Is Military Retirement Taxed In Va Under the new law starting in 2022 Virginia is making up to 10 000 in military retirement pay tax free for those ages 55 and older The state income tax deduction will increase by 10 000

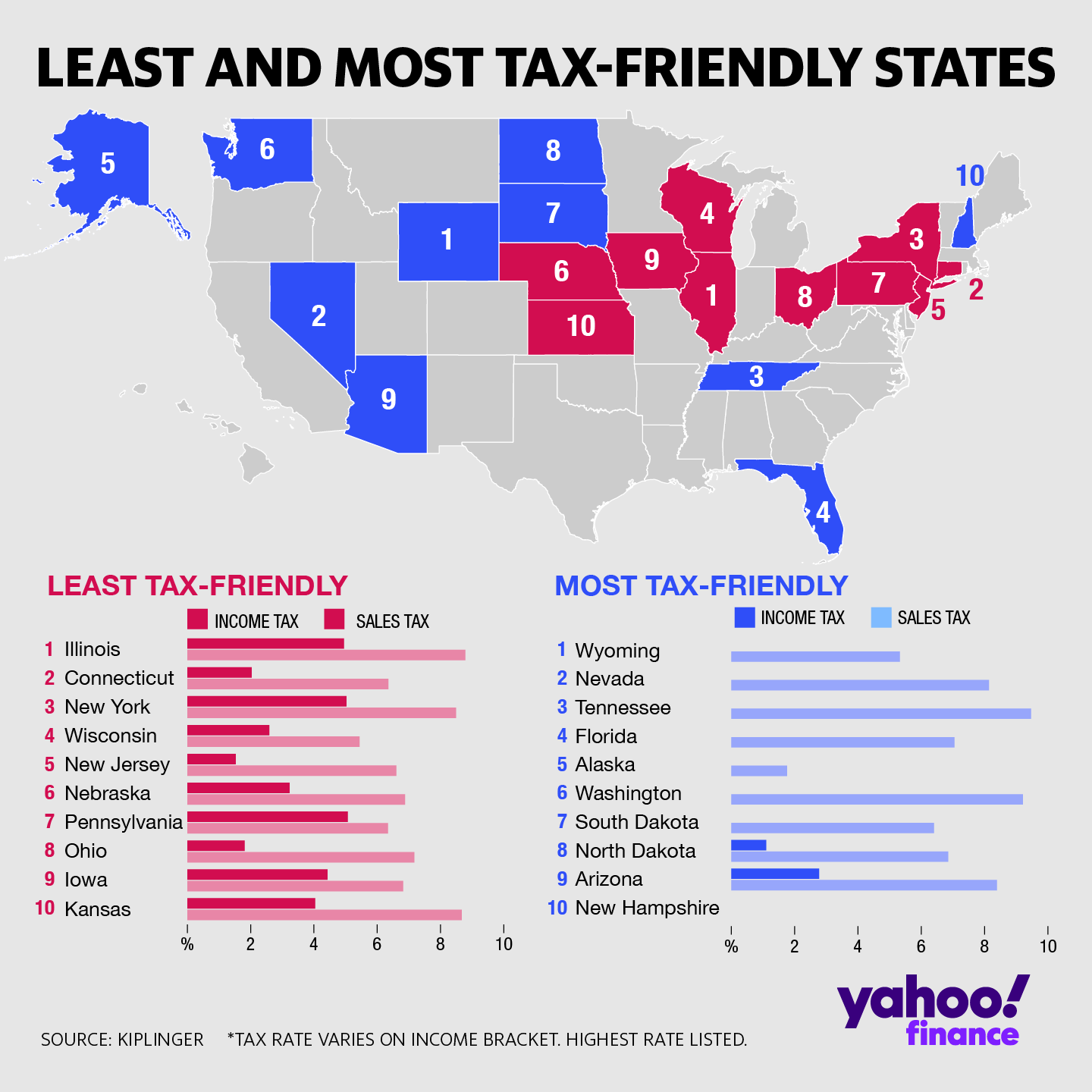

In all states U S Department of Veterans Affairs disability payments are tax free If you have issues with retired pay and state income tax including changing your withholding amount you Nearly all U S states offer exemptions for military retirement income or do not tax it at all As of 2024 California is the last state that fully taxes military retirement income Understanding your taxes is a big part of financial planning whether you are in the midst of your career or are reaching your retirement years

