Is Jersey Tax Free Salary All income liable to Jersey tax less allowable expenses pension contributions and your tax exemption threshold charged at 26 You will pay tax at the lower of the two

Independent taxation From 1 January 2022 you will be independently taxed Independent Taxation Paying your tax if you re employed Income Tax Instalment System ITIS Those prospective residents who are high net worth individuals must meet and sustain a minimum income of 1 250 000 or about 1 591 048 as of January

Is Jersey Tax Free Salary

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)

Is Jersey Tax Free Salary

https://www.thebalancemoney.com/thmb/D5iOrYTRfjREp8u3TTLAHu5gBw4=/1500x1000/filters:fill(auto,1)/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png

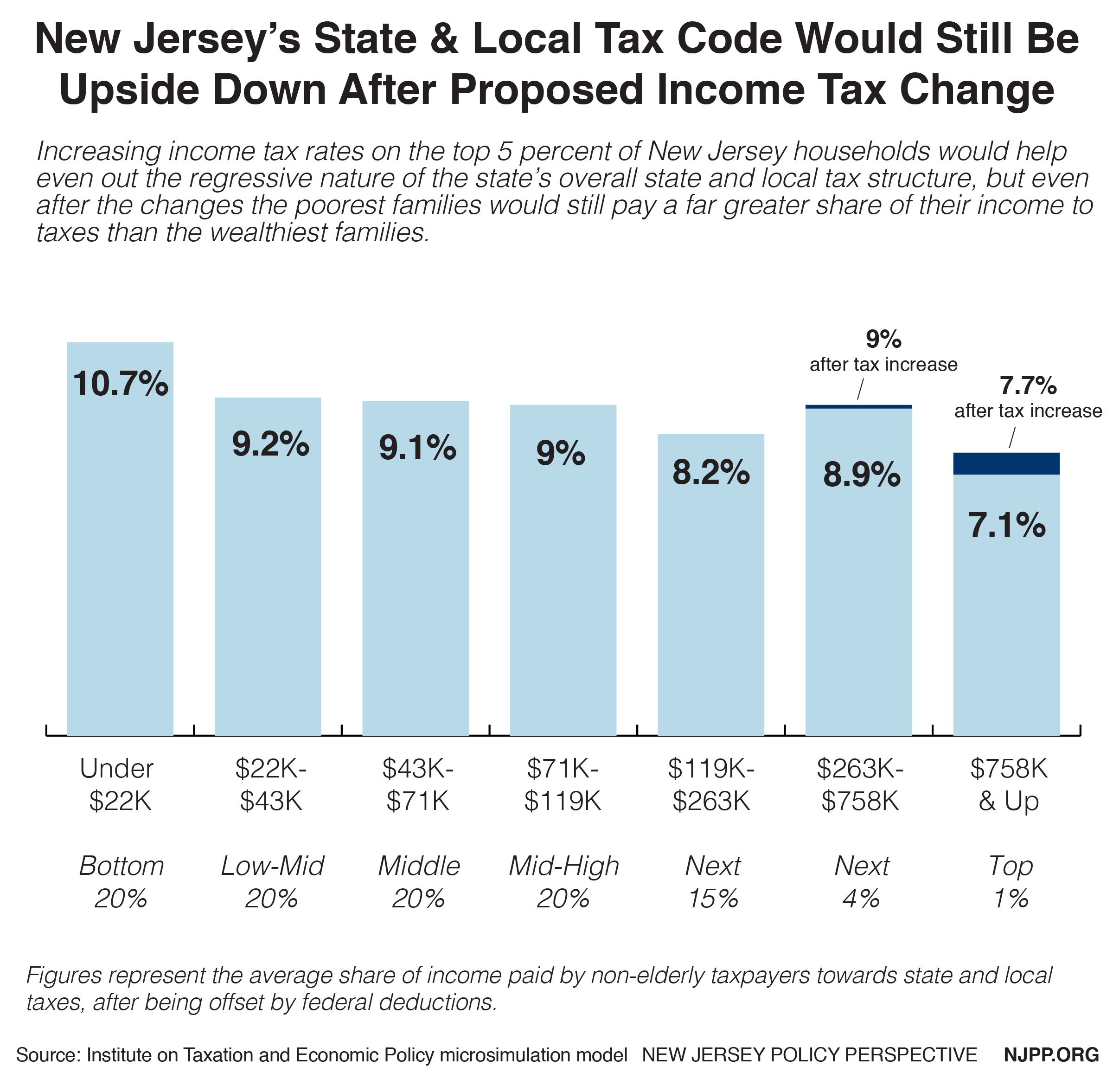

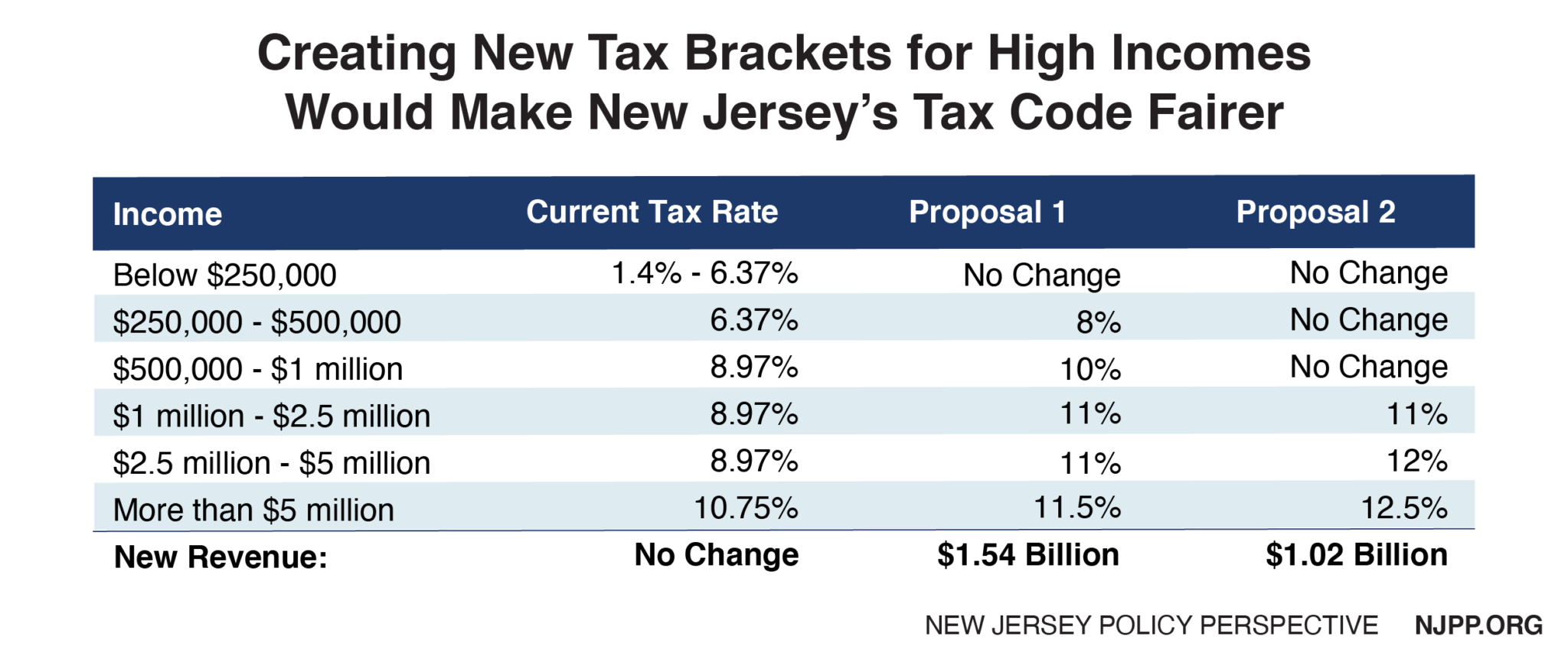

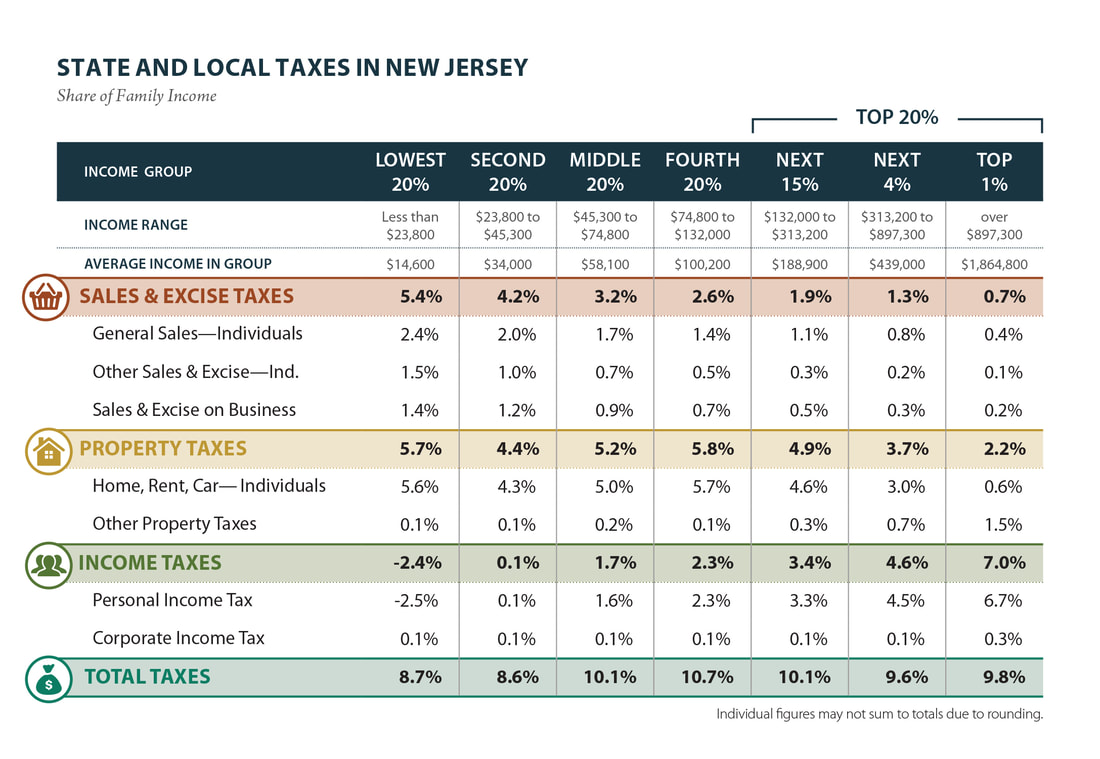

Reforming New Jersey s Income Tax Would Help Build Shared Prosperity

https://www.njpp.org/wp-content/uploads/2017/09/who-pays-inc-tax-increase-2017-01.jpg

Verw sten Gew hnliche Zur cktreten New Jersey Tax Free Verbrannt

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-bracketsproposed-01.jpg

Tax is payable at the rate of 20 on net income after allowances Alternative tax calculation In Jersey an alternative means of computing tax liability by reference to 20 on the first 1 250 000 1 on all income over 1 250 000 20 on income derived from Jersey land and property or dividends paid from a company in receipt of Jersey property income There is an annual

Ordinary residents of Jersey are liable to pay income tax on all worldwide income non ordinary residents are liable to pay tax on Jersey source income and worldwide income The Annual Salary Calculator is updated with the latest income tax rates in Jersey for 2021 and is a great calculator for working out your income tax and salary after tax based on a

