Is Lic Income Taxable These new guidelines have come after Budget 2023 made the life insurance maturity amount taxable if the premium paid in a financial year exceeds Rs 5 lakh

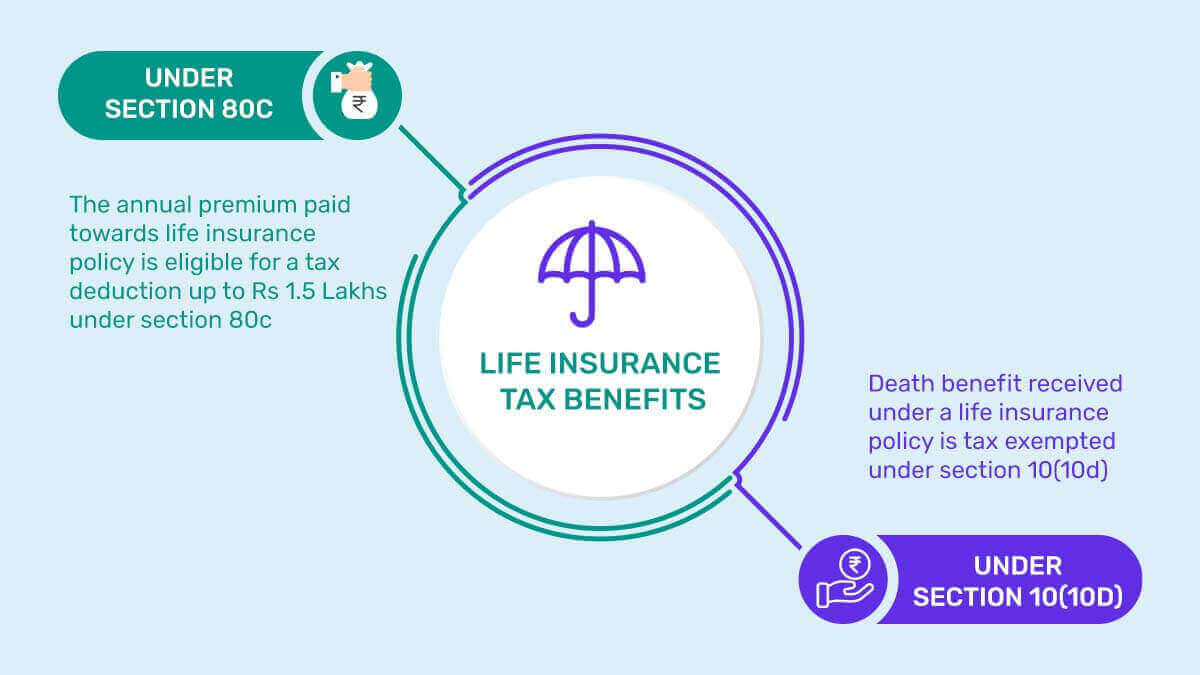

Discover the tax benefits of LIC insurance plans Maximize your savings with comprehensive policies that offer financial security and tax advantages Tax Implications on LIC Maturity Benefit The entire amount that you will receive as a maturity benefit from a LIC life insurance policy is tax free This includes the total bonus

Is Lic Income Taxable

Is Lic Income Taxable

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

Easy Ways To Reduce Your Taxable Income In Australia Tax Warehouse

https://www.taxwarehouse.com.au/wp-content/uploads/money-1673582_1280-1024x769.png

Is LIC Maturity Amount Taxable Or Not Learn About Which Life

https://www.paybima.com/blog/wp-content/uploads/2023/04/Is-LIC-Maturity-Amount-Taxable-or-Not-Cover-Image-1.jpg

Amount received from life insurance companies including bonus is tax free u s 10 10D of the Income Tax Act 1961 except following receipt a any sum received u s 80DD 3 The taxability of the LIC Life Insurance Corporation maturity amount is a critical aspect that policyholders need to understand Whether the LIC maturity amount is taxable

Deduction from total income up to Rs 75000 is allowable on amount deposited with LIC under Jeevan Aadhar Jeevan Vishwas plan for maintenance of a handicapped 3 conditions under which the LIC maturity benefit is not taxable Apart from the conditions mentioned above the maturity amount in the rest of the conditions come under the

Download Is Lic Income Taxable

More picture related to Is Lic Income Taxable

85k Salary Effective Tax Rate V s Marginal Tax Rate KR Tax 2024

https://kr.icalculator.com/img/og/KR/100.png

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

Life Insurance Tax Benefits In India 2024 PolicyBachat

https://www.policybachat.com/ArticlesImages/1165.jpg

However it s crucial to understand the tax implications of the LIC Life Insurance Corporation maturity amount In this article we will delve into the tax benefits and LIC Policy List Check out the complete list of best LIC policies for girl and boy child tax benefits senior citizens middle class family and policy with high returns The Life

