Is Jersey Tax Exempt All income liable to Jersey tax less allowable expenses pension contributions and your tax exemption threshold charged at 26 You ll pay tax at the lower of the two calculations

Residents of Jersey pay a maximum income tax rate of 20 Except for financial services firms utilities rentals and development projects Jersey s corporate tax rate is zero 2022 tax allowances and reliefs Details of tax allowances exemption thresholds and reliefs for 2022

Is Jersey Tax Exempt

Is Jersey Tax Exempt

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Verw sten Gew hnliche Zur cktreten New Jersey Tax Free Verbrannt

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-bracketsproposed-01.jpg

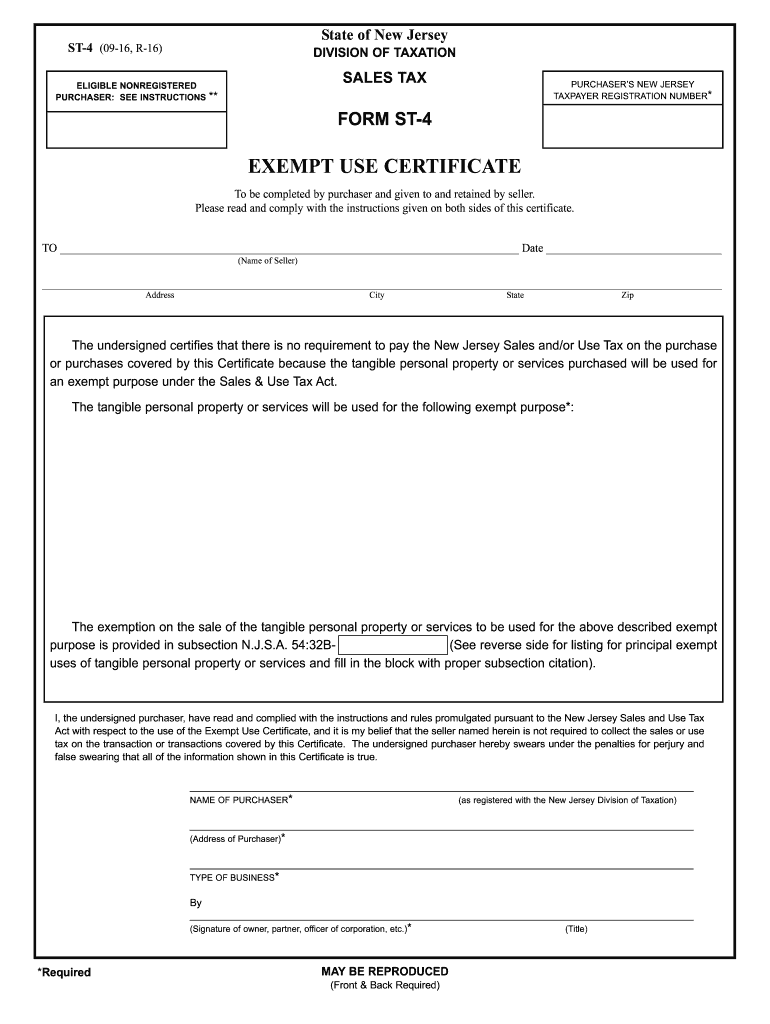

NJ ST 4 2016 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/395/763/395763626/large.png

Ordinary residents of Jersey are liable to pay income tax on all worldwide income non ordinary residents are liable to pay tax on Jersey source income and worldwide income The standard rate of business income tax in Jersey is 0 The exceptions to this standard rate are certain regulated financial service companies as defined in the Income Tax Law which are taxed at 10 see Financial

Exempt Nontaxable Income Certain items of income are not subject to New Jersey tax and should not be included when you file a New Jersey return Below is a partial list of Non resident companies are taxable on Jersey real estate income Companies are liable to income tax at a rate of 0 10 or 20 on taxable income The general rate applicable

Download Is Jersey Tax Exempt

More picture related to Is Jersey Tax Exempt

Is It Legal For A Tax exempt Church To Tell People How To Vote I m In

https://preview.redd.it/is-it-legal-for-a-tax-exempt-church-to-tell-people-how-to-v0-t7x7ia2pi7s91.jpg?auto=webp&s=44e4b0716d28e6bd1ab0618d25f18978732007dd

2023 List Of Income Exempt From Taxes Fed States Both Internal

https://www.irstaxapp.com/wp-content/uploads/2023/03/tax-exempt-income-2.png

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

You can claim a 1 000 regular exemption even if someone else claims you as a dependent on their tax return If you are married or in a civil union and are filing jointly Introduction This bulletin explains the most commonly used exemption certificates the administration of exemptions and how and when to use exemption certificates to make

Jersey as a tax neutral jurisdiction helps institutional investors such as pension funds insurance companies and investment banks who invest on behalf of other people and who are exempt from tax to access a Significant changes have been made to the system of corporate taxation in Jersey These changes include the introduction of a standard rate of corporate income tax of 0 and

Tax Exempt Church Pastor Politics Endorse

https://s3.amazonaws.com/lwnewsroom/newsroom/files/2016/09/tax-exemption.jpg

Nj Tax Exempt Form St 5 2020 2022 Fill And Sign Printable Template

https://www.pdffiller.com/preview/6/514/6514503/large.png

https://www.gov.je/TaxesMoney/IncomeTax/...

