Is Military Retirement Taxed In West Virginia For tax years beginning on and after January 1 2019 all military retirement income from the regular Armed Forces Reserves National Guard and uniformed services that are not part of the Armed Forces is exempt from WV income tax This is a decreasing modification to federal adjusted gross income

Updated July 17 2024 at 11 26am EDT Published February 23 2022 Some states don t charge income tax on military retired pay In all states U S Department of Veterans West Virginia Military income Tax free if the service member maintained a physical presence in the state for less than 30 days Retired pay Tax free Survivor Benefit Plan Tax free Social

Is Military Retirement Taxed In West Virginia

Is Military Retirement Taxed In West Virginia

https://military-paychart.com/wp-content/uploads/2020/12/understand-the-military-retirement-pay-system-2048x1365.png

4 Types Of Income Not Taxed In Retirement FinTips YouTube

https://i.ytimg.com/vi/B05OtAHXuJI/maxresdefault.jpg

Your Retirement Distributions Won t Be Taxed In These States AARP

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2020/07/0/0/Tax-free-retirement.png?ve=1&tl=1

According to the West Virginia instructions military retirement income is no longer taxed by West Virginia You can now subtract the taxable amount of retirement income reported on your federal return received from Defense Finance Accounting Military retirees pay federal taxes on retirement pay However some situations may impact your retirement pay A common one is receiving VA disability compensation due to a service connected disability rating

West Virginia Veteran Financial Benefits Income Tax All military pay is tax free if stationed out of state Retired pay and SBP payments are tax free Disabled Veterans Homestead Exemption For example Hawaii doesn t tax military retirement pay but West Virginia waives up to 2 000 of taxes for military retirees Some offer a low income exemption and others tax your pension according to federal tax rules source Birk Many military retirees also have questions regarding exemptions and deductions

Download Is Military Retirement Taxed In West Virginia

More picture related to Is Military Retirement Taxed In West Virginia

States That Don t Tax Military Retirement Pay Discover Here

https://www.thesoldiersproject.org/wp-content/uploads/2023/04/military-retirement-tax-exemption.png

Guns And Ammo No Longer Taxed In West Virginia WCHS

https://wchstv.com/resources/media2/16x9/full/1015/center/80/49f6c01e-de44-4f45-96c5-5862e1021938-large16x9_taxfreeguns.png

What Are The States That Don t Tax Military Retirement ClearMatch

https://images.prismic.io/clearmatchmedicare/5c9fa687-f6e2-465b-83b8-f142c7928367_What+Are+the+States+That+Don't+Tax+Military+Retirement.png?auto=compress,format&rect=52,0,741,556&w=2000&h=1500

