Is Military Pension Taxable In Maryland According to the Maryland Department of Revenue you can subtract up to 12 500 of your military retirement income including death benefits from your federal adjusted gross if

Other states considering amended tax policies toward military retirement pay include Oregon New Mexico and Maryland States That Don t Tax Military Retirement Military personnel who develop a state income tax liability in Maryland automatically develop a local income tax liability in Maryland Military personnel can often avoid owing

Is Military Pension Taxable In Maryland

Is Military Pension Taxable In Maryland

https://irstaxtrouble.com/wp-content/uploads/sites/5/2022/04/military-disability-pay-1568x1045.jpg

Wait Is Military Retirement Pay Taxable Or Not Article The United

https://api.army.mil/e2/c/images/2019/04/30/551375/original.jpg

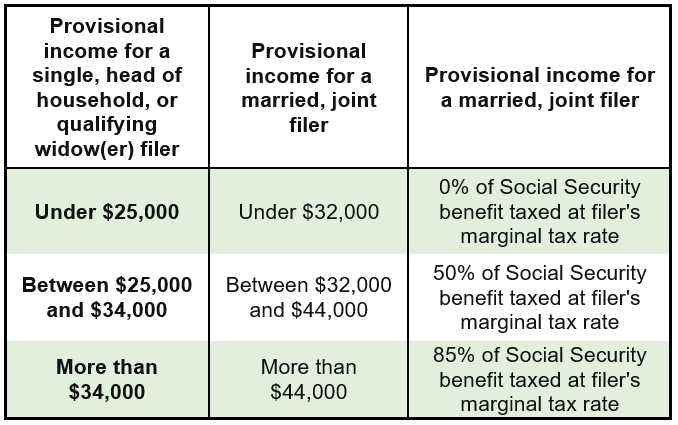

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Included among Governor Moore s champion pieces of legislation signed today are H B 554 S B 553 Keep Our Heroes Home Act increases the military retirement income tax exemption for Military personnel who are legal residents of Maryland without overseas pay must file a resident return Form 502 and report all income from all sources wherever earned

If you are a nonresident of Maryland stationed in Maryland on military orders the active duty military pay is not taxable on your return Any other income earned while in Maryland The law will exempt up to 20 000 of military retirement income for Maryland residents who are 55 and older It will exempt up to 12 500 for retirees who are

