Is Mortgage Loan Interest Tax Deductible India Even when you have an ongoing home loan you are eligible to get tax benefits however there are no tax benefits for Loan Against Property under Section 80C of the Income Tax Act Any salaried or self employed professional can apply

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually Can I claim deduction for mortgage interest The short answer is yes You can claim the interest charged on your home loan as a deduction when completing your income tax return

Is Mortgage Loan Interest Tax Deductible India

Is Mortgage Loan Interest Tax Deductible India

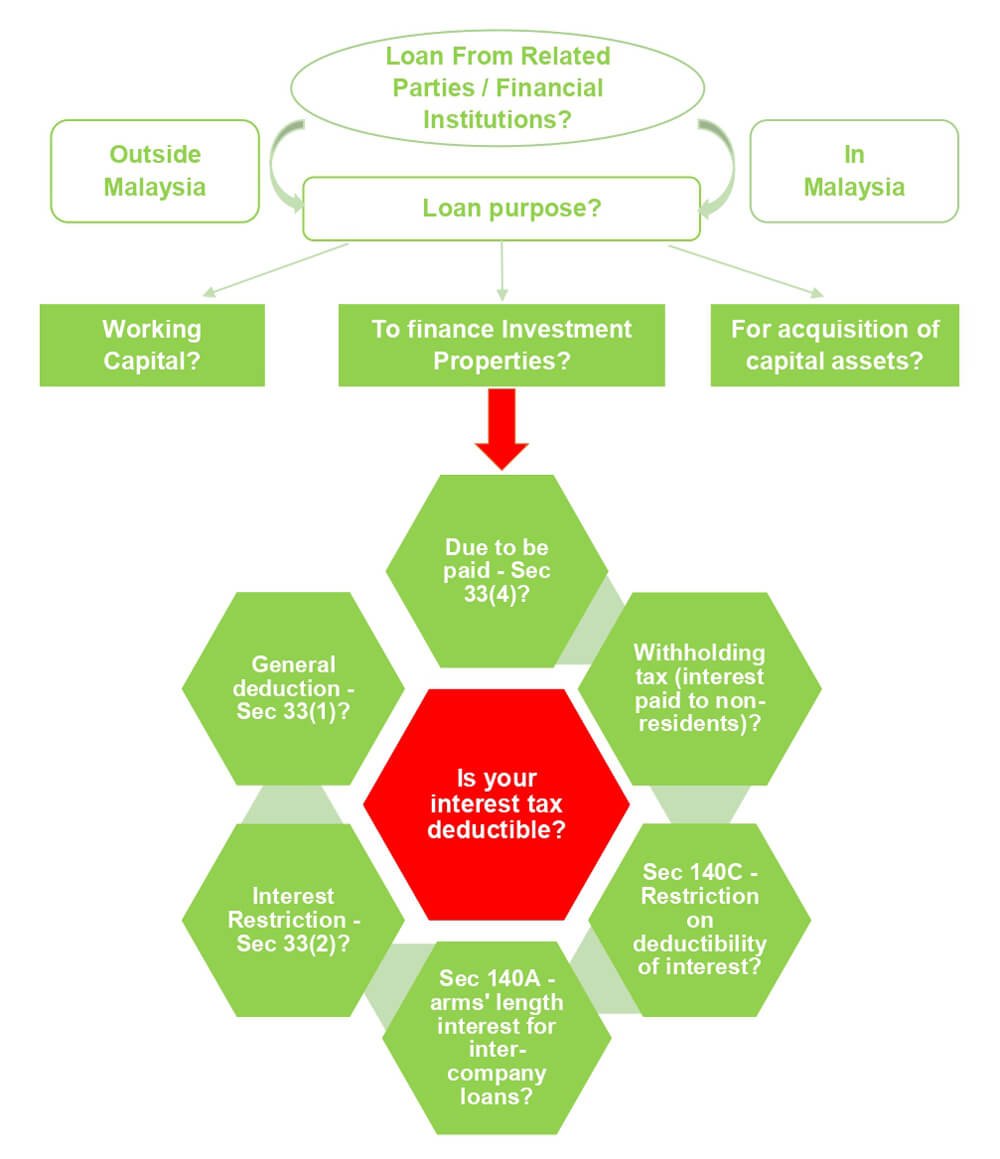

https://shinewingtyteoh.com/wp-content/uploads/2021/11/Interest-Tax-Graph.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

