Is It Better To Take 0 Financing Or Rebate Should you Take the Rebate or Low Interest Finance Deal When low advertised interest rates yield a higher cost of borrowing than traditional bank rates In most cases dealers use their

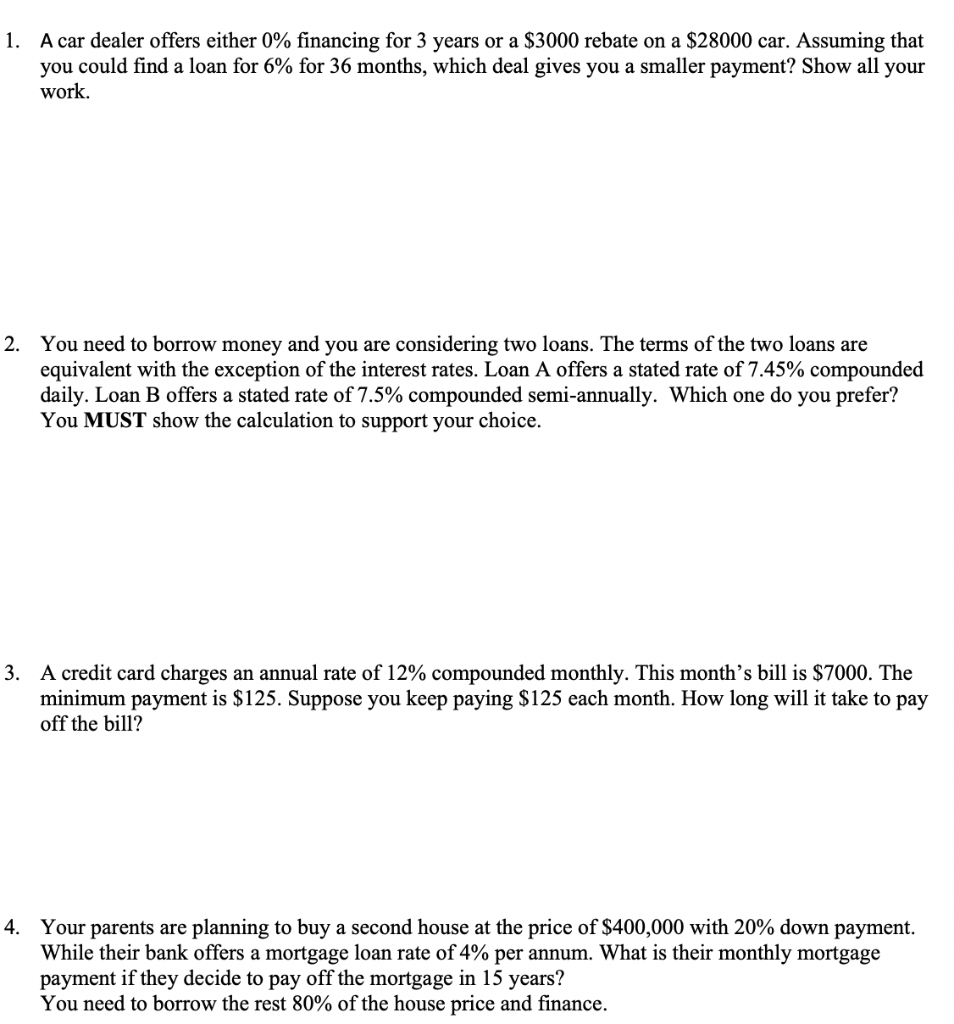

The 0 APR offer is better in this case and it would still be better even if the rebate doubled Presume you score a 2 000 rebate which is highly unlikely for a 30 000 car The first step in choosing between 0 financing and a rebate offer is figuring out your credit score If you don t have a credit score that s at least 700 or even closer to 800