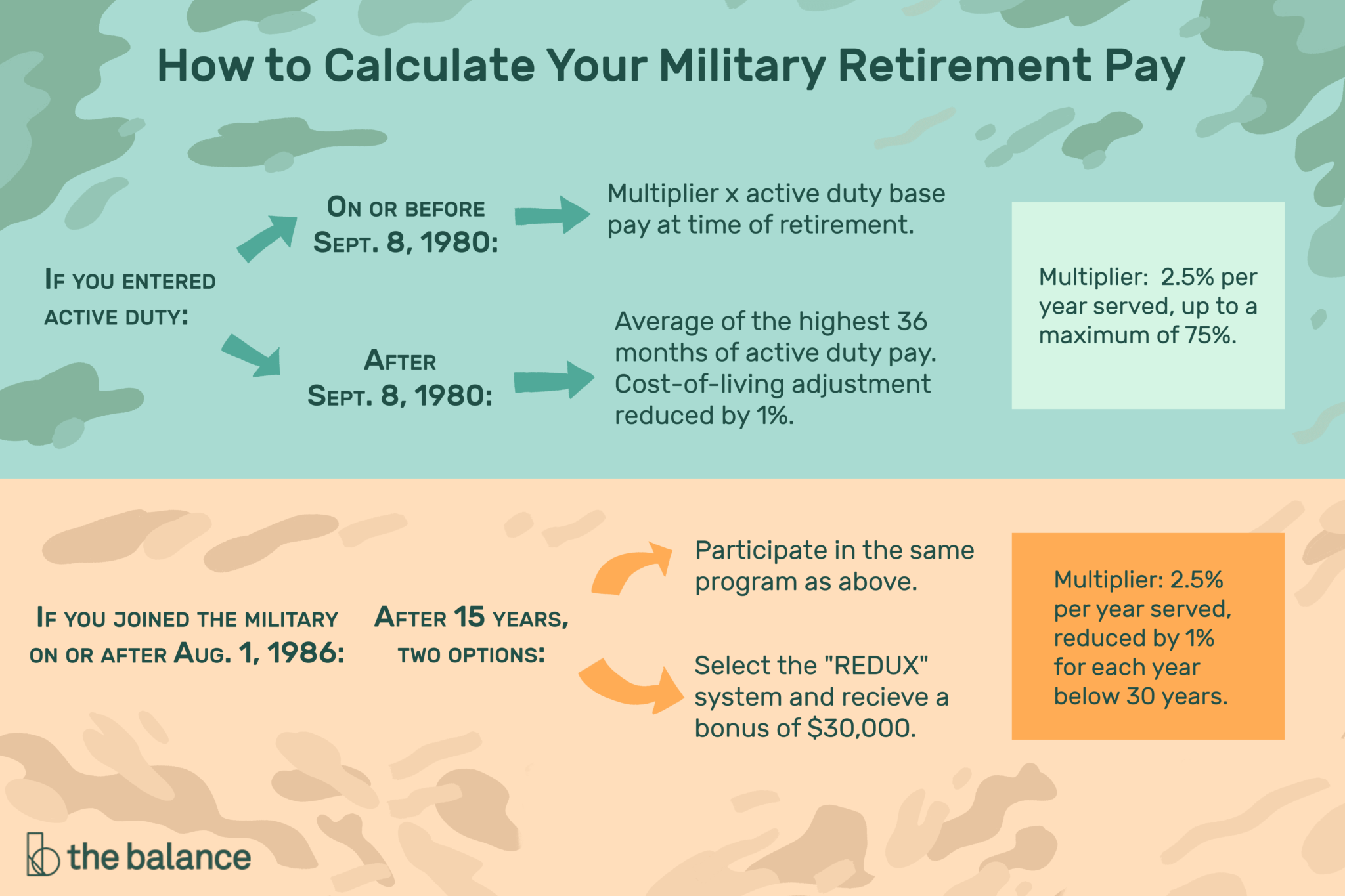

Whether a portion or all of an individual s military retired pay is subject to federal income taxes depends on his her individual circumstances A military retiree can either use myPay or send an IRS Form W 4 to alter the amount DFAS withholds for federal income taxes from their military retired pay Eleven states tax military retirement benefits but only partially These states include Colorado Delaware Georgia Idaho Kentucky Maryland New Mexico Oregon South Carolina Virginia and West Virginia The District

Military retirees can take the taxable amount of retirement income reported on their federal return received from Defense Finance Accounting Service DFAS A 1099 R must be included with the return even if no withholding is reported Virginia Retirees age 55 and over can deduct up to 20 000 in military benefits from their 2023 state income taxes The deduction increases to 30 000 for the 2024 tax year and to 40 000 for 2025 and beyond

Military Divorce The Process Challenges And Resources Tamara Like

https://i0.wp.com/tamaracamerablog.com/wp-content/uploads/2022/06/Military-Divorce-The-Process-Challenges-and-Resources.png?ssl=1

An Overhaul Of The Military Retirement Program Fox Business

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2017/11/0/0/military-retirement.jpg?ve=1&tl=1

https://tax.wv.gov › Documents › TSD

For tax years beginning on and after January 1 2019 all military retirement income from the regular Armed Forces Reserves National Guard and uniformed services that are not part of the Armed Forces is exempt from WV income tax This is a decreasing modification to federal adjusted gross income

https://www.military.com › benefits › military-pay › ...