Under section under section 194DA of the Act a person is obliged to deduct tax at source if it pays any sum to a resident under a life insurance policy which is not exempt under The tax benefit is available in terms of income tax deduction and income tax exemption Provisions of section 80C offer the income tax deduction whereas provisions of section

60k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

https://bi.icalculator.com/img/og/BI/100.png

Income Tax Overview Booklet CIBC Private Wealth Page 2

https://view.publitas.com/39896/1424428/pages/d646d165-01a2-40c3-ab00-9956e1989714-at1600.jpg

https://economictimes.indiatimes.com/wealth/tax/...

These new guidelines have come after Budget 2023 made the life insurance maturity amount taxable if the premium paid in a financial year exceeds Rs 5 lakh

https://licindia.in/tax-benefit

Discover the tax benefits of LIC insurance plans Maximize your savings with comprehensive policies that offer financial security and tax advantages

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

60k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Taxable Income Calculator India

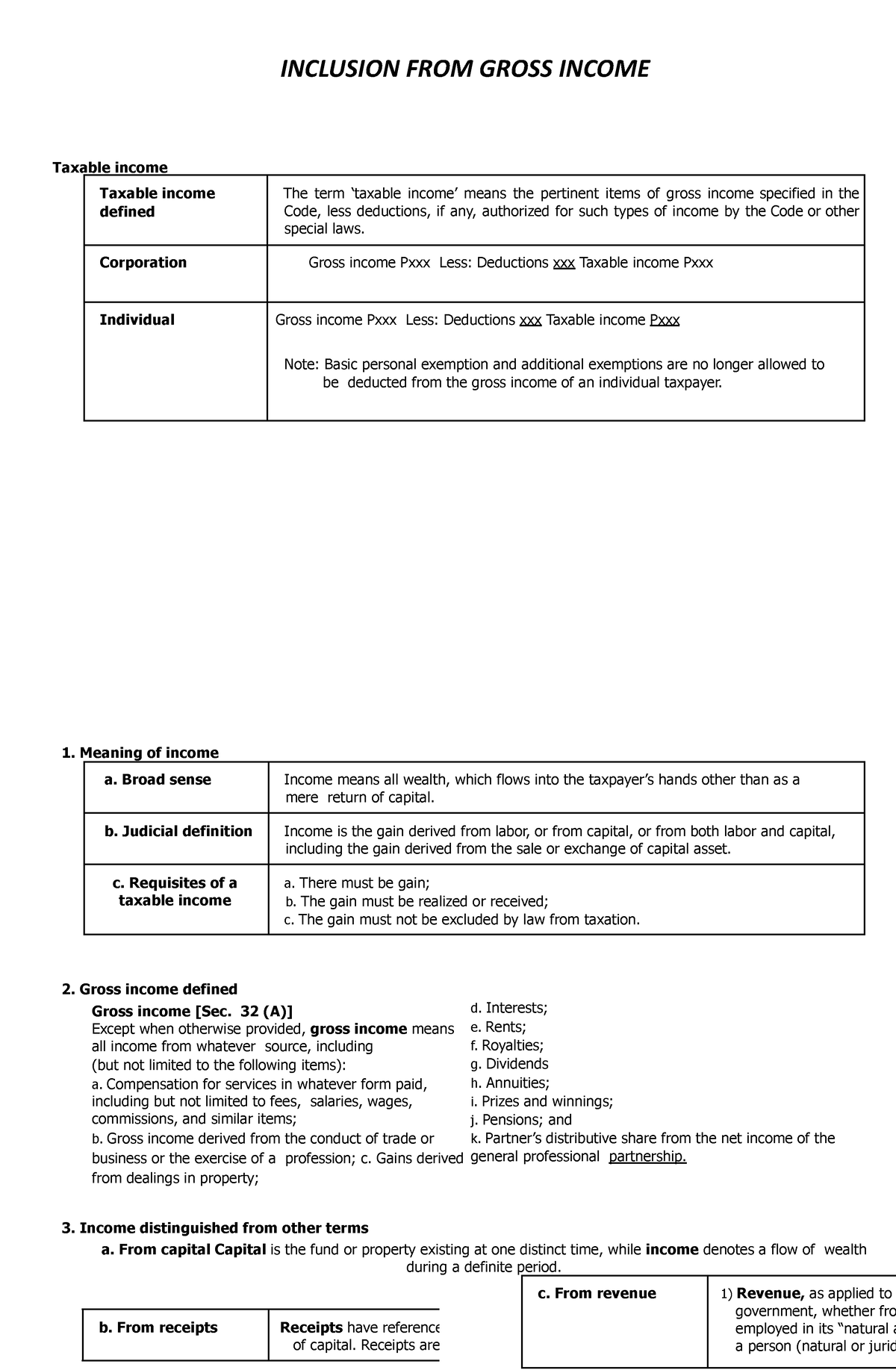

Inclusion Of Gross Income INCLUSION FROM GROSS INCOME Taxable Income

