Is Mortgage Interest On Second House Tax Deductible Second mortgage interest is tax deductible in certain circumstances provided minimum IRS qualifications are met and current federal tax guidelines are followed This means that only a certain portion of expenses associated with your outstanding debts may be deductible

The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions States that assess an income tax also may allow homeowners to How Much Mortgage Interest Can You Deduct That depends on what kind of debt you already have and how much more you want to assume If you are married and file jointly you can only deduct

Is Mortgage Interest On Second House Tax Deductible

Is Mortgage Interest On Second House Tax Deductible

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Wendy Jimenez Where Will Mortgage Rates Be Headed In 2015

http://www.keepingcurrentmatters.com/wp-content/uploads/2015/01/Interest-Rates-2015.jpg

By TurboTaxUpdated 3 weeks ago You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest If you rent out your second home you must also use it as a home during the year You might still be able to deduct mortgage interest but it s not guaranteed If the IRS views the second home as an investment property you may not claim the mortgage interest deduction however you could deduct mortgage interest as a business expense to lower the taxable income you accrued through rent

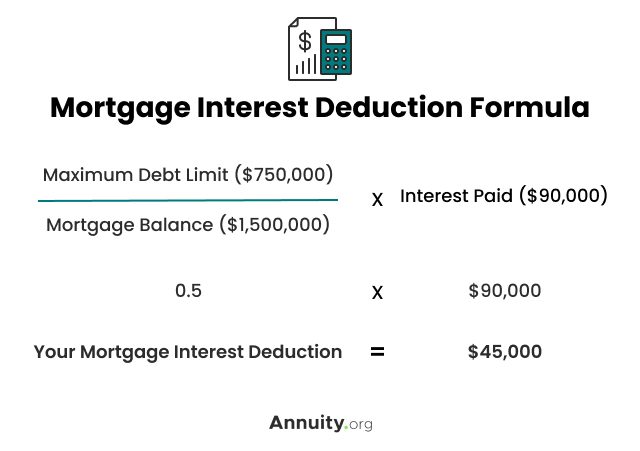

In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home Is the mortgage interest and real property tax I pay on a second residence deductible Answer Yes and maybe Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence

Download Is Mortgage Interest On Second House Tax Deductible

More picture related to Is Mortgage Interest On Second House Tax Deductible

In California Can You Deduct Interest On A Second Mortgage

https://s.hdnux.com/photos/01/26/17/30/22607361/10/1200x0.jpg

How To Calculate Interest Using Apr Haiper

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

Is Mortgage Interest Tax Deductible In 2023 Orchard

https://assets-global.website-files.com/5fcff9094e6ad8e939c7fa3a/639ba11b8923dc39fc2c17c1_Is mortgage interest tax deductible_.png

A second mortgage A line of credit A home equity loan If the loan is not a secured debt on your home it is considered a personal loan and the interest you pay usually isn t deductible Your home mortgage must be secured by your main home or a second home You can t deduct interest on a mortgage for a third home a fourth If you use the house as a second home rather than renting it out interest on the mortgage is deductible within the same limits as the interest on the mortgage on your first home For tax years prior to 2018 you can write off 100 of the interest you pay on up to 1 1 million of debt secured by your first and second homes and used to

The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750 000 for couples and 375 000 for single filers 1 You aren t limited to deducting the interest on the first home You can deduct interest paid on a second home up to the annual limit If itemizing a single filer Generally home mortgage interest is any interest you pay on a loan secured by your home main home or a second home The loan may be a mortgage to buy your home or a second mortgage You can t deduct home mortgage interest unless the following conditions are met

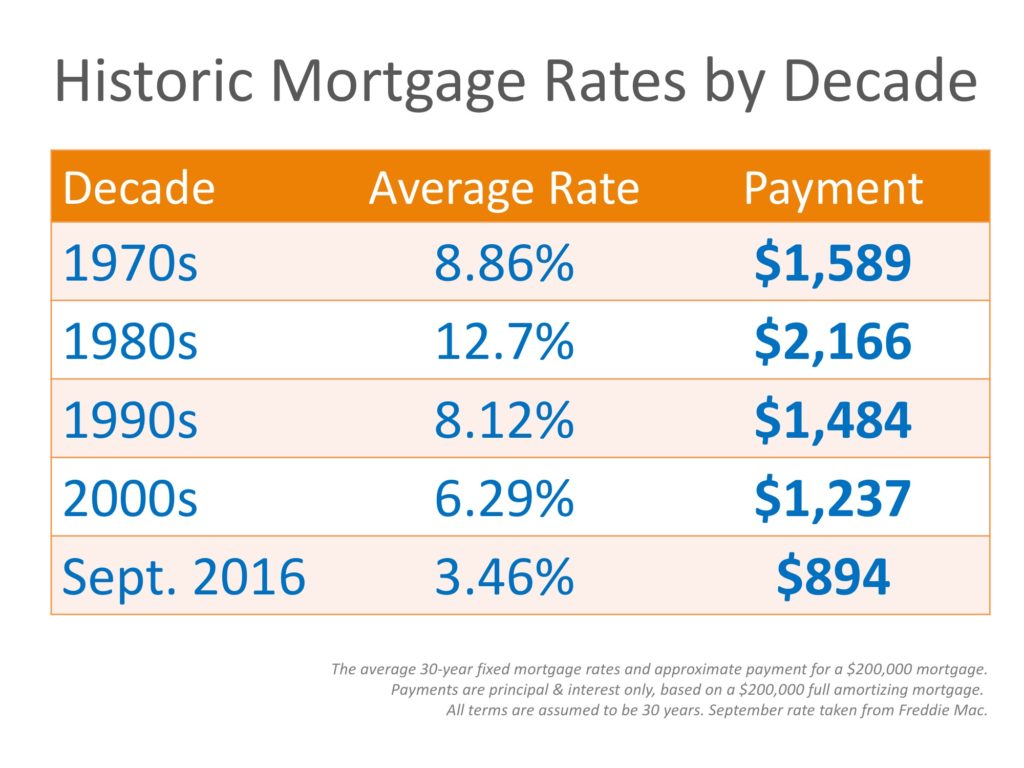

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

https://www.thepeak.com/wp-content/uploads/2021/02/20210219-MEM.png

Which States Benefit Most From The Home Mortgage Interest Deduction

https://files.taxfoundation.org/20170810130243/HomeMortgIntDed-01.png

https://www.rocketmortgage.com/learn/can-you...

