Is Military Retirement Taxable In Indiana Pay for working in the military is taxed in Indiana though there is a 5 000 deduction for many personnel Military retirement benefits and surviving spouse benefits will soon be exempt from taxes Gov Eric Holcomb signed a law in 2019 that phases out any taxes on those benefits by 2022

As recently as the 2022 tax year Indiana Nebraska and North Carolina passed laws ending income tax on military retirement pay Military Retirement Income Taxes By State States with a partial exemption on military retirement pay have varying tax policies which are laid out below As of 2022 military retired pay is not taxed at all This means that no part of a veteran s retirement counts as taxable income Indiana is increasing tax exemptions and deductions for veterans with disabilities and military survivor benefits

Is Military Retirement Taxable In Indiana

Is Military Retirement Taxable In Indiana

https://assets.contenthub.wolterskluwer.com/api/public/content/da0fd1b1bf364dfc89ebcfbd8dfc2dab

Wait Is Military Retirement Pay Taxable Or Not Article The United

https://api.army.mil/e2/c/images/2019/04/30/551375/original.jpg

ELECTRONIC LEVY TAXABLE NON TAXABLE ITEMS Agricultural Development

https://agricbank.com/wp-content/uploads/2022/04/E-levy-scaled.jpg

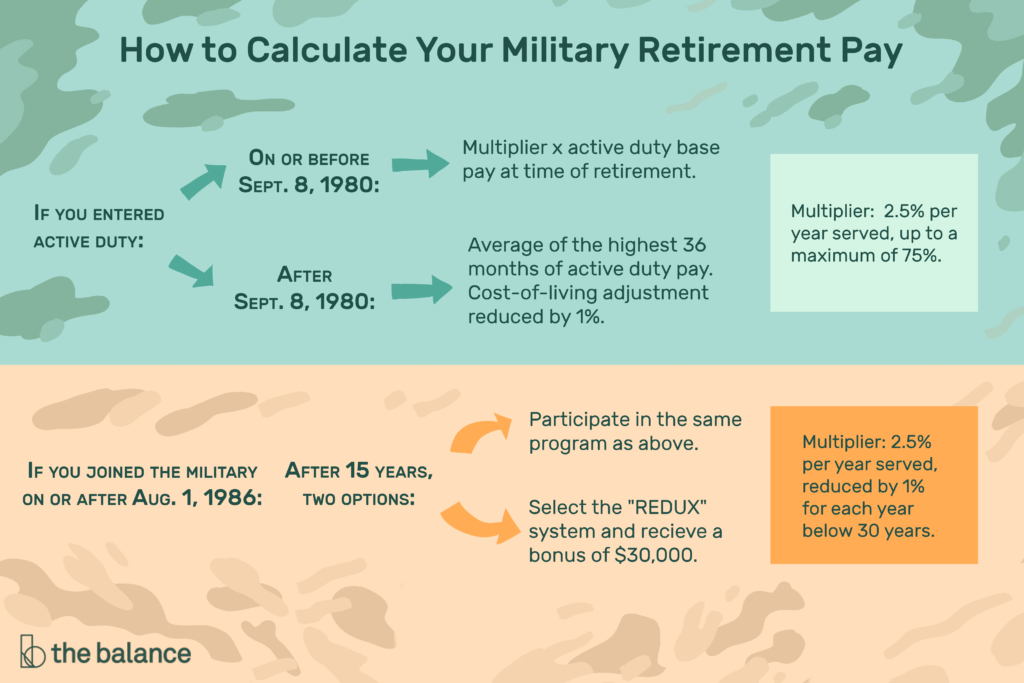

For retirees in general up to 5 060 is exempt if gross income is less than 42 140 for the 2023 tax year Starting in the 2024 tax tear taxpayers ages 65 and over will receive a 5 500 For taxable years beginning after December 31 2017 the maximum allowable deduction for military retirement or survivor s benefits otherwise includible in Indiana adjusted gross income is increased to 6 250 In addition the minimum age requirement for qualification has been eliminated

Hoosier veterans no longer have to pay state taxes on their military retirement benefits INDIANAPOLIS A newly signed law in Indiana will be a big help to military veterans and their spouses by exempting their retirement income and survivors benefits from the state income tax Learn more about the Indiana Income Tax on Military Retired Pay Indiana Nonresident Military Spouse Earned Income Deduction Nonresident military spouses do not have to pay Indiana

Download Is Military Retirement Taxable In Indiana

More picture related to Is Military Retirement Taxable In Indiana

Average Federal Tax Rate On Military Retirement Pay Military Pay

https://military-paychart.com/wp-content/uploads/2020/12/understand-the-military-retirement-pay-system-1024x683.png

Do Veterans Benefits And Military Retirement Pay Count As Income

https://www.navymutual.org/wp-content/uploads/2023/03/VA-Benefits-Taxable-scaled.jpg

Army Retirement Plaque Army Military

https://cdn.shoplightspeed.com/shops/618457/files/17900391/military-service-retirement-plaque-12-x-15.jpg

The Indiana Department of Revenue DOR provides more detailed information for military service members regarding Indiana state taxes for these topics Military issues including residency issues filing due dates deductions credits Filing for an extension Understanding military retirement or survivor s benefits deduction Veterans military pensions will be 100 exempt from Indiana s income tax in the next four years And the state is using that to recruit retiring servicemembers to Indiana

February 19 2024 The Indiana Department of Revenue has announced new tax information for Indiana s military service members New for this year s Indiana individual income tax return is a Members of the military won t have to pay income tax in Indiana starting next year while the rate goes down for all other Hoosiers A bill passed earlier this year exempts

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

Reserve Military Retirement Calculator

https://i2.wp.com/kellybeamsley.com/wp-content/uploads/2017/11/retirement-information.jpg

https://www.wthr.com/article/news/verify/verify...