What Is Taxable Income Explanation Importance Calculation Bizness

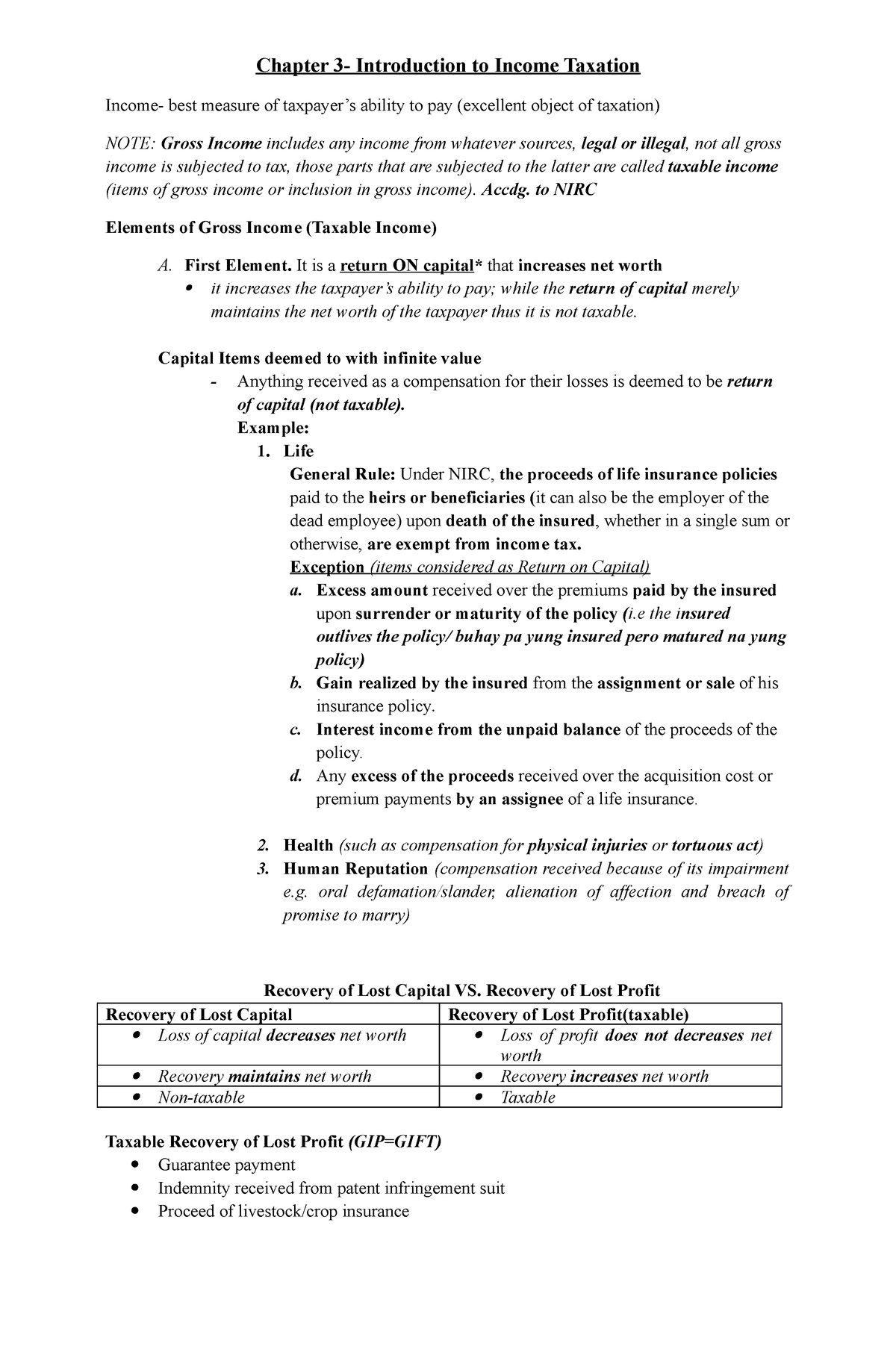

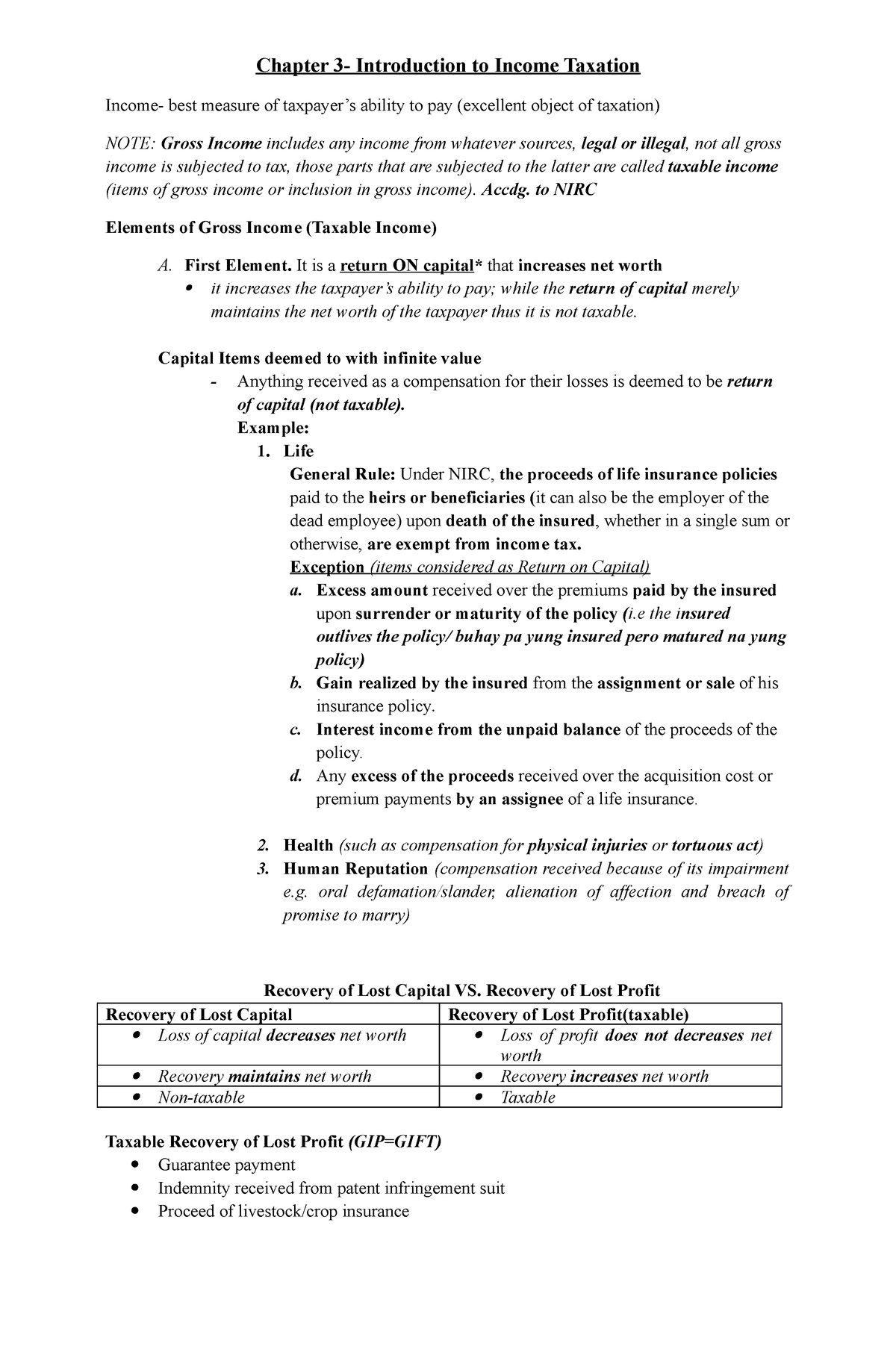

Chapter 3 Introduction To Income Taxation Accdg To NIRC Elements

Chapter 3 Introduction To Income Taxation Accdg To NIRC Elements

What State Benefits Are Taxable

Income Tax Rates Free Of Charge Creative Commons Green Highway Sign Image

8 Brilliant Passive Income Ideas With No Money Passive Income Wise

Is Lic Income Taxable - 3 conditions under which the LIC maturity benefit is not taxable Apart from the conditions mentioned above the maturity amount in the rest of the conditions come under the