Download Is Military Pension Taxable In Maryland

More picture related to Is Military Pension Taxable In Maryland

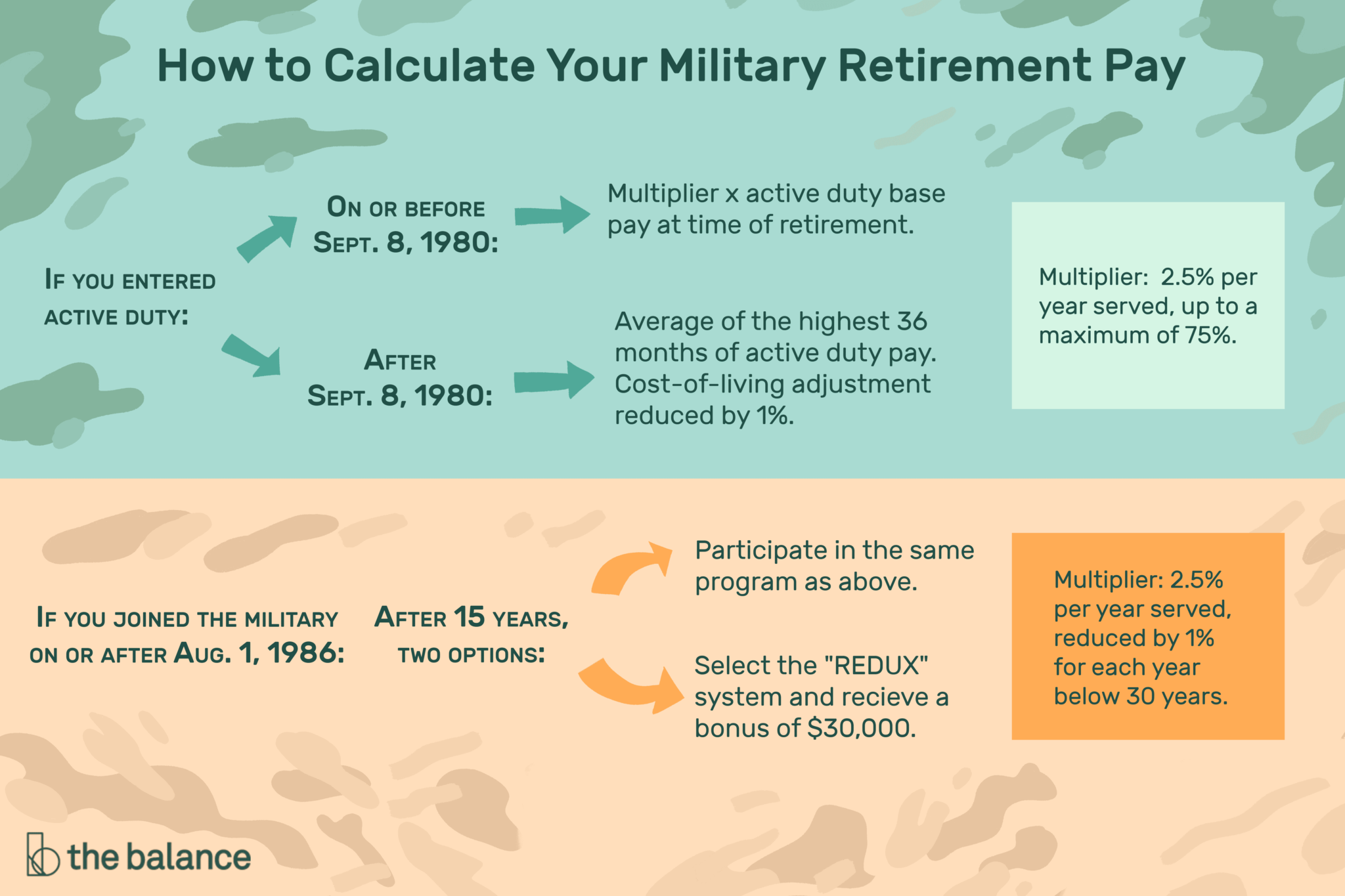

Average Federal Tax Rate On Military Retirement Pay Military Pay

https://military-paychart.com/wp-content/uploads/2020/12/understand-the-military-retirement-pay-system-2048x1365.png

Are Workers Comp Awards Taxable In Maryland Maryland Law Firm

https://www.pinderplotkin.com/wp-content/uploads/2018/11/taxable.jpg

Workers Pension Fund Not For Borrowing NLC Warn Governors

https://lawcarenigeria.com/wp-content/uploads/2020/12/pension-e1562619027391.jpg

Maryland Starting in the 2023 tax year up to 12 500 of military retirement income is exempt for taxpayers up to age 55 and up to 20 000 is exempt for taxpayers 55 and older Montana Currently Military Pay Active Duty Pay Up to 15 000 may be exempt if total military pay is less than 30 000 Military Retirement Pay May be eligible for 12 500 exclusion if under

Maryland is one of just 14 states that does not have a complete exemption of military retirement income from taxation West Virginia and Retired pay like other income is subject to Federal income taxation unless wholly or partially exempted by statute

Is Pension Taxable Max Life Insurance

https://www.maxlifeinsurance.com/content/dam/corporate/images/Is-Pension-Taxable-2.png

Is Pension Taxable In India All You Need To Know

https://trendtalky.com/wp-content/uploads/2018/09/Webp.net-resizeimage-2.jpg

https://support.taxslayer.com/hc/en-us/articles/360029125731

According to the Maryland Department of Revenue you can subtract up to 12 500 of your military retirement income including death benefits from your federal adjusted gross if

https://themilitarywallet.com/military-retirement-pay-tax-exempt

Other states considering amended tax policies toward military retirement pay include Oregon New Mexico and Maryland States That Don t Tax Military Retirement

