Is Laundry Allowance Taxable A laundry allowance is a taxable allowance meaning it must be shown on your tax return as assessable income Your employer may also be required to withhold

How much can I claim for laundry expenses self employed one of our most commonly asked questions The answer is that it depends on a few things In certain industries you can claim a flat The following allowances are taxable and must be included on your Form W 2 and reported on your return as wages Allowances paid to your spouse and minor children while you

Is Laundry Allowance Taxable

Is Laundry Allowance Taxable

https://www.paycat.com.au/hubfs/Award images/MA000081.jpeg#keepProtocol

How Much Allowance Should You Give Your Kids Crave Magazine

https://cravemag.co.uk/wp-content/uploads/2022/08/allowance-money.jpg

Motivation And Learning Unlimited Laundry

http://unlimitedlaundromats.com/wp-content/uploads/2022/04/IMG_0802.png

Under the RIA where an employee is responsible for laundering special clothing the employer must pay a weekly laundry allowance of an amount agreed between the employer and the employee In the absence of such 82 rowsFor general laundry expenses for uniforms and other protective clothing not covered by the agreements in the following table see EIM32485 See the appropriate

Allowances If you receive an allowance from your employer for laundry expenses you can only claim a deduction for the amount you actually spent not the amount of the Table 1a lists types of allowances an employee might receive and describes how they are treated You need to withhold for these allowances The employee is

Download Is Laundry Allowance Taxable

More picture related to Is Laundry Allowance Taxable

The Allowance Game Teach Your Kids About Money Planning To Save

https://i0.wp.com/planningtosave.com/wp-content/uploads/2014/01/Allowance.jpg?resize=1500%2C1200&ssl=1

Laundry Detergent Sheets

https://help.sheetslaundryclub.com/cdn-cgi/image/quality=100,width=3840/https://hsfiles.gorgias.help/gm/help-centers/20602/attachments/0a84967e-11f5-4940-85e3-858acc047c15.png

2029 Alpha Chemical

https://deverechemical.com/wp-content/uploads/Laundry_Products.png

To claim work related clothing laundry and dry cleaning expenses you must first show income from salary and wages or foreign employment income in the Understanding when to pay uniform and laundry allowances prescribed by modern awards is an issue that is commonly misunderstood by employers The misunderstanding often arises because employees