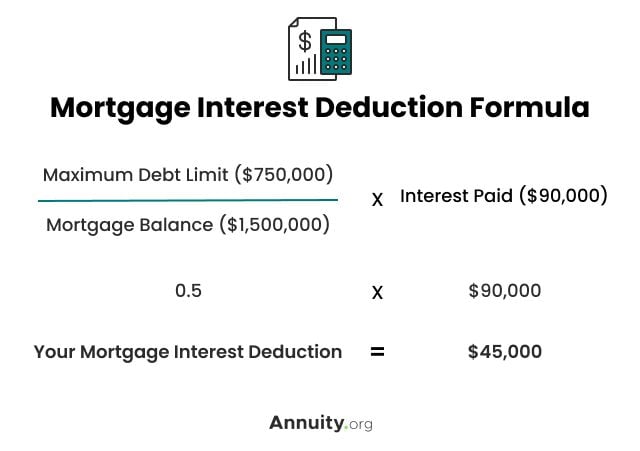

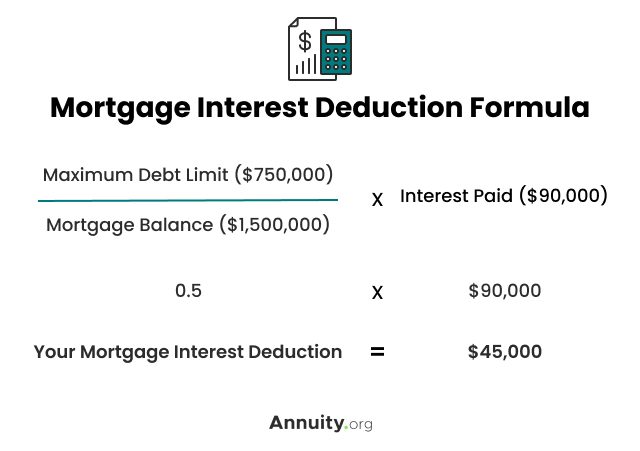

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Tax Benefit on Home Loan Interest Under Section 24 b a tax deduction of up to 2 lakh per year is allowed for interest paid on a home loan This deduction applies if the loan was taken for the purchase construction or renovation of a Home loan borrowers can benefit from several tax provisions under the Income Tax Act to reduce their taxable income Section 24 allows deductions on the interest paid for home loans with

Paying interest on a mortgage loan can provide you with tax benefits under the Indian Income Tax Act As per Section 24 b deductions can be claimed on the interest Section 80EE of the Income Tax Act introduced in the Financial Year 2013 14 offers an additional deduction on interest payments made towards home loans This deduction

Download Is Mortgage Loan Interest Tax Deductible India

More picture related to Is Mortgage Loan Interest Tax Deductible India

Mortgage Minute Making Mortgage Interest Tax Deductible YouTube

https://i.ytimg.com/vi/vlLTI8XKn8E/maxresdefault.jpg

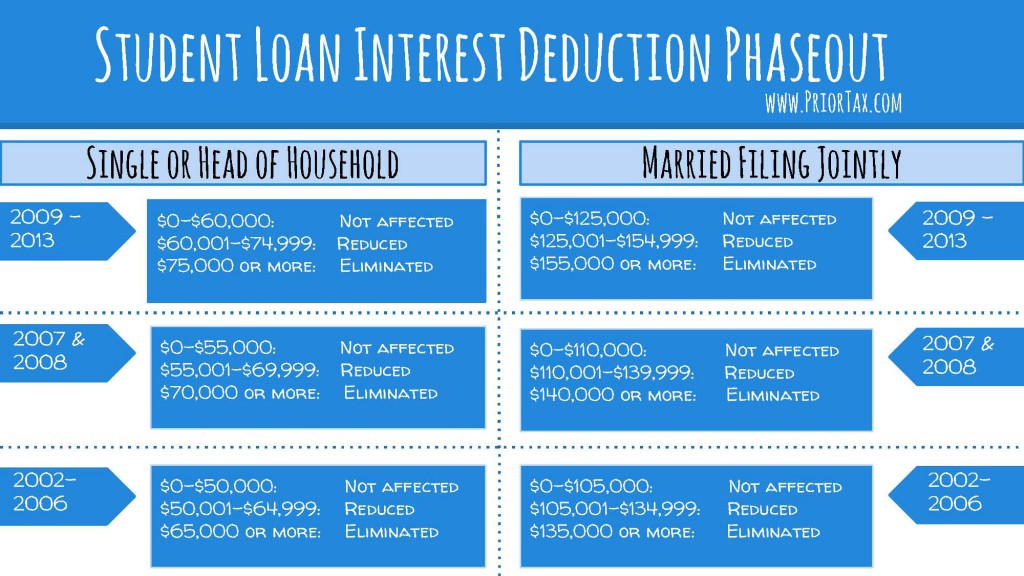

How To Claim The Student Loan Interest Deduction Tomcaligist

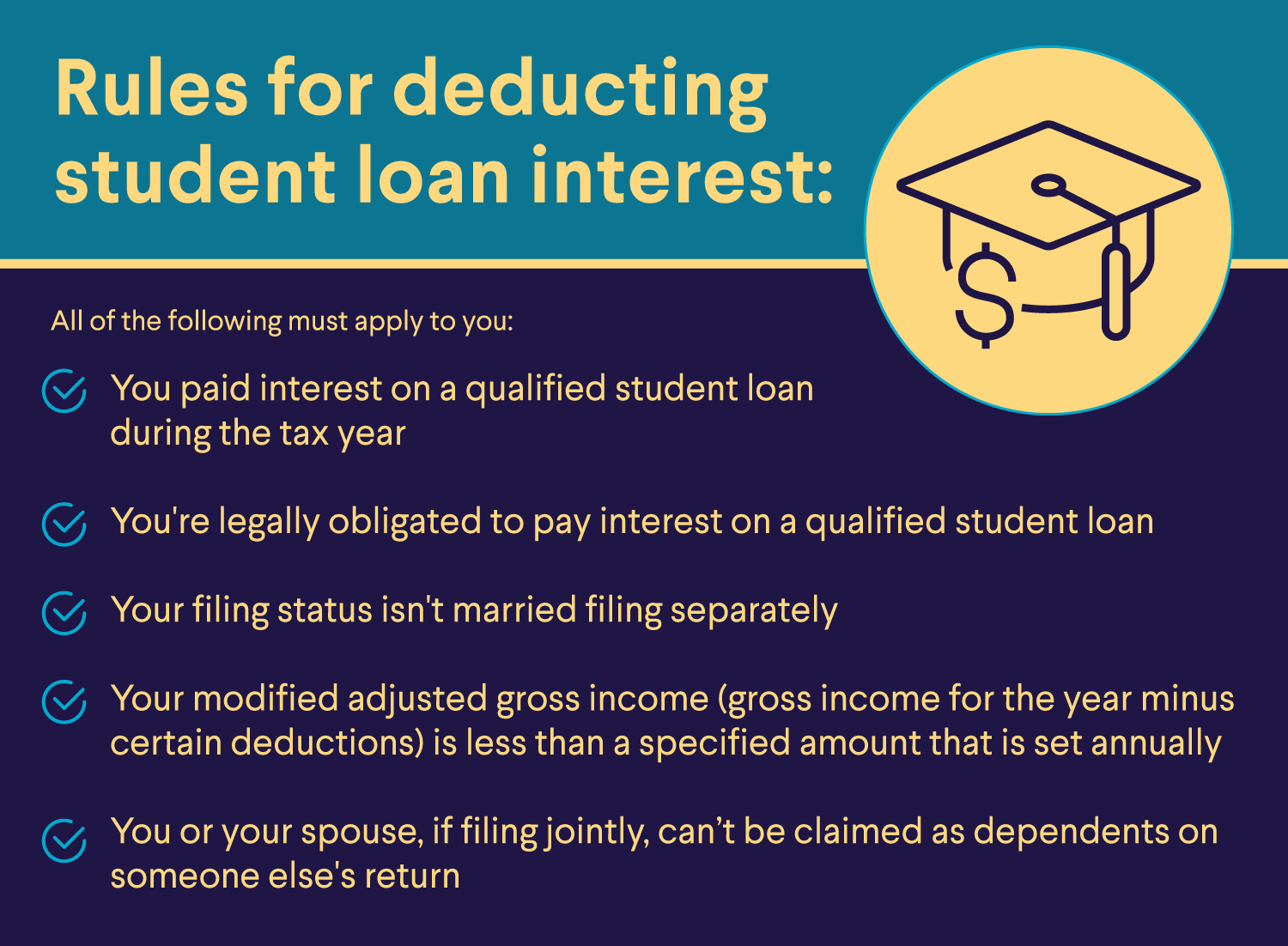

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/Deducting-Student-Loan-Interest-1.png

Understanding The Mortgage Interest Deduction The Official Blog Of

https://www.taxslayer.com/blog/wp-content/uploads/2022/05/Mortgage-Interest-Deduction-8-1594x2048.png

Interest on Loan Section 24 b If you have taken a loan to purchase construct or repair the property the interest paid on the loan is deductible The maximum limit of this Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if

Under Section 24 b of the Income Tax Act 1961 borrowers can claim a deduction of up to Rs 2 lacs per financial year on the interest paid on home loans for a self occupied Interest paid on home loans also qualifies for tax benefits under Section 24 b You can claim a deduction of up to 2 lakh annually for self occupied properties For rented

Is Your Business Loan Tax Deductible

https://img.caminofinancial.com/wp-content/uploads/2019/12/07172627/Tax-deduction-1024x683.jpg

Is Mortgage Interest Tax Deductible In 2023 Orchard

https://assets-global.website-files.com/5fcff9094e6ad8e939c7fa3a/639ba11b8923dc39fc2c17c1_Is mortgage interest tax deductible_.png

https://www.icicibank.com › blogs › home …

Even when you have an ongoing home loan you are eligible to get tax benefits however there are no tax benefits for Loan Against Property under Section 80C of the Income Tax Act Any salaried or self employed professional can apply

https://www.hdfc.com › ... › home-loan-tax-…

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Is Your Business Loan Tax Deductible

The Deduction Of Interest On Mortgages Is More Delicate With The New

Personal Loan Tax Deduction Tax Benefit On Personal Loan EarlySalary

Student Loan Interest Deduction 2013 PriorTax Blog

Where Are Interest Rates Headed This Year Keeping Current Matters

Where Are Interest Rates Headed This Year Keeping Current Matters

Mortgage Interest Tax Deductible 2023

How Can I Deduct TDS On Home Loan In India Kanakkupillai

Solved Please Note That This Is Based On Philippine Tax System Please

Is Mortgage Loan Interest Tax Deductible India - Section 80EE of the Income Tax Act introduced in the Financial Year 2013 14 offers an additional deduction on interest payments made towards home loans This deduction