Updated July 17 2024 at 11 26am EDT Published February 23 2022 Some states don t charge income tax on military retired pay In all states U S Department of Veterans

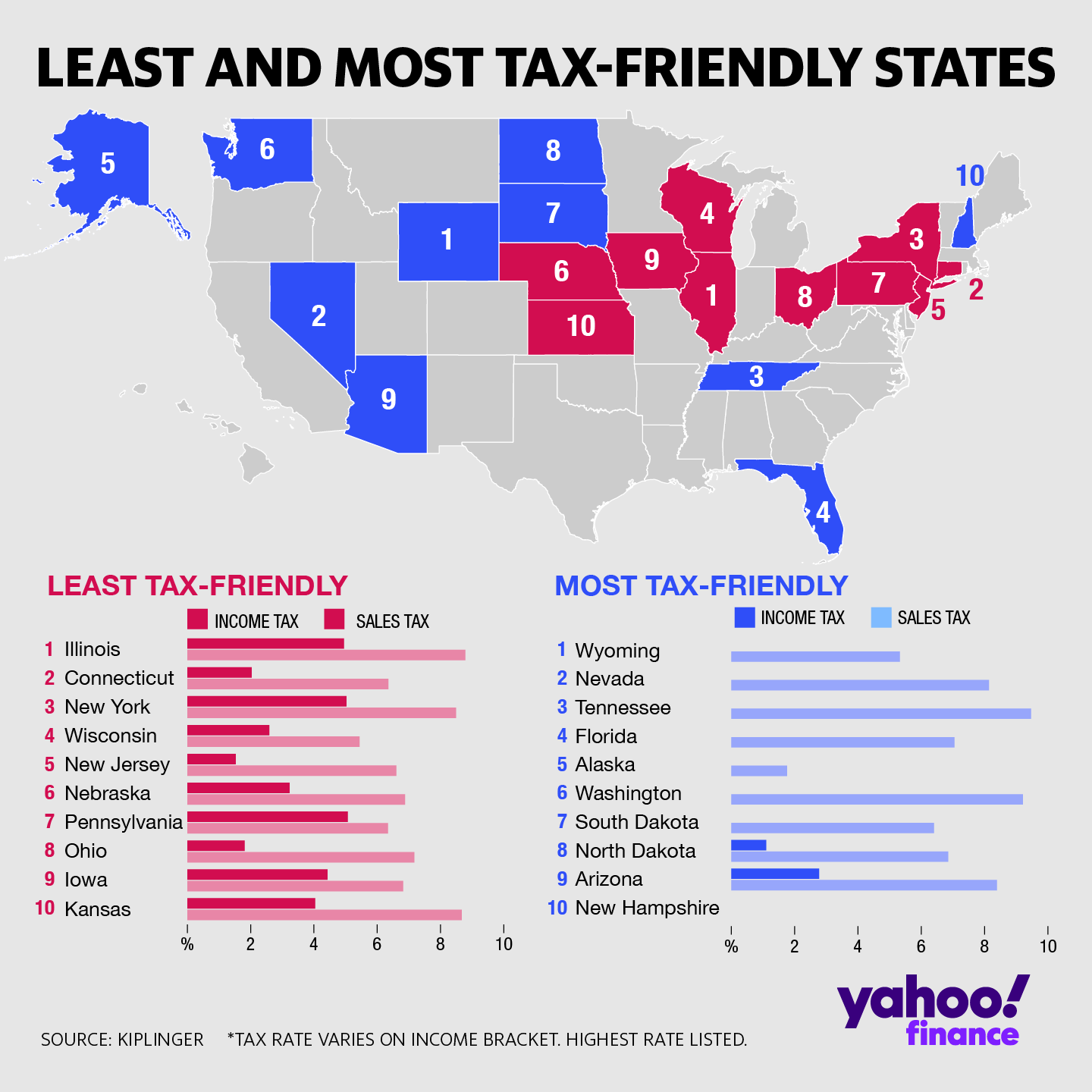

These Are The Best And Worst States For Taxes In 2019

Military Divorce The Process Challenges And Resources Tamara Like

States That Don t Tax Military Retirement A Detailed List

Is Military Retirement Pay Taxable Finance Zacks

The Most Common Sources Of Retirement Income SmartZone Finance

West Virginia Exempts Military Retirement Pay From State Income Tax

West Virginia Exempts Military Retirement Pay From State Income Tax

How Is Income In Retirement Taxed Plan To Rise Above

Jim Justice On Twitter In West Virginia We Are Cutting Taxes

Best And Worst States For Retirement Retirement Living

Is Military Retirement Taxed In West Virginia - Military retirees pay federal taxes on retirement pay However some situations may impact your retirement pay A common one is receiving VA disability compensation due to a service connected disability rating