All income liable to Jersey tax less allowable expenses pension contributions and your tax exemption threshold charged at 26 You ll pay tax at the lower of the two calculations

https://www.investopedia.com/ask/answers/061716/...

Residents of Jersey pay a maximum income tax rate of 20 Except for financial services firms utilities rentals and development projects Jersey s corporate tax rate is zero

Tips For Maintaining Your Tax Exempt Status

Tax Exempt Church Pastor Politics Endorse

How To Make Your Memberships Tax Exempt With WordPress 2 Easy Ways

What Is A Tax Exempt Donation And Where Can I Donate To Save Tax

NJ Tax Credit COVID Building Imporvements Hamilton CPA Firm

LOVE YOUR MONEY New Jersey On Path To Tying For Highest Corporate Tax

LOVE YOUR MONEY New Jersey On Path To Tying For Highest Corporate Tax

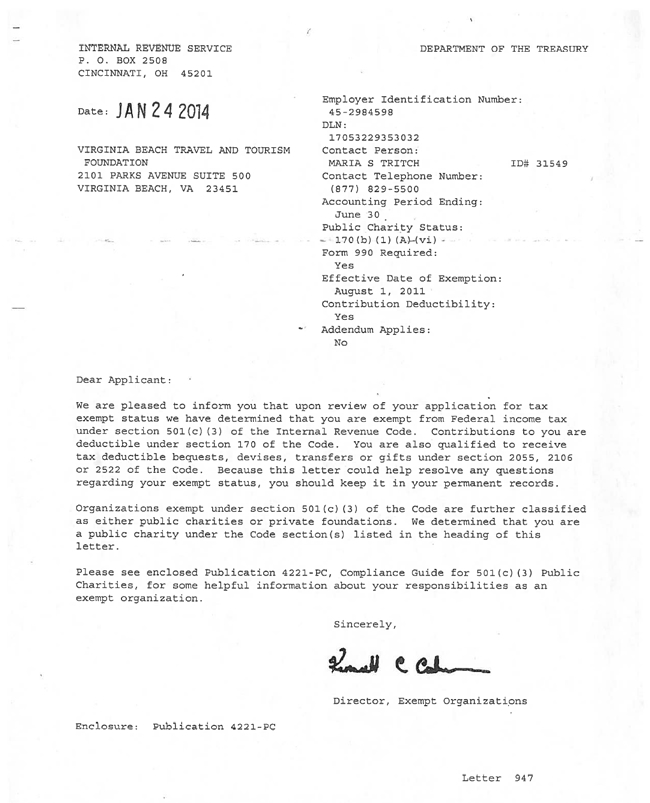

IRS 501 c 3 Tax Exempt Letter

Tax Exempt Weekend In South Carolina Items That Will Surprise You

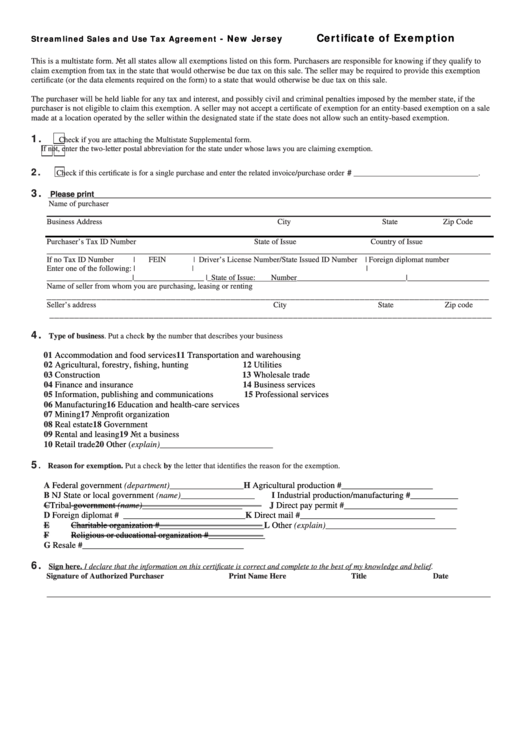

Fillable Certificate Of Exemption Streamlined Sales And Use Tax

Is Jersey Tax Exempt - The undersigned certifies that there is no requirement to pay the New Jersey Sales and or Use Tax on the purchase or purchases covered by this Certificate because the