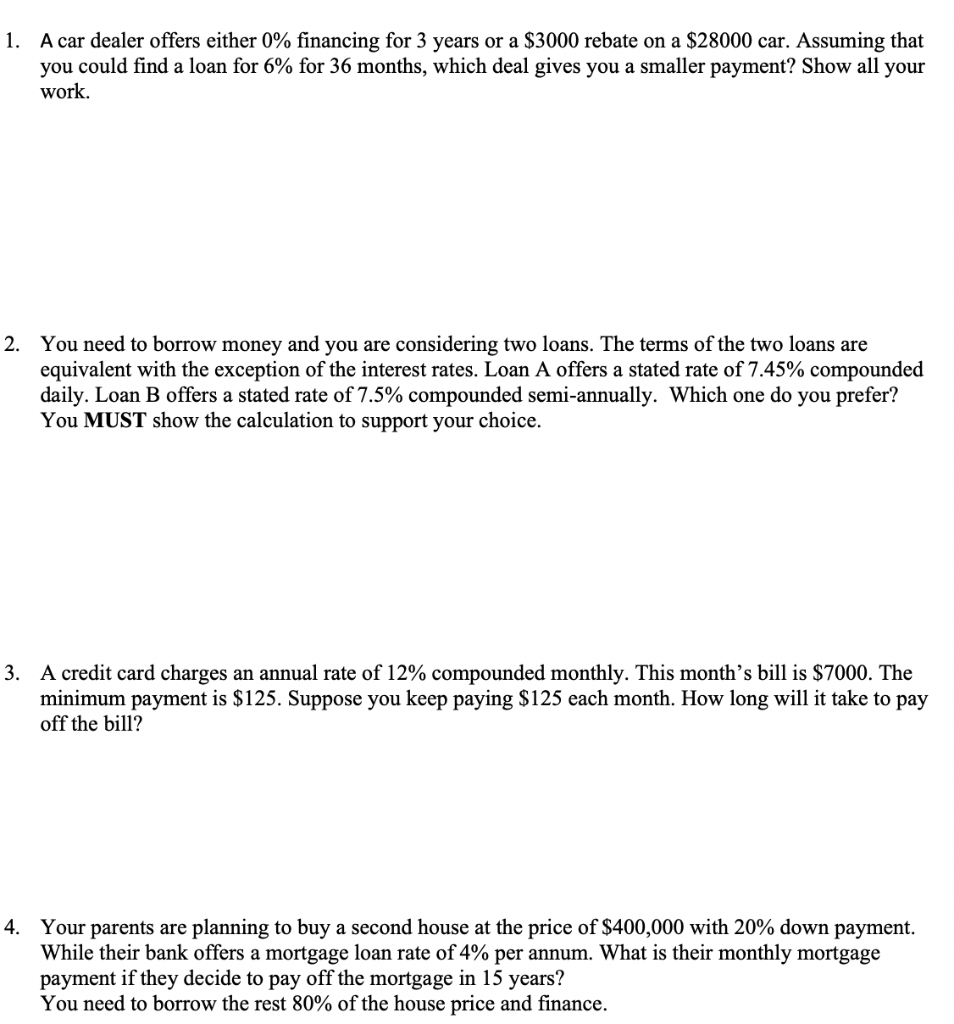

Is It Better To Take 0 Financing Or Rebate

Is It Better To Take 0 Financing Or Rebate

https://www.bankrate.com/2010/08/25175559/Should-you-take-a-rebate-or-0-percent-financing.jpeg

Rebate Vs 0 Percent Financing CAP COM FCU A Division Of Broadview

https://www.capcomfcu.org/globalassets/ccfcu/blogs/blog-rebate-vs-financing.jpg

Comparing Rebate Vs Low Interest Financing For Cars IDFC FIRST Bank

https://www.idfcfirstbank.com/content/dam/idfcfirstbank/images/blog/car-loan/rebate-vs-low-interest-financing-for-cars--717x404.jpg

If you don t qualify for a zero percent financing it may be best to take the rebate Some financing companies will offer low financing for the first six months of your loan term and after that charge a higher interest rate for the remaining loan Should you take the big factory rebate or financing at low 0 1 9 etc APR s Sometimes it can get a little confusing as to which option saves you more money in the long run This

When choosing between 0 percent financing and a rebate consider which would benefit your finances the most The best option will depend on your finances and budget goals However Using this calculator buyers can compare a number of different scenarios including applying a rebate to their down payment putting their rebate into a savings account and whether dealer financing can successfully compete with