Download Is Jersey Tax Free Salary

More picture related to Is Jersey Tax Free Salary

The 10 Most Lucrative Jersey City Tax Abatements Nj

https://www.nj.com/resizer/Ea1v9KWaLGO5hKZl-4ApmXbZJpM=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.nj.com/home/njo-media/width2048/img/hudsoncountynow_impact/photo/one49jpg-47a2769cf62395b7.jpg

New Salary Threshhold For Salaried Exempt Employees Platinum HR

https://platinumhr.com/wp-content/uploads/2019/11/Salary-.jpg

Salary Format In Excel Free Download Google Search Payroll Template

https://i.pinimg.com/736x/23/1e/32/231e320159ca9b8ba8080cfbe20606bd--free-download-slip.jpg

The Jersey Tax Calculator and salary calculators within our Jersey tax section are based on the latest tax rates published by the Tax Administration in Jersey In this dedicated No Jersey does not have a tax free salary system Individuals in Jersey are required to pay taxes on their income goods and services However Jersey does

Employment Income This is the amount of salary you are paid The Jersey tax calculator assumes this is your annual salary before tax If you wish to enter you monthly salary The Annual Wage Calculator is updated with the latest income tax rates in Jersey for 2023 and is a great calculator for working out your income tax and salary after tax based on a

Will New Jersey Be Tied For Highest Corporate Tax Rate Tax Foundation

https://files.taxfoundation.org/20180312103730/NJCIT2018-02.png

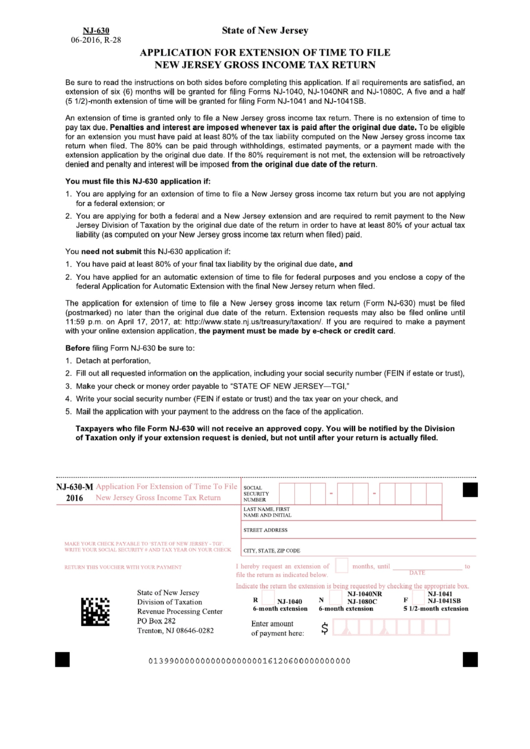

Fillable Nj 630 M Application For Extension Of Time To File New Jersey

https://data.formsbank.com/pdf_docs_html/269/2697/269749/page_1_thumb_big.png

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png?w=186)

https://www.gov.je/TaxesMoney/IncomeTax/...

All income liable to Jersey tax less allowable expenses pension contributions and your tax exemption threshold charged at 26 You will pay tax at the lower of the two

https://www.gov.je/lifeevents/movingtojersey/...

Independent taxation From 1 January 2022 you will be independently taxed Independent Taxation Paying your tax if you re employed Income Tax Instalment System ITIS