Is Military Retirement Taxed In Va

Is Military Retirement Taxed In Va

https://api.army.mil/e2/c/images/2019/04/30/551375/original.jpg

Average Federal Tax Rate On Military Retirement Pay Military Pay

https://military-paychart.com/wp-content/uploads/2020/12/understand-the-military-retirement-pay-system-2048x1365.png

Your Retirement Distributions Won t Be Taxed In These States AARP

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2020/07/0/0/Tax-free-retirement.png?ve=1&tl=1

Military Retirement is taxable and is included in gross income on the return This applies to a military pension received while the retiree is a Virginia resident regardless of where the military retiree was stationed Gov Glenn Youngkin on June 21 signed the two year budget which exempts the first 10 000 in military retirement income in the 2022 tax year This number will jump to 20 000 in 2023 30 000 in 2024 and 40 000 in 2025 and beyond The new law also applies to surviving spouses of military retirees

Virginia Income Tax Deduction for Military Pay Resident Service members serving on active duty who earn less than 30 000 base pay can deduct up to 15 000 from their Virginia Income tax On Friday Governor Glenn Youngkin reiterated his commitment to Virginia s veterans and celebrated the extended tax exemptions for military retirement

Download Is Military Retirement Taxed In Va

More picture related to Is Military Retirement Taxed In Va

VA Disability Payment Increase VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/2020-va-disability-pay-chart-va-claims-insider-1.jpg

Is Military Retirement Pay Tax Exempt USMilitary

https://usmilitary.org/wp-content/uploads/2023/01/image-1-1-1024x682.jpg

An Overhaul Of The Military Retirement Program Fox Business

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2017/11/0/0/military-retirement.jpg?ve=1&tl=1

As a veteran over 55 you can deduct up to 40 000 of your retired military pay from Virginia taxable income This Virginia veteran tax credit phases in over four years starting at 10 000 for the 2022 tax year and increasing by 10 000 yearly until 2025 Commonwealth of Virginia are collecting a military retirement This would be an appreciation of the Commonwealth of Virginia to our including all income derived from federal or military contracts consulting or full time employment will be taxed at the full gross income percentages The qualifying retirement income must be received as a

Virginia Retirees age 55 and over can deduct up to 20 000 in military benefits from their 2023 state income taxes The deduction increases to 30 000 for the 2024 tax year and to 40 000 for 2025 and beyond For Tax Year 2026 allow military retirees to subtract 100 of their military retirement income from the state income tax Virginia is not the only nearby state to improve taxation policies for military retirees A July 2022 law increased the military pension exclusion for Delaware residents under age 60 to 12 500 up from 2 000

States That Don t Tax Military Retirement A Detailed List

https://www.safecallnow.org/wp-content/uploads/2023/03/states-that-dont-tax-military-retirements.jpg

The Most Common Sources Of Retirement Income SmartZone Finance

https://smartzonefinance.com/wp-content/uploads/2018/06/retirement-a03-g01-1024x776.png

https://www.wric.com/news/politics/capitol...

Under the new law starting in 2022 Virginia is making up to 10 000 in military retirement pay tax free for those ages 55 and older The state income tax deduction will increase by 10 000

https://www.military.com/benefits/military-pay/...

In all states U S Department of Veterans Affairs disability payments are tax free If you have issues with retired pay and state income tax including changing your withholding amount you

Are Military Retirements Exempt From Taxes Finance Zacks

States That Don t Tax Military Retirement A Detailed List

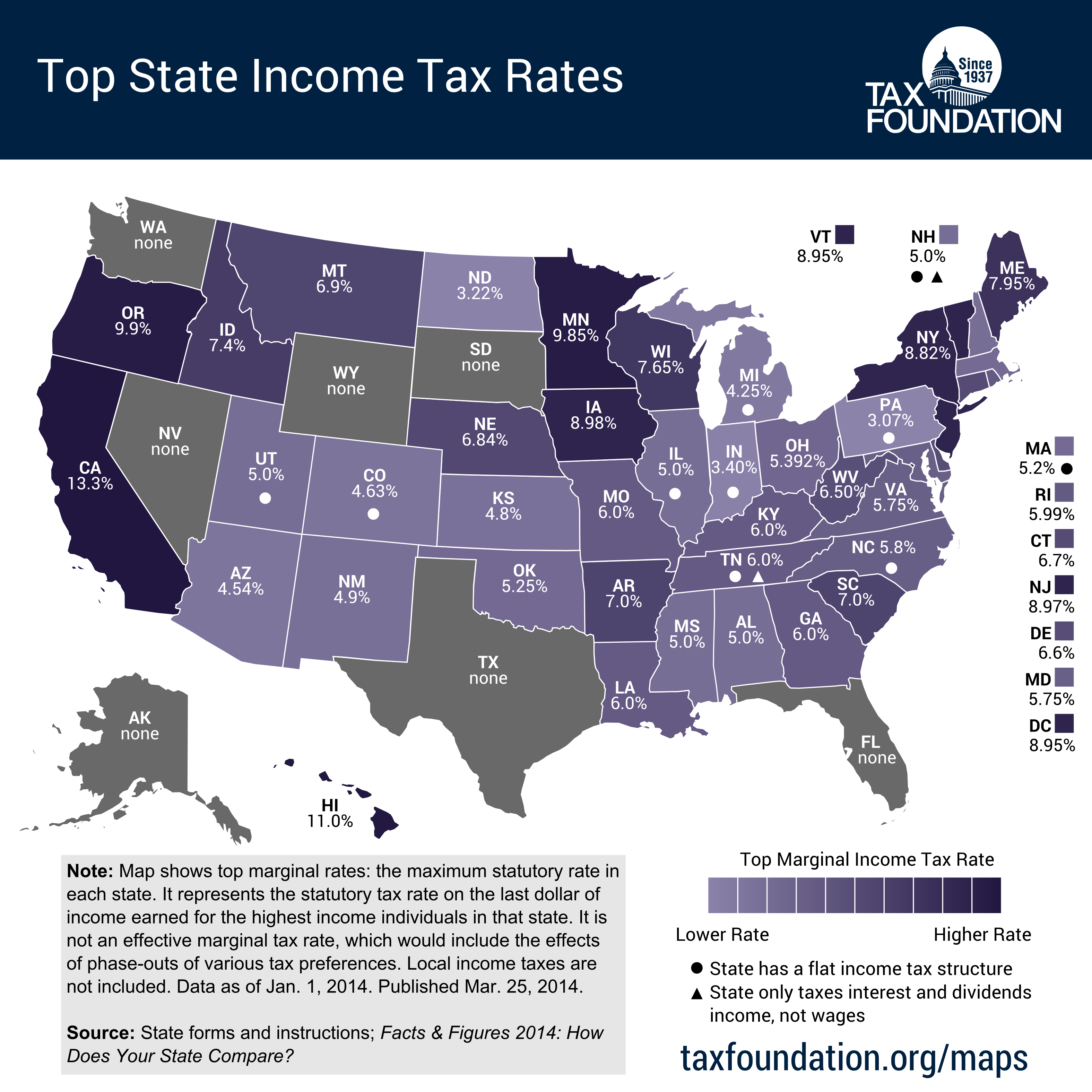

These Are The Best And Worst States For Taxes In 2019

States That Tax Social Security Benefits Tax Foundation

/Soldier-5713d9e75f9b588cc20dac1e.jpg)