Download Is It Better To Take 0 Financing Or Rebate

More picture related to Is It Better To Take 0 Financing Or Rebate

Is 0 Financing Better Associated Healthcare Credit Union

https://www.ahcu.org/custom/ahcu/image/financing0.gif

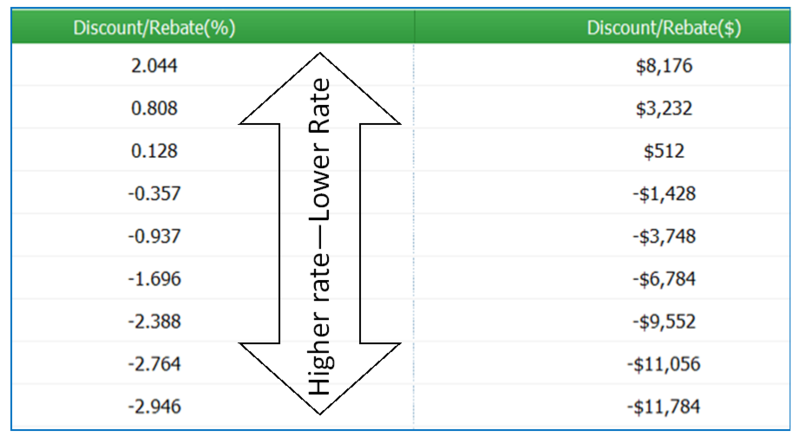

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

https://mortgageporter.com/images/old/6a00d834522f5769e2015390e201e9970b-800wi.png

Car Rebate Vs Financing Comparison Calculator Car Car Finance

https://i.pinimg.com/originals/d9/4a/56/d94a56459b0685a06deec09d3e45ca2c.jpg

However if it s to be purchased with a loan is it better to go with a rebate or no interest loan assuming both are offered As you can see in our example above a loan at It s not ALWAYS a good idea to take the rebate vs 0 However if the rate you qualified for in my example was 1 9 you d only pay 976 in interest meaning the 0 loan would NOT benefit

Deciding between a low rate dealer loan or a rebate can be difficult So take a look at these facts before you finance your next new vehicle A dealer loan rate of 0 or whatever today s Some of these incentives involve a generous car rebate or low APR financing sometimes as low as zero percent These are two good options if you want to save money How do you

Solved A Car Dealer Offers Either 0 Financing For 3 Years Chegg

https://media.cheggcdn.com/media/af0/af04b4f8-4eac-46c7-9bde-9027d1471593/phpqbjc66.png

Difference Between Rebate And Discount Difference Between

http://cdn.differencebetween.net/wp-content/uploads/2018/04/Discount-VERSUS-Rebate.jpg

https://www.car-buying-strategies.com › rebate-vs-low-interest.html

Should you Take the Rebate or Low Interest Finance Deal When low advertised interest rates yield a higher cost of borrowing than traditional bank rates In most cases dealers use their

https://finance.yahoo.com › news

The 0 APR offer is better in this case and it would still be better even if the rebate doubled Presume you score a 2 000 rebate which is highly unlikely for a 30 000 car