Second mortgage interest is tax deductible in certain circumstances provided minimum IRS qualifications are met and current federal tax guidelines are followed This means that only a certain portion of expenses associated with your outstanding debts may be deductible

https://www.forbes.com/advisor/mortgages/mortgage-interest-

The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions States that assess an income tax also may allow homeowners to

Pin On Chicago Accountant

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

When Is Mortgage Interest Tax Deductible

Investment Expenses What s Tax Deductible Charles Schwab

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Home Mortgage Interest Deduction Second Home Home Sweet Home

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Home Mortgage Interest Deduction Second Home Home Sweet Home

Mortgage Rates By Decade Compared To Today INFOGRAPHIC Steve Casalenda

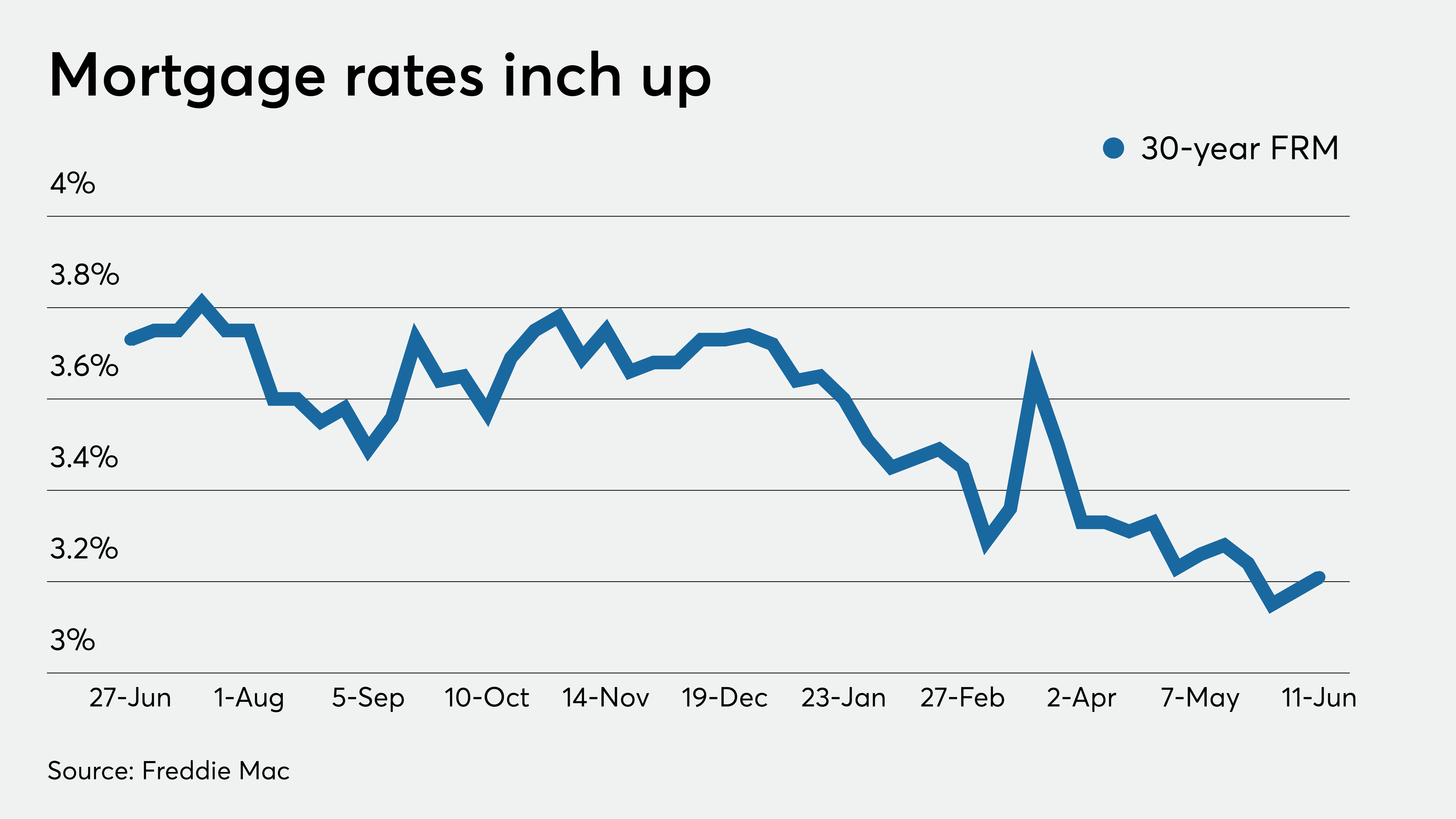

What The Fed s 0 Interest Rate Plan Means For Mortgage Rates Muevo

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

Is Mortgage Interest On Second House Tax Deductible - Is the mortgage interest and real property tax I pay on a second residence deductible Answer Yes and maybe Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence