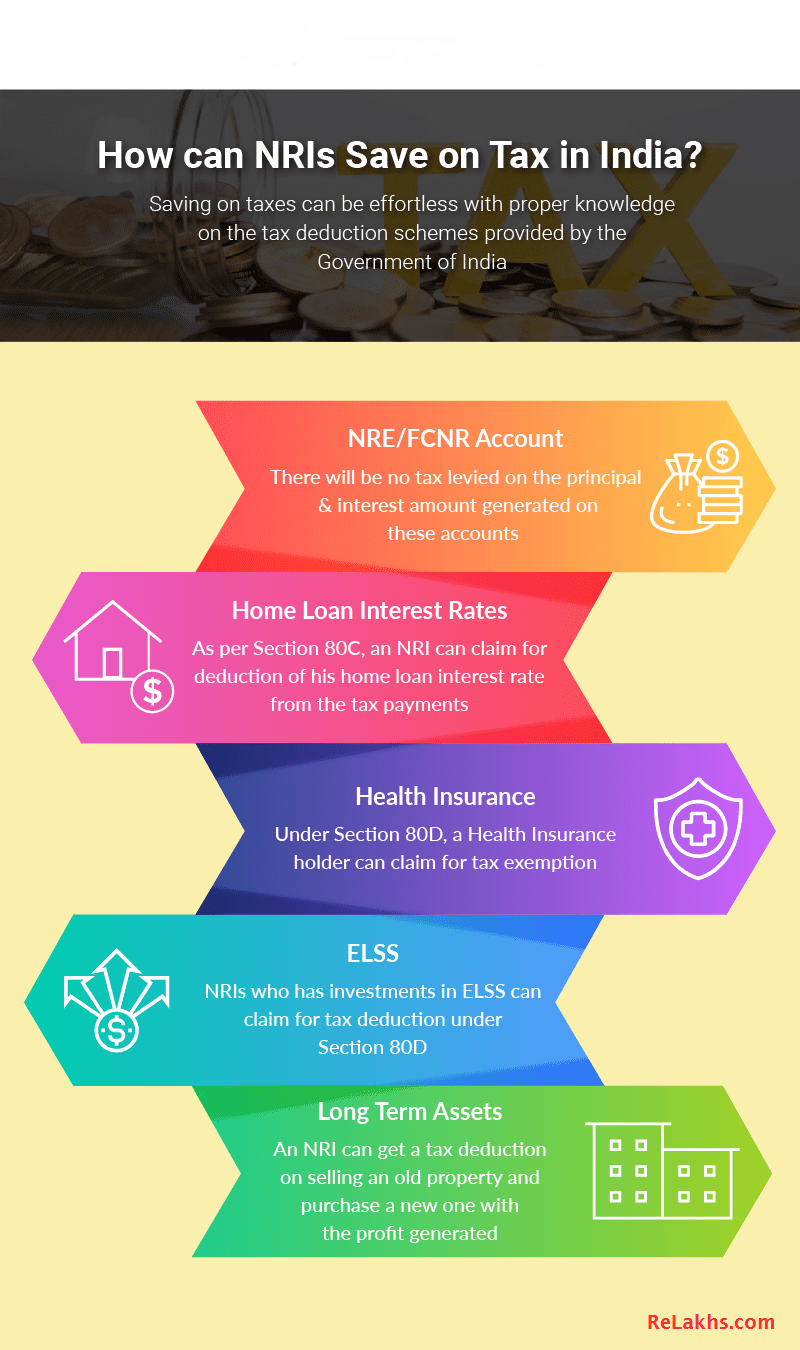

Best NRI Tax Saving Options 2023 2024 How NRIs Can Save On Tax

https://www.relakhs.com/wp-content/uploads/2019/07/How-can-NRIs-Save-on-Tax-in-India-NRI-Tax-Saving-options.png

NRE FD Is Interest On NRE Fixed Deposit Taxable

https://www.dbs.com/in/iwov-resources/media/images/nri-hub/articles/is-interest-on-nre-fixed-deposit-taxable-1404x630.jpg

I am aware NRE interest income is taxed as Global Income Yes you need to add this income and offer it in your US tax return You can claim a tax credit of the TDS on NRI Account An NRE account is completely tax free This means that both savings and fixed deposits in NRE accounts as well as the interest earned

An NRE Fixed Deposit is exempt from taxation but an NRO Fixed Deposit is liable for the NRI tax due Interest earned on NRE Fixed Deposit is exempt from tax in India but Any interests that you earn on NRE accounts is not taxable in India This means that banks will not deduct any amount from your earnings directly Similarly any interests that you earn on your FCNR

Download Is Interest On Nre Fixed Deposit Taxable In Us

More picture related to Is Interest On Nre Fixed Deposit Taxable In Us

Income Not Taxable In The Hand Of On NRIs Working Abroad

https://carajput.com/art_imgs/receipt-of-salary-income-into-nre-ac-not-taxable-in-the-hand-of-on-nris-working-abroad.jpg

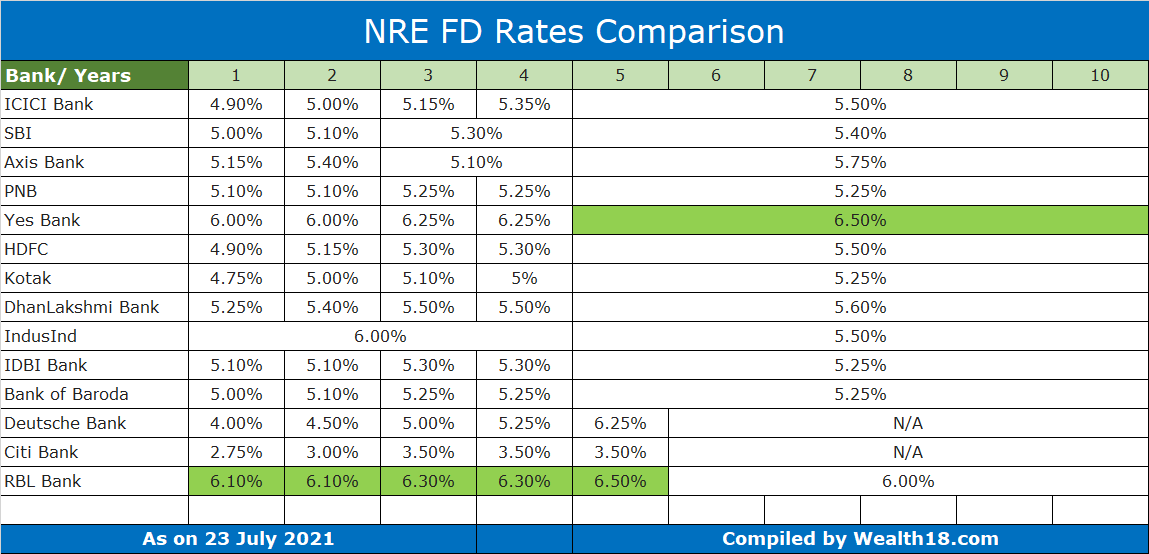

NRE FD Rates Best NRE Fixed Deposit Interest Rates 2022

https://www.paisabazaar.com/wp-content/uploads/2018/10/nre-fd.png

NRE FD Is Interest On NRE Fixed Deposit Taxable DBS Treasures India

https://www.dbs.com/in/iwov-resources/media/images/nri-hub/articles/what-is-interest-rate-for-nre-fd-684x630.jpg

This means that both the interest earned on an NRE FD and NRE savings account is not taxable as per the provisions of Section 10 4 1 of the Income Tax Act A returning NRI who has opted to be Resident but Not Ordinarily Resident RNOR has earned the following types of income for a particular assessment year

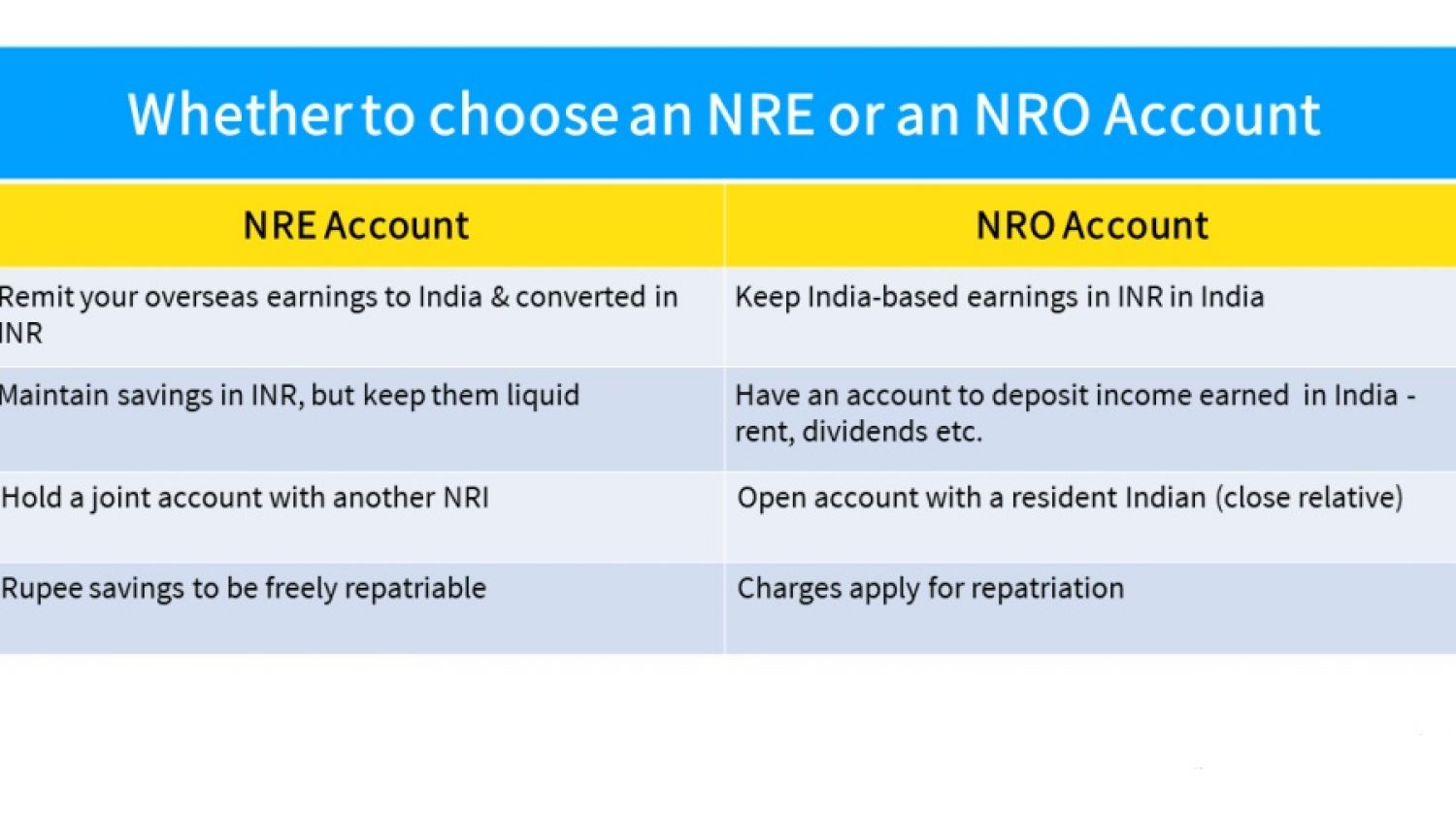

NRE Account The interest earned on NRE account balances is tax free in India Additionally the principal and interest are exempt from wealth tax and gift tax NRO Account The interest earned on NRO account Only the interest that you earn from your NRO Account is taxable

ICICI Bank Increases Its FD Interest Rates Again BW Businessworld Test

http://static.businessworld.in/upload/SO5G8N_20220430_160300.jpg

Nre Fixed Deposit Interest Rates Icici

http://dcicomp.com/nre-fixed-deposit-interest-rates-icici-714.png

https://money.stackexchange.com/questions/36239

AFAIU you don t need pay any taxes for you amount in NRE account since this amount is already taxed I also think you do not need to pay taxes on the interest

https://www.aotax.com/account-nre-nro-inter…

Any interest that you earn from your NRE or NRO account or even Fixed Deposits for that matter is taxable And you must not

Recurring Deposit Interest Rates Of Major Banks May 2020 Yadnya

ICICI Bank Increases Its FD Interest Rates Again BW Businessworld Test

Foreign Bank Or Indian Banks Which Offers More Interst On NRE Fixed

Which Bank Is Best For Fixed Deposit For Nri

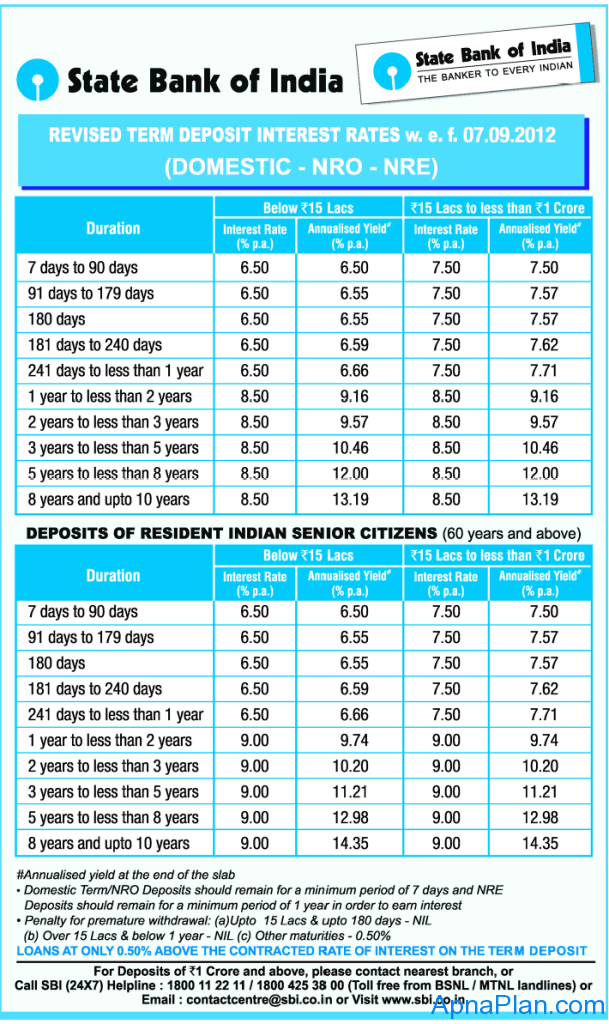

SBI NRE NRO Senior Citizen Domestic Fixed Deposit Rates March 2012

NRE Vs NRO Vs FCNR Fixed Deposits Know The Difference Paisabazaar

NRE Vs NRO Vs FCNR Fixed Deposits Know The Difference Paisabazaar

Is NRO NRE FCNR Interest Taxable In The US AOTAX COM

Best NRE Fixed Deposit Interest Rates For NRIs May 2017

Is NRO NRE FCNR Interest Taxable In The US AOTAX COM

Is Interest On Nre Fixed Deposit Taxable In Us - As such the interest on NRE FD Fixed Deposit and or NRE savings account is not taxable as per the provisions of Section 10 4 of the Income Tax Act 1961 However it