Difference Between Discount And Rebate with Comparison Chart Key

Solved A Car Dealer Offers Either 0 Financing For 3 Years Chegg

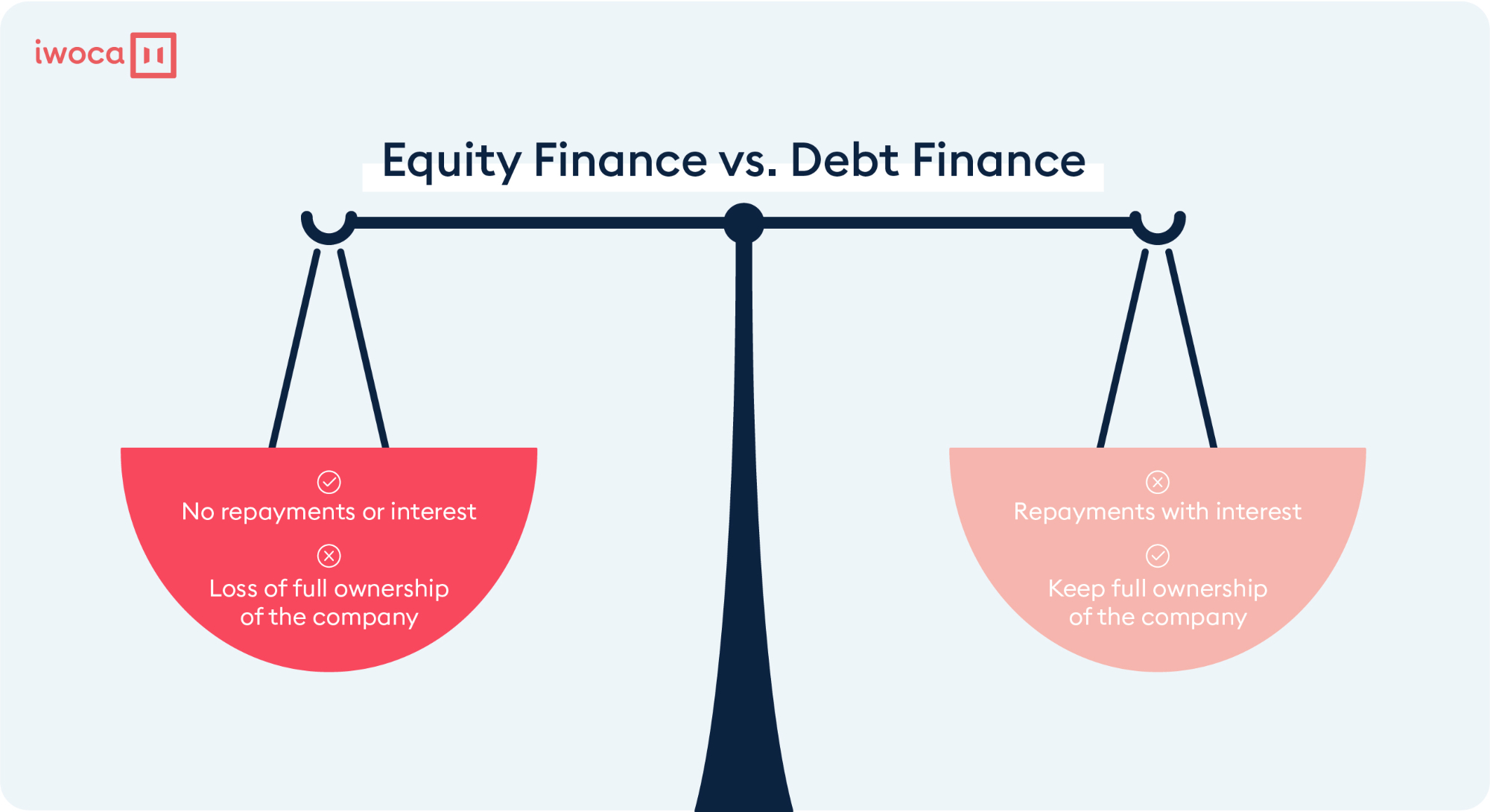

What Is Equity Financing The Different Types Of Equity Finance Iwoca

0 Financing What You Should Know Find Better Value

How Revenue Based Financing Solutions Help Grow Your Business

