Is Mileage Reimbursement Taxable The answer is it depends Typically the reimbursement stays non taxable as long as the mileage rate used for reimbursement does not exceed the IRS standard business rate 0 655 mile for 2023 But this assumes that other rules are being followed to make the reimbursement part of an accountable plan

If these conditions are met your employer doesn t have to report the reimbursements as taxable wages on your W 2 which means you don t pay income tax on them But since you receive tax free mileage reimbursements it means you re precluded from also taking a deduction for the same mileage expenses When Is a Car Allowance or Mileage Rate Taxable Income Written by mBurse Team Member Sep 4 2023 8 00 00 AM 2 min read CATEGORIES Company Car Allowance Both employers and employees often ask us whether their car allowance or mileage reimbursement should be taxed Here s a typical question and how we answer it

Is Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

https://www.motus.com/wp-content/uploads/2022/02/is-mileage-reimbursement-taxable-header.jpg

Is Mileage Reimbursement Taxable Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/110/22/71417548.jpg

What Is The IRS Mileage Rate Tax Deduction For 2020 2021 YouTube

https://i.ytimg.com/vi/ZDIMBlW26Q0/maxresdefault.jpg

In general mileage reimbursements are not taxable if they follow IRS rules which we will get to in a bit But if the employer reimburses based on a flat rate higher than the IRS rate you might owe tax on the extra amount Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans Moses Balian Jul 28 2023 4 minutes Table of Contents No matter whether a company is big or small every business incurs costs and expenses that may reduce the business taxable income

If the reimbursement amount is at the standard IRS there won t be any tax implications However if your employer reimburses you at a higher rate the excess will be considered taxable income for you In other words your company is paying you more than what the IRS determines is the cost per mile The business mileage rate for 2024 is 67 cents per mile You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents per mile rule to value the personal use of a vehicle you provide to an employee See Cents Per Mile Rule in section 3

Download Is Mileage Reimbursement Taxable

More picture related to Is Mileage Reimbursement Taxable

Does Mileage Reimbursement Get Taxed MileIQ

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/624af9297972108fa2ab6f5c_emrecan-arik-dgquDmlhRAI-unsplash.jpg

Is Employee Mileage Reimbursement Taxable

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Is employee mileage reimbursement taxable_featured.jpg#keepProtocol

Mileage Reimbursement Rate Increases On July 1 HRWatchdog

https://hrwatchdog.calchamber.com/wp-content/uploads/EmployeeMileageReimburse.jpg

The short answer is yes mileage reimbursement is taxable if the reimbursement rate exceeds the IRS rate set at 62 5 cents per mile for 2022 When an employer reimburses at 62 6 cents per mile or above each reimbursement will be taxable This raises questions about mileage reimbursement in general Current Tax Deductible Mileage Rates How much you can deduct for mileage depends on the type of driving you did Business mileage is most common but you can also deduct mileage accrued

[desc-10] [desc-11]