Pay for working in the military is taxed in Indiana though there is a 5 000 deduction for many personnel Military retirement benefits and surviving spouse benefits will soon be exempt from taxes Gov Eric Holcomb signed a law in 2019 that phases out any taxes on those benefits by 2022

https://themilitarywallet.com/military-retirement-pay-tax-exempt

As recently as the 2022 tax year Indiana Nebraska and North Carolina passed laws ending income tax on military retirement pay Military Retirement Income Taxes By State States with a partial exemption on military retirement pay have varying tax policies which are laid out below

An Overhaul Of The Military Retirement Program Fox Business

Solved Please Note That This Is Based On Philippine Tax System Please

Is Military Retirement Pay Taxable Finance Zacks

How Much Is Military Retirement Worth Calculate Present Value Of

Is Military Retirement Taxable Debunking Common Myths And Exploring

Military Retirement Award Plaque Armed Forces Gift For Retiring From

Military Retirement Award Plaque Armed Forces Gift For Retiring From

Army Retirement Plaque Army Military

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

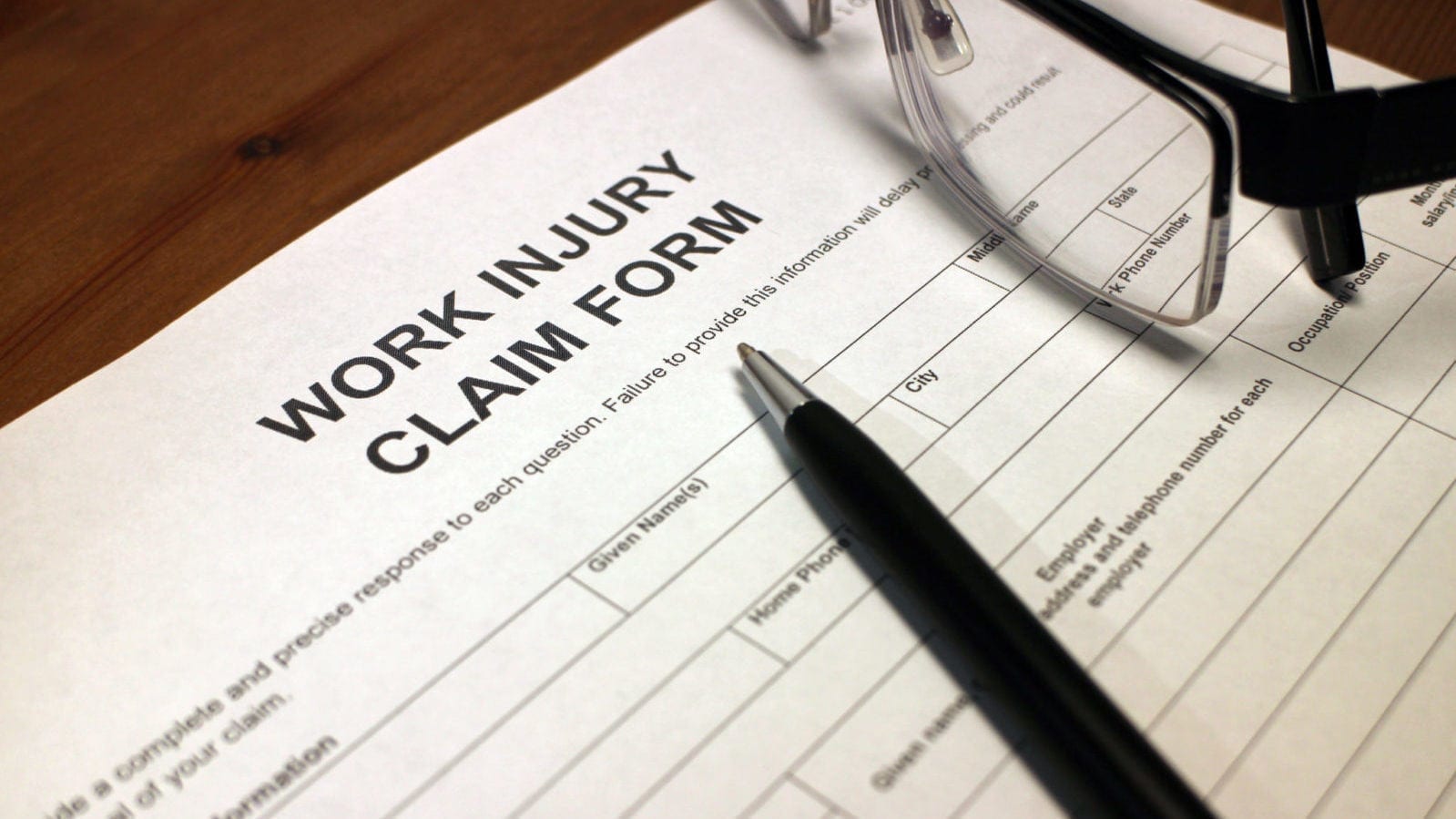

Are My Workers Comp Benefits Taxable In Indiana

Is Military Retirement Taxable In Indiana - INDIANAPOLIS Veterans would pay no state tax on their military retirement income under legislation overwhelmingly approved Tuesday by the Indiana House