Is Malta Tax Free Is Malta a traditional tax free jurisdiction in today s world Definitely not it has some of the highest on paper tax rates in the world But there are some very attractive tax advantages in Malta and we ll thoroughly outline them in this article

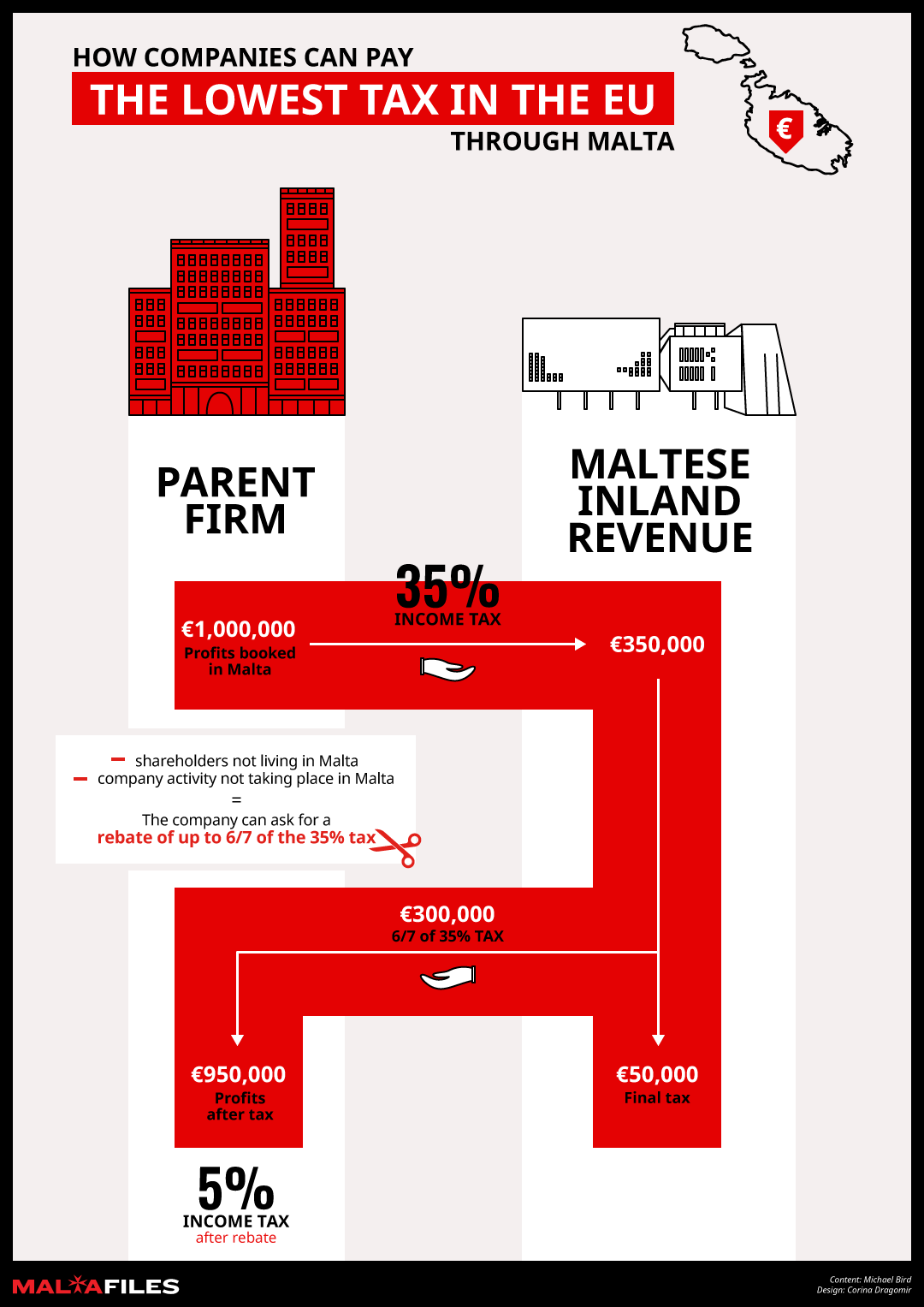

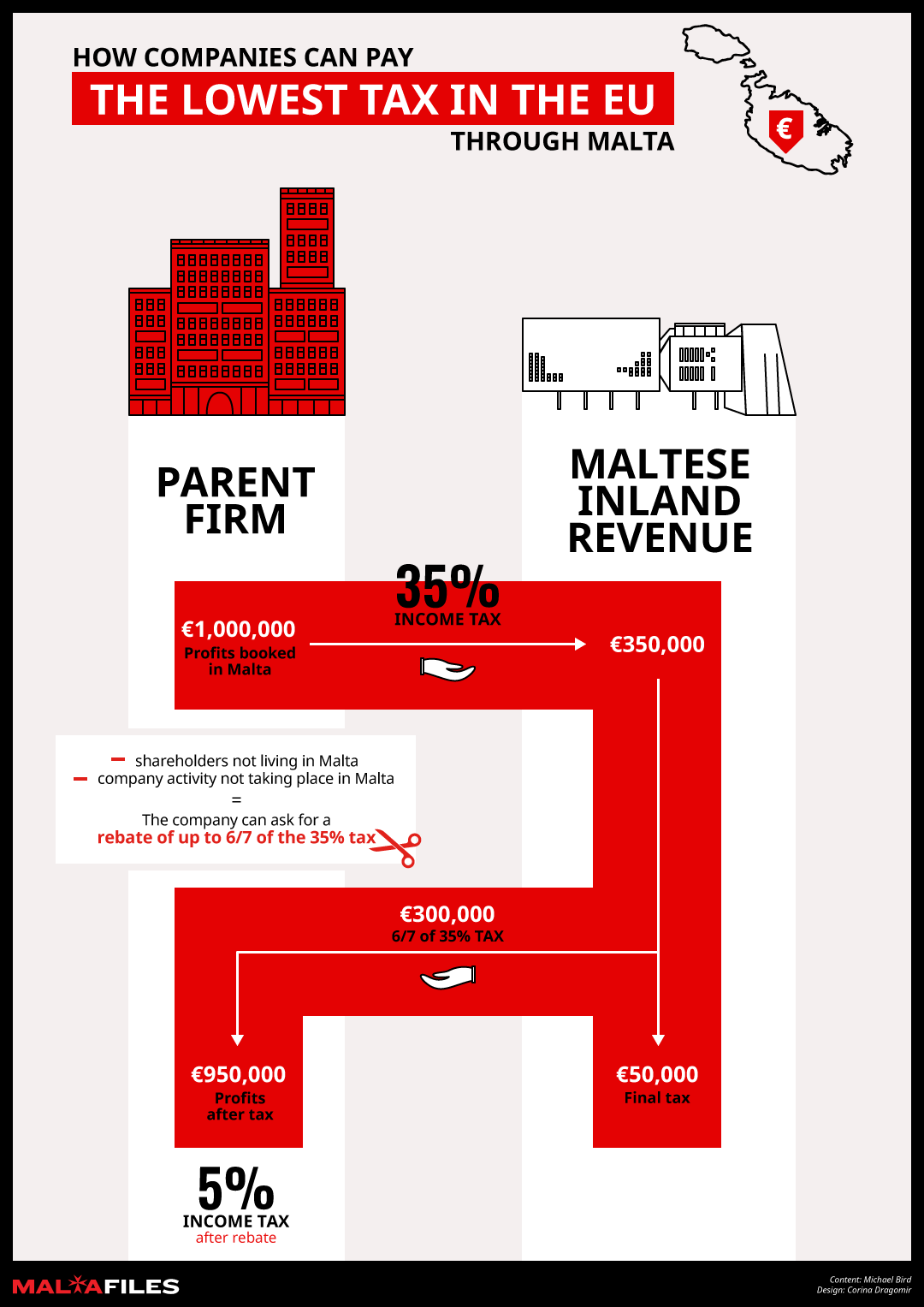

Malta exhibits some features associated with tax havens but doesn t fully fit the traditional definition The country maintains a nominal corporate tax rate of 35 which appears high However tax refund schemes can effectively reduce this to No Malta is not a tax free haven but it is undoubtedly a low tax jurisdiction

Is Malta Tax Free

Is Malta Tax Free

https://www.relocateandsave.org/wp-content/uploads/2021/11/zoltan-tasi-nMFMlK4XpQU-unsplashmalta1-2048x1249.jpg

Malta s Tax System Explained Malta Guides

https://maltaguides.co/wp-content/uploads/2019/03/malta-tax-system.jpg

File Malta Mdina BW 2011 10 05 12 41 38 JPG Wikipedia

http://upload.wikimedia.org/wikipedia/commons/9/9c/Malta_Mdina_BW_2011-10-05_12-41-38.JPG

Any person who is ordinarily resident in Malta but not domiciled in Malta is taxable only on income arising in Malta and on any foreign income remitted to Malta i e on income and chargeable gains arising in Malta and on income outside Malta that is received in Malta Malta does not impose inheritance wealth or annual property taxes making it an attractive destination for tax planning Foreign income sourced outside Malta is tax free and capital gains from outside Malta are also excluded from taxation

Malta is a very tax friendly country regarding taxes and social contributions paid by companies In Malta the tax rate for corporate income is 35 The same tax rate applies to branches and subsidiaries of foreign companies Maltese residents pay personal income tax on worldwide income at progressive rates from 0 to 35 However Malta s remittance based tax system a legacy of its British colonial past provides significant advantages for foreigners

Download Is Malta Tax Free

More picture related to Is Malta Tax Free

Taxes In Malta Changes If 2023

https://immigrantinvest.com/wp-content/uploads/2021/12/tax-changes-in-malta-image2.jpg

How To Apply Tax ID In Malta Malta Tax Rates Income Tax Malta Social

https://i.ytimg.com/vi/PcEPfwVBE18/maxresdefault.jpg

Tax Benefits In Malta Company In Malta

https://company-in-malta.com/wp-content/uploads/image-13-660x200.jpg

In general terms Malta taxes worldwide income i e all income received at a progressive rate of 0 to 35 The brackets work as follows 35 for amounts over 60 000 Additionally under exceptional circumstances of the non dom regimes a flat tax of 15 is applied only to foreign income remitted to Malta with a minimum taxation of 5 000 euros One of the main attractions of Malta is its corporate tax system that allows some companies to reduce their effective tax rate to as low as 5 for foreign shareholders While the headline corporate tax rate is 35 Malta offers a refundable tax credit system

[desc-10] [desc-11]

Malta Tax And Residency Requirements 2023

https://www.relocateandsave.org/wp-content/uploads/2021/11/alexander-serzhantov-96QncT4b8co-unsplashmalta-2-2048x1360.jpg

Malta Company Malta Tax Malta Tax Refund Malta Tax Planning

https://nebula.wsimg.com/c812812d9a352587d36df5741b47b86a?AccessKeyId=AB4D0A7FD4E991030CE0&disposition=0&alloworigin=1

https://maltaguides.co › tax › haven

Is Malta a traditional tax free jurisdiction in today s world Definitely not it has some of the highest on paper tax rates in the world But there are some very attractive tax advantages in Malta and we ll thoroughly outline them in this article

https://www.offshore-protection.com › malta

Malta exhibits some features associated with tax havens but doesn t fully fit the traditional definition The country maintains a nominal corporate tax rate of 35 which appears high However tax refund schemes can effectively reduce this to

Malta Tax Tax Planning Income Tax Value Added Tax

Malta Tax And Residency Requirements 2023

Taxes In Malta Malta Guide Expat

How Does The Malta Tax System Work Learn More With A Tax Consultant

Malta Tax Focus For Business And Indivduals Papilio Services

Cash Loans Czar s Maltese Tax Escape Plan

Cash Loans Czar s Maltese Tax Escape Plan

Malta Tax Rates Dates 2019 ACT

11 Best Things To Do In Malta 2022 Travel Guide Salt In Our Hair

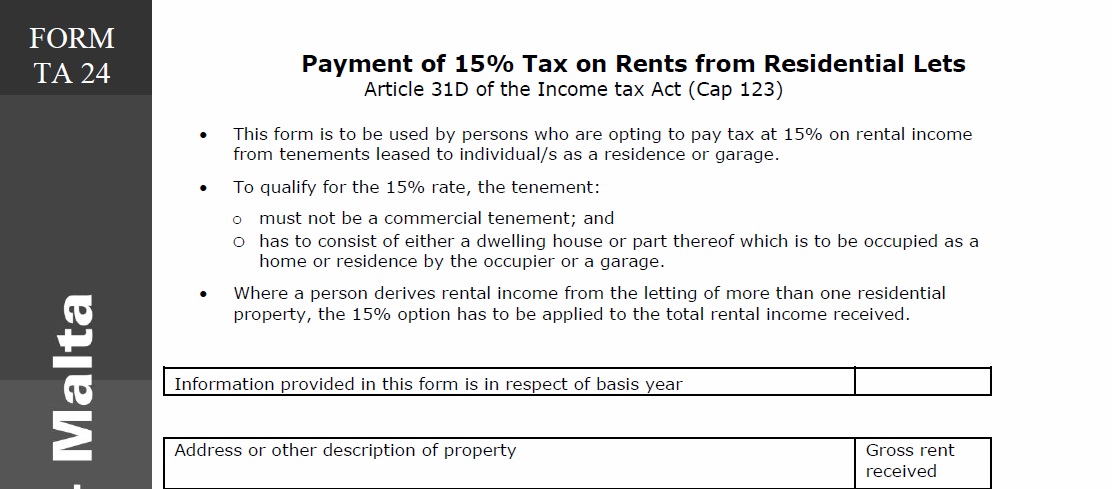

MALTA Tax On Residential Rentals 2015 TA24 30th June 2016

Is Malta Tax Free - [desc-13]