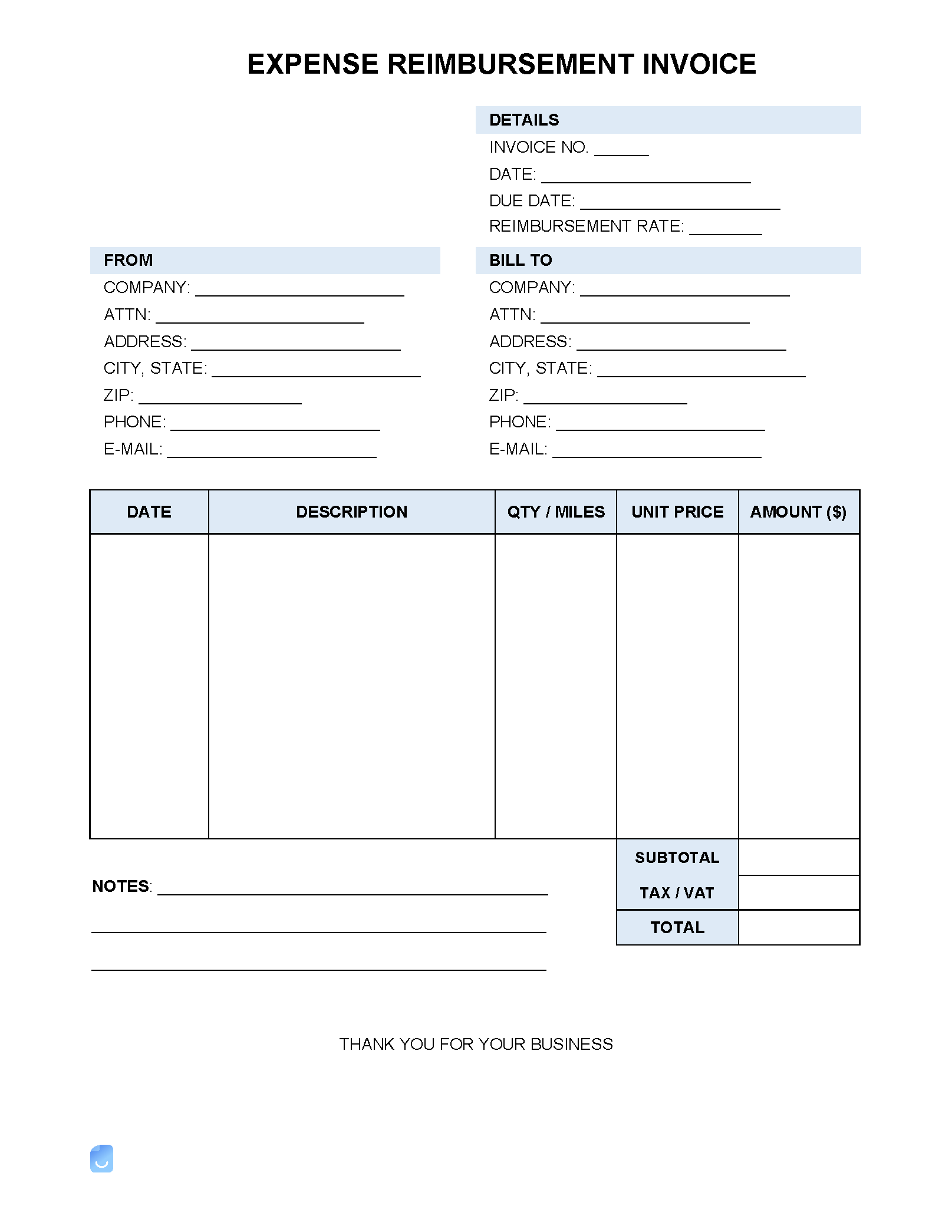

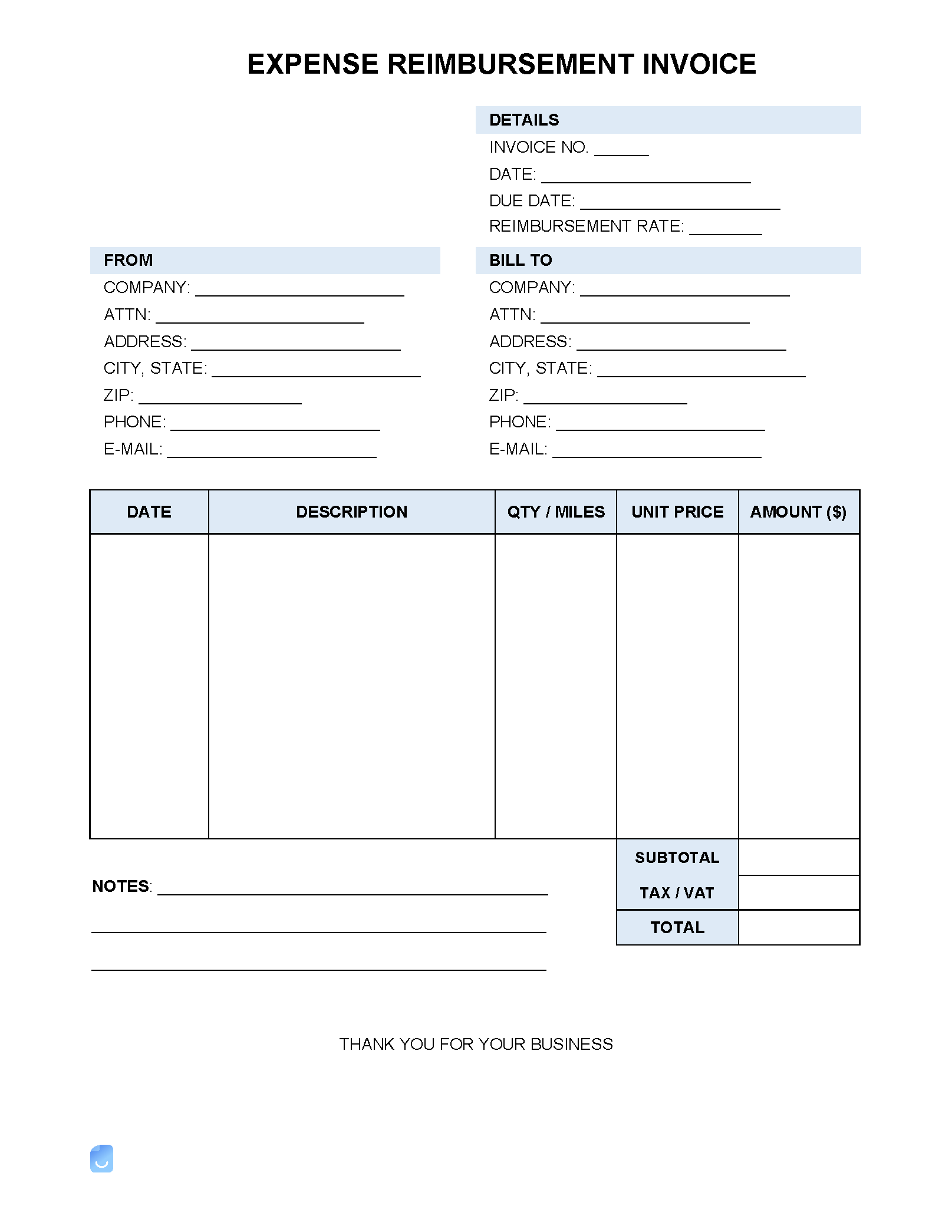

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

Is Mileage Reimbursement Considered Taxable Income TripLog

https://triplogmileage.com/wp-content/uploads/2021/02/mileage-reimbursement-taxable-triplog.jpg

https://www.mburse.com/blog/is-a-mileage-reimbursement-taxable

The answer is it depends Typically the reimbursement stays non taxable as long as the mileage rate used for reimbursement does not exceed the IRS standard business rate 0 655 mile for 2023 But this assumes that other rules are being followed to make the reimbursement part of an accountable plan

https://turbotax.intuit.com/tax-tips/jobs-and-career/federal-tax...

If these conditions are met your employer doesn t have to report the reimbursements as taxable wages on your W 2 which means you don t pay income tax on them But since you receive tax free mileage reimbursements it means you re precluded from also taking a deduction for the same mileage expenses