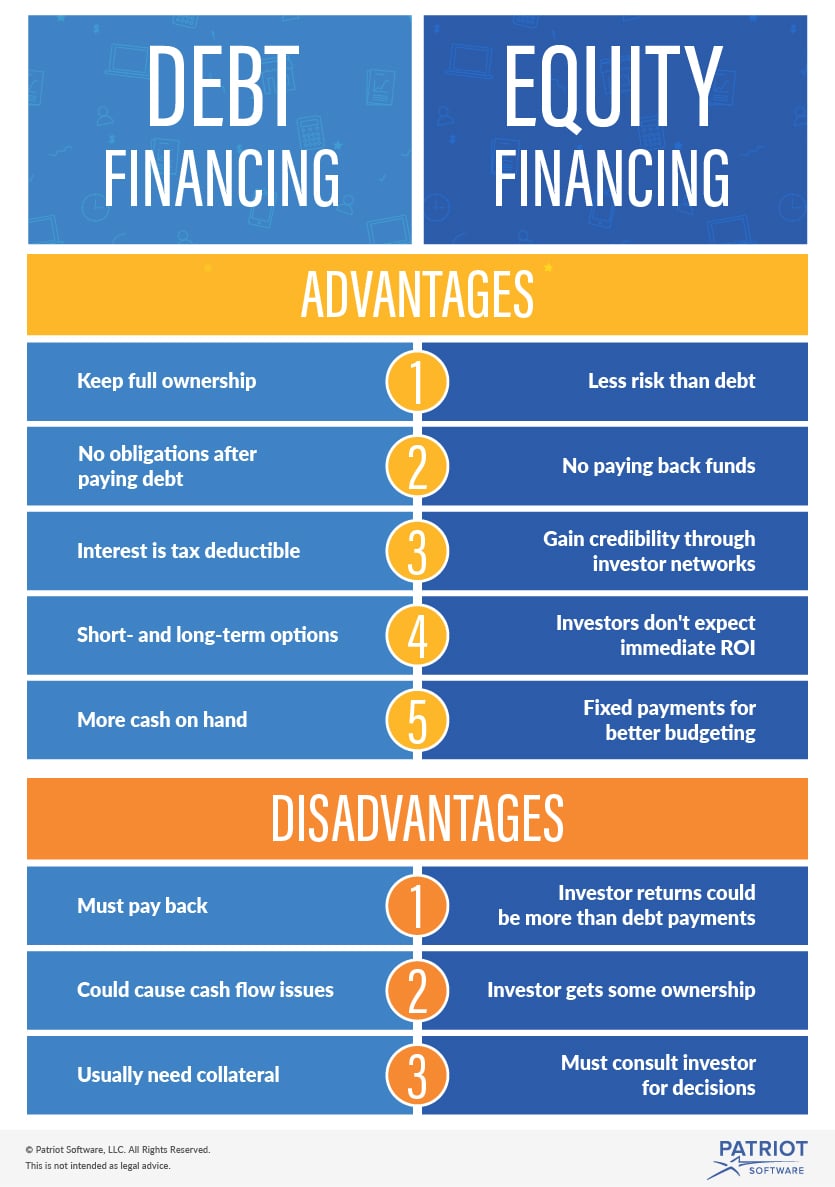

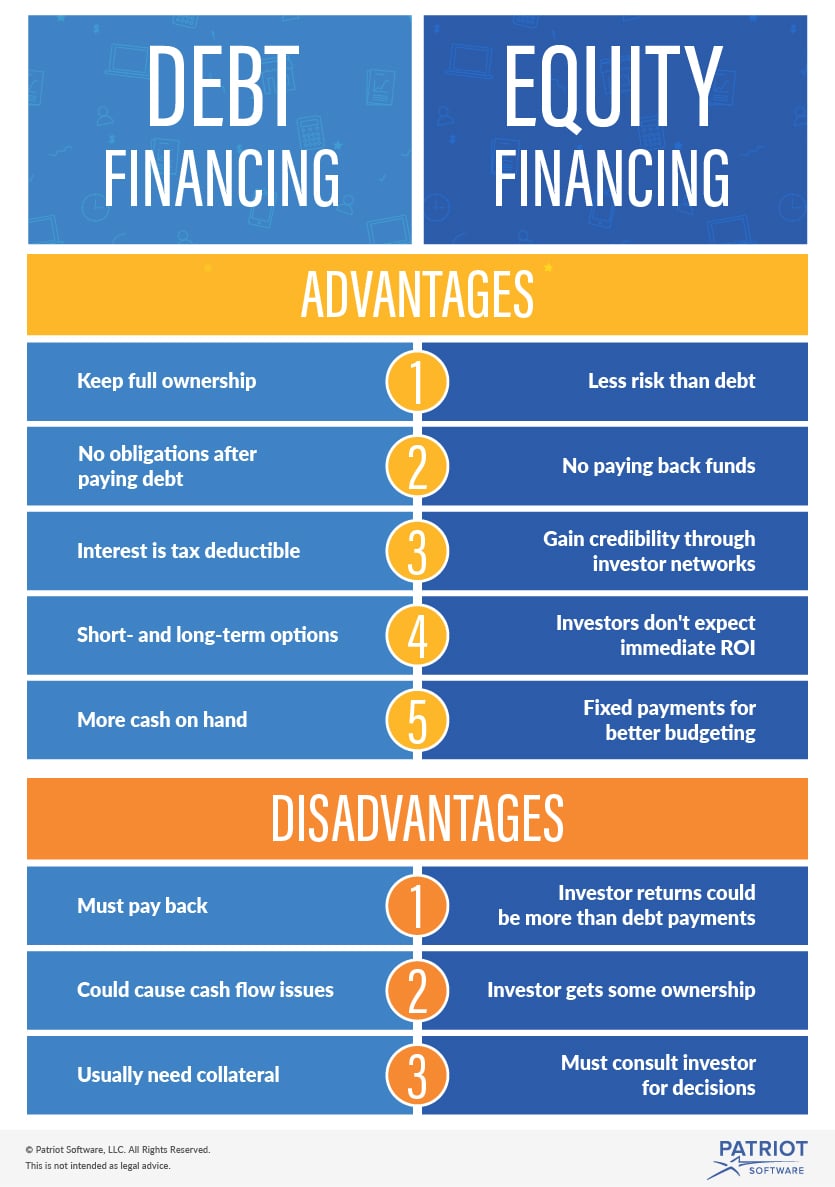

Debt Financing Vs Equity Financing What s The Difference

Debt Financing Vs Equity Financing What s The Difference

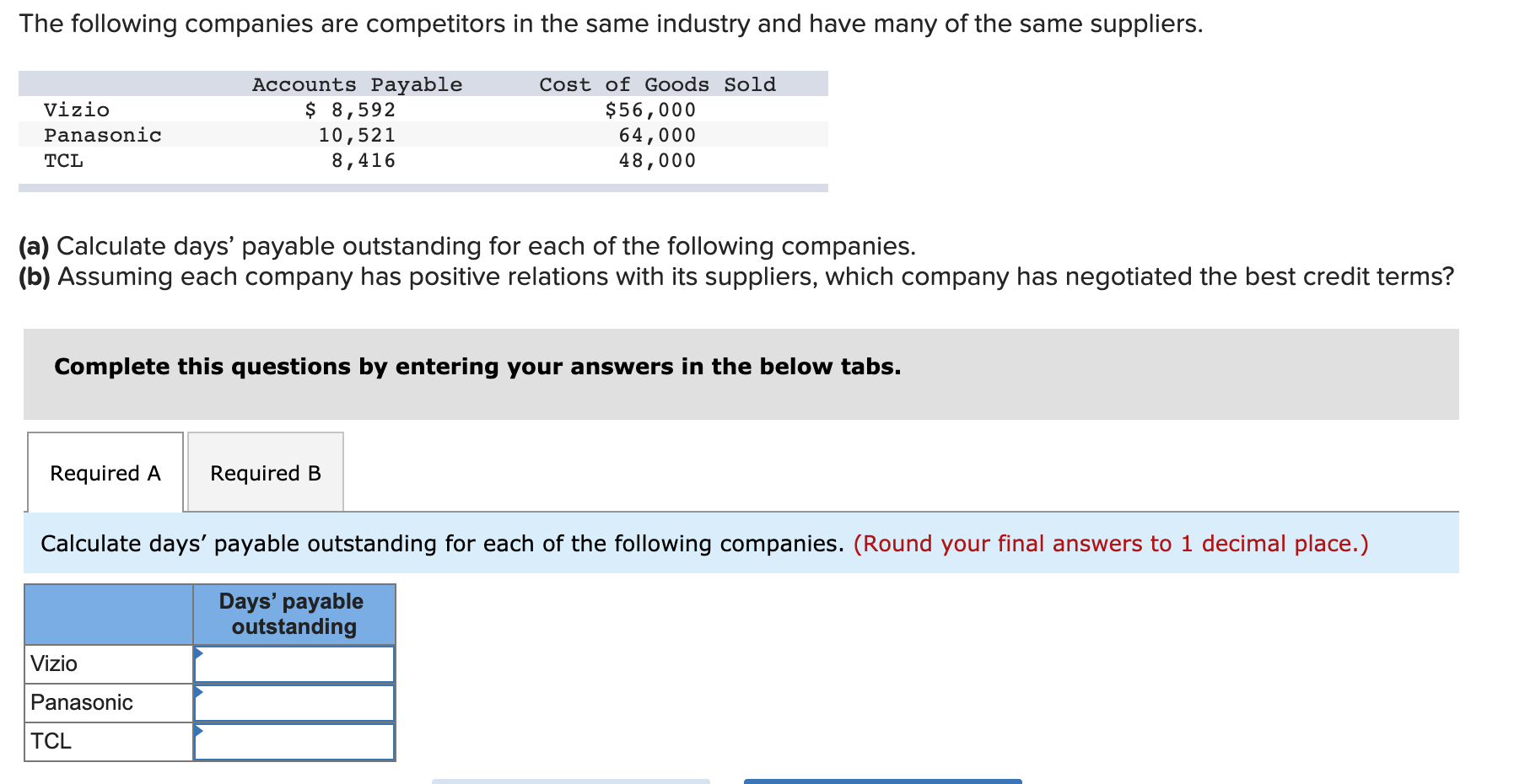

Solved The Following Companies Are Competitors In The Same Chegg

Finance Vs Accounting 5 Differences You Need To Know

What Is Asset Finance And How Could It Benefit Your Business SME News

Is It Better To Take 0 Financing Or Rebate - When choosing between 0 percent financing and a rebate consider which would benefit your finances the most The best option will depend on your finances and budget goals However