How Is Military Retirement Pay Divided During Divorce

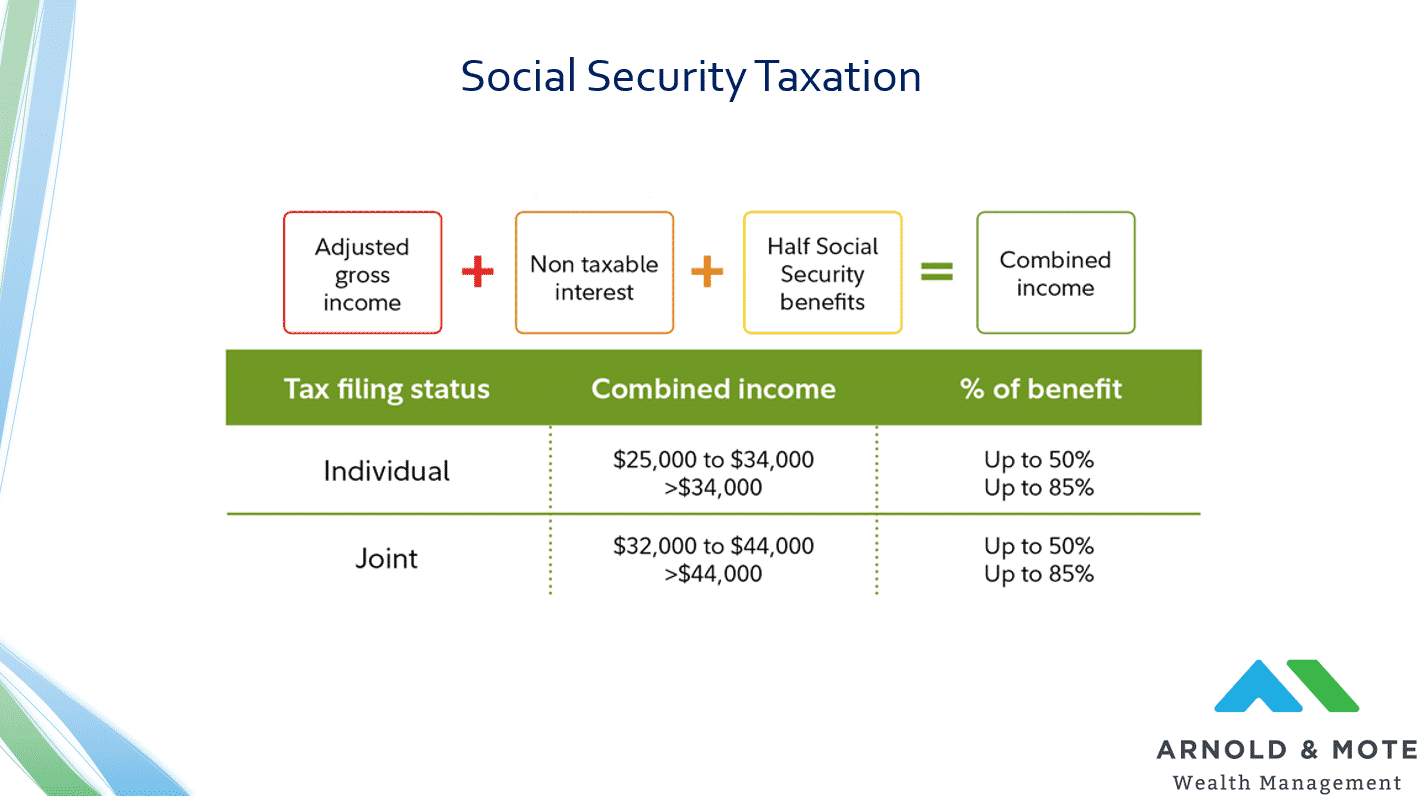

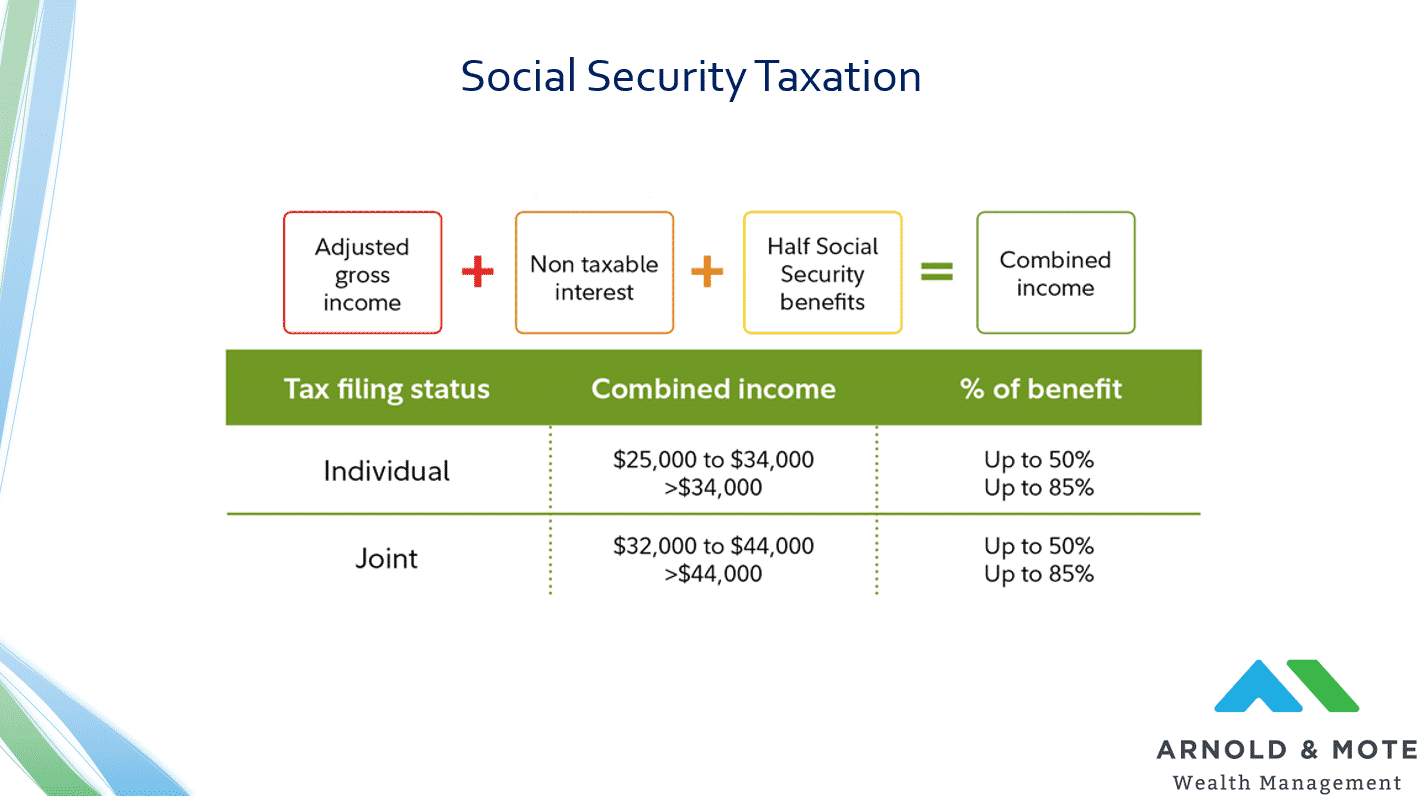

04 Social Security taxed in retirement Arnold Mote Wealth Management

04 Social Security taxed in retirement Arnold Mote Wealth Management