Mileage Reimbursement Workers Compensation Attorney Work Accident

Expense Reimbursement Invoice Template Invoice Maker

Federal Mileage Reimbursement IRS Mileage Rate 2021

Accounting For Mileage Reimbursements From Ministry Staff

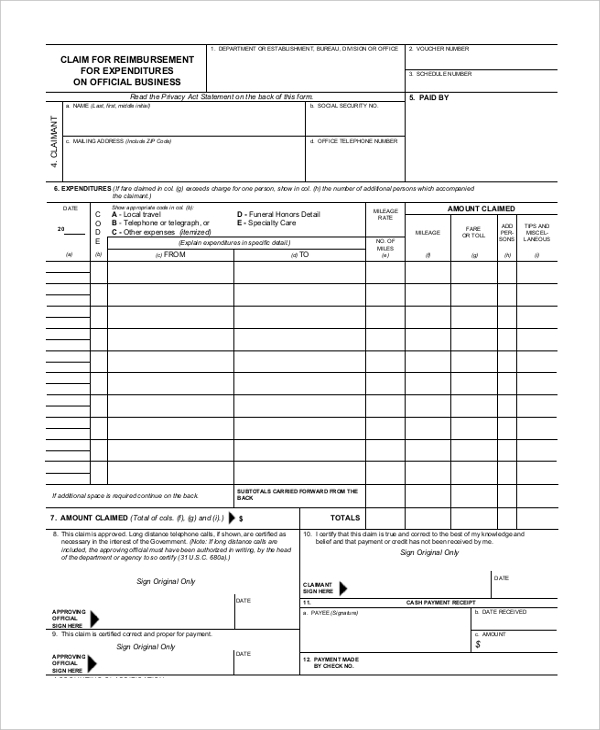

Reimbursement Form Template IRS Mileage Rate 2021

How To Get Your Mileage Reimbursement For Travel Expenses In Virginia

How To Get Your Mileage Reimbursement For Travel Expenses In Virginia

Mileage Reimbursement A Complete Guide TravelPerk

Is A Mileage Reimbursement Taxable

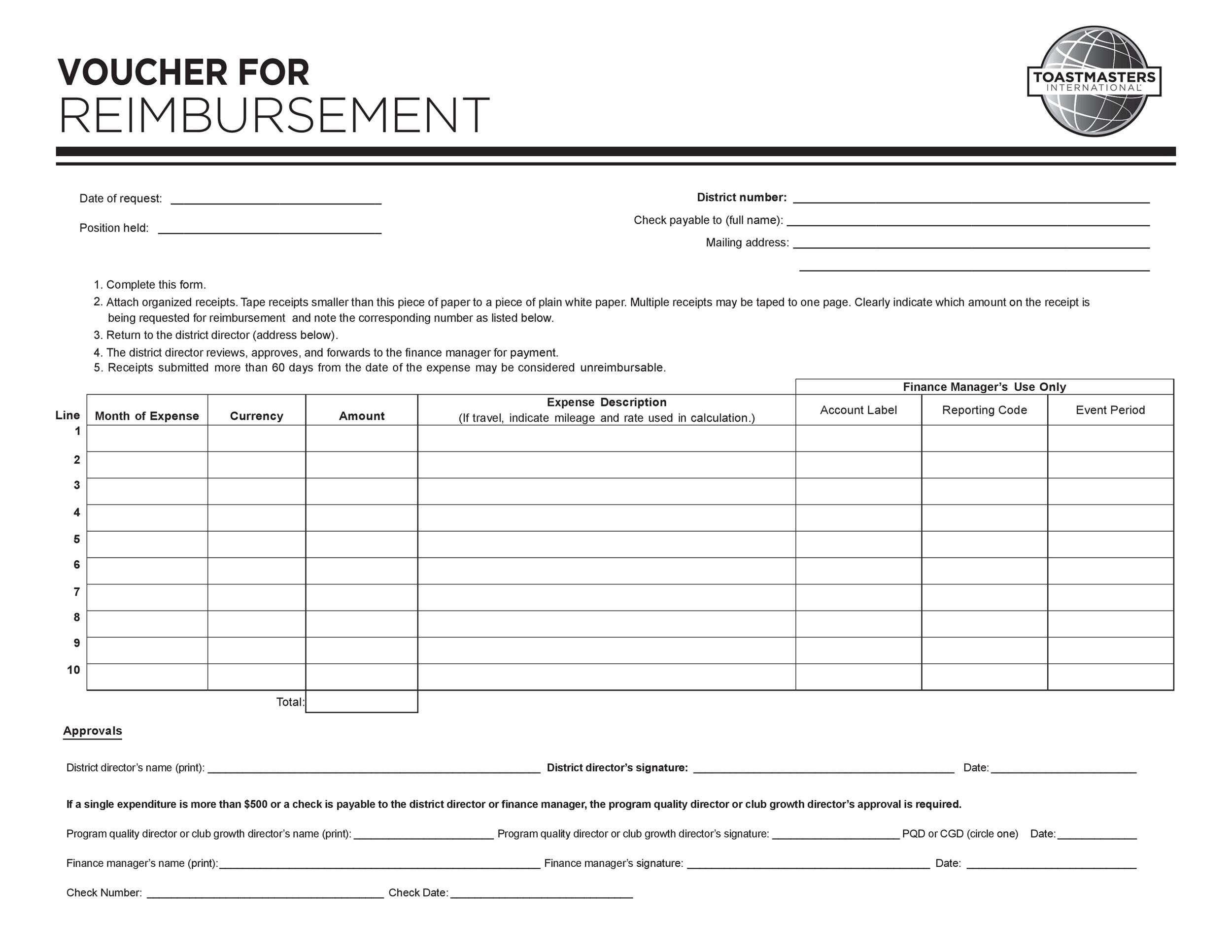

9 Free Mileage Reimbursement Forms To Download PerformFlow

Is Mileage Reimbursement Taxable - In general mileage reimbursements are not taxable if they follow IRS rules which we will get to in a bit But if the employer reimburses based on a flat rate higher than the IRS rate you might owe tax on the extra amount