Is Medical Insurance Tax Deductible Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath

For taxpayers who itemize deductions premiums can be included as part of medical expenses on Schedule A However only the portion of medical expenses exceeding 7 5 of adjusted gross income AGI is deductible This threshold often limits the benefit for You typically can t claim a medical expense deduction for health insurance premiums if you get coverage through your employer but tax deductions are available for medical expenses

Is Medical Insurance Tax Deductible

Is Medical Insurance Tax Deductible

https://help.taxreliefcenter.org/wp-content/uploads/2018/10/TRC-PIN-Is-Health-Insurance-Tax-Deductible_.png

Is Medical Insurance Tax Deductible Grants For Medical

https://www.grantsformedical.com/wp-content/uploads/2022/11/Is-Medical-Insurance-Tax-Deductible-777x437.jpg

Is Medical Insurance Tax Deductible In Canada Insurdinary

https://www.insurdinary.ca/wp-content/uploads/2021/03/medical-insurance-deductible.jpeg

Generally premiums for plans purchased through the Health Insurance Marketplace employer sponsored plans and certain private policies can be deductible However eligibility depends on the plan and the taxpayer s circumstances It is tax deductible a hospital plan is not a medical insurance plan and will still be deductible as you had before Who told you it was not tax deductible I was advised this directly by Liberty In general this specific policy hospital plan can not be obtained in SA anymore apparently I have had it since 2004 and it ceases in 2041

Health insurance premiums can generally be paid with pre tax dollars For most people this means that their employer sponsored health insurance is deducted from their paycheck pre tax and nothing further has to be done on their tax return Is health insurance tax deductible Health insurance premiums are deductible on federal taxes in some cases as these monthly payments are classified as medical expenses Generally if you pay for medical insurance on your own you can deduct the

Download Is Medical Insurance Tax Deductible

More picture related to Is Medical Insurance Tax Deductible

Is Medical Insurance Tax Deductible Grants For Medical

https://www.grantsformedical.com/wp-content/uploads/2022/11/Is-Medical-Insurance-Tax-Deductible-Medical-Insurance.jpg

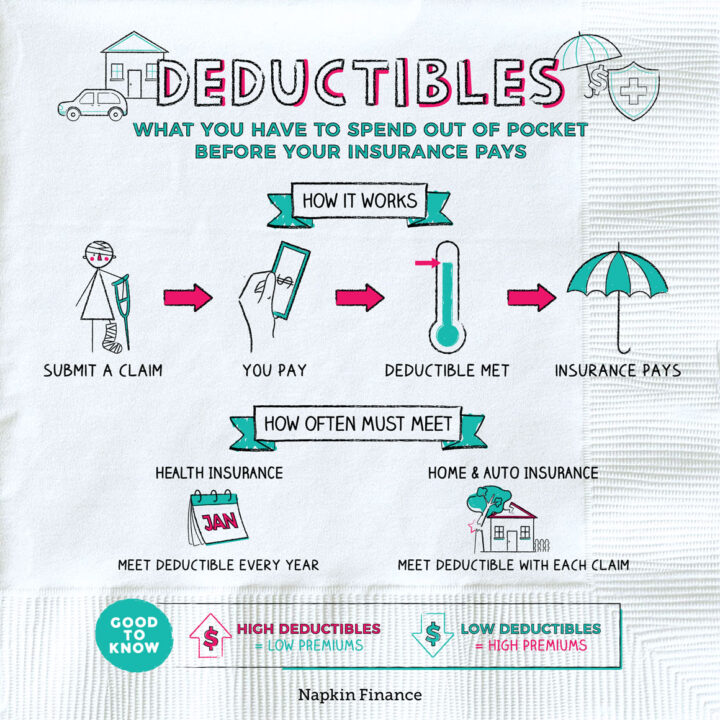

What Is An Insurance Deductible Napkin Finance

https://napkinfinance.com/wp-content/uploads/2016/12/NapkinFinance-Deductibles-Napkin-06-24-20-v04-720x720.jpg

Is Health Insurance Tax Deductible Get The Answers Here

https://help.taxreliefcenter.org/wp-content/uploads/2018/10/written-word-tax-deductible-on-red-is-health-insurance-tax-deductible-ss.jpg

Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction Yes it probably is so if you pay an insurance premium you should check and see whether you can use it to get a tax deduction As we enter tax season it s more important than ever to know if insurance is tax deductible but different types of insurance might deal with tax deductions differently

[desc-10] [desc-11]

Are Health Insurance Premiums Tax Deductible

https://www.insurance.com/imagesvr_ce/3814/Upload.png

Is Health Insurance Tax Deductible YouTube

https://i.ytimg.com/vi/iXIVPzjnBss/maxresdefault.jpg

https://www.forbes.com › advisor › health-insurance › is...

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath

https://accountinginsights.org › can-you-deduct...

For taxpayers who itemize deductions premiums can be included as part of medical expenses on Schedule A However only the portion of medical expenses exceeding 7 5 of adjusted gross income AGI is deductible This threshold often limits the benefit for

Medical Insurance Is Medical Insurance Tax Deductible

Are Health Insurance Premiums Tax Deductible

Is Health Insurance Tax Deductible For Self Employed International

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

Is Your Auto Insurance Tax Deductible Answer At Good To Go Insurance

Is Medical Insurance Tax Deductible Build A Spreadsheet To Help You

Is Medical Insurance Tax Deductible Build A Spreadsheet To Help You

Tax Deductions You Can Deduct What Napkin Finance

Is Car Insurance Tax Deductible Explore All Insights

Premiums Deductibles Copay s How It All Works

Is Medical Insurance Tax Deductible - Generally premiums for plans purchased through the Health Insurance Marketplace employer sponsored plans and certain private policies can be deductible However eligibility depends on the plan and the taxpayer s circumstances