23 States Do Not Tax Military Retirement Pay 24 States Exempt A

Want To Avoid High Taxes Retire In One Of These 10 States Retirement

California Tops List Of 10 States With Highest Taxes

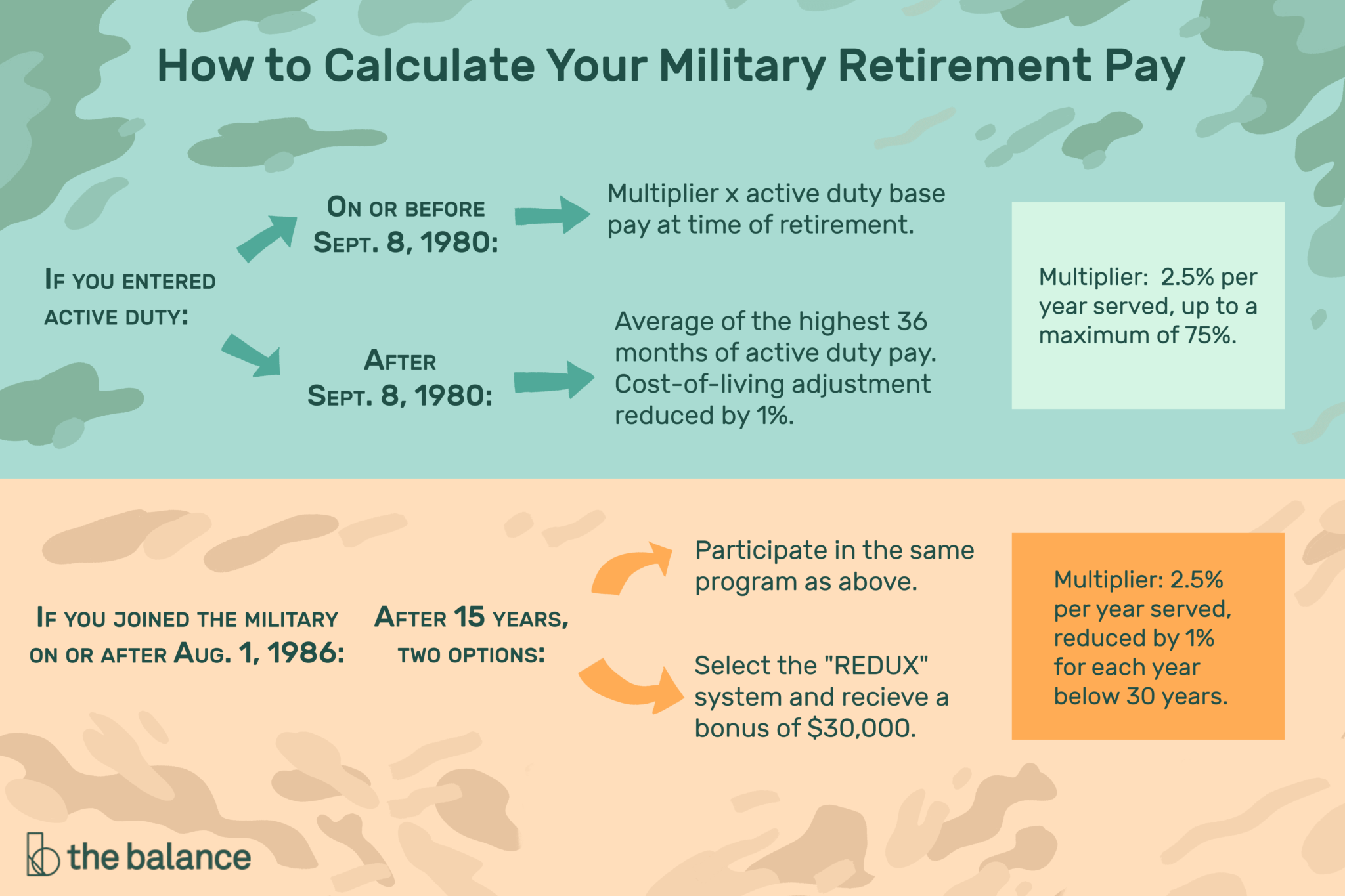

Is Military Retirement Taxed In Va - The amount of VA compensation received or A tax exempt amount of gross pay determined by the following formula Step 1 Military not VA disability percentage x times Active Duty pay at the time of retirement equals Initial amount of tax exempt gross pay Step 2 Initial amount of tax exempt gross pay