Account Based Pension Versus Accumulation Account Retirement

Is Pension Taxable Max Life Insurance

Are Maryland State Pension Benefits Taxable Finance Zacks

It s Time To Reform Lavish Military Pensions Foundation For Economic

Is My Pension Taxable

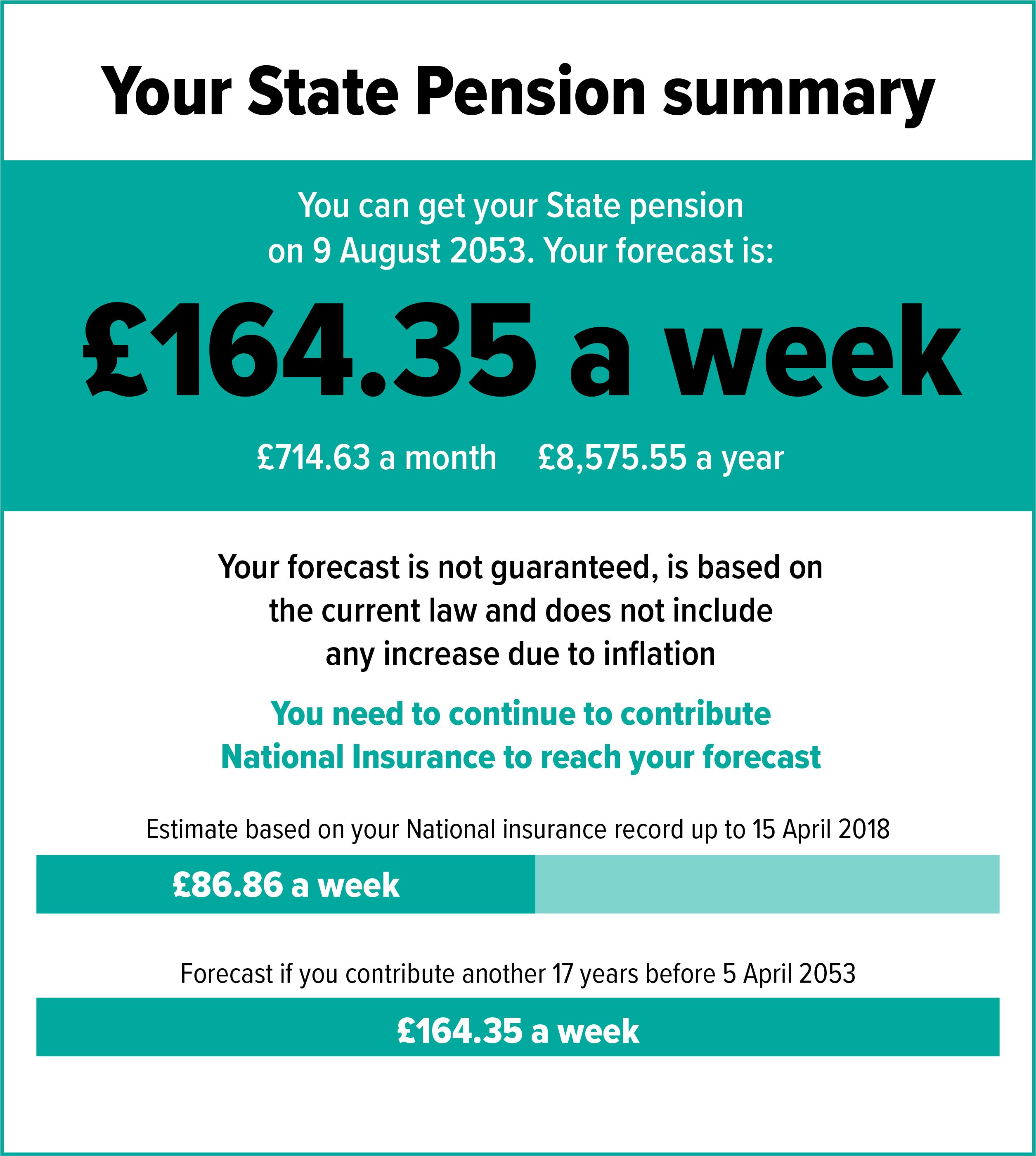

Your State Pension Forecast Explained Which

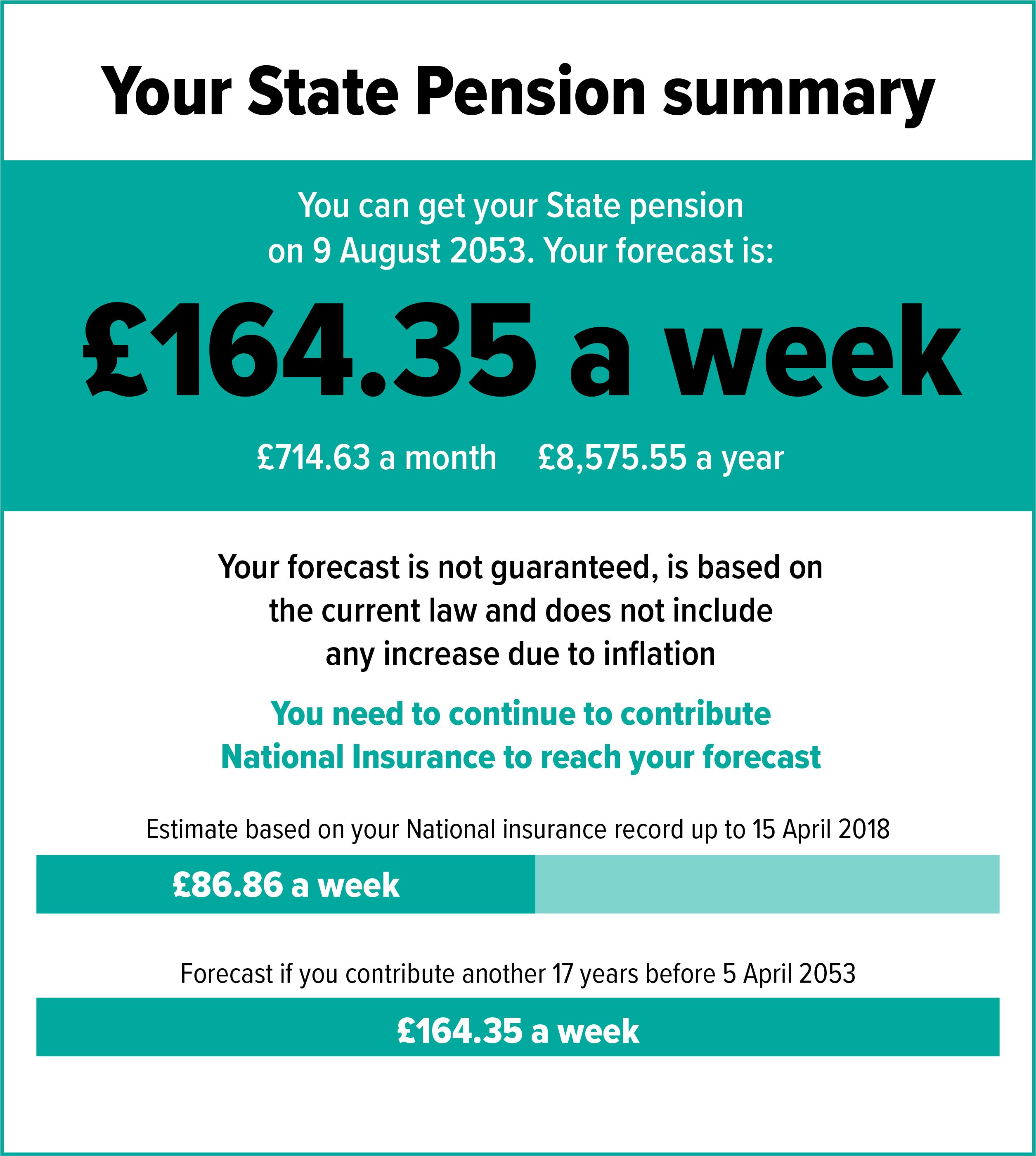

Your State Pension Forecast Explained Which

Is A Wrongful Death Settlement Taxable In Maryland

For About 2000 A Fed Can Buy Back Their 4 Year Military Service Time

Maryland Determines SaaS Is Subject To Sales Tax Anrok

Is Military Pension Taxable In Maryland - Is Military Retirement Pay Taxed in Maryland While military retirement pay is fully taxable in Maryland there are some tax deductions and exclusions available for military retirees