Tax Cuts Don t Pay For Themselves

Will New Jersey Be Tied For Highest Corporate Tax Rate Tax Foundation

Nj Tax Refund Status Skylasem

New Jersey Delaying Income Tax Refunds Until March

Salary Slip Format Pdf Simmopla

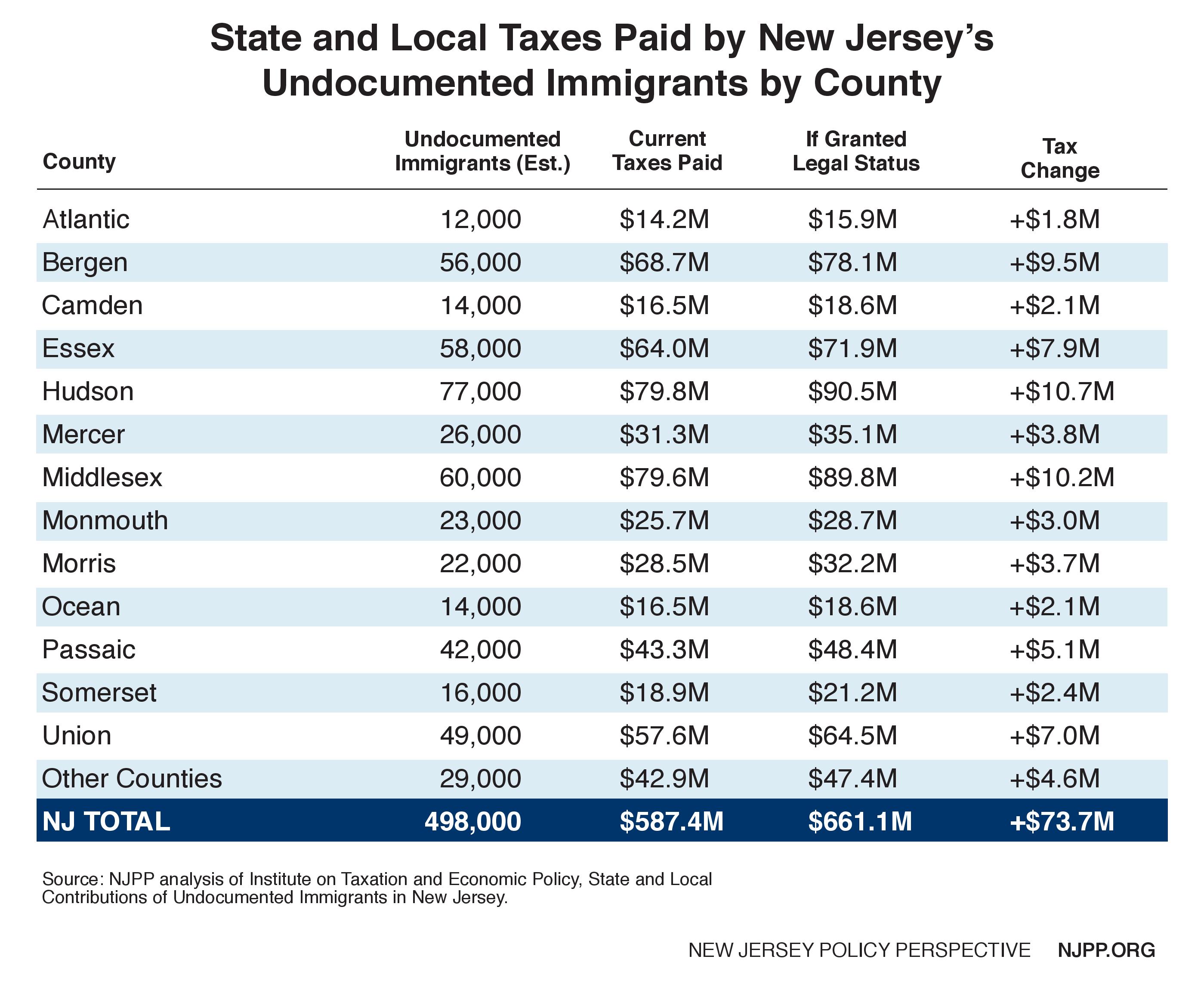

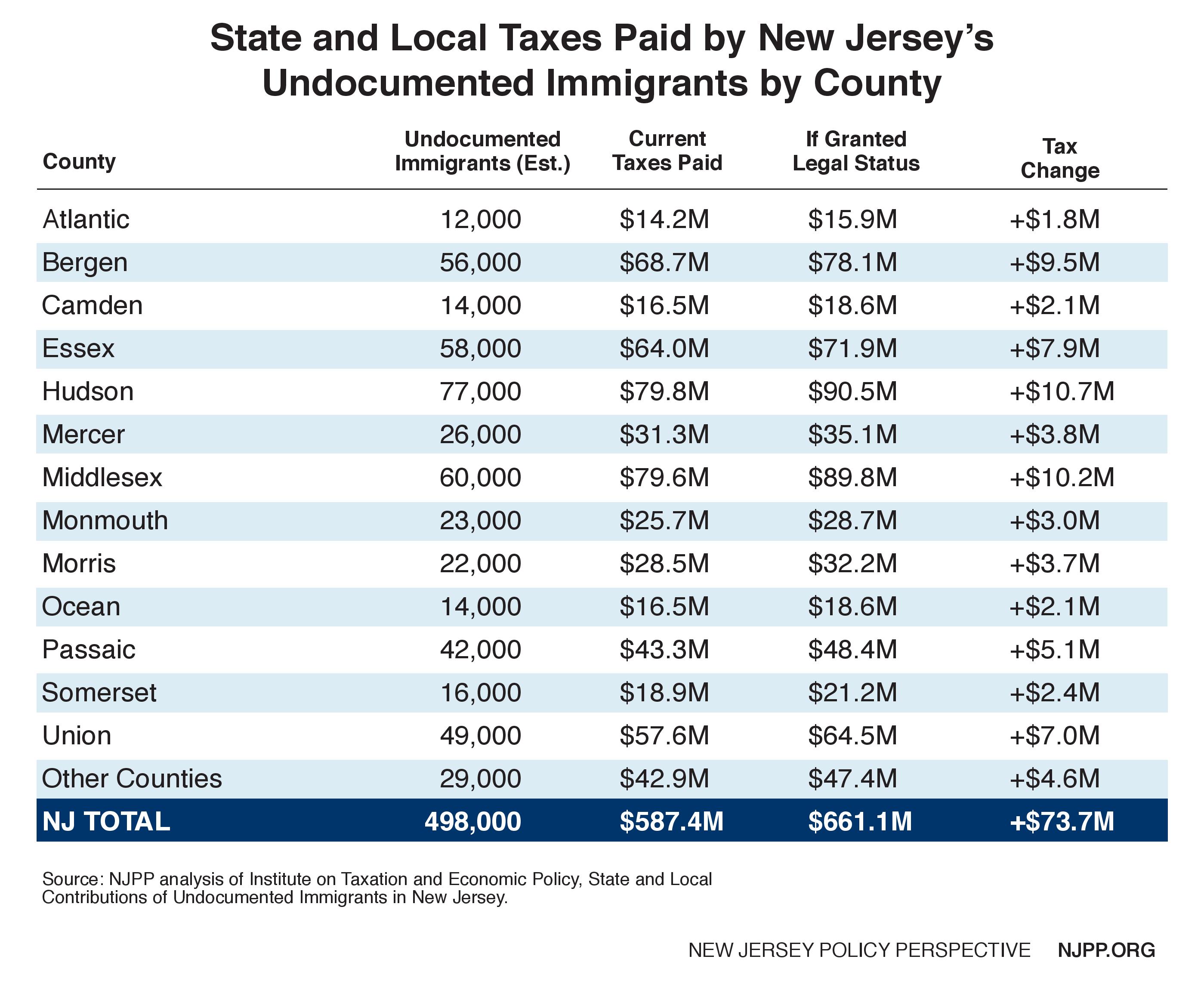

Undocumented Immigrants Pay Taxes County Breakdown Of Taxes Paid New

Undocumented Immigrants Pay Taxes County Breakdown Of Taxes Paid New

Road To Recovery Reforming New Jersey s Income Tax Code New Jersey

How Should You Answer What Are Your Salary Expectations Career

New Jersey Taxes NewJerseyAlmanac

Is Jersey Tax Free Salary - 20 on the first 1 250 000 1 on all income over 1 250 000 20 on income derived from Jersey land and property or dividends paid from a company in receipt of Jersey property income There is an annual