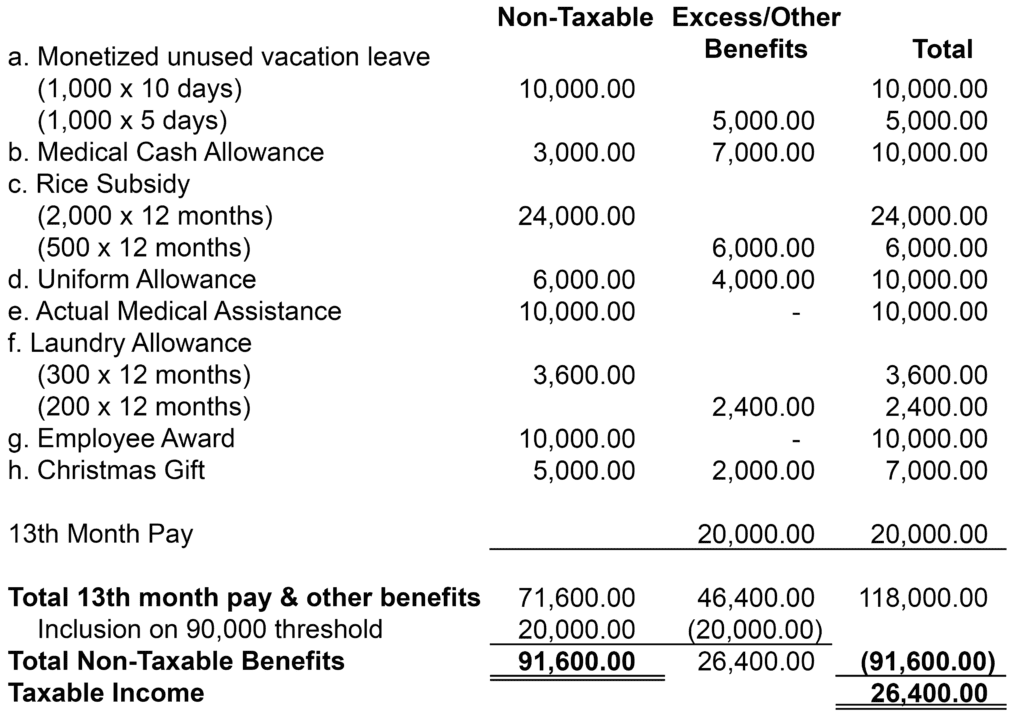

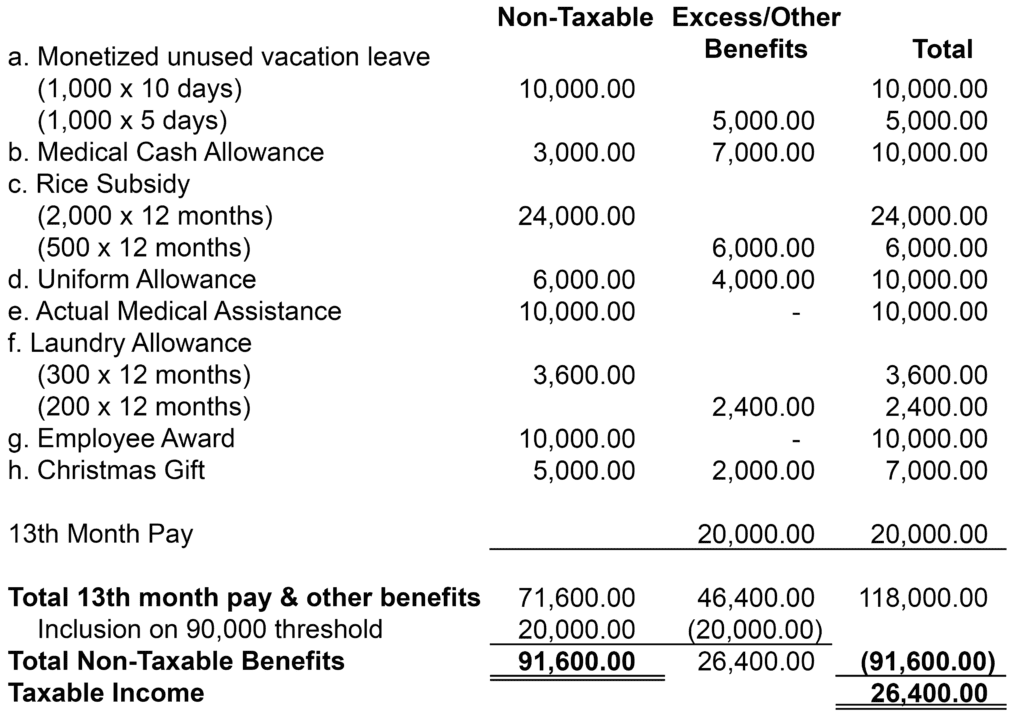

Learn what allowances are how they re reported to the ATO via Single Touch Payroll STP and details of the different allowance types An allowance is a payment made to Uniform and clothing allowance not exceeding P6 000 per annum as amended by RR 11 2018 6 Actual medical assistance e g medical allowance to cover medical and

Laundry Allowance Approved Uniform ATO Measure S W OTE E

https://hf-files-oregon.s3.amazonaws.com/hdpepaydaysupport_kb_attachments/2023/05-23/1f292dd3-3a53-4907-9002-09257760ca09/Laundry_Allowance_Approved_Uniform__ATO_Measure_SW__OTE.png

Home Living Laundry Vinyl Decals Laundry Decorations Laundry Laundry

https://wildeyessigns.com/wp-content/uploads/2018/08/hh2236-Laundry-room-help-needed-apply-wtthin-APROOF..jpg

https://community.ato.gov.au/s/question/a0J9s0000001HO1

A laundry allowance is a taxable allowance meaning it must be shown on your tax return as assessable income Your employer may also be required to withhold

https://taxscouts.com/expenses/how-mu…

How much can I claim for laundry expenses self employed one of our most commonly asked questions The answer is that it depends on a few things In certain industries you can claim a flat

Allowances Family Money Values

Laundry Allowance Approved Uniform ATO Measure S W OTE E

Laundry A How To Not Guide Delaney Lundquist

Miele APCL 094 Laundry Tub Red

Laundry Allowance Private Purposes S W OTE E PayDay Support

What Are De Minimis Benefits AccountablePH

What Are De Minimis Benefits AccountablePH

Detergent Laundry Free Stock Photo Public Domain Pictures

Lifetime Allowance Explained Cardens For Pensions

Laundry Link Newsom s French Laundry Dining Companion Barred From

Is Laundry Allowance Taxable - Allowances If you receive an allowance from your employer for laundry expenses you can only claim a deduction for the amount